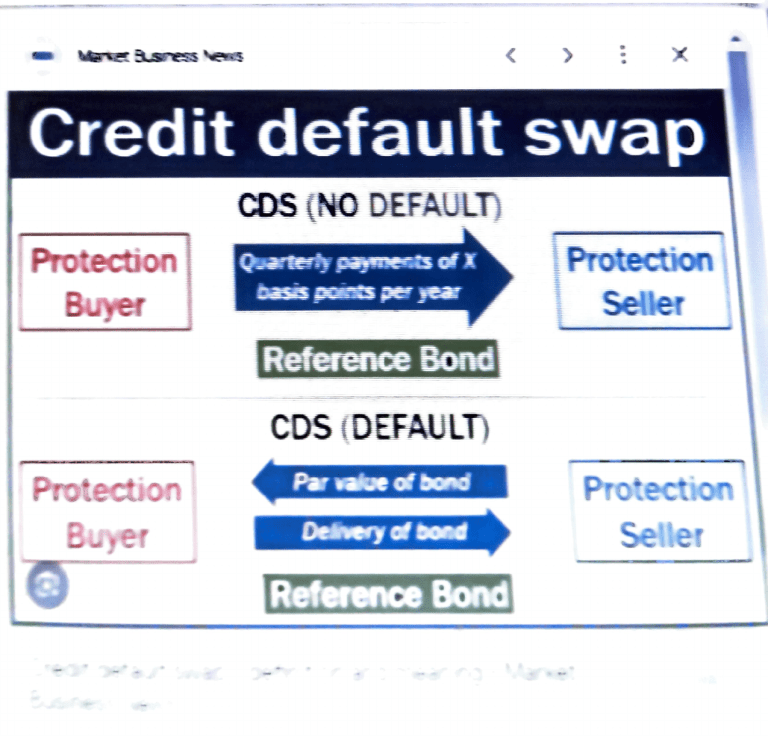

Mae sress e s Credit default swap CDS (NO DEFAULT) Protection Buyer Protection Qarterly payments of X basis points per year Seller Reference Bond CDS (DEFAULT) Protection Par value of bond Buyer Delivery af bond Protection Seller Reference Bond Mare SOFR SOR Co A Swap Bank Co B 0.5% Profit Notional 7% $5 million Definitions the valtue of the unde SOFR adewaM Floatine interest rate an interest rate that is+1%6 $5 million aable and may change periodically leg-one side of a swaptrade (foed feg or ti Payertypically refers to the payer of the Bank A Rate on Foed an interest rate swap Rcehver typicaly refees to the raceiver of the Fed e Bank A offers Co A two choices of loan: 5/m ot Fixed 7% Or Bank B on n Maturity 1he date on wich the prncipal applicable) and final interest coupon are paid. Payment frequency-the number of interest payments per yeare8 Quartet, monthiy otnantiaintert eio Exxaniples include AcVS0, SU 360 etc. Bank B offers Co B two choices of loan: SSm at Fixed 10% Or S5m at oiaDie Interest Rate Swap Example Julia Simone Interest Rate Swap Fixed interest rote 2% Flooting interest rate LIBOR 15% A swap onily occurs If one party hos o fixed rote hile the other hos o "flooting rote". Each porty beleves they con get o lower interest rate by suwopping. Thot is the only reoson Julla and Simone would "suop" their Interest rotes from the banks in thls scenario. Flooting interest rate LIBOR 15% Fixed interest rate 2%