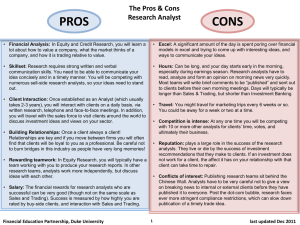

What do i want? Strength and weaknesses Job Summary: The Financial Analyst will analyze past financial performance to predict future performance and to advise the company on its financial strategy. Duties/Responsibilities: ● Analyses business and financial data. ● Creates financial models based on analyses to support organizational decision making. ● Develops financial plans and reports for organizational leaders. ● Analyzes industry trends and makes recommendations based on those trends. ● Evaluates capital expenditures and depreciation. ● Develops automated reporting and forecasting tools for more efficient use of data. ● Performs other related duties as assigned. Required Skills/Abilities: ● ● ● ● Excellent verbal and written communication skills. Thorough understanding of Generally Accepted Accounting Principles (GAAP). Thorough understanding of Generally Accepted Auditing Standards. Thorough understanding of methods of systems analysis and the principles, design, and procedural methods used in big data analysis. ● Thorough understanding of project management. ● Excellent organizational skills and attention to detail. Education and Experience: ● Bachelor's degree in Accounting, Finance, or related field required. ● Two years of professional experience as an accountant, auditor, or computer programmer analyst OR valid CPA (Certified Public Accountant) certificate with at least one year of professional experience as an accountant, auditor, or computer programmer analyst. Certification Exams to Take If you are not an MBA graduate student or an economics major as an undergraduate, you may want to consider studying for the Series 7 and Series 63 exams or participating in the Chartered Financial Analyst (CFA ®) [Bachelor and 4000 hours experience; Historically the pass rates on each exam have been below 50%, making obtaining the CFA Charter one of the most difficult sets of financial certifications; a minimum of 300 hours of study is recommended for each exam https://www.investopedia.com/terms/c/cfa.asp]. Keep in mind that participating in the Series 7 exam will require sponsorship from a FINRA member firm or a regulatory organization. In October 2018, FINRA created a new exam called the Securities Industry Essentials (SIE) exam to reduce duplicative testing of knowledge when taking exams to register in multiple categories and to make it easier to enter the securities industry. While the CFA exam is highly technical, the Series 7 and Series 63 exams are other ways to demonstrate a basic familiarity with investment terms and accounting practices. If you look at a sample CFA exam and it seems overwhelming, start by taking the SIE and then work your way up to the CFA exam, or begin to interview for junior analyst positions after passing the SIE. Many institutions also have training programs for candidates who show promise in the field. Types of Analyst Positions The field of financial analysis is broad, featuring a variety of job titles and career paths. Within the financial/investment industry, the three major categories of analysts are those who work for: ● Buy-side firms (investment houses that manage their own funds) ● Sell-side firms ● Investment banks Financial analysts may also work for local and regional banks, insurance companies, real estate investment brokerages, and other data-driven companies. Any business that frequently makes weighty decisions on how to spend money is a place where a financial analyst can potentially add value Buy-Side Analysts The majority of financial analysts work on what is known as the buy-side. They help their employers make decisions on how to spend their money, whether that means investing in stocks and other securities for an in-house fund, buying income properties (in the case of a real estate investment firm), or allocating marketing dollars. Some analysts perform their jobs not for a specific employer but for a third-party company that provides financial analysis to its clients. This shows the value of what a financial analyst does; an entire industry exists around it. Buy-side financial analysts rarely have the final say in how their employers or clients spend their money. However, the trends they uncover and the forecasts they make are invaluable in the decision-making process. With global financial markets evolving faster than ever and regulatory environments changing seemingly daily, it stands to reason that the demand for skilled buy-side financial analysts will only increase in the future. Sell-Side Analysts At a sell-side firm, analysts evaluate and compare the quality of securities in a given sector or industry. Based on this analysis, they then write research reports with certain recommendations, such as "buy," "sell," "strong buy," "strong sell" or "hold." They also track the stocks that are in a fund's portfolio in order to determine when/if the fund's position in that stock should be sold. The recommendations of these research analysts carry a great deal of weight in the investment industry, including for people employed at buy-side firms. Perhaps the most prestigious (and highest-paid) financial analyst job is that of a sell-side analyst for a big investment bank. These analysts help banks price their own investment products and sell them in the marketplace. They compile data on the bank's stocks and bonds and use quantitative analysis to project how these securities will perform in the market. Based on this research, they make buy and sell recommendations to the bank's clients, steering them into certain securities from the bank's menu of products. Even within these specialties, there are subspecialties: analysts who focus on stocks or on fixed-income instruments. Many analysts also specialize even further within a specific sector or industry. An analyst may concentrate on energy or technology, for example. Investment Banking and Equity Analysts Analysts in investment banking firms often play a role in determining whether or not certain deals between companies such as initial public offerings (IPOs), mergers, and acquisitions (M&A) are feasible, based on corporate fundamentals. Analysts assess current financial conditions–as well as relying heavily on modeling and forecasting–to make recommendations as to whether or not a certain merger is appropriate for that investment bank's client or whether a client should invest venture capital in an enterprise. Analysts who help make buy and sell decisions for big banks and who attempt to locate auspicious IPO opportunities are called equity analysts. Their focus is primarily on equity markets; they help find companies that present the most lucrative opportunities for ownership. Typically, equity analysts are among the highest-paid professionals in the field of financial analysis. This is partly a function of their employers; the big investment banks use huge salaries to lure the best talent. Equity analysts often deal with huge sums of money. When they make a winning prediction, the gain for the employer is often in the millions of dollars. As such, equity analysts are handsomely compensated. What's the Difference Between a Financial Analyst and an Equity Research Analyst? Financial analysts look at market trends to help with investment decisions or examine financial statements of companies to identify an investment's potential. An equity research analyst instead looks closely at a company's financial information, examining, interpreting, and reporting on the data collected in order to come up with a price target for a stock. International and Korean firms Korea has a highly developed and profitable financial services sector including the third largest insurance market and third largest banking market in Asia. The stability of the banking sector is underpinned by strong fundamentals and active regulation. https://www.glassdoor.com/Job/south-korea-entry-level-finance-jobs-SRCH_IL. 0,11_IN135_KO12,31.htm