Sample Quiz #3 Questions – based on Chapters 7 and...

advertisement

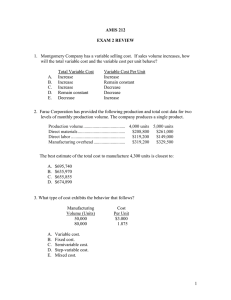

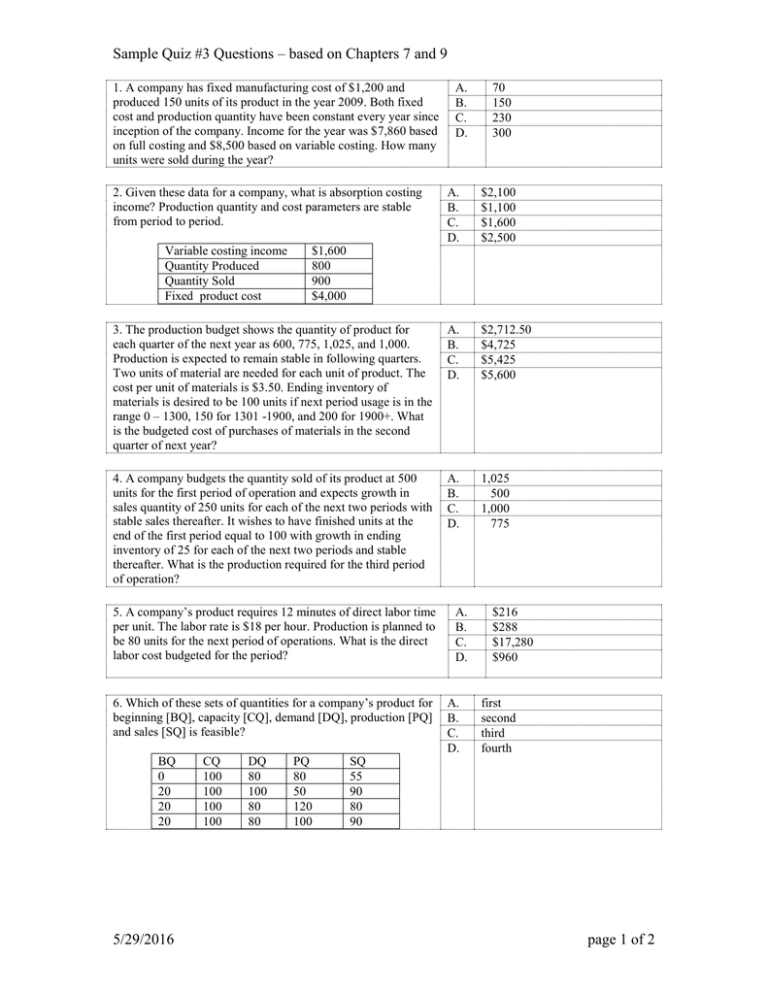

Sample Quiz #3 Questions – based on Chapters 7 and 9 1. A company has fixed manufacturing cost of $1,200 and produced 150 units of its product in the year 2009. Both fixed cost and production quantity have been constant every year since inception of the company. Income for the year was $7,860 based on full costing and $8,500 based on variable costing. How many units were sold during the year? 2. Given these data for a company, what is absorption costing income? Production quantity and cost parameters are stable from period to period. A. B. C. D. 70 150 230 300 A. B. C. D. $2,100 $1,100 $1,600 $2,500 3. The production budget shows the quantity of product for each quarter of the next year as 600, 775, 1,025, and 1,000. Production is expected to remain stable in following quarters. Two units of material are needed for each unit of product. The cost per unit of materials is $3.50. Ending inventory of materials is desired to be 100 units if next period usage is in the range 0 – 1300, 150 for 1301 -1900, and 200 for 1900+. What is the budgeted cost of purchases of materials in the second quarter of next year? A. B. C. D. $2,712.50 $4,725 $5,425 $5,600 4. A company budgets the quantity sold of its product at 500 units for the first period of operation and expects growth in sales quantity of 250 units for each of the next two periods with stable sales thereafter. It wishes to have finished units at the end of the first period equal to 100 with growth in ending inventory of 25 for each of the next two periods and stable thereafter. What is the production required for the third period of operation? A. B. C. D. 1,025 500 1,000 775 Variable costing income Quantity Produced Quantity Sold Fixed product cost $1,600 800 900 $4,000 5. A company’s product requires 12 minutes of direct labor time per unit. The labor rate is $18 per hour. Production is planned to be 80 units for the next period of operations. What is the direct labor cost budgeted for the period? 6. Which of these sets of quantities for a company’s product for beginning [BQ], capacity [CQ], demand [DQ], production [PQ] and sales [SQ] is feasible? BQ 0 20 20 20 5/29/2016 CQ 100 100 100 100 DQ 80 100 80 80 PQ 80 50 120 100 A. B. C. D. A. B. C. D. $216 $288 $17,280 $960 first second third fourth SQ 55 90 80 90 page 1 of 2 Sample Quiz #3 Questions – based on Chapters 7 and 9 7. Last period a company required 48 pounds of direct material to make 120 units of its product. The company has 11 units of its product in finished goods inventory at the start of this period. It plans to sell 35 units during this period and desires an inventory of 8 units of product at the end of this period. What is the amount of material, in pounds, which is budgeted to be used in production for this period? Work in process inventories are zero at both the start and end of the period. A. B. C. D. 43 12.8 32 17.2 A company has the following simplified cash budget [all amounts are $], without any financing needed, for four quarters and the year as a whole: Q1 begin add total subtract end Q2 8 10 18 12 6 Q3 Q4 8 19 15 10 2 Year 2 10 12 8 41 . Q# Answer 5/29/2016 8. In the “end” row what is the first missing number? A. B. C. D. 8 6 4 5 9. In the “Year” column, what is the first missing number? A. B. C. D. 8 2 20 10 1. C 2. B 3. D 4. A 5. B 6. A 7. B 8. C 9. A page 2 of 2