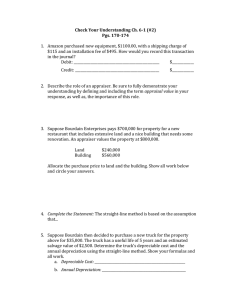

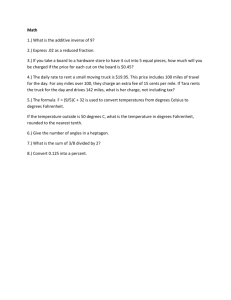

Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles Chapter 08 Student Name: Bytullah Karar Class: MFA 6 2023 Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles Learning Objectives and Related Assignment Materials MiniExercises Exercises Alternate Cases and Problems Problems Projects 1. Define, classify, and explain the nature of long-lived productive assets and interpret the fixed asset turnover ratio. 2. Apply the cost principle to measure the acquisition and maintenance of property, plant, and equipment. 3. Apply various cost allocation methods as assets are held and used over time. 1, 2 1, 2, 20 1, 4, 5 1, 4 3 3, 4, 5, 6, 20, 22 1, 2, 3, 8 1, 2, 3, 6 1, 4, 5, 6 2, 3, 4, 5, 6, 8, 9, 10, 11 2, 3, 4, 5, 6, 7 3, 5, 11 4. Explain the effect of asset impairment on the financial statements. 5. Analyze the disposal of property, plant, and equipment. 7 3, 4, 5, 6, 7, 8, 9, 10, 11, 15, 20, 21, 22, 23 12, 20 10 7 1, 11 6, 7 5 7 6. Apply measurement and reporting concepts for natural resources and intangible assets. 7. Explain the impact on cash flows of acquiring, using, and disposing of long-lived assets. Chapter Supplement A: Changes in depreciation estimates 1, 9 12, 13, 14, 15, 20 16, 17, 18, 19, 20 11, 20, 23 8, 9, 10 6, 7 1, 2, 6, 11 21, 23 11 Learning Objectives 8 10 7 This chapter also includes a Comprehensive Problem, which covers chapters 6, 7, and 8. HANDOUT 8 – 1 SOLUTION DEPRECIATION METHODS AND GAIN/LOSS ON SALE 8-1 1, 2, 3, 6, 7, 9, 10, 11 1, 2, 8, 9, 10, 11 6, 7, 10, 11 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles Joel Harvey Florists acquired a truck on January 1, 2007. The company paid $11,000 for the truck, $500 for destination charges, and $250 to paint the company name on the side of the truck. The company’s accounting manager estimates the truck to have a five-year useful life and a residual value of $1,750. The truck is expected to be driven 100,000 miles in five years. It is actually driven 15,000 miles in 2007, 25,000 miles in 2008, 30,000 miles in 2009, 25,000 miles in 2010, and 5,000 miles in 2011. Part 1 On January 1, 2007, how much should Joel Harvey Florist capitalize for the cost of the truck? 11,000 + 500 + 250 = $11,750. Part 2 How much depreciation expenses that would be recorded for the years 2007 through 2011 using each of the following methods? a. Straight-line (11,750 – 1,750) ÷ 5 = $2,000 per year b. Unit-of-production (11,750 – 1,750) ÷ 100,000 = 10 cents/mile 2005: 15,000 x 0.10 = $1,500; 2006: 25,000 x 0.10 = $2,500; 2007: 30,000 x 0.10 = $3,000; 2008: 25,000 x 0.10 = $2,500; 2009: 5,000 x 0.10 = $500. c. Declining-balance 8-2 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles Year Computation Depreciation Expense Accumulated Net Book Value Depreciation Acquisition 11,750 2007 11,750 x 2/5 $4,700 $4,700 7,050 2008 7,050 x 2/5 2,820 7,520 4,230 2009 4,230 x 2/5 1,692 9,212 2,538 2010 2,538 x 2/5 2,538 – 1,750 788 1,015 10,000 10,227 1,750 1,448 2011 1,448 x 2/5 0 579 0 10,806 1,750 944 Part 3 On December 31, 2011, Joel Harvey sold the truck for $3,000 cash. Compute the gain or loss on sale. $3,000 - $1,750 = $1,250 gain 8-3 Chapter 08 - Reporting and Interpreting Property, Plant, and Equipment; Natural Resources; and Intangibles HANDOUT 8 – 2 COMPARISON OF DEPRECIATION EXPENSE AND NET BOOK VALUE Depreciation Expense $5,000 $4,700 $4,500 $4,000 $3,500 $3,000 $2,820 $2,500 $2,500 $2,000 $1,500 $2,000 $2,000 $3,000 $2,500 $2,000 $2,000 $1,692 $1,500 $1,000 Straight-line $2,000 Units-ofproduction $788 $500 $500 $0 $0 2007 2008 2009 2010 2011 Doubledeclining balance Net Book Value $14,000 $12,000 $10,000 $11,750 Straight-line $10,250 $9,750 $8,000 $7,750 Units-ofproduction $7,050 $6,000 $4,000 $2,000 $5,750 $4,230 $4,750 $3,750 $2,538 $2,250 $1,750 $1,750 $0 Pre- 2007 2008 2009 2010 2011 2007 8-4 Doubledeclining balance