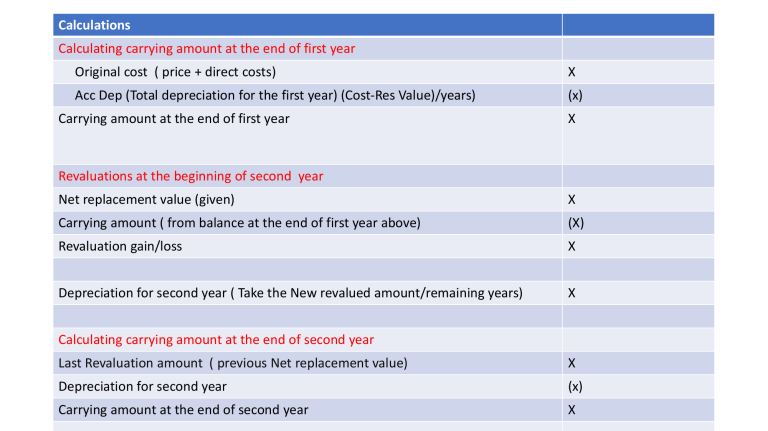

Calculations Calculating carrying amount at the end of first year Original cost ( price + direct costs) X Acc Dep (Total depreciation for the first year) (Cost-Res Value)/years) (x) Carrying amount at the end of first year X Revaluations at the beginning of second year Net replacement value (given) X Carrying amount ( from balance at the end of first year above) (X) Revaluation gain/loss X Depreciation for second year ( Take the New revalued amount/remaining years) X Calculating carrying amount at the end of second year Last Revaluation amount ( previous Net replacement value) X Depreciation for second year (x) Carrying amount at the end of second year X Depreciation for Third year after change in Residual value and useful life Take New Revalued amount at the beginning of third year Less New Residual value/new remaining period x Calculating carrying amount at the end of third year New Revalued Amount at the beginning of third year x Less depreciation for third year (x) Carrying amount at the end of the third year x PPE NOTE Eg Building First year Original Cost x Accumulated Depreciation (x) Carrying amount x Second year Revaluation done at the beginning of second year x Depreciation for second year (x) Third year x Revaluation gain/loss at the beginning of third year x Depreciation for third year (x) New Revaluation amount x Less Acc Dep ( Dep for third year) (x) Carrying amount at the end of third year x Describe what happened during the year eg there was