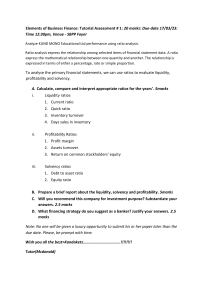

Falcon Ltd Profitability Ratios: G.P Ratio : (Gross Profit / Sales) * 100 = (430 / 2,500) * 100 = 17.20% N.P. Ratio (Net Profit / Sales) * 100 = (166 / 2,500) * 100 = 6.64% (Net Profit / Shareholders' Equity) * 100 = (166 / 368) * 100 = 45.11% Efficiency Ratios: Inventory Turnover: (Cost of Sales / Average Inventory) = (2,290 / [(190 + 220) / 2]) = 10.88 times Accounts Receivable Turnover: (Sales / Average Accounts Receivable) = (2,500 / [(104 + 29) / 2]) = 24.04 Asset Turnover: (Sales / Total Assets) = (2,500 / 557) = 4.49 times Liquidity Ratios: Current Ratio: (Current Assets / Current Liabilities) = (399 / 189) = 2.11 Quick Ratio: (Current Assets - Inventory) / Current Liabilities = (179 / 189) = 0.95 Investing Ratios: Return on Investment (ROI): (Net Profit / Total Assets) * 100 = (166 / 557) * 100 = 29.82% Fixed Asset Turnover: (Sales / Total Non-Current Assets) = (2,500 / 158) = 15.82 times Profitability: Easylawn Ltd has a higher gross profit margin and net profit margin than Falcon Ltd, indicatin improvement. Efficiency: Falcon Ltd has a higher inventory turnover and accounts receivable turnover, indicating better eff Easylawn Ltd should work on improving these ratios. Liquidity: Both companies have reasonable current and quick ratios, suggesting good short-term liquidity. Ea Investing: Easylawn Ltd has a much higher ROI and fixed asset turnover, indicating more efficient use of asse In conclusion, Easylawn Ltd outperforms Falcon Ltd in terms of profitability, efficiency, and investing ratios. should focus on improving profitability and continue to manage their assets and liabilities efficiently. Easylaw accounts receivable management. It's also essential for both companies to monitor their working capital closel Easylawn Ltd. Profitability Ratios: G.P Ratio (Gross Profit / Sales) * 100 = (430 / 1,600) * 100 = 26.88% N.P. Ratio (Net Profit / Sales) * 100 = (170 / 1,600) * 100 = 10.63% (Net Profit / Shareholders' Equity) * 100 = (170 / 223) * 100 = 76.23% Efficiency Ratios: nventory Turnover: (Cost of Sales / Average Inventory) = (1,330 / [(110 + 160) / 2]) = 8.03 times nts Receivable Turnover: (Sales / Average Accounts Receivable) = (1,600 / [(130 + 120) / 2]) = 12.31 times Asset Turnover: (Sales / Total Assets) = (1,600 / 261) = 6.13 times Liquidity Ratios: Current Ratio: (Current Assets / Current Liabilities) = (199 / 38) = 5.24 Quick Ratio: (Current Assets - Inventory) / Current Liabilities = (39 / 38) = 1.03 Investing Ratios: rn on Investment (ROI): (Net Profit / Total Assets) * 100 = (170 / 261) * 100 = 65.13% xed Asset Turnover: (Sales / Total Non-Current Assets) = (1,600 / 62) = 25.81 times gin than Falcon Ltd, indicating better profitability. However, both companies have room for turnover, indicating better efficiency in managing inventory and collecting receivables. g good short-term liquidity. Easylawn Ltd has a significantly stronger current ratio. ating more efficient use of assets and better returns on investment. fficiency, and investing ratios. Falcon Ltd has a slight edge in liquidity ratios. Both companies d liabilities efficiently. Easylawn Ltd, in particular, should work on optimizing its inventory and tor their working capital closely.