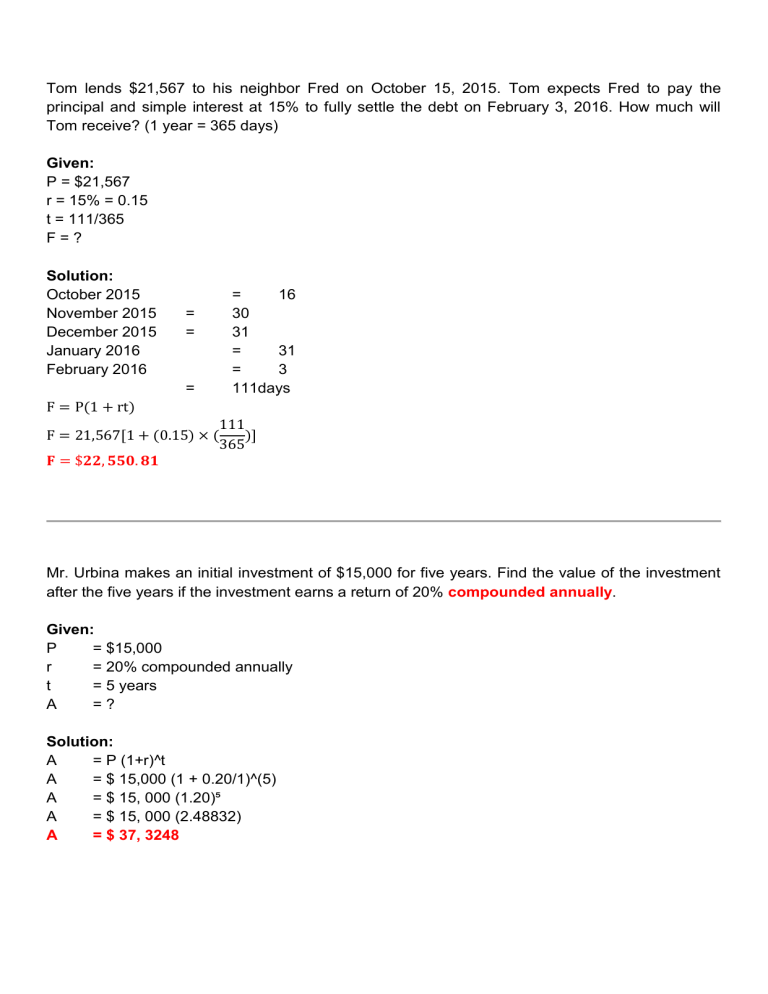

Tom lends $21,567 to his neighbor Fred on October 15, 2015. Tom expects Fred to pay the principal and simple interest at 15% to fully settle the debt on February 3, 2016. How much will Tom receive? (1 year = 365 days) Given: P = $21,567 r = 15% = 0.15 t = 111/365 F=? Solution: October 2015 November 2015 December 2015 January 2016 February 2016 = = = = 16 30 31 = 31 = 3 111days F = P(1 + rt) F = 21,567[1 + (0.15) × ( 111 )] 365 𝐅 = $𝟐𝟐, 𝟓𝟓𝟎. 𝟖𝟏 Mr. Urbina makes an initial investment of $15,000 for five years. Find the value of the investment after the five years if the investment earns a return of 20% compounded annually. Given: P = $15,000 r = 20% compounded annually t = 5 years A =? Solution: A = P (1+r)^t A = $ 15,000 (1 + 0.20/1)^(5) A = $ 15, 000 (1.20)⁵ A = $ 15, 000 (2.48832) A = $ 37, 3248 Compound Interest Semi- annually If the compound interest on ₱ 12000 for the period of 1 ½ years at the rate of interest 15% per annum, what if the interest is compounded half yearly? Given: Principle Rate of interest Time P R t t = ₱ 12000 = 15% = 1 1/2 = 3/2 years = 3/2 × 2= 3 years (interest is compounded half yearly) Solution: A = P (1+ R) ^t = 12000(1+ 15) ^3 = 12000(1.15) ^3 = 12000× (1.520875) ^3 = ₱ 18,250.5 CI = A−P = ₱ 18,250 − ₱ 12000 = ₱ 6,250.5 So, if the interest is compounded half yearly, the result will be ₱ 6,250.5 Joy is first-year student, and she wants to invest her ₱ 75,000 before she graduates at a nominal interest rate of 8%, compound quarterly. How much will her investment be worth in 4 years? Given: A =? P = ₱ 75,000 r = 8% = 0.08 t = 4 years Solution: A = P (1+r/4)^4t A = ₱ 75,000 (1+0.08/4)^(4)(4) A = ₱ 75,000 (1+0.02)¹⁶ A = ₱ 75,000 (1.02)¹⁶ A = ₱ 75,000 (1.372785705) A = ₱ 102,958.93 Let's consider Gwen's plan to start a business and examine her cash flow using a diagram. In order to initiate her business venture, she requires an initial capital of 10, 000 pesos. To secure this capital, Gwen decides to borrow money from a bank that offers a loan with a 5% annual interest rate, and she agrees to make monthly payments. After a year of running her business, she makes arrangements to repay the loan to the bank Given: P = 10, 000 r = 5% = 0.05 t = 1 years Where: M is the monthly payment. P is the principal loan amount (initial capital), which is 10,000 pesos in this case. r is the monthly interest rate, which is the annual interest rate divided by 12 (since there are 12 months in a year). So, 0.05 12 n is the total number of payments, which is the loan term in months. In this case, it's 12 months. Now, you can plug these values into the formula: Solution: A = Pr/ [1- (1 + r)^-t] A = 10000 (0.05) / [1-(1 + 0.05)^-1] A = 500/ 1- 0.9524 A = 500/ 0.0476 A = 10, 504.20 Monthly payment 10, 504.20/12 = 875.35 Shorter method: 𝑃 ∗ 𝑟 ∗ (1 + 𝑟) 𝑛 𝑀= (1 + 𝑟) 𝑛 − 1 0.05 0.05 10,000 ∗ ( 12 ) (1 + 12 ) 12 𝑀= 0.05 (1 + 12 ) 12 − 1 𝑴 = 𝟖𝟕𝟓. 𝟑𝟓