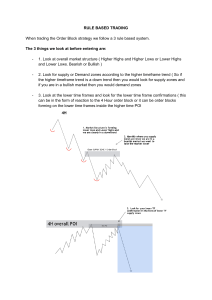

Forex order block strategy pdf Order block forex meaning. Forex limit order strategy. Order block smart money forex strategy pdf. Stop order in forex. Forex close all orders. Order block forex definition. A strategy that is not as common with retail traders is order block trading. You can use many order block strategies to attempt to target significant areas to enter the market and manage your trades. This post breaks down order block trading and how to use it in your trading. NOTE: You can get your free order block trading PDF guide below. Free PDF Guide: Get Your Order Block Trading Strategies PDF Guide What is Order Block Trading? Order block trading is analyzing where large blocks of orders form in the market and using this information to buy or sell. Big trading institutions and banks usually create these blocks. Knowing where these big players are putting their order blocks can help you identify the best areas to enter new trades or exit existing ones. While there is no one central exchange for foreign exchange markets, the big banks and institutions significantly affect where prices move. Where these whales of the markets are placing their order blocks can have a significant effect on what prices do. If you know and understand where these order blocks are building up, you can use it to your advantage when making trades. The key to order block trading is recognizing these critical levels in the market. When prices move into an order block area, we often see large price movements and a spike in liquidity. This can lead to very profitable trades. Order Block Theory Because central banks and large institutions play a huge role in price movement, it’s essential to understand where they’re placing order blocks. There are several reasons these whales are placing orders the way they are, but it’s often to enter or exit huge positions without spooking the market. If a bank is trying to enter the market at the best possible price, they will use order blocks instead of one large order. This way price will not explode, and they will get in at the best possible price. For example: ‘Bank XYZ’ has a huge trade they need to fill… If they make this trade in one large order, they risk that there will not be enough liquidity to enter it all. They also risk price spiking as they start to enter, and don’t end up with the best price. Instead, they will enter multiple positions known as order blocks. They will place these order blocks at strategic points where they can be fulfilled and will get the best possible price. Another example is the way a large institution would break their order up. If they’re trying to enter a market with a $500 million trade, but only $100 million are being sold, they face two things… The first is that they will be entered into that first $100 million. However, there will still be $400 million left not entered. This could cause the price to spike, and price levels to worsen. Order Block Smart Money Concepts Identifying the activities of significant market actors is a central part of the smart money method of trading. This requires finding the places they arrange order blocks and stop-outs. To do so, one must inspect the market structure and observe the relevant price fluctuations. How to Trade With Order Blocks Order block and smart money trading can be used hand in hand with your other technical analysis and price action trading. You can also use other helpful indicators that can help you refine trade entries and where to place your take profit and stop loss. The example below shows how a stop hunt occurs, and you can use this information to make high-probability reversal trades. The first part of this stop hunt is the clear resistance level that is in place. Each time price has tested this resistance, the big players have stepped in and pushed the price back lower. The key to this setup is that a large number of stop losses would sit above this resistance. Many traders who have sold when the price hits the resistance would place stops just above. The big players know this. When the price moves into the resistance again, it breaks through. This would activate many of these stop-loss orders and close many trades. This is a false move, and stop out. As soon as the price has popped above this level and hit a lot of stops, it quickly reverses. Lastly Order block and smart money trading take some time to practice and master. After you start to work out where these big order blocks are being placed and when to stop hunting, you can use it to your advantage. This vital information can help you get on the right side of the market, and instead of having your stops hit, you can trade in the direction of the smart money. Related Have you encountered a situation where you placed a trade that goes in the opposite direction with a strong momentum?So, what happened?The reason for this is central banks placed chunk of orders. And when we do have that situation, it is known as order blocks.Order blocks are a viable trading strategy, and in this guide, we’ll talk about three order block trading strategies.So, hopefully, by the end of this post, you’ll become familiar with this popular trading strategy.As a retail trader, you and I can’t control the market. We are talking about over $6 trillion worth of transactions daily in the forex market; how can we control that?It’s the big boys known as smart money who control the market. Smart money refers to central banks, market makers, and institutional investors.When they place an order, they don’t place it for thousands of dollars; they place it for millions and billions of dollars. That’s when the market moves, creating a situation known as order blocks.The idea of an order block strategy is to ride along with the smart money. As mentioned earlier, as retail traders, we don’t control the market, so how about we do what smart money is doing?We must create order blocks for the order block trading strategy. Bearish order blocks form when there is a large sell order by smart money. Bullish order blocks appear when there is a large buy order.You can locate these zones at the end of a strong trend. After that, you just have to draw a rectangle on the origin of the new trend.By plotting order block zones, we can move along with the big boys and place buy and sell orders.You might be thinking, “How will these zones help me?”Central banks and other market movers don’t place their orders at once. They wait and place their orders in regular intervals creating “blocks.”They don’t place their orders at once because it can create high volatility and disrupt the market. That’s when the price returns to certain levels, so smart money can place their orders again, which presents us with an entry point.So, now you know what order blocks are, we can move into the best order block trading strategies.The pin bar trading strategy combines well with the order block. The idea is to locate a bullish or bearish order block, and whenever the price returns to these levels, creating a pin bar, we can enter our trades.The pin bar is a single candlestick pattern that mentions strong reversal, meaning the price has rejected this level.One thing to remember is pin bar will appear in the bullish or bearish order block. So you wait for it to appear and then enter the trade.Draw a bullish order block on the chart.Wait for the price to return to the bullish order block, creating a bullish pin bar.Enter the trade after the formation of the pin bar.Set your stop-loss at the low of the bullish order block.Set your TP at the closest bearish order block you see.Draw a bearish order block on the chart.Wait for the price to return to the bearish order block, creating a bearish pin bar.Enter the trade after the formation of the pin bar.Set your stop-loss at the high of the bearish order block.Set your TP at the closest bullish order block you see.You can see the bearish order block and pin bar on the chart below.Notice how the price reversed after the formation of the pin bar. That’s when we entered our trade. The price did retrace a bit, but eventually, it continued in the downtrend.The trend line and order block is the simplest strategy you can try. All you have to do is to locate the overall trend, plot the bullish or bearish order blocks, draw a trend line, and when the price breaks, you enter your positions.The overall trend must be upwards.Draw a bullish order block on the chart.When the price goes to the next high, draw a trend line.Wait for the price to come back to the bullish order block.Enter the trade when the price breaks through the trend line.Set your stop-loss at the low of the bullish order block.Set your TP at the next closest bearish order block.The overall trend must be downwards.Draw a bearish order block on the chart.When the price goes to the next low, draw a trend line.Wait for the price to come back to the bearish order block.Enter the trade when the price breaks through the trend line.Set your stop-loss at the high of the bearish order block.Set your TP at the next closest bullish order block.On the chart below, you can see a bearish order block. The overall trend was downwards, so we drew the bearish order block and plotted a trend line from where the price started returning to the bearish order block. When the price broke through the trend line, we entered our trade.A wedge pattern appears from converging trend lines and indicates the market reversal. The pattern comes in two types; rising wedge and falling wedge.We can enter the trade whenever the price forms a wedge at the order block zone.Draw the bullish order block on the chart.The price must form a falling wedge pattern in the zone.Enter the trade after the formation of the falling wedge pattern.Set your stop-loss at the low of the bullish order block.Place your TP at the next closest bearish order block.Draw the bearish order block on the chart.The price must form a rising wedge pattern in the zone.Enter the trade after the formation of the rising wedge pattern.Set your stop-loss at the high of the bearish order block.Place your TP at the next closest bullish order block.On the chart below, we have the bearish order block. You can see how the price reversed after the appearance of the rising wedge pattern. So, here we entered the trade.Order blocks are a strategy that can do miracles if you follow them properly. You must follow certain confluences with each strategy mentioned above and wait for the price to do its magic.Why trade anything else when you can trade with the big players?Which timeframe is the best for an order block trading strategy?The longer the timeframe, the better. You need to locate the overall trend on the higher timeframes, like the 4H or the daily, and then you can return to the 1H chart to draw the order blocks. There is too much market noise on lower timeframes, so it’s best to avoid them.What are the types of order blocks in trading?There are two types of order block zones that form in trading depending on the presense of institutional orders.Bullish order blockBearish order block As a trader who has been in the forex trading industry for a while, the dogma of supply and demand is certainly not a new concept. Of course, there are certain aspects to the price movement in the financial markets that is governed by supply and demand factors but they cannot arrive at the fundamentals of what the institutions are doing in terms of buying and selling. Apart from the commonly used supply and demand zones, orderblocks are very specific levels of price movement that can be refined to precise price levels (not as a broad range or zone) on lower timeframes. Central banks and large institutions are the key players of foreign exchange transactions of the financial markets; they set the tone of price movement and the directional bias on the higher timeframe charts by accumulating large volumes of orders (bullish or bearish) at a particular price level, these volumes of orders are then released in smaller packets by orderblocks in the same direction on the higher, intermediate and lower timeframe charts. The term ‘orderblocks’ refers to certain candlestick formations or bars that suggest what is known as 'smart money buying and selling' when viewed in an institutional context (i.e the foreign exchange transactions between central banks, commercial hedgers and institutional traders) displayed on price charts. The term smart money will be most often used in this article to narrate a clear and concise approach to the orderblock theory and how to trade with the orderblock strategy effectively. This can be the very beginning of your understanding (from an institutional perspective) of how various levels of price movement are determined by these large scale entities (banks and institutions). You will also clearly understand why the market moves the way it does, the mechanics behind the highs and the lows that form in price movement, when an impulsive price swing is expected to retrace, where to expect the next expansion of price movement and the extent of the expansion. Formation of an Orderblock Orderblocks usually form at the extremes and the origin of price movement. They might appear in varying forms but their identification is distinct by a specific price pattern. A bullish orderblock is identified by the most recent down-close (bearish) candle followed by an up-close (bullish) candle that extends above the high of the most recent down close (bearish) candle. Varying examples of Bullish orderblocks This can appear on both bullish and bearish price moves but is more highly probable on a bullish price move and a bullish directional bias. Conversely, a bearish orderblock is identified by the most recent up close (bullish) candle followed by a down-close (bearish) candle that extends below the low of the most recent up-close (bullish) candle. Varying examples of Bearish orderblocks This can appear on both bullish and bearish price moves but is more highly probable on a bearish price move and bearish directional bias. This price pattern is often confused among retail traders, as supply and demand zones or sometimes seen as bullish engulfing or bearish engulfing patterns but the mechanics and the theory behind the formation of the orderblocks and their impact in price movement serves greater insights to trading the orderblock trading strategy profitably. A brief review on the mechanics of orderblocks Most often, the candlestick formation of orderblocks, when viewed on lower timeframes, is seen as an extended period of consolidation which simply means that orders have been built up by large banks and institutions before the spring of the large extrapolated price move from the orderblock (lower timeframe consolidation). For instance, a daily bullish orderblock when viewed on an hourly chart, it is seen as a consolidation (build-up phase) before the bullish impulsive rally in price move. Image illustration of a high probable bullish orderblock Image illustration of a high probable bearish orderblock Now that we can clearly identify bullish and bearish orderblocks. There are certain factors that will be discussed in the next section and these conditions must be met before an orderblock is deemed as highly probable. When an orderblock meet the criteria of high probability in price movement, a large extrapolated price move is propagated by a retest with either of the next series of candlesticks or bars toward the direction of orderblock. Price movement is characterized by impulsive price expansions and retracements hence after an impulsive price expansion from the orderblock, there is usually a retracement into the high probable orderblock for the second leg of an impulsive price expansion. Criteria to framing high probable orderblocks Long term trends: First and foremost, emphasis is laid on long term trends. The popular saying that the trend is your trend also applies to the orderblock trading strategy. Because large banks and institutions place most of their orders on higher timeframes charts, therefore momentum and trends on the higher timeframe monthly, weekly, daily and 4hr are critical to selecting high probable orderblocks to hunt trade setups. Any timeframe below the monthly, weekly, daily and 4hr means leaving the higher timeframe premise to an intraday basis. Current price expansion: Understanding the current price expansion is equally important to detect the actions of smart money buying and selling. Focus should be on what these higher timeframe price moves are most likely reaching for. Therefore trading within this higher timeframe premise will remove a lot of the uncertainties that plague most traders in their hunt for trade setups when using the orderblock trading strategy. Market structure: The ability to identify lower timeframe market structure of price movement within a larger trend or a higher timeframe is key to identifying high probable orderblocks on intermediate and lower timeframe charts. If the price is in a consolidation, we can frame high probable orderblocks after price has expanded out of the range. A retracement to ‘the orderblock’ that facilitated the breakout of the consolidation is deemed highly probable. Image illustration of a High probable orderblock that facilitated the expansion from a consolidation price movement If price is making successive higher highs, only bullish orderblocks will be identified as high probable orderblocks. Image illustration of high probable bullish orderblocks in a bullish trend of successive higher highs If price is making successive lower lows, only bearish orderblocks will be identified as high probable orderblocks. Image illustrations of high probable bearish orderblock in a bearish trend of successive lower lows Moving averages: A pair of moving averages can be plotted over price movement to help keep our focus on a one-directional premise of the market. The pair of moving averages that can be used is either 18 & 40 EMA or 9 & 18 EMA. Crossovers are not necessarily needed but proper stacking or the opening up of these moving averages in the same direction is indicative of a buy or sell program. In a buy program, only bullish orderblocks are deemed highly probable and in a sell program, only bearish orderblocks are deemed highly probable. Fibonacci retracement and extension levels: In a buy program, the Fibonacci tool can be used to frame high probable bullish orderblock at a discount price which is usually at or below the 61.8% optimal trade entry level of a defined bullish price move and conversely in a sell program, the Fibonacci tool can be used to frame high probable bearish orderblock at a premium price which is usually at or below the 61.8% optimal trade entry-level above of a defined bearish price move. The Fibonacci tool is not a magic indicator here but it is used to frame high probable discount orderblock in a buy program and high probable premium orderblocks in a sell program. The idea behind the effectiveness of the Fibonacci is that smart money accumulates long orders at cheap discount prices which is below the 50% of a defined bullish price move and also accumulate sell orders at a higher premium price above the 50% of a defined bearish price move. Most sensitive price levels of an orderblock: when hunting for a bullish trade setup, the most sensitive price level of the bullish orderblock to expect sharp price reactions or open a long market order is the high, the open and the midpoint (last most sensitive price level) of the body of the last down candle of the bullish orderblock. When hunting for a bearish trade setup, the most sensitive price level of the bearish orderblock to expect sharp price reactions or open a short market order is the low, the open and the midpoint (last most sensitive price level) of the body of the last up candle of the bearish orderblock. Either of these three sensitive levels can be used as trade entry depending on the traders risk appetite and level of proficiency Trade examples of high probable orderblocks Example 1: Dollar Index on the daily chart We can see framed high probability bearish orderblocks in confluence with the bearish trend, fibonacci retracement and extension levels, the 18 & 40 pair EMA. Example 2: UsdCad on the daily chart We can see framed high probability bearish orderblocks in confluence with the bearish trend, fibonacci retracement and extension levels, the 18 & 40 pair EMA. Example 3: GbpCad on the 1hr chart Notice the bullish orderblock that facilitated the breakout from the consolidation with a defined bullish price move. And then a bullish expansion from the retest of the orderblock. There are lot of perfect trade examples of the orderblock trading strategy that can be reviewed in hindsight and the same strategy can also be used to nurture profit consistency in trading. Click on the button below to Download our "Orderblock trading strategy" Guide in PDF