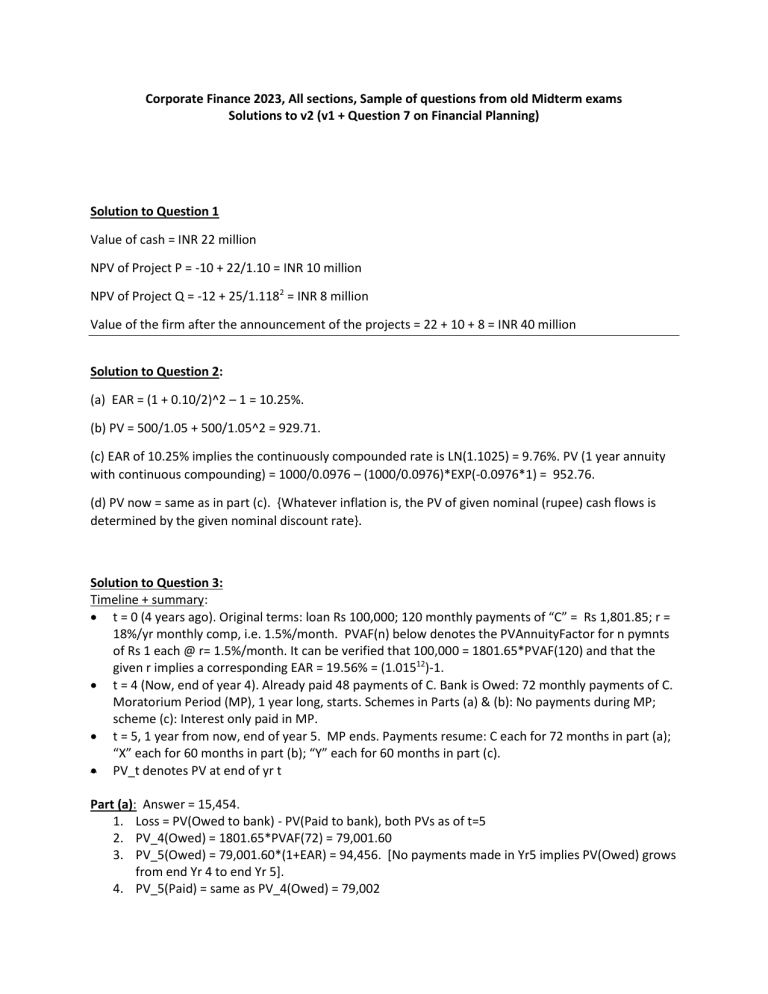

Corporate Finance 2023, All sections, Sample of questions from old Midterm exams

Solutions to v2 (v1 + Question 7 on Financial Planning)

Solution to Question 1

Value of cash = INR 22 million

NPV of Project P = -10 + 22/1.10 = INR 10 million

NPV of Project Q = -12 + 25/1.1182 = INR 8 million

Value of the firm after the announcement of the projects = 22 + 10 + 8 = INR 40 million

Solution to Question 2:

(a) EAR = (1 + 0.10/2)^2 – 1 = 10.25%.

(b) PV = 500/1.05 + 500/1.05^2 = 929.71.

(c) EAR of 10.25% implies the continuously compounded rate is LN(1.1025) = 9.76%. PV (1 year annuity

with continuous compounding) = 1000/0.0976 – (1000/0.0976)*EXP(-0.0976*1) = 952.76.

(d) PV now = same as in part (c). {Whatever inflation is, the PV of given nominal (rupee) cash flows is

determined by the given nominal discount rate}.

Solution to Question 3:

Timeline + summary:

• t = 0 (4 years ago). Original terms: loan Rs 100,000; 120 monthly payments of “C” = Rs 1,801.85; r =

18%/yr monthly comp, i.e. 1.5%/month. PVAF(n) below denotes the PVAnnuityFactor for n pymnts

of Rs 1 each @ r= 1.5%/month. It can be verified that 100,000 = 1801.65*PVAF(120) and that the

given r implies a corresponding EAR = 19.56% = (1.01512)-1.

• t = 4 (Now, end of year 4). Already paid 48 payments of C. Bank is Owed: 72 monthly payments of C.

Moratorium Period (MP), 1 year long, starts. Schemes in Parts (a) & (b): No payments during MP;

scheme (c): Interest only paid in MP.

• t = 5, 1 year from now, end of year 5. MP ends. Payments resume: C each for 72 months in part (a);

“X” each for 60 months in part (b); “Y” each for 60 months in part (c).

• PV_t denotes PV at end of yr t

Part (a): Answer = 15,454.

1. Loss = PV(Owed to bank) - PV(Paid to bank), both PVs as of t=5

2. PV_4(Owed) = 1801.65*PVAF(72) = 79,001.60

3. PV_5(Owed) = 79,001.60*(1+EAR) = 94,456. [No payments made in Yr5 implies PV(Owed) grows

from end Yr 4 to end Yr 5].

4. PV_5(Paid) = same as PV_4(Owed) = 79,002

5. Loss = (3) – (4) = 15,454.

Multiple other equivalent approaches (which may overlap each other) are possible: three such are

below:

• Loss = interest lost over year 5 on PV_4(Owed) = 79,001.60*EAR = 15,454 (shortest approach)

• Loss = PV pymnts not made in yr 5 – PV pymnts made in yr 11 (with PVs as of t=5)

= 1801.65*PVAF(12)*(1+EAR) - [1/((1+EAR)5)]*1801.65*PVAF(12) = 23,498.33 – 8,044.18 = 15,454

• From 100K, subtract PV at t=0 of 1st 48 pymnts received, to get 38,660. Delay means effectively lose

interest on this for 1 year (@ EAR of 19.56%) whose PV at t=1 is 7,563. Its FV at t=5 of

7563*(1+ear)^4 = 15,454.

Part (b): Answer X = 2,398.56. Multiple approaches possible; one such is below.

1. Reset pymnts of X each must be such that FV_10(60 of X paid to bank) = FV_10(Owed to bank)),

since liability must be cleared as of end yr 10. Discounting the FVs above to t=5, need to solve

X*PVAF(60) = PV_5(owed).

2. Note last is equivalent to student gain/loss = 0 in PV terms.

3. PV_5(Owed) = 94,456 (from part a)

4. Thus, X = 79,002*1.015^12/PVAF(60) = 94,455.75/39.3803 = 2,398.56

Part (c): Answer Y = 2,006.12. Multiple approaches possible; one such is below.

1. Pymnts of Y each must be such that PV_5(60 of Y paid to bank) = PV_5(Owed to bank, new), since

student must neither gain nor lose (both PVs are as of end of yr 5).

2. I.e. need to solve Y*PVAF(60) = PV_5(owed, new)

3. PV_5(Owed to bank, new), i.e. Principal owed as of end of yr 5 = PV(Owed as of end yr 4) from part

(a) of 79,001.60. This is because “Outstanding principal stays unchanged from the start of year 5 to

the end of year 5”, since only (full) interest and is paid each month and no principal is paid during

the Moratorium Period; i.e. only 1.5%*79,001.60 is paid each month in year 5.

Solution to Question 4: Suppose the face value of the bond is F = $100. (The % rate of return answer is

the same whatever F value you choose, say 1,000). Then, the bond investor was promised each year, for

five years, fixed coupon payments of 10% of the face value which is: C = 100*0.10 = $10. He is also

promised the face value =$100 at the end of five years.

The AAA bond price at 5% yield is:

𝑃0 =

𝐶

1

𝐹

10

1

100

=

= 121.65

[1 −

]+

[1 −

]+

5

5

5

(1 + 𝑟)

(1 + 𝑟)

(1.05)

(1.05)5

𝑟

0.05

Once the yield increases to 7%, the bond price falls today. Note that the bond now matures not in five

but four years. Its new price which the investor gets is:

𝑃0 =

10

1

100

+

= 110.16

[1 −

]

(1.07)4

(1.07)4

0.07

Additionally, the investor receives a fixed cash flow of $10 as coupon. Hence the rate of return reaped

by the bondholder is:

rate of Return = ((110.16– 121.65) + 10)/121.65 = -0.0122 or -1.22%.

Solution to Question 5:

(a) P(0) = D(1)/(r – g) = 3/(0.25 – 0.05) = 15.

(b) E1 = D1_old/payout_old = 3/0.75 = 4. D1_new = E1*payout_new = 4*0.5 = 2.

ROE = g_old/(1 – payout_old) = 5%/(1 – 75%) = 20%.

g_new = ROE*(1 – payout_new) = 0.2*(1 – 50%) = 10%. P0_new = D1/(r – g) = 2/(0.25 – 0.1) = 13.33.

(c) E1 of B = (D1 of 3)/(payout of 5/6) = 3.6. D1_new of B = (E1 of 3.6)*(payout of 50%) = 1.8.

ROE of B = g_old/(1 – payout_old of B) = 5%/(1 – (5/6)) = 30%.

g_new = ROE*(1 – payout_new) = 0.3*(1 – 50%) = 15%. P0_new of B = D1/(r – g) = 1.8/(0.25 – 0.15) = 18.

{Aside: B’s old P0 = 3/(0.25 – 0.05) = 15 = same as P0_old of A}.

(d) Different. PriceChg_B is > 0 whereas PriceChg_A is < 0.

(e) ROE A < r. Whereas ROE of B > r. Hence, announcement of more aggressive growth leads to the stock

price reflecting PVGO for A that is < 0. For B, this PVGO of B is > 0.

Solution to Question 6: DSO = DAYS Sales Outstanding = Collection Period

Rs/lakhs

Annual Sales

2400

Current DSO

45

Current AR

300

Proposed DSO

30

Proposed AR

200

Redn in AR

100

Opportunity Cost of Capital

0.1

Savings in financial costs of AR

10

Costs

10

Net benefits

0

Annual Sales - Current

2400

Annual Sales - Proposed

3000

Current DSO

45

Current AR

300

Proposed DSO

60

Proposed AR

500

Increase in AR due to new sales

100

VC / Sales

0.75

Increase in AR investment due to new sales

75

Solution to Question 7:

Income statement

Net sales

COGS (60%)

Gross profit

SGA

PBDIT

Depreciation

Interest

PBT

Tax (50%)

PAT

Q1: April-June,

April'15-March'16

2016

300

60.00

180

36.00

120

24.00

24

6.00

96

18.00

2

0.75

2

2.64

92

14.61

46

7.31

46

7.31

Balance sheet

Cash

Receivables

Inventory

NFA

Total assets

31st March, 2016

30th June, 2016

10

10.00

108

60.00

30

30.00

30

39.25

178

139.25

A/c payable

Bank: cash credit

Accrued tax

Provision for dividend

Long term debt, current

portion

Long term debt

Shareholders' equity

Total liability and equity

Trial assets

Trial liabilities

Trial liabilities - Trial assets

Cash

Bank - cash credit

18

18

26

4

10.00

14.14

-4.20

0.00

8

52

52

178

8.00

52.00

59.31

139.25

129.25

125.11

-4.14

10

14.14

CASH BUDGET

Cash receipts:

Collections

Cash payments:

Payment for raw material purchases

COGS, net of purchases

Tax payment

Payment for equipment

Interest paid

Dividends paid

SGA

Cash outflow

Net cashflow

Beginning cash

Total cash before loan repayment

Minimum cash requirement

Balance available for cc loan repayment

Beginning bank cash credit outstanding

Bank cc repayment

Ending bank cc loan balance

End of quarter cash balance

108

38

6

37.5

10

2.64

4

6

104.14

3.86

10

13.86

10

3.86

18

3.86

14.14

10