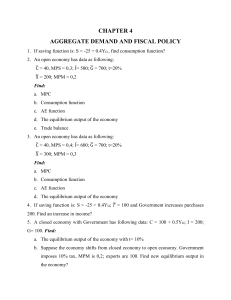

Aggregate demand is the sum total of planned (ex-ante) expenditure that the people in an economy are willing to incur on the purchase of goods and services produced in the economy during an accounting year corresponding to different income levels. Components of AD (Measurement of AD) Private Final Consumption Expenditure (C) Investment Expenditure (I) Government Expenditure (G) Net Exports (X – M) Household consumption expenditure refers to the expenditure on final goods and services by the individual households. Consumption function : Tabular presentation Y (₹) C (₹) Autonomous 0 20 Consumption 50 60 100 100 150 140 200 180 1. There is always some minimum level of C, even when Y = 0. This is called autonomous consumption ( 𝑪) This leads to negative savings or dissavings. 2. Consumption is positively related to income i.e. rise in Y causes a rise in C and vice versa. 3. The entire increase in Y during a particular period is not converted into C. A part of it is saved as well. So the rate of increase of C lags behind the rate of increase of Y. This is called the Psychological Law of consumption. Y Y (₹) 0 50 100 150 200 C 180 Consumption (C) 160 C<Y 140 CY(₹) (₹) 20 0 60 50 100 140 150 180 200 Savings 120 100 B 80 C = Y Break i.e. S =Even 0 Point 60 40 20 45 0 50 C > Y i.e. Dissavings 100 150 200 Income(Y)/ Output Y (₹) 0 50 100 150 200 C (₹) S (₹) -20 20 60 -10 0 100 140 10 180 20 C>Y Dissavings C=Y Break – even point C<Y Savings Savings 40 C S (₹) S (₹) 0 -20 20 -20 50 -10 60 -10 100 100 0 0 150 140 10 10 200 180 20 20 S Break – Even Point 20 Y (₹) +S 0 -S -20 50 100 150 200 Income/ output Q. Draw a straight line consumption curve. Fromfrom it derive a saving curve. Explain Derivation of saving curve consumption curvethe steps of derivation. Consumption Y Steps of Derivation C B Y=C A 45 O Income/ Output Saving S O A’ B’ S=0 1. When Y = 0, S = Hence, corresponding to point A in fig. (i) mark A’ in fig. (ii) 2. When Y = C, S = 0 Hence corresponding to point B in fig. (i), mark B’ in fig. (ii) 3. Join A’ B’ to obtain the saving curve Income/ Output Concepts of Consumption Average Propensity to Consume (APC) APC = C Y Marginal Propensity to Consume (MPC) MPC = C Y Concepts of Saving Average Propensity to Save (APS) Marginal Propensity to Save (MPS) APS = MPS = S Y S Y Important concepts related to MPC, MPS, APC and APS 1. APC + APS = 1 CAPC + + SAPS== 1Y Y Y Y 2. MPC + MPS = 1 3. The value of MPC, MPS and APC can never be zero. APC== ∆SCS MPC MPS APS C Y ∆Y Y Since S consumption saving C is and negative Yand cannot income whenever and beincome negative, are positively C >are Y,APC Hence positively cannot related, APSrelated, be they can negative. be also they negative. change changeininthe thesame samedirection. direction. 4. The value of MPC and MPS always lie between 0 and 1. 5. The value of APC can be greater than one. Consumption function expresses functional relationship between aggregate consumption (C) and national income (Y). Thus, consumption (C) is a function of income (Y). Algebraically, 𝐂 = 𝐂 + 𝐛𝐘 Here, C is the consumption, 𝐂 is autonomous consumption b is Marginal propensity to consume Y is income It reveals the behaviour of household consumption expenditure with respect to the level of income Saving function expresses functional relationship between Saving (S) and national income (Y). Thus, Saving (S) is a function of income (Y). Algebraically, 𝐒 = −𝐂 + (𝟏 − 𝐛)𝐘 𝐂 is autonomous consumption Here, C is the consumption, (1 – b) is Marginal propensity to Save Y is income It reveals the behaviour of household saving with respect to the level of income. 𝐘=𝐂+𝐒 𝐒=𝐘 − 𝐂 𝐒 = 𝐘 − (𝑪 + 𝒃𝒀) 𝐒 = 𝐘 − 𝑪 − 𝒃𝒀 𝐒 = −𝑪 + 𝒀 − 𝒃𝒀 𝐒 = −𝑪 + (𝟏 − 𝒃)𝒀 𝐂 = 𝐂 + 𝐛𝐘 𝐒 = −𝐂 + (𝟏 − 𝐛)𝐘 C = 100 + 0.6 Y 𝐂 = 𝐂 + 𝐛𝐘 𝐒 = −𝐂 + 𝟏 − 𝐛 𝐘 S = -100 + 0.4 Y S = - 200 + 0.25 Y C = 200 + 0.75 Y Complete the following table: Income 0 50 100 150 200 Saving -20 -10 0 30 60 Marginal propensity to consume ---- Average propensity to consume ---- ---- ---- ---- ---- ---- ---- ---- ---- Y 0 50 100 S -20 -10 0 C =Y - S MPC = ∆𝐶 ∆𝑌 𝐶 APC = 𝑌 20 --- 60 40 =0.8 50 60 =1.2 50 100 40 =0.8 50 100 =1 100 20 =0.4 50 20 =0.4 50 120=0.8 150 140=0.7 200 150 30 120 200 60 140 --- Y 0 C 15 S =Y - C -15 MPS = ∆ S APS = ∆Y --- 15 =0.3 50 S Y --- 0 =0 50 50 50 0 100 85 15 15 =0.3 15 = 0.15 50 100 150 120 30 200 155 45 15 =0.3 30 =0.2 50 150 15 =0.3 45 =0.22 50 200 Complete the following table: Y MPC S 0 --- -30 100 0.75 200 0.75 300 0.75 400 0.75 APC Y MPC ∆C ∆Y S (Y – C) C (Y – S) APC C Y 0 --- -30 30 100 0.75 -5 105 =1.05 100 200 0.75 20 180 =0.9 200 300 0.75 400 0.75 --- MPC = ∆ C ∆Y 0.75 = ∆ C 100 75 = ∆ C 45 255 255 =0.85 C = 105 30 ++75 75=180 180 70 330 C = 105 300 330 =0.825 400 Complete the following table: Y APC S 0 --- -80 100 1.6 200 1 300 0.8 MPC APC = Y 0 100 APC C (Y – S) S (Y – C) MPC --- 80 -80 --- 1.6 160 -60 80 =0.8 100 200 1 300 0.8 200 240 0 40 =0.4 100 60 40 =0.4 100 1.6 = 160 = C Y C 100 C Assignment on MPC and MPS Q1. Complete the following table: Income Consumption MPC 400 240 500 320 600 395 700 465 MPS Q2. If consumption function is 𝑪 = 𝟓𝟎𝟎 + 𝟎. 𝟔 𝒀, show with an example that APC decreases as income increases. Q3. Complete the following table: Income Consumption MPS 0 12 20 26 40 40 60 54 APC Q4. Complete the following table: Income 0 Consumption MPC APS 40 120 0.8 200 0.8 280 0.8 Q5. Given below is the saving function: 𝑆 = −100 + 0.25𝑌. Show with a numerical example that APS rises with an increase in income. Q6. In an economy, total savings are ₹2000 crores and the ratio of average propensity to save and average propensity to consume is 2:7. Calculate the level of income in the economy. Q7. In an economy the ratio of average propensity to consume and average propensity to save is 5:3. If the level of income is ₹6000, calculate the level of savings. Q8. If national income is ₹90 crore and consumption is ₹81 crores, find out APS? When income rises to ₹100 crore and consumption expenditure to ₹88 crores, what will be the marginal propensity to consume and marginal propensity to save? Q9. If national income is ₹50 crores and saving is ₹5 crores, find the value of APC. When income rises to ₹60 crores and saving to ₹9 crores, what will be the APC and MPS? Q10. Find the autonomous consumption and total consumption when the saving function is 𝑆 = −100 + 0.5 𝑌 and Y = ₹1500 crores. Private investment demand refers to the demand for capital goods by producers. Investment is of two types, Autonomous Investment and Induced Investment, but in Keynes theory investment is assumed to be Autonomous. Induced Investment : It refers to the investment which is made with the motive of earning profit. It is affected by three factors 1. Income Level 2. Rate of interest (r) Interest on borrowed capital r is inversely related to induced investment Induced Investment I 3.Marginal Efficiency of capital (MEC) Expected rate of return Income Induced Investment takes place only when r < MEC Autonomous Investment Autonomous Investment : It refers to the investment which is made without any profit motive. It is not affected by income level, rate of interest or marginal efficiency of capital. I Income Induced Investment Basis Autonomous Investment It refers to the investment which is made with the motive of earning profit. Motive It refers to the investment which is made without any profit motive. It is generally done by the private sector Sector It is generally done by the government sector. Income Elasticity It is income inelastic i.e. it does not change with a change in the national income. It is income elastic i.e. if national income goes up, induced investment also goes up. This happens because an increase in national income leads to an increase in the demand for goods and services and for meeting the same the investment also increases. Curve AD Schedule Y C I Autonomous AD 0 20 10 30 20 25 10 35 40 30 10 40 60 35 10 45 80 40 10 50 100 45 10 55 120 50 10 60 (C + I) AD (C+ I) 60 C C, I , AD 50 Y C I AD 0 20 10 30 20 25 10 35 40 30 10 40 60 35 10 45 80 40 10 50 100 45 10 55 120 50 10 60 40 30 20 I 10 0 20 40 60 80 Y/GDP 100 120 Aggregate Supply refers to the flow of goods and services as planned by the producers during an accounting year. Components of Aggregate Supply whatever is produced an equal amount of income gets generated. AS = Y Y=C+S AS = C + S Hence components of AS are Consumption and Saving. AS 100 80 C, I , AD 60 40 20 45 0 20 40 60 80 Y/GDP 100 Y AS 0 20 40 60 80 100 0 20 40 60 80 100 Short Run Equilibrium Equilibrium output or Equilibrium GDP or Equilibrium income It refers to that level of output in the economy where: AD = AS Assumptions: (i) Short period analysis: Equilibrium GDP according to Keynesian theory is discussed only with reference to short period usually one year. (ii) Two Sector Closed Economy: Initially Keynes discussed the theory of equilibrium GDP in the contest of a two sector closed economy. Accordingly, AD = C + I. (iii) AS is perfectly elastic: Keynes assumed that AS is perfectly elastic i.e AS will adjust itself according to the AD. AS is perfectly elastic as long as there is idle capacity or excess capacity existing in the economy. At Equilibrium, AD = AS AD = C + I & AS = C + S C+S =C+I S=I Approaches to determination of Equilibrium Output (GDP) or Equilibrium Income AD – AS approach S–I approach AS (Y) AD – AS Approach AD (C+ I) 60 E C C, I , AD 50 40 Point of Equilibrium AD = AS B 30 Break even point Y=C 20 Equilibrium GDP 𝐂 I 10 0 20 40 60 80 Y/GDP 100 120 AD – AS Approach AS (C + S) AD (C+ I) When AD > AS E Existing stocks of the producer will be sold out. C, I , AD Producer will suffer a loss of unfulfilled demand Producer will plan an increase in production This will lead to increase in income. This will in turn lead to increase in demand. Q1 Q AD > AS AD = AS Y/GDP AS or Y (C + S) AD – AS Approach AD (C+ I) When AD < AS Existing stocks of the producer will remain unsold. E C, I , AD Producer will want to clear unwanted stocks. Hence they will plan a cut in production This will lead to decrease in income. This will in turn lead to decrease in demand. Q Q1 AD = AS AD < AS Y/GDP Savings, Investment 40 S (₹) I (₹) 0 20 -20 10 50 60 -10 10 100 100 0 10 150 140 10 10 200 180 20 10 E 10 0 C (₹) S Point of Equilibrium 20 Y (₹) 50 100 150 I 200 -20 Eq. GDP Income/ output S<I Leads to more consumption expenditure and more demand Savings, Investment Existing stocks of the producer will be sold out. O Producer will suffer a loss of unfulfilled demand S Producer will plan an increase in production This will lead to increase in income. This will in turn lead to increase in saving. E Q1 Q S<I S=I I Income/ output S<I Leads to less consumption expenditure and less demand Savings, Investment Existing stocks of the producer will remain unsold O Producer will want to clear unwanted stocks. S Producer will plan a cut in production This will lead to decrease in income. This will in turn lead to decrease in saving. E Q S=I I Q1 S>I Income/ output Q. Find equilibrium S and equilibrium I when: Y = ₹ 4400, MPC = 0.75 and 𝐂 = 𝟏𝟎𝟎 At equilibrium, S = I Also, 𝐂 = 𝐂 + 𝐛𝐘 𝐂 = 𝟏𝟎𝟎 + 𝟎. 𝟕𝟓 × 𝟒𝟒𝟎𝟎 𝐂 = 𝟏𝟎𝟎 + 𝟑𝟑𝟎𝟎 𝐂 = ₹ 𝟑𝟒𝟎𝟎 We know that Y = C + S ∴ S=Y–C S = 4400 – 3400 = 1000 At eq. S = I ∴ eq. S = eq. I = ₹ 1000 Q. S = - 25 + 0.5Y and I = 5000, find equilibrium Y and equilibrium C. At equilibrium, S = I −𝟐𝟓 + 𝟎. 𝟓𝐘 = 𝟓𝟎𝟎𝟎 𝐒 = −𝐂 + (𝟏 − 𝐛)𝐘 𝟎. 𝟓𝐘 = 𝟓𝟎𝟐𝟓 𝟓𝟎𝟐𝟓 𝐘= 𝟎. 𝟓 𝐘 = 10050 We know at equilibrium, S = I ∴ S = 5000 Also, Y = C + S ∴ C=Y–S C = 5050 C = 10050 – 5000 C = 10050 – 5000 Q. Given C = 400 + 0.9 Y and I = 4000, find equilibrium Y and S and C at equilibrium . At equilibrium, S=I −𝟒𝟎𝟎 + 𝟎. 𝟏 𝐘 = 𝟒𝟎𝟎𝟎 𝟎. 𝟏 𝐘 = 𝟒𝟎𝟎𝟎 + 𝟒𝟎𝟎 𝟒𝟒𝟎𝟎 𝐘= 𝟎. 𝟏 𝐘 = 𝟒𝟒𝟎𝟎𝟎 We know at equilibrium, S = I ∴ S = 4000 Also, Y = C + S ∴ C=Y–S C = 44000 – 4000 C = 40000 C = 400 + 0.9 Y Convert C into S Since, 𝐒 = −𝐂 + (𝟏 − 𝐛)𝐘 ∴ 𝐒 = −𝟒𝟎𝟎 + 𝟎. 𝟏 𝐘 An economy is in equilibrium. Calculate national income from the following: Autonomous consumption = ₹ 100 Marginal propensity to save = 0.2 Investment expenditure = ₹200 An economy is in equilibrium. Find marginal propensity to consume from the following: National Income = ₹2000 Autonomous Consumption = ₹400 Investment expenditure = ₹200 An economy is in equilibrium. Find investment expenditure from the following: National Income = ₹800 Marginal Propensity to Save = 0.3 Autonomous Consumption = ₹100 Y AD1 (C+ I +I) C, I , AD E1 Additional investment has Multiplier Effect E Q AD (C + I ) Q1 Y/GDP Y AD (C + I ) C, I , AD E AD1 (C+ I - I) E1 Q1 Q Y/GDP Investment Multiplier and its mechanism Round Increase in Investment ( I ) Change in Change in income ( Y ) consumption ( C) MPC = 0.5 Leakage or Saving (S) 1 100 100 50 50 2 --- 50 25 25 3 --- 25 12.5 12.5 4 --- 12.5 6.25 6.25 5 --- 6.25 3.125 3.125 After multiple rounds Total 100 200 100 100 Mathematically, ∆𝒀 𝒌= ∆𝑰 𝟏 𝒐𝒓 𝒌 = 𝟏 − 𝑴𝑷𝑪 𝟏 𝒐𝒓 𝒌 = 𝑴𝑷𝑺 𝟏 In the above example, 𝒌 = 𝟏 − 𝟎. 𝟓 i.e. 𝒌 = 𝟏 𝟎.𝟓 k and MPC have a direct relation & k and MPS have an inverse relation =𝟐 Hence an additional investment generates two times income Minimum and maximum values of k MPC Minimum Maximum 1 0 MPS 0 1 k 1 ∞ There is increase in investment of ₹1000 crores in an economy. Marginal propensity to consume is zero. What is the total increase in income? In an economy, investment increases by ₹120 crores. The value of investment multiplier is 4. Calculate the marginal propensity to consume. In an economy, the equilibrium level of income is ₹12000 crore. The ratio of marginal propensity to consume and marginal propensity to save is 3:1. Calculate the additional investment needed to reach a new equilibrium level of income of ₹20000 crore. Change in investment Change in demand Change in output Change in Change in consumption employment Change in income Some essential concepts Full Employment Equilibrium and Underemployment Equilibrium Full Employment Equilibrium refers to a situation in the economy when AD = AS (or S = I) along with fuller utilization of resources. This means that there is no idle/ excess capacity or unemployment in the economy. Underemployment Equilibrium refers to a situation in the economy when AD = AS (or S = I) but without fuller utilization of resources. This means that there is idle/ excess capacity or unemployment in the economy even in a state of equilibrium. Voluntary and Involuntary unemployment Involuntary unemployment refers to a situation when people who are willing to work at the existing wage rate are not getting employment. The economy fails to create enough jobs because planned output is lower than the potential output owing to lack of demand. Voluntary unemployment occurs when some people are not willing to work at the existing wage rate or not willing to work at all. The problem of unemployment refers to the problem of involuntary unemployment and not voluntary unemployment. Full Employment and Natural Unemployment Full Employment refers to a situation in the economy when all those who are able to work and are willing to work at the prevailing wage rate are getting work. In this situation at the prevailing wage rate, the demand for labour = supply of labour i.e. the labour market is cleared.refers to a situation in the economy when all those who are able to work and are willing to work at the prevailing wage rate are getting work. Natural Unemployment occurs owing to the fact that there are constant changes in the supply-demand parameters in the economy and adjustment to these changes takes time. While adjustments occur, some people continue to remain unemployed. This situation causes ‘frictional’ and ‘structural’ unemployment in the economy. Frictional unemployment and Structural Unemployment Frictional unemployment refers to the unemployment associated with the changing of jobs in a dynamic economy. It arises due to immobility of labour, shortage of raw material, lack of information regarding job opportunities, shortage of power, wear and tear of machines, job hopping etc. Structural Unemployment is the unemployment that is a result of the long – term decline of certain sectors or industries. It is associated with situations like short supply of other factors of production, lack of skilled labourers for emerging industries, change in production techniques etc. Seasonal and Cyclic unemployment Seasonal unemployment refers to the unemployment of seasonal workers without jobs due to the time of year where there are seasonal changes in employment. Cyclic Unemployment is caused by a downturn in the business cycle. It's part of the natural rise and fall of economic growth that occurs over time. Cyclical unemployment is temporary and depends on the length of economic contractions caused by a recession. A typical recession lasts around 18 months. When the business cycle re-enters the expansionary phase (rising toward the peak of the wave), the unemployed tend to be rehired. Important Full employment situation does not mean zero unemployment Owing to constantly changing supply – demand parameters in the economy and adjustments taking time, some frictional and structural unemployment always exist. This minimum rate of unemployment that exists always in the economy is called the natural rate of unemployment. AS (Y) EE ADE ADF ADU C, I , AD EF EU Q Q Y/GDP Deficient Demand : It refers to a situation when AS (Y)aggregate demand is ADUF of less than aggregate supply corresponding to full employment level output in the economy. Hence Deficient Demand is a situation when EF AD < AS corresponding to full employment in the economy C, I , AD Deficient Demand EU When AD < AS corr. to full employment Y/GDP 1. Reduction in Private Final Consumption Expenditure 2. Reduction in Private Investment Expenditure 3. Reduction in Government Expenditure 4. Decline in Exports 5. Rise in Imports 6. Increase in taxes Underemployment Equilibrium 1 Producers are not able to fully utilize their resources Deflationary Gap 2 Consequences of Deficient Demand Inducement to invest is hurt. Low investment leads to low output. Implying low income and low demand once again. Undesired Stocks 3 4 Producers are not able to sell all that they plan to sell. Accordingly undesired stocks tend to pile up. This leads to fall in the prices and fall in the planned output for the year ahead. Loss of Profits This happens because (i) the producers are not able to clear their stocks and (ii) undesired stocks lead to ‘price crash. Fiscal Policy:It refers to the receipt and expenditure policy of the government and is also known as the Budgetary Policy of the government. Borrowing from RBI Government Expenditure Borrowing from RBI is increased which leads to greater liquidity in the economy. Govt. expenditure includes expenditure on construction of roads, dams bridges, expenditure on education, health, defense, maintenance of law and order, expenditure on subsidies etc. Public Borrowing/ Public Debt The govt. reduces borrowing from the public. Rather it pays back the money already borrowed from the public. 4 3 1 2 Taxes By reducing the tax burden on the households, the govt. increases their disposable income. This results in a rise in AD. Monetary Policy 02 Bank Rate/Repo Rate Open Market Operations RBI will buy back approved securities from the open market to increase liquidity in the economy. 04 Statutory Liquid Ratio RBI will decrease the SLR. This will leave more liquidity with the banks and they will be able to create more credit 06 Margin Requirement RBI will reduce margin requirement so that more people are able to take loans. 08 Credit Rationing Credit rationing, if any in force, is withdrawn to enhance the availability of credit 01 Bank rate/repo rate will be lowered to increase credit flow in the economy. Cash Reserve Ratio 03 RBI will decrease the CRR. This will leave more liquidity with the banks and they will be able to create more credit Reverse Repo Rate 05 RBI will lower reverse repo rate. This will force banks to not park surplus funds with RBI instead give them out as loans. Moral Suasion RBI will exert moral pressure on the commercial banks to be liberal in lending. 07 Excess Demand : It refers to a situationAS when (Y) aggregate demand is more than aggregate supply corresponding to full employment level of output in the economy. EE ADEF Hence Excess Demand is a situation when AD > AS corresponding to full employment in the economy Excess Demand C, I , AD EF When AD > AS corr. to full employment Y/GDP 1. Increase in Private Final Consumption Expenditure 2. Increase in Private Investment Expenditure 3. Increase in Government Expenditure 4. Rise in Exports 5. Decline in Imports 6. Decrease in taxes Inflationary Gap Output cannot rise as factors are already fully employed. This creates a pressure of the demand for existing resources. Accordingly cost of production rises which leads to a rise in the general price level. 1 Static GDP Consequences of Excess Demand 2 Even when the level of AD is higher than its full employment level, the level of GDP does not rise. It remains static. Excess Demand and Wage – Price Spiral 3 Owing to high pressure of the resources, the cost of production (particularly wages) rise. Rise in cost of production and wages leads to a rise in general price level. Rise in prices leads to arise in cost of living. Rise in cost of living leads to rise in wages again. Fiscal Policy:It refers to the receipt and expenditure policy of the government and is also known as the Budgetary Policy of the government. Borrowing from RBI Government Expenditure Borrowing from RBI is reduced which leads to lesser liquidity in the economy. Govt. expenditure includes expenditure on construction of roads, dams bridges, expenditure on education, health, defense, maintenance of law and order, expenditure on subsidies etc. Public Borrowing/ Public Debt The govt. increases borrowing from the public, thereby reducing liquidity in the system. 4 3 1 2 Taxes By increasing the tax burden on the households, the govt. decreases their disposable income. This results in a fall in AD. Monetary Policy 02 Bank Rate/Repo Rate Open Market Operations RBI will sell govt. securities from the open market to increase liquidity in the economy. 04 Statutory Liquid Ratio RBI will increase the SLR. This will leave less liquidity with the banks and they will be able to create less credit 06 Margin Requirement RBI will increase margin requirement so that less people take loans. 08 Credit Rationing Credit rationing will be implemented to reduce the availability of credit 01 Bank rate/repo rate will be increased to reduce credit flow in the economy. Cash Reserve Ratio 03 RBI will increase the CRR. This will leave less liquidity with the banks and they will be able to create less credit Reverse Repo Rate 05 RBI will increase reverse repo rate. Hence the banks will park surplus funds with RBI instead of giving them out as loans. Moral Suasion RBI will exert moral pressure on the commercial banks to be strict in lending. 07