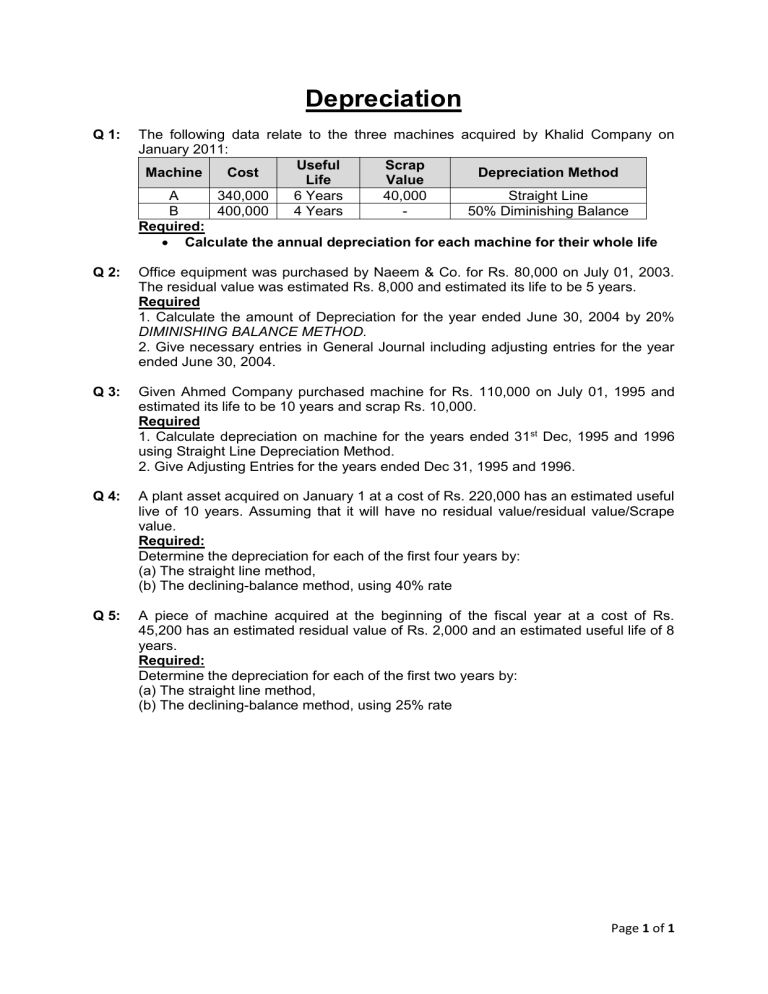

Depreciation Q 1: The following data relate to the three machines acquired by Khalid Company on January 2011: Useful Scrap Machine Cost Depreciation Method Life Value A 340,000 6 Years 40,000 Straight Line B 400,000 4 Years 50% Diminishing Balance Required: Calculate the annual depreciation for each machine for their whole life Q 2: Office equipment was purchased by Naeem & Co. for Rs. 80,000 on July 01, 2003. The residual value was estimated Rs. 8,000 and estimated its life to be 5 years. Required 1. Calculate the amount of Depreciation for the year ended June 30, 2004 by 20% DIMINISHING BALANCE METHOD. 2. Give necessary entries in General Journal including adjusting entries for the year ended June 30, 2004. Q 3: Given Ahmed Company purchased machine for Rs. 110,000 on July 01, 1995 and estimated its life to be 10 years and scrap Rs. 10,000. Required 1. Calculate depreciation on machine for the years ended 31st Dec, 1995 and 1996 using Straight Line Depreciation Method. 2. Give Adjusting Entries for the years ended Dec 31, 1995 and 1996. Q 4: A plant asset acquired on January 1 at a cost of Rs. 220,000 has an estimated useful live of 10 years. Assuming that it will have no residual value/residual value/Scrape value. Required: Determine the depreciation for each of the first four years by: (a) The straight line method, (b) The declining-balance method, using 40% rate Q 5: A piece of machine acquired at the beginning of the fiscal year at a cost of Rs. 45,200 has an estimated residual value of Rs. 2,000 and an estimated useful life of 8 years. Required: Determine the depreciation for each of the first two years by: (a) The straight line method, (b) The declining-balance method, using 25% rate Page 1 of 1