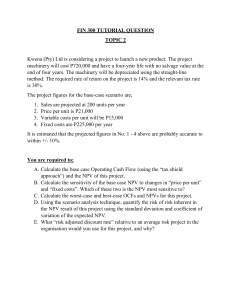

Chapter 16 Country Risk Analysis Lecture Outline Why Country Risk Analysis Is Important Political Risk Factors Attitude of Consumers in the Host Country Actions of Host Government Blockage of Fund Transfers Currency Inconvertibility War Bureaucracy Corruption Financial Risk Factors Indicators of Economic Growth Types of Country Risk Assessment Macro-Assessment of Country Risk Micro-Assessment of Country Risk Techniques to Assess Country Risk Checklist Approach Delphi Approach Quantitative Analysis Inspection Visits Combination of Techniques Measuring Country Risk Variation in Methods of Measuring Country Risk Using the Country Risk Rating for Decision Making Comparing Country Risk Ratings Across Countries Actual Country Risk Ratings Across Countries Incorporating Country Risk in Capital Budgeting Adjustment of the Discount Rate Adjustment of the Estimated Cash Flows How Country Risk Affects Financial Decisions 278 Chapter 16: Country Risk Analysis 279 Reducing Exposure to Host Government Takeovers Use a Short-term Horizon Rely on Unique Supplies or Technology Hire Local Labor Borrow Local Funds Purchase Insurance Use Project Finance Chapter Theme This chapter attempts to acquaint the student with various forms of risk that must be considered by a multinational corporation. Methods used to assess country risk are defined. It should be emphasized that country risk is often difficult to assess. Furthermore, it may change over time. A firm should incorporate the country risk assessment in its decision of whether to begin (or continue) business in a particular country. If it decides to conduct business there, it should continue to assess country risk as it decides whether to expand in that country. Topics to Stimulate Class Discussion 1. How would you rate the country risk of the U.S.? Would your rating change if you lived in a foreign country? Why? 2. Some people say that you cannot separate the political and financial risk of a country. What does this mean? 3. If you use a country risk rating system based on a scoring range of 0 to 100 (100 representing a very safe country), and Country Z earns a score of 77, are you going to invest in that country? Explain your answer. The point is to realize that the ratings are subjective, and it would help to consider a probability distribution of possible outcomes before finalizing a decision. POINT/COUNTER-POINT: Does Country Risk Matter for U.S. Projects? POINT: No. U.S.-based MNCs should consider country risk for foreign projects only. A U.S.-based MNC can account for U.S. economic conditions when estimating cash flows of a U.S. project or deriving the required rate of return on a project, but it does not need to consider country risk. COUNTER-POINT: Yes. Country risk should be considered for U.S. projects. Country risk can indirectly affect the cash flows of a U.S. project. Consider a U.S. project in which supplies are produced and sent to a U.S. exporter. The demand for the supplies will be dependent on the demand for the exports over time, and the demand for exports over time may be dependent on country risk. WHO IS CORRECT? Use the Internet to learn more about this issue. Which argument do you support? Offer your own opinion on this issue. 280 International Financial Management ANSWER: In some cases, country risk could influence cash flows. When assessing a U.S. project, an MNC should consider the ultimate source of the products that it produces, so that it can determine whether the cash flows may be affected by country risk. Answers to End of Chapter Questions 1. Forms of Country Risk. List some forms of political risk other than a takeover of a subsidiary by the host government, and briefly elaborate on how each factor can affect the risk to the MNC. Identify common financial factors for an MNC to consider when assessing country risk. Briefly elaborate on how each factor can affect the risk to the MNC. ANSWER: Forms of political risk include the possibility of (1) blocked funds, (2) changing tax laws, (3) public revolt against the firm, (4) war, and (5) a changing attitude of the host government toward the MNC. The forms of country risk mentioned here can cause reduced demand for the subsidiary’s product, higher taxes, or restrictions of fund transfers. Financial factors include inflation, interest rates, GNP growth, and labor costs. These factors can affect the cost of production or revenues to the subsidiary. 2. Country Risk Assessment. Describe the steps involved in assessing country risk once all relevant information has been gathered. ANSWER: First, a rating must be assigned to each factor. Then, a weight must be assigned. Finally, the weighted ratings can be consolidated to derive an overall political risk and financial risk rating, and (if desired) an overall country risk rating. 3. Uncertainty Surrounding the Country Risk Assessment. Describe the possible errors involved in assessing country risk. In other words, explain why country risk analysis is not always accurate. ANSWER: Errors occur due to (1) assigning inaccurate ratings to factors and (2) weighting the importance of the factors improperly. 4. Diversifying Away Country Risk. Why do you think that an MNC’s strategy of diversifying projects internationally could achieve low exposure to overall country risk? ANSWER: If the MNC can set up foreign projects in countries whose country risk levels are not highly correlated over time, then it reduces the exposure to the possibility of high country risk in all of these areas simultaneously. 5. Monitoring Country Risk. Once a project is accepted, country risk analysis for the foreign country involved is no longer necessary, assuming that no other proposed projects are being evaluated for that country. Do you agree with this statement? Why or why not? ANSWER: Disagree! The country risk must be monitored continuously, since if risk becomes too high, the MNC should divest its subsidiaries in that country. Chapter 16: Country Risk Analysis 281 6. Country Risk Analysis. If the potential return is high enough, any degree of country risk can be tolerated. Do you agree with this statement? Why or why not? Do you think that a proper country risk analysis can replace a capital budgeting analysis of a project considered for a foreign country? Explain. ANSWER: Disagree! If country risk is so high that there is great danger to employees, no expected return is high enough to warrant the project. No. Country risk analysis is not intended to estimate all project cash flows and determine the present value of these cash flows. It is intended to identify forms of country risk and their potential impact. This is important information for capital budgeting but is not a substitute for capital budgeting. 7. Country Risk Analysis. Niagara, Inc., has decided to call a well-known country risk consultant to conduct a country risk analysis in a small country where it plans to develop a large subsidiary. Niagara prefers to hire the consultant since it plans to use its employees for other important corporate functions. The consultant uses a computer program that has assigned weights of importance linked to the various factors. The consultant will evaluate the factors for this small country and insert a rating for each factor into the computer. The weights assigned to the factors are not adjusted by the computer, but the factor ratings are adjusted for each country that the consultant assesses. Do you think Niagara, Inc. should use this consultant? Why or why not? ANSWER: No! The consultant’s program has not allowed for the weights on importance for each rating to be flexible, depending on the country or firm project of concern. Therefore, the program will definitely assign improper weights to some factors. 8. Micro Assessment. Explain the micro assessment of country risk. ANSWER: A micro-assessment of country risk assesses risk factors as related to the firm’s particular projects. 9. Incorporating Country Risk in Capital Budgeting. How could a country risk assessment be used to adjust a project’s required rate of return? How could such an assessment be used instead to adjust a project’s estimated cash flows? ANSWER: For countries with a lower country risk rating (implying high risk), the project’s required rate of return could be increased (by increasing the discount rate on NPV analysis). To adjust cash flows, consider each key form of country risk and re-estimate cash flows if that form of risk occurs. For example, if the host government may block funds temporarily, estimate the NPV of the project if that occurs. Re-estimate the NPV for any other forms of country risk as well. This process results in a distribution of possible NPVs that can be assessed to determine whether a project should be accepted. 10. Reducing Country Risk. Explain some methods of reducing exposure to existing country risk, while maintaining the same amount of business within a particular country. 282 International Financial Management ANSWER: Some of the more common methods to reduce country risk are: 1. 2. 3. 4. 5. use a short-term horizon hire local labor borrow local funds obtain insurance create joint ventures These and other methods are discussed in the chapter. 11. Managing Country Risk. Why do some subsidiaries maintain a low profile as to where their parents are located? ANSWER: Some subsidiaries are concerned that the public in the country where they are located will harm their employees or damage the facilities as an act of protest against the home country of subsidiaries. 12. Country Risk Analysis. When NYU Corp. considered establishing a subsidiary in Zealand, it performed a country risk analysis to help make the decision. It first retrieved a country risk analysis performed about one year earlier, when it had planned to begin a major exporting business to Zenland firms. Then it updated the analysis by incorporating all current information on the key variables that were used in that analysis, such as Zenland’s willingness to accept exports, its existing quotas, and existing tariff laws. Is this country risk analysis adequate? Explain. ANSWER: No. A country risk analysis used for an exporting project incorporates different information than an analysis used to assess the feasibility of establishing a subsidiary. 13. Reducing Country Risk. MNCs such as Alcoa, DuPont, Heinz, and IBM donated products and technology to foreign countries where they had subsidiaries. How could these actions have reduced some forms of country risk? ANSWER: When MNCs donate products and/or technology to foreign countries where they have subsidiaries, they may receive more favorable treatment from the consumers in that country, their employees that work for their subsidiaries, and the host governments. 14. Country Risk Ratings. Assauer Inc. would like to assess the country risk of Glovanskia. Assauer has identified various political and financial risk factors, as shown below. Political Risk Factor Blockage of fund transfers Bureaucracy Assigned Rating 5 3 Assigned Weight 40% 60% Financial Risk Factor Interest rate Inflation Exchange rate Competition Growth Assigned Rating 1 4 5 4 5 Assigned Weight 10% 20% 30% 20% 20% Chapter 16: Country Risk Analysis 283 Assauer has assigned an overall rating of 80 percent to political risk factors and of 20 percent to financial risk factors. Assauer is not willing to consider Glovanskia for investment if the country risk rating is below 4.0. Should Assauer consider Glovanskia for investment? ANSWER: Determine the combined country risk rating: Political risk rating = (5 × 40%) + (3 × 60%) = 3.8 Financial risk rating = (1 × 10%) + (4 × 20%) + (5 × 30%) + (4 × 20%) + (5 × 20%) = 4.2 Weighted rating = (3.8 × 80%) + (4.2 × 20%) = 3.88 Since the weighted rating is below 4.0, Assauer will probably not consider the investment. 15. Effects of September 11. Arkansas Inc. exports to various less developed countries, and its receivables are denominated in the foreign currencies of the importers. It considers reducing its exchange rate risk by establishing small subsidiaries to produce products. By incurring some expenses in the countries where it generates revenue, it reduces its exposure to exchange rate risk. Since September 11, 2001, when terrorists attacked the U.S., it has questioned whether it should restructure its operations. Its CEO believes that its cash flows may be less exposed to exchange rate risk but more exposed to other types of risk as a result of restructuring. What is your opinion? ANSWER: Arkansas Inc. could be more exposed to political risk as a result of establishing subsidiaries in other countries. Thus, its cash flows may be subject to more uncertainty with the exposure to political risk than if it continues to export and is subject to exchange rate risk. Advanced Questions 16. How Country Risk Affects NPV. Hoosier, Inc., is planning a project in the United Kingdom. It would lease space for one year in a shopping mall to sell expensive clothes manufactured in the U.S. The project would end in one year, when all earnings would be remitted to Hoosier, Inc. Assume that no additional corporate taxes are incurred beyond those imposed by the British government. Since Hoosier, Inc., would rent space, it would not have any long-term assets in the United Kingdom, and expects the salvage (terminal) value of the project to be about zero. Assume that the project’s required rate of return is 18 percent. Also assume that the initial outlay required by the parent to fill the store with clothes is $200,000. The pretax earnings are expected to the £300,000 at the end of one year. The British pound is expected to be worth $1.60 at the end of one year, when the after-tax earnings are converted to dollars and remitted to the United States. The following forms of country risk must be considered: • The British economy may weaken (probability = 30%), which would cause the expected pretax earnings to be £200,000. • The British corporate tax rate on income earned by U.S. firms may increase from 40 percent to 50 percent (probability = 20 percent). These two forms of country risk are independent. Calculate the expected value of the project’s net present value (NPV) and determine the probability that the project will have a negative NPV. 284 International Financial Management ANSWER: Sensitivity analysis can be used to measure the net present value under each possible scenario, as shown in the attached exhibit. There are four possible scenarios. The most favorable scenario is a strong British economy and a relatively low (40%) British tax rate. This scenario results in after-tax dollar earnings of $288,000 in one year. The NPV is determined by obtaining the present value of these earnings (discounted at the required rate of return of 18%) and subtracting the initial outlay of $200,000. The NPV resulting from the most favorable scenario is $44,068. The joint probability of a strong British economy and the 40% tax rate is the product of the probabilities of these two situations (assuming that the situations are independent). Given a 70 percent probability for the strong British economy and an 80 percent probability for the 40% British tax rate, the joint probability is 70% × 80% = 56%. The NPV and joint probability for each of the other three scenarios are also estimated in the exhibit, following the same process as discussed above. The expected value of the project’s NPV can be determined as the sum of the products of each scenario’s NPV and joint probability, as shown below: E(NPV) = ($44,068 × 56%) + ($3,390 × 14%) + (–$37,288 × 24%) + (–$64,407 × 6%) = ($24,678) + ($475) + (–$8,949) + (–$3,864) = $12,340 The expected net present value of the project is positive. Yet, the NPV is expected to be negative for two of the four possible scenarios that could occur. Since the joint probabilities of these two scenarios add up to 30 percent, this implies that there is a 30 percent chance that the project will result in a negative NPV. The example was simplified in that the project has a planned life of only one year, and there was no terminal value for the project. However, a more complicated example could be analyzed by using spreadsheet software to conduct the sensitivity analysis. The analyst would need to develop some “compute” statements that lead to an estimate of NPV. Each scenario causes a change in one or more of the numbers to be input when estimating the NPV. EXHIBIT FOR QUESTION 16 Pretax Pound Earnings After-Tax Pound Earnings After-Tax Dollar Earnings British Corp. Tax Rate=40% (Prob.=80%) £300,000 × (1–.40) = £180,000 £180,000 × $1.60=$288,000 Estimated NPV $288,000 ( 1.18) Strong British Economy £300,000 (Prob. = 70%) British Corp. Tax Rate=50% (Prob.=20%) − $200,000 = $44,068 Chapter 16: Country Risk Analysis 285 £300,000 × (1–.50) = £150,000 $240,000 £150,000 × $1.60 = $240,000 ( 1.18) £120,000 × $1.60 = $192,000 $192,000 − $200,000 = $3,390 British Corp. Tax Rate=40% (Prob.=80%) £200,000 × (1–.40) = £120,000 ( 1.18) − $200,000 = $ - 37,288 Weak British Economy £200,000 (Prob. = 30%) British Corp. Tax Rate =50% (Prob.=20%) £200,000 × (1–.50) = £100,000 £100,000 × $1.60 = $160,000 $160,000 ( 1.18) − $200,000 = $ - 64,407 17. How Country Risk Affects NPV. Explain how the capital budgeting analysis in the previous question would need to be adjusted if there were three possible outcomes for the British pound along with the possible outcomes for the British economy and corporate tax rate. ANSWER: A simplification of the example provided is that only one expectation for the British pound’s value was assumed. In reality, Hoosier Inc. may create a probability distribution for the pound’s value one year from now. If Hoosier Inc. used three possible outcomes for the pound, this would expand the number of possible scenarios. For each of the four scenarios in the previous question, there would now be three possible outcomes for the pound’s value, resulting in a total of 12 possible scenarios. 18. J.C. Penney’s Country Risk Analysis. Recently, J.C. Penney decided to consider expanding into various foreign countries; it applied a comprehensive country risk analysis before making its expansion decisions. Initial screenings of 30 foreign countries were based on political and economic factors that contribute to country risk. For the remaining 20 countries where country risk was considered to be tolerable, specific country risk characteristics of each country were considered. One of J.C. Penney’s biggest targets is Mexico, where it planned to build and operate seven large stores. a. Identify the political factors that you think may possibly affect the performance of the J.C. Penney stores in Mexico. ANSWER: Perhaps the most likely political factor is the blockage of fund transfers or currency inconvertibility, because the currency (the peso) is sometimes volatile and could require special controls in some periods. b. Explain why the J.C. Penney stores in Mexico and in other foreign markets are subject to financial risk (a subset of country risk). 286 International Financial Management ANSWER: The economy in Mexico is volatile, and if economic conditions deteriorate, the demand for many products sold at the J.C. Penney stores will decline. While some economies are more stable than Mexico’s economy, any country is subject to a possible weakening of the economy. Therefore, J.C. Penney stores in any country could experience weak sales due to financial risk. c. Assume that J.C. Penney anticipated that there was a 10 percent chance that the Mexican government would temporarily prevent conversion of peso profits into dollars because of political conditions. This event would prevent J.C. Penney from remitting earnings generated in Mexico and could adversely affect the performance of these stores (from the U.S. perspective). Offer a way in which this type of political risk could be explicitly incorporated into a capital budgeting analysis when assessing the feasibility of these projects. ANSWER: The expected cash flows of the project could be re-estimated based on the scenario that the Mexican government restricts the conversion of currencies. The net present value of the project can be re-estimated as well. Thus, the capital budgeting analysis results in a distribution of NPVs based on possible scenarios. d. Assume that J.C. Penney decides to use dollars to finance the expansion of stores in Mexico. Second, assume that J.C. Penney decides to use one set of dollar cash flow estimates for any project that it assesses. Third, assume that the stores in Mexico are not subject to political risk. Do you think that the required rate of return on these projects would differ from the required rate of return on stores built in the U.S. at that same time? Explain. ANSWER: If J.C. Penney generated a single set of cash flow estimates for the establishment of a given store in Mexico, it would likely use a required rate of return that is higher than that used for a proposed store in the U.S. The higher required rate of return on new stores in Mexico is attributed to the greater degree of uncertainty associated with the new stores in Mexico than new stores in the U.S. Even though there is more potential for profits from new stores in Mexico, there is more uncertainty about the future cash flows generated by those stores. The Mexican economy is more volatile than the U.S. economy, so the demand for products in Mexico is subject to more uncertainty. Also, the exchange rate movements will affect the dollar earnings that are generated by the stores in Mexico. Since the exchange rate movements are very uncertain, so are the dollar earnings that will be received by the U.S. parent. e. Based on your answer to the previous question, does this mean that proposals for any new stores in the U.S. have a higher probability of being accepted than proposals for any new stores in Mexico? ANSWER: No. The U.S. markets have less potential because J.C. Penney has stores in most U.S. markets (as mentioned in the case). Therefore, the estimated cash flows would be lower for U.S. projects. Even though the required rate of return may be higher for a proposed store in Mexico, the dollar cash flows should be much higher, which could result in a higher probability of accepting this type of project. 19. How Country Risk Affects NPV. Monk, Inc. is considering a capital budgeting project in Tunisia. The project requires an initial outlay of 1 million Tunisian dinar; the dinar is currently valued at $.70. In the first and second years of operation, the project will generate 700,000 dinar in each year. After two years, Monk will terminate the project, and the expected salvage value is Chapter 16: Country Risk Analysis 287 300,000 dinar. Monk has assigned a discount rate of 12 percent to this project. The following additional information is available: • • • There is currently no withholding tax on remittances to the U.S., but there is a 20 percent chance that the Tunisian government will impose a withholding tax of 10 percent beginning next year. There is a 50 percent chance that the Tunisian government will pay Monk 100,000 dinar after two years instead of the 300,000 dinar it expects. The value of the dinar is expected to remain unchanged over the next two years. a. Determine the net present value (NPV) of the project in each of the four possible scenarios. b. Determine the joint probability of each scenario. c. Compute the expected NPV of the project and make a recommendation to Monk regarding its feasibility. ANSWER: a. Scenario 1: No withholding taxes, 300,000 dinar salvage value Year 0 Dinar remitted by subsidiary Withholding tax Dinar remitted after withholding tax Salvage value Exchange rate Cash flows to parent PV of parent cash flow Initial investment by parent $700,000 Cumulative NPV Year 1 Year 2 700,000700,000 0 0 700,000700,000 300,000 $.70 $.70 $490,000 $700,000 $437,500 $558,036 –$262,500 $295,536 Scenario 2: 10% withholding tax, 300,000 dinar salvage value Year 0 Dinar remitted by subsidiary Withholding tax Dinar remitted after withholding tax Salvage value Exchange rate Cash flows to parent PV of parent cash flow Initial investment by parent $700,000 Cumulative NPV Year 1 Year 2 700,000700,000 70,000 70,000 630,000630,000 300,000 $.70 $.70 $441,000 $651,000 $393,750 $518,973 –$306,250 $212,723 288 International Financial Management Scenario 3: 10% withholding tax, 100,000 dinar salvage value Year 0 Dinar remitted by subsidiary Withholding tax Dinar remitted after withholding tax Salvage value Exchange rate Cash flows to parent PV of parent cash flow Initial investment by parent $700,000 Cumulative NPV Year 1 Year 2 700,000700,000 70,000 70,000 630,000630,000 100,000 $.70 $.70 $441,000 $511,000 $393,750 $407,366 –$306,250 $101,116 Scenario 4: No withholding taxes, 100,000 dinar salvage value Year 0 Dinar remitted by subsidiary Withholding tax Dinar remitted after withholding tax Salvage value Exchange rate Cash flows to parent PV of parent cash flow Initial investment by parent $700,000 Cumulative NPV Year 1 Year 2 700,000700,000 0 0 700,000700,000 100,000 $.70 $.70 $490,000 $560,000 $437,500 $446,429 –$262,500 $183,929 a. The joint probabilities for the four cases are shown below: Scenario 1: No withholding taxes, 300,000 dinar salvage value = 80% × 50% = 40% Scenario 2: 10% withholding tax, 300,000 dinar salvage value = 20% × 50% = 10% Scenario 3: 10% withholding tax, 100,000 dinar salvage value = 20% × 50% = 10% Scenario 4: No withholding taxes, 100,000 dinar salvage value = 80% × 50% = 40% b. E(NPV) = $295,536(40%) + $212,723(10%) + $101,116(10%) + $183,929(40%) = $223,170 Since the expected NPV is positive, and since the NPV is positive in each individual scenario, Monk should undertake the project. 20. How Country Risk Affects NPV. In the previous question, assume that instead of adjusting the estimated cash flows of the project, Monk had decided to adjust the discount rate from 12 percent to 17 percent. Reevaluate the NPV of the project’s expected scenario using this adjusted discount rate. Chapter 16: Country Risk Analysis 289 ANSWER: Year 0 Dinar remitted by subsidiary Withholding tax Dinar remitted after withholding tax Salvage value Exchange rate Cash flows to parent PV of parent cash flow Initial investment by parent $700,000 Cumulative NPV Year 1 Year 2 700,000700,000 0 0 700,000700,000 300,000 $.70 $.70 $490,000 $700,000 $418,803 $511,359 –$281,197 $230,342 The project still has a positive NPV of $230,342 and should be accepted. Notice that the NPV obtained using t adjusted discount rate is very close to the expected NPV when the cash flows are adjusted. 21. The Risk and Cost of Potential Kidnapping. In 2004 following the war in Iraq, some MNCs capitalized on opportunities to rebuild Iraq. However, in April 2004, some employees were kidnapped by local militant groups. How should an MNC account for this potential risk when it considers direct foreign investment (DFI) in any particular country? Should it avoid DFI in any country in which such an event could occur? If so, how would it screen the countries to determine which are acceptable? For whatever countries that it is willing to consider, should it adjust its feasibility analysis to account for the possibility of kidnapping? Should it attach a cost to reflect this possibility or increase the discount rate when estimating the net present value? Explain. ANSWER: This question can lead to an interesting class discussion. Some students will suggest that an MNC should never pursue opportunities in countries where such events could occur. Yet, this could occur anywhere, so the students must attempt to decide how much risk they should be willing to take. The question is complicated because human lives are involved. MNCs may consider the potential cost of paying kidnappers, but there are some other costs such as the moral of the company and the long-term effect on kidnapped employees (even if they are rescued) that are difficult to measure. 22. Integrating Country Risk and Capital Budgeting. Tovar Co. is a U.S. firm that has been asked to provide consulting services to help Grecia Company (in Greece) improve its performance. Tovar would need to spend $300,000 today on expenses related to this project. In one year, Tovar will receive payment from Grecia, which will be tied to Grecia’s performance during the year. There is uncertainty about Grecia’s performance and about Grecia’s tendency for corruption. Tovar expects that it will receive 400,000 euros if Grecia achieves strong performance following the consulting job. However, there are two forms of country risk that are a concern to Tovar Co. There is an 80 percent chance that Grecia will achieve strong performance. There is a 20 percent chance that Grecia will perform poorly, and in this case, Tovar will receive a payment of only 200,000 euros. While there is a 90 percent chance that Grecia will make its payment to Tovar, there is a 10 percent chance that Grecia will become corrupt, and in this case, Grecia will not submit any payment to Tovar. 290 International Financial Management Assume that the outcome of Grecia’s performance is independent of whether Grecia becomes corrupt. The prevailing spot rate of the euro is $1.30, but Tovar expects that the euro will depreciate by 10 percent in one year, regardless of Grecia’s performance or whether it is corrupt. Tovar’s cost of capital is 26 percent. Determine the expected value of the project’s net present value. Determine the probability that the project’s NPV will be negative. ANSWER: First, the expected spot rate of the euro in one year is $1.30 × (1 – .10) = $1.17. Here are the results of each of four scenarios: 1. If the Greek firm performs well and there is no corruption, the net present value of the project is: [(400,000 euros × $1.17)/1.26] – $300,000 = $71,428 2. If Grecia performs well and there is corruption, there will not be a payment to Tovar, so the net present value of the project is –$300,000. 3. If the Grecia performs poorly and there is no corruption, the net present value of the project is: [(200,000 euros × $1.17)/1.26] – $300,000 = –$114,286 4. If Grecia performs poorly and there is corruption, there will be no payment to Tovar, so the net present value of the project is –$300,000. Summary of Scenarios: Scenario Regarding Performance Strong Strong Weak Weak Probability Regarding Performance 80% 80% 20% 20% Scenario Strong/Not corrupt Strong/Corrupt Weak/Not corrupt Weak/Corrupt Scenario Regarding Corruption Not corrupt Corrupt Not corrupt Corrupt Joint Probability 80% × 90% = 72% 80% × 10% = 8% 20% × 90% = 18% 20% × 10% = 2% Probability Regarding Corruption 90% 10% 90% 10% NPV $71,428 –$300,000 –$114,286 –$300,000 NPV $71,428 –$300,000 –$114,286 –$300,000 Expected Value of NPV = (72% × $71,428) + (8% × –$300,000) + 18% (–$114,286) + 2% (–$300,000) = ($51,428) + (–$24,000) + (–$20,571) + (–$6,000) = –$857. There is a 28% chance that the project’s NPV will be negative. 23. Capital Budgeting and Country Risk. Wyoming Co. is a non-profit educational institution that wants to import educational software products from Hong Kong and sell them in the U.S. It wants to assess the net present value of this project since any profits it earns will be used for its Chapter 16: Country Risk Analysis 291 foundation. It expects to pay HK$5 million for the imports. Assume the existing exchange rate is HK$1 =$.12. It would also incur selling expenses of $1 million to sell the products in the U.S. It would be able to sell the products in the U.S. for $1.7 million. However, it is concerned about two forms of country risk. First, there is a 60% chance that the Hong Kong dollar will be revalued to be worth HK$1 = $.16 by the Hong Kong government. Second, there is a 70% chance that the Hong Kong government imposes a special tax of 10% on the amount that U.S. importers must pay for Hong Kong exports. These two forms of country risk are independent, meaning that the probability that the Hong Kong dollar will be revalued is independent of the probability that the Hong Kong government will impose a special tax. Wyoming’s required rate of return on this project is 22%. What is the expected value of the project’s net present value? What is the probability that the project’s NPV will be negative? ANSWER: Revenue Import cost ( in HKD) Exchange rate Import cost in $ Gross profit Selling expense Cash flow NPV Scenario 1: No Tax or Exchange Rate Adjustment $1,700,000 5,000,000 $0.12 $600,000 $1,100,000 $1,000,000 $100,000 $81,967 Scenario 2: 10% Tax $1,700,000 5,500,000 $0.12 $660,000 $1,040,000 $1,000,000 $40,000 $32,787 Scenario 3: Exchange Rate Adjustment $1,700,000 5,000,000 $0.16 $800,000 $900,000 $1,000,000 –$100,000 –$81,967 Scenario 4: 10% Tax and Exchange Rate Adjustment $1,700,000 5,500,000 $0.16 $880,000 $820,000 $1,000,000 –$180,000 –$147,541 Expected NPV of the project is: ($81,967 × .12) + ($32,787 × .28) + (–$81,967 × .18) + (–$147,541 × .42) = –$57,704 There is a 60% probability that the project’s NPV will be negative. 24. Accounting for Country Risk of a Project. Kansas Co. wants to invest in a project in China, It would require an initial investment of 5,000,000 yuan. It is expected to generate cash flows of 7,000,000 yuan at the end of one year. The spot rate of the yuan is $.12, and Kansas thinks this exchange rate is the best forecast of the future. However, there are 2 forms of country risk. First, there is a 30% chance that the Chinese government will require that the yuan cash flows earned by Kansas at the end of one year be reinvested in China for one year before it can be remitted (so that cash would not be remitted until 2 years from today). In this case, Kansas would earn 4% after taxes on a bank deposit in China during that second year. Second, there is a 40% chance that the Chinese government will impose a special remittance tax of 400,000 yuan at the time that Kansas Co. remits cash flows earned in China back to the U.S. The two forms of country risk are independent. The required rate of return on this project is 26%. There is no salvage value. What is the expected value of the project’s net present value? 292 International Financial Management ANSWER: Yuan remitted by subsidiary Withholding tax Interest rate Yuan after interest earned Yuan remitted after taxes Exchange rate of yuan Cash flow to parent PV of parent cash flow (26%) Initial investment in U.S. $ NPV Scenario 1 Scenario 2 Scenario 3 Scenario 4 Scenario 1: No Country Risk 7,000,000 NA NA NA NA $0.12 $840,000.00 $666,666.67 –$600,000.00 $66,666.67 30% 40% Scenario 2: Remittance Scenario 3: Must be 400,000 Yuan Scenario 4: Invested for 1 Remittance Both Country Year Tax Risks 7,000,000 7,000,000 7,000,000 NA 400,000 400,000 0.04 NA 0.04 7280000 NA 7280000 NA 6,600,000 6,880,000 $0.12 $0.12 $0.12 $873,600.00 $792,000.00 $825,600.00 $550,264.55 $628,571.43 $520,030.23 –$600,000.00 –$600,000.00 –$600,000.00 –$49,735.45 $28,571.43 –$79,969.77 NPV $66,666.67 –$49,735.45 $28,571.43 –$79,969.77 NPV × Probability $28,000.00 –$8,952.38 $8,000.00 –$9,596.37 Probability 70% × 60% 30% × 60% 70% × 40% 30% × 40% Probability 0.42 0.18 0.28 0.12 Total NPV $17,451.25 25. Accounting for Country Risk of Projects. Slidell Co. (a U.S. firm) considers a foreign project in which it expects to receive 10 million euros at the end of this year. It plans to hedge receivables of 10 million euros with a forward contract. Today, the spot rate of the euro is $1.20, while the oneyear forward rate of the euro is presently $1.24, and the expected spot rate of the euro in one year is $1.19. The initial outlay is $7 million. Slidell has a required return of 18%. There is a 20% chance that political problems will cause a reduction in foreign business, such that it would only receive 4 million euros at the end of one year. Determine the expected value of the net present value of this project. ANSWER: Normal conditions: Dollar cash flows = 10,000,000 euros × $1.24 = $12,400,000 NPV = ($12,400,000/1.18) – $7,000,000 = $3,508,474 Political problem: Dollar cash flows = 4,000,000 × $1.24 = $4,960,000 But the forward contract on the remaining 6,000,000 euros converts to ($1.24 – $1.19) × 6,000,000 = $300,000 Chapter 16: Country Risk Analysis 293 So the total cash flow is $5,260,000. NPV = $5,260,000/1.18 = $4,457,627 $4,457,627 – $7,000,000 = –$2,542,373 E(NPV) = (.8 × $3,508,474) + (.2 × –$2,542,373) = $2,298,305 Solution to Continuing Case Problem: Blades, Inc. 1. Based on the information provided in the case, do you think the political risk associated with Thailand is higher or lower for a manufacturer of leisure products such as Blades as opposed to, say, a food producer? That is, conduct a micro-assessment of political risk for Blades, Inc. ANSWER: Based on the information provided in the case, the political risk for a manufacturer of leisure products appears to be lower for a manufacturer of leisure products such as Blades. This is because the number of licenses and permits required for Blades’ industry is relatively few compared to other industries. 2. Do you think the financial risk associated with Thailand is higher or lower for a manufacturer of leisure products such as Blades as opposed to, say, a food producer? That is, conduct a microassessment of financial risk for Blades, Inc. Do you think a leisure product manufacturer such as Blades will be more affected by political or financial risk factors? ANSWER: The level of financial risk in Thailand is higher for a manufacturer of leisure products such as Blades, Inc. This is because consumers will first eliminate purchases of these types of products as opposed to more essential products such as food in the event of an economic turndown. Consequently, Blades would suffer more from high levels of interest rates and inflation in Thailand than producers of more essential items. A leisure product manufacturer such as Blades will probably be more affected by financial risk factors than political risk factors in Thailand. Financial risk factors can have a devastating effect on the consumption of “luxury” items such as roller blades. Political risk factors will affect Blades if the Thai government imposes controls or restrictions that would make it more difficult for Blades, Inc. to operate efficiently in Thailand, which is currently not the case. 3. Without using a numerical analysis, do you think establishing a subsidiary in Thailand or acquiring Skates’n’Stuff will result in a higher assessment of political risk? Of financial risk? Substantiate your answer. ANSWER: Establishing a subsidiary in Thailand will probably result in a higher level of political risk than acquiring Skates’n’Stuff. Asian consumers prefer to purchase from Asian producers. If Blades acquires Skates’n’Stuff and retains the company’s management and employees, the acquisition will result in a lower level of political risk than the establishment of a subsidiary. The financial risk associated with Thailand will probably not differ substantially between the two approaches of direct foreign investment. If the Thai economy enters a recession, demand for Blades’ products will be affected negatively, regardless of whether it establishes a subsidiary in Thailand or purchases Skates’n’Stuff. 294 International Financial Management 4. Using a spreadsheet, conduct a quantitative country risk analysis for Blades, Inc., using the information Ben Holt has provided for you. Use your judgment to assign weights and ratings to each political and financial risk factor and determine an overall country risk rating for Thailand. Conduct two separate analyses for (a) the establishment of a subsidiary in Thailand and (b) the acquisition of Skates’n’Stuff. ANSWER: (See spreadsheet below.) There is no one correct answer to this question. The estimates provided in the attached spreadsheet are somewhat arbitrary, but students should at least use the information provided to assign a rating. However, because of the higher political risk associated with the establishment of a subsidiary (as opposed to the acquisition of Skates’n’Stuff), the establishment of a subsidiary should result in a higher (i.e., less favorable) country risk rating for the establishment of a subsidiary. (1) Establishment of a Subsidiary in Thailand (1) Political Risk Factor Attitude of Thai Consumers Capital Controls Bureaucracy Financial Risk Factor Interest Rates Inflation Level Exchange Rates (2) (3) Rating Assigned Weight Assigned by Blades to by Blades to Factor (within a Factor According range of 1-5) to Importance 4 30% 4 2 5 3 4 (4) = (2) × (3) Weighted Value of Factor 1.2 40% 30% 100% 1.6 0.6 3.4 35% 30% 35% 100% 1.75 0.9 1.4 4.05 = Political risk rating = Financial risk rating Chapter 16: Country Risk Analysis (1) Category Political Risk Financial Risk 295 (2) (3) (4) = (2) × (3) Rating as Determined Above 3.4 4.05 Weight Assigned by Blades to Each Risk Category 40% 60% 100% Weighted Rating 1.36 2.43 3.79 (3) (4) = (2) × (3) = Overall country risk rating (2) Acquisition of Skates’n’Stuff (1) Political Risk Factor Attitude of Thai Consumers Capital Controls Bureaucracy Financial Risk Factor Interest Rates Inflation Level Exchange Rates (1) Category Political Risk Financial Risk (2) Rating Assigned Weight Assigned by Blades to by Blades to Factor (within a Factor According range of 1-5) to Importance 3 30% 4 1 5 3 4 Weighted Value of Factor 0.9 40% 30% 100% 1.6 0.3 2.8 35% 30% 35% 100% 1.75 0.9 1.4 4.05 (2) (3) (4) = (2) × (3) Rating as Determined Above 2.8 4.05 Weight Assigned by Blades to Each Risk Category 40% 60% 100% Weighted Rating 1.12 2.43 3.55 = Political risk rating = Financial risk rating = Overall country risk rating 5. Which method of direct foreign investment should utilize a higher discount rate in the capital budgeting analysis? Would this strengthen or weaken the tentative decision of establishing a subsidiary in Thailand? 296 International Financial Management ANSWER: Establishing a subsidiary should utilize a higher discount rate in the capital budgeting analysis. This would reduce the NPV associated with establishing a subsidiary in Thailand. Since the capital budgeting analysis indicated that establishing a subsidiary would be preferable to the acquisition of Skates’n’Stuff, this adjustment would weaken the tentative decision of establishing a subsidiary in Thailand. Solution to Supplemental Case: King, Incorporated a. There are several government-related issues to consider. Some of these issues are listed below: 1. Will Bulgaria’s government allow the firm to establish the subsidiary? Or will it require that King, Inc. participate in a joint venture with the government? This issue is relevant because it could affect the risk and return of the project. 2. What is the corporate tax rate to be charged on profits earned by King, Inc. in Bulgaria? 3. What is the withholding tax rate to be imposed on profits remitted to the parent of King, Inc.? 4. What are Bulgaria’s plans regarding privatization? If Bulgaria encourages privatization, this may allow for other competitors to compete against King, Inc. 5. Will Bulgaria require King, Inc. to incur any additional expenses for environmental reasons? In past years, Eastern Bloc countries have not focused on environmental problems, but this issue is now receiving more attention. 6. What is the government’s monetary and fiscal policy? Any effect that these policies have on the economy could influence the demand for the food products to be marketed by King, Inc. 7. What are the political relations between Bulgaria and other Eastern Bloc countries? Will King, Inc. be able to transport the products produced in Bulgaria to other countries without incurring any taxes or bureaucratic inconveniences? 8. Would King, Inc. be able to sell the subsidiary at market value if it desired to divest the project in the future? Or would the selling price be dictated by the government? b. The demand could be affected by: 1. The economies of the various Eastern Bloc countries (not just Bulgaria) that are targeted for this project; all the factors that affect economic conditions such as government policies, interest rates, etc. need to be assessed for each of these countries. 2. Consumer preferences for the food products; King, Inc. must assess consumer preferences in these countries. c. The cost of production could be affected as follows: Chapter 16: Country Risk Analysis 297 1. Changes in wage rates in Bulgaria would affect the labor cost incurred by King, Inc. 2. Changes in inflation could affect the cost of obtaining the necessary ingredients for production. 3. The cost of leasing the plant may be dictated by the government or be influenced by inflation. Small Business Dilemma Country Risk Analysis at the Sports Exports Company The Sports Exports Company produces footballs in the U.S. and exports them to the United Kingdom. It also has an ongoing joint venture with a British firm that produces some sporting goods for a fee. The Sports Exports Company is considering the establishment of a small subsidiary in the United Kingdom. 1. Under the current conditions, is the Sports Exports Company subject to country risk? ANSWER: Yes. While the firm’s exposure to country risk is quite limited, it should still recognize the risk that does exist. The country risk can be segmented into political risk and financial risk. The firm’s cash flows could be adversely affected if British consumers reduce their demand for the U.S. firm’s products as a form of protest against the U.S. (Although the type of product being sold is not likely to be the target of a major protest). The firm is not exposed to other forms of political risk because it does not have any of its own assets based in the United Kingdom at this time. The firm is exposed to financial risk factors such as the potential for a weak economy in the United Kingdom, which could result in a weak demand for the firm’s products. 2. If the firm does decide to develop a small subsidiary in the United Kingdom, will its exposure to country risk change? If so, how? ANSWER: The exposure to country risk would now increase, because the subsidiary would now be subject to British tax laws, which could change at any time. Also, the subsidiary could be subject to the possibility of a government takeover. However, such a risk is normally considered to be very low in a country such as the United Kingdom.