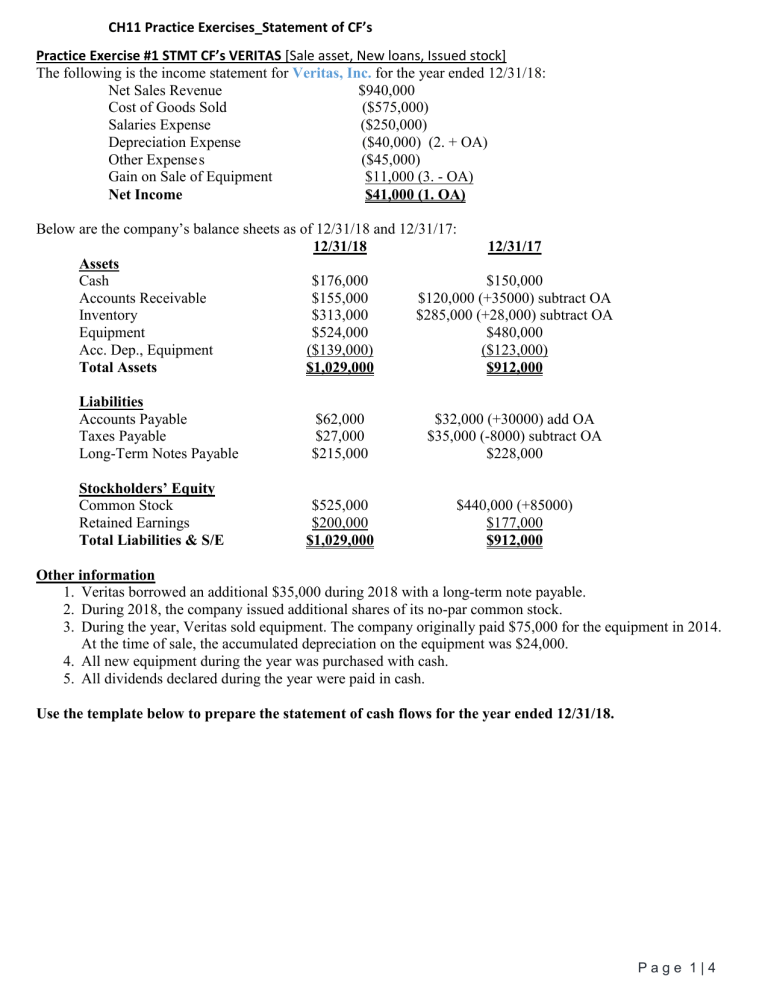

CH11 Practice Exercises_Statement of CF’s Practice Exercise #1 STMT CF’s VERITAS [Sale asset, New loans, Issued stock] The following is the income statement for Veritas, Inc. for the year ended 12/31/18: Net Sales Revenue $940,000 Cost of Goods Sold ($575,000) Salaries Expense ($250,000) Depreciation Expense ($40,000) (2. + OA) Other Expense s ($45,000) Gain on Sale of Equipment $11,000 (3. - OA) Net Income $41,000 (1. OA) Below are the company’s balance sheets as of 12/31/18 and 12/31/17: 12/31/18 12/31/17 Assets Cash $176,000 $150,000 Accounts Receivable $155,000 $120,000 (+35000) subtract OA Inventory $313,000 $285,000 (+28,000) subtract OA Equipment $524,000 $480,000 Acc. Dep., Equipment ($139,000) ($123,000) Total Assets $1,029,000 $912,000 Liabilities Accounts Payable Taxes Payable Long-Term Notes Payable Stockholders’ Equity Common Stock Retained Earnings Total Liabilities & S/E $62,000 $27,000 $215,000 $32,000 (+30000) add OA $35,000 (-8000) subtract OA $228,000 $525,000 $200,000 $1,029,000 $440,000 (+85000) $177,000 $912,000 Other information 1. Veritas borrowed an additional $35,000 during 2018 with a long-term note payable. 2. During 2018, the company issued additional shares of its no-par common stock. 3. During the year, Veritas sold equipment. The company originally paid $75,000 for the equipment in 2014. At the time of sale, the accumulated depreciation on the equipment was $24,000. 4. All new equipment during the year was purchased with cash. 5. All dividends declared during the year were paid in cash. Use the template below to prepare the statement of cash flows for the year ended 12/31/18. Page 1|4 CH11 Practice Exercises_Statement of CF’s Veritas Corporation Statement of Cash Flows For the Year Ended 12/31/18 Operating Activities: Net income $41,000 Add depreciation expense +$40,000 Add (subtract) losses (gains) on sale of PP&E <$11,000> Add (subtract) decreases (increases) in current assets: Increase in AR <$35,000> Increase in Inventory <$28,000> Add (subtract) increases (decreases) in current liabilities: Increase in AP +$30,000 Decrease in Taxes Payable <$8,000> Net Cash Flow from Operating Activities $29,000 Investing Activities: Sale of Equipment +$62,000 Purchase of Equipment <$119,000> <$57,000> Net Cash Flow from Investing Activities Financing Activities: Issuance of Common Stock +$85,000 Borrowing of Long-Term Notes Payable +$35,000 Payment on Notes Payable <$48,000> Payment of Dividends <$18,000> Net Cash Flow from Financing Activities +$54,000 Net increase (decrease) in cash (A) +$26,000 Cash at beginning of the period (B) $150,000 Cash at the end of the period (C) A+B=C $176,000 Page 2|4 CH11 Practice Exercises_Statement of CF’s Practice Exercise #2 STMT CF’s NOFX [Sale asset, No new loans] The following is the income statement for NOFX Corporation for the year ended 12/31/18: Net Sales Revenue $635,000 Cost of Goods Sold ($240,000) Salaries Expense ($295,000) Depreciation Expense ($37,000) Other Expenses ($24,000) Loss on Sale of Equipment ($12,000) Net Income $27,000 Below are the company’s balance sheets as of 12/31/18 and 12/31/17: 12/31/18 12/31/17 Assets Cash $91,000 $54,000 Accounts Receivable $21,000 $35,000 Inventory $162,000 $195,000 Equipment $378,000 $342,000 Acc. Dep., Equipment ($78,000) ($57,000) Total Assets $574,000 $569,000 Liabilities Accounts Payable Salaries Payable Long-Term Notes Payable $25,000 $30,000 $107,000 $31,000 $18,000 $125,000 Stockholders’ Equity Common Stock Retained Earnings Total Liabilities & S/E $300,000 $112,000 $574,000 $300,000 $95,000 $569,000 Other information 1. During 2018, the company sold equipment. The equipment was initially purchased in 2016 for $50,000. At the time of sale, the accumulated depreciation on the equipment was $16,000. 2. The company did not take out any additional loans during the year. 3. The company purchased all new equipment during the year with cash. 4. The company paid cash for all dividends declared during 2018. Use the template below to prepare the statement of cash flows for the year ended 12/31/18. Page 3|4 CH11 Practice Exercises_Statement of CF’s NOFX Corporation Statement of Cash Flows For the Year Ended 12/31/18 Operating Activities: Net income Add depreciation expense Add (subtract) losses (gains) on sale of PP&E Add (subtract) decreases (increases) in current assets: Add (subtract) increases (decreases) in current liabilities: Net Cash Flow from Operating Activities Investing Activities: Net Cash Flow from Investing Activities Financing Activities: Net Cash Flow from Financing Activities Net increase (decrease) in cash Cash at beginning of the period Cash at the end of the period Page 4|4