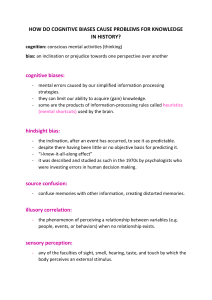

The current issue and full text archive of this journal is available on Emerald Insight at: https://www.emerald.com/insight/1755-4179.htm Behavior biases and investment decision: theoretical and research framework Satish K. Mittal Behavior biases 213 School of Management, Gautam Buddha University, Greater Noida, UP, India Received 11 September 2017 Accepted 3 January 2018 Abstract Purpose – This paper developed a theoretical and research framework by identifying the behavioral biases in investment decision and by presenting a review of the available literature in the field of behavior financerelated biases. This paper aims to present a compressive review of the literature available in the public domain in past five decades on behavior finance and biases and its role in investment decision-making process. It also covers insights on the subject for developing a deeper understating of the behavior of investor and related biases. Design/methodology/approach – The work follows the comprehensive literature review approach to review the available literatures. The review carried out on different parameters such as year of publication, journal of publication, country, type of research, data type, statistical technique used and biases identified. This is a funnel approach to decrease the number of behavior biases up to six for further research. Findings – Most of the existing works have summarized behavior finance as an emerging area in finance. This indicates the limited valuable research in developing economy in this area. This literature review helps in identifying major research gap in this domain. It helps in identifying the behavior biases which work dominantly in investment decision-making. It would be interesting to explore the area of behavior biases and their impact on investment decision of individual investors in India. Originality/value – This paper worked on literature prevailing on the subject and available on various online research data source and search engines. It covers a long time frame of almost five decades (1970-2015). This paper is an attempt to look at the impact of behavior finance and biases and its role in investment decision-making process of the investor behavior. This study builds up a strong theoretical framework for researchers and academicians by detailed demonstration of available literature on behavior biases. Keywords Investment management, Behavioural finance, Behavioural bias Paper type Literature review 1. Introduction Traditional economics and financial theories are built on the key assumption that human beings are rational; they take all available information into consideration while making investment decision. Proponents of efficient market hypothesis and modern portfolio theory believed that all known information is priced into a stock or investment product. Regardless of disciplined investment, people often make errors when they pick their stocks. A bulk research indicates that investors’ behavior differ from their hypothetical rational investors. Many investors either hold under-diversified portfolio or trade frequently to avoid the risk without taking into account: transaction cost, tax, hidden charges, etc. Behavior finance uses insight from psychology to explain why investors behave the way they do. Investors do not always make choice in a rational way. Most investor’s decision-making use through process that is intuitive and automatic rather than deliberative and controlled. Behavior finance-identified investors’ financial decisions are imparted by human psychology and use the term “Quasi-rational” to describe how, when and why we sometime behave irrationally. Behavior finance identifies two primary reasons which make investors Qualitative Research in Financial Markets Vol. 14 No. 2, 2022 pp. 213-228 © Emerald Publishing Limited 1755-4179 DOI 10.1108/QRFM-09-2017-0085 QRFM 14,2 214 behavior quasi-rationally. First, investors are human beings and experience a range of emotion while making an investment decision, and second, outside factors such as news clips, media and research report. Traditional finance theories explain what one should do, whereas behavior finance explains what one really does. Traditional finance theories such as EMP and MPT are a hypothetical situation but human decision-making process influenced by a number of determinants and biases which can be truly explained by behavior finance. Generally it is assumed by the researchers that stock prices movements are fixed by rational investors’ anticipations and reactions. Rational investor means an investor who have access of all kind of information pertain to that particular stock which in itself is an unrealistic assumption. Because of its simplicity and its success to capture the stock price movements, this famous investor’s rationality hypothesis was for a long time supported by the academic researchers in finance. Researchers in behavior finance were motivated to break with the rule of rationality hypothesis. They take into account some behavior biases on the investors’ decisions and subsequently measure the effect of such influenced decision or reactions on the stock price movements. 2. Conceptual framework Behavioral finance relaxes the traditional assumptions of financial economics by incorporating these observable, systematic, and very human departures from rationality into standard models of financial markets. The tendency for human beings to be overconfident causes the first bias in investors, and the human desire to avoid regret prompts the second. (Barber and Odean, 1999). Therefore, behavioral finance can be defined as a field of finance that proposes explanation of stock market anomalies using identified psychological biases, rather than dismissing them as “chance results consistent with the market efficiency hypothesis” (Fama, 1998). The role of behavioral finance is not to diminish the primary work that has been done by proponents of efficient market hypothesis. Rather, it is to examine the importance of calm unrealistic behavioral assumptions and make it more realistic. It does this by adding more individual aspects of the decision-making process in financial markets. A large number of empirical research shows that real individual investors behave differently from investors. 2.1 Behavior biases and individual investment decision The first dictionary definition of biases is consistent with faulty cognitive reasoning or thinking, while are more consistent with impaired reasoning influence by feeling or emotion. Behavioral bias is defined as a pattern of variation in judgment that occurs in particular situations, which may sometimes lead to perceptual alteration, inaccurate judgment, illogical interpretation or what is largely called irrationality. As defined by Shefrin (1985), bias is nothing else but the inclination toward error. Understanding the effect of behavior biases on the investment process, investors and their advisors may be able to improve economic outcomes and attain stated financial objectives. Simply identifying behavioral biases at the right time can save client from potential financial disaster (by Michael M. Pompian, Book: Behavior Finance and Wealth Management, second edition, Wily publication). Figure 1 shows the factors from different dimensions which affect the investment decision of an individual. Investors are influenced by various types of behavior biases, and here, we have identified following six biases which affect the investment decision of individual investors for further research. Demographic Factors: Age, gender, marital status, educaon, income, occupaon Risk bearing Capacity: Risk averse, Risk taker, Neutral Liquidity Stock fundamentals: Past return, beta, EPS, Firm size, share price Psychological influence: Desire, Goal, Biases and emoon, Heuriscs FACTORS INFLUENCING THE INDIVIDUAL INVESTORS BEHAVIOUR Expert advice: Advice from broker/ family members/ friends etc Behavior biases Personal value: Social & religious impact, atude, Lifestyle, personal ability, confidence level Personal Financial need: Need to minimize risk & maximize return Others like press release, accounng informaon, Govt. policy impact 2.1.1 Overconfidence. Investors often overly over-estimate themselves and consider themselves smarter than other investors. This biased sense and the resultant erroneous stockpicking often reduce the return on their assets. This fact was propagated by Odean (1998). 2.1.2 Disposition effect. Investors tend to retain losing securities for too long a period. On the contrary, they tend to sell off profitable securities too soon. Shefrin and Stateman (1985) developed a theoretical framework related to selling of winning stock and holding of lossmaking stock. 2.1.3 Herd instincts. Investors often blindly follow the action of a larger group without judging the rationality of such an action. This behavior is inbuilt in human nature. Such an instinct is attributable to the natural inclination in human beings to desire to be better accepted by a group he/she belongs to. Few important studies have been conducted by Grinblatt et al. (1995) and Wermers (1999) on the herd behavior in investment decisionmaking. 2.1.4 Hind sight biases. Shiller (2000) describe hindsight bias as “the tendency to think that one would have known actual events were coming before they happened, had one be then or had reason to pay attention.” The investor believes that some past event was predictable, though in fact it was not. Such faulty belief or bias may lead to establishing false causal relationships, which may end up in incorrect oversimplifications. 2.1.5 Availability biases. Investors tend to allot more importance to recent information than on relatively past information. Thus, they focus on the short-term perspective and miss out on the long-term picture. Thus, they are willing to assume more risks after a gain. On the contrary, they are willing to assume less risks after a loss. Odean and Barber (2002) tested the proposition that individual investors buy stocks that happen to catch their attention. 2.1.6 Self-Attribution biases. Investors who suffer from self-attribution bias tend to attribute successful outcomes to their own actions and bad outcomes to external factors. They often exhibit this bias as a means of self-protection or self-enhancement. Investors afflicted with self-attribution bias may become overconfident, which can lead to overtrading and underperformance. A famous work “Learning to be overconfident” by Gervais and Odean (2000) explained the phenomena. 215 Figure 1. Factors influencing investors’ behavior compiled from various studies QRFM 14,2 216 3. Research methodology and data A comprehensive literature review approach has been used to review the papers available in public domain on behavior biases and its role in investment decision-making process. To conduct the search of paper, we used the key works such as behavior finance, behavior biases, individual investor decision-making, overconfidence, herd biases, availability biases, disposition effect, hind sight biases and self-attribution biases. We used databases such as Emerald, JSTOR, INSTEAD, ELSEVIER, Science Direct, Google Scholar and others to find the relevant literature on the subject. We selected the time horizon of almost five decades (1970-2015) which cover the literature from the origin of basic theory to number of empirical and descriptive research to available literature review and analytical research paper. The year 1972 was considered are origin year for new paradigm shift of financial theory with the publication of a paper titled “Subjective Probability: A judgement of Representativeness” published in COGNITIVE PSYCHOLOGY, authored by Kahneman and Tversky, also known as Father of Behavior Finance. First empirical research paper was published in the year 1977 titled “Pattern of investment strategy and Behavior among individual investors” by Leweller et al. in JSTOR: The journal of business, Vol.50, Issue.3 (Jul.1977). Following criteria have been used for identification and selection of paper for this study: paper published in different journals and available on online database; paper published in English and having full content; different paper type, including theoretical, analytical, literature review, case study, working paper and conference paper; and paper having the search key word in title and abstract. After intensive research based on above criteria, we selected 117 papers for review. The objective of this study is to prepare and comprehensively review studies on behavior biases and their impact on investment decision. 4. Analysis of literature In this section, we comprehensively review the selected research papers based on criteria such as year of publication, journal of publication, country, type of research, data type, biased identified and statistical technique used for the study. Thus, it helped in analyzing the previous work done in the area and development of framework for future research. 4.1 Year of publication vs number and type of study Table 1 shows the distribution of research paper based on its year of publication and number and type of study. It can be seen from the table that there has been a drastic increase in number of papers during the past decade, i.e. 2010-14. Very few number of research papers are available on behavior finance and biases up to year 2004. Graph (1) indicates that increasing number of research papers show that researchers and academicians in this area accepted the key role of behavior factors and biases in investment decision-making process. Now, the domain of research is gradually shifted toward the unit of analysis, i.e. individual investor and the factor affecting their investment decision. 4.2 Country vs number and type of research Table 2 shows the location where the research was conducted and different types of research done in that location based on their data type. The data show that research on behavior biases was done in 29 locations, and around nine research papers were either conducted in Year Theoretical Lit. review Type of study Analytical Empirical Descriptive Total 1970-74 1975-79 1980-84 1985-89 1990-94 1995-99 2000-04 2005-09 2010-14 2015 Total 3 1 2 2 2 2 0 1 1 1 15 Location Type of research Total no. Theory Lit. Empirical/ Empirical/ Descriptive/ Descriptive/ of paper based review Primary Secondary Primary Secondary Analytical Australia Britain California China Europe Finland France India Iran Israel Istanbul Jena Kenya Korea Lagos Malaysia The Netherlands New York Pakistan South Africa Spain Sweden Taiwan Tehran Tunisia Turkey UK US Vietnam Not mentioned Total 2 1 5 8 2 2 1 23 1 3 1 1 4 1 1 2 2 2 7 1 1 1 2 2 2 1 4 23 5 9 120 2 3 8 2 10 4 7 1 1 1 10 33 2 49 9 25 4 39 3 3 2 2 4 2 4 20 71 9 120 Behavior biases 217 Table 1. Year of publication vs type of study 2 1 5 1 1 1 1 5 1 1 1 1 1 1 1 7 5 4 3 1 2 2 1 1 4 1 1 1 1 2 1 2 1 5 1 1 1 1 1 1 1 2 1 3 2 1 16 1 2 3 12 1 6 2 1 29 2 4 1 18 2 1 1 24 3 3 1 14 1 7 Table 2. Country vs number and type of research QRFM 14,2 more than one location or had not specified the place of research. It shows that majority of basic work of behavior finance and biases have been done in developed countries in early 1980s. Now, during the past decade, developing countries like China, India and Pakistan show growing number of research papers on this subject. The major factor behind this is growing economy. 218 4.3 Journal of publication vs number and type of research The objective of this analysis is to identify the important journal and publication in this area. Table 3 shows that 117 research papers were collected from 20 journals and publications and part of PhD thesis. Out of these, 15 journals had two or more than two publications. Table 3 shows that ELSEVIER, Emerald insight and JSTOR together published 22 research papers, Journal of Wealth Management published 6 research papers and Review of Finance published 5 research papers. The important research paper in this area is published in above-mentioned journal and publication. The remaining journal had only limited number of research papers on the behavior biases and investment decision of individual investors. 4.4 Type of research vs number of paper We categorized the type of research into five categories, i.e. theoretical research, literature review, analytical research, empirical research and descriptive research. In theoretical research, we considered the paper that develops the conceptual theory or model related to behavior finance and identified biases, whereas in analytical research, we considered the paper that has analyzed a previously available model or facts. In empirical research, we included studies based on observation or experiments, whereas descriptive research included studies that are related to survey or fact findings. Table 4 shows that majority of research is empirical, followed by descriptive research. The data show that 53 research papers worked on primary data, which were collected mostly through questionnaires. In total, 32 research papers used the secondary source of data, which were collected from respective brokerage firms and stock exchange. Increasing trend of survey method of data collection can be seen during the past decade onward. 4.5 Statistical technique vs number of paper This parameter of review gives us insight about the statistical technique frequently used in behavior finance and biases research. Table 5 clearly shows that descriptive analyses, correlation and regression analysis are most frequently used statistical technique in this area. It shows that 28, 21 and 14 of the 117 papers used descriptive analysis, regression and correlation analysis, respectively. Probability is the most frequently statistical tool in early decade. A few studies applied factor analysis, structural equation model, chi-square and variant analysis. 4.6 Identified behavior biases vs number of paper In this section, we analyzed the selected papers based on the behavior biases identified by the researcher. Table 6 shows that 39 research papers found on overall behavior biases, its concept, integrated work on more than one behavior biases identified. Mostly, these papers prove the importance of behavior biases and its impact on investment decision of individual investors. There are 27 research papers available on overconfidence biases, 17 papers on herd behavior and 16 papers on disposition effect, whereas there are 6 research papers on hind sight biases, availability biases and self-attribution biases. Algorithmic Finance Asian Journal of Finance and Accounting Cognitive Psychology Contemporary Economics ELSEVIER Emerald Insight European Scientific Journal Handbook of Economics and Finance Indian Journal of Applied research INSTEAD university publication International Journal of Business and Management International Journal of humanities and Social science International Journal of multi-disciplinary and Academic research International research journal of Applied and basic science Journal of Business and Economics Journal of Finance, Accounting and Management Jounal of Risk and Uncertainity JSTOR Review of Finanace Journal of Wealth Management Part of P.Hd thesis Others Total Name of Journal/Publication 1 2 2 1 10 8 1 2 1 2 6 1 6 3 3 2 3 6 5 6 17 32 120 2 16 1 1 2 5 1 1 1 2 3 2 12 1 1 1 1 3 4 13 33 1 1 1 2 3 1 4 1 1 1 5 4 17 2 1 4 1 3 7 20 1 4 1 1 1 1 1 3 10 3 2 1 1 3 2 1 12 1 1 2 2 Type of research Theory Lit. Empirical/ Empirical/ Descriptive/ Descriptive/ Total no. of paper based review Primary Secondary Primary Secondary Analytical Behavior biases 219 Table 3. Journal of publication vs number and type of research QRFM 14,2 220 5. Finding Researchers in the area of behavior finance analyzed the existence and role of behavior finance in financial decision-making. It works on a funnel approach of research, where the first step was to find the existence and importance of behavior finance, then its role in individual decision-making process and further its implication on stock market return. It has been observed during the review that now researchers are working on a single dimension of behavior finance and establishing its impact of investment decision of an individual investor. Above all, the results are consistent that there is a dynamic relationship between individual investment decision and behavior biases. Few important reviews in the area of behavior finance and biases are presented in Table 7. Type of research Table 4. Type of research vs number of paper Table 5. Statistical technique vs number of paper No. of paper Theoretical Lit. review Analytical Empirical Descriptive Total 15 10 7 49 39 120 S. no. Name of technique 1 2 3 4 5 6 7 8 9 10 11 12 13 14 15 16 17 ANOVA AHP Chi-square Factor analysis KMO efficient Descriptive analysis Regression method Sensitivity analysis Dickey fuler test Principal component analysis Correlation analysis Structured equation model Mann Whitney U test Cluster analysis Simulation Probability Univariate and multivariate analysis Identified biases Table 6. Identified behavior biases vs number of paper Self-attribution biases Availability biases Hind sight biases Disposition effect Herd behavior Overconfidence Overall behavioral finance concept and biases No. of paper 3 3 9 8 3 28 22 1 1 3 15 6 1 1 2 9 5 No. of paper 6 7 7 16 17 27 40 Behavior biases Finding Basic behavior biases concept and research Denial and Tversky (1974) described three heuristic that are employed in making judgement under uncertainty representativeness, availability of instance or scenario, adjustment from an anchor. These heuristic is highly economical and usually effective which lead to systematic and predictable errors. During 1981reseracher published another work on psychological principles that govern the perception of decision problems, evaluation and outcomes produce predictable shifts of preference when the same problem is framed in different ways. The effects of frames on preferences are compared to the effects of perspectives on perceptual appearance Daniel et al. (1998) developed a theory based on investor overconfidence and biased self-attribution of investment outcomes. The theory implies that investors overreact to private information signals and underreact to public information signals Fellner and Maciejovsky (2003) empirically reported the results of an experiment in which they contrasted institutional with behavioral explanations by comparing asymmetric information to social identity. Results show that social forces, triggered by group affiliation, drive under diversified and domestically biased portfolio allocations Todd Feldman (2011) indicated that putting too much weight on the current environment, anchoring, is the largest factor in explaining individual investor underperformance. In addition, loss aversion is the largest factor to explain excessive trading Onsomu (2014) conducted descriptive research on impact of behavior biases on investment decision and concluded that individual investors are affected by number of behavior biases. There is no significant correlation between gender and biases This paper identified six behavior biases that affect the decision process in one or other way. Few of them push the decision toward market portfolio and others deviate from efficient market hypothesis. The factors that affect the investment decision is the most discussed issue among researchers of this field. A large number of research papers are available worldwide that discuss the behavior of individual investors. Most of the papers are available from a foreign perspective, especially a developed economy, and very few but good research papers are available from an Indian perspective. 5.1 Review of identified behavior biases Based on the papers reviewed, six behavior biases have been identified for further research: overconfidence, disposition effect, herd instinct, availability biases, hind sight biases and self-attribution biases. The objective would be measure the impact of these biases on investment decision-making process of an individual investor. Therefore, these biases have been reviewed separately to get insight in the phenomena. 5.1.1 Overconfidence. Overconfidence has been evident as a factor causing irrational investment decision of an individual investor who is not much informed. Researchers in all decades documented the significant role of overconfidence in investment decision-making of individual investors. Few significant works on this bias are tabulated in Table 8. 5.1.2 Disposition effect. Scholars in this area empirically worked on this biases and stated that disposition effect and experience of investors are related to each other. Investors who have more experience in the trading of stock market are less affected by the disposition Behavior biases 221 Table 7. Important review in basic behavior biases concept and research QRFM 14,2 Behavior biases Finding Overconfidence Daniel et al. (1998) developed a theory based on investor overconfidence and biased selfattribution of investment outcomes. It implies that investor overreact to private information signals and under-react to public information signal Stateman et al. (2006) tested the trading volume prediction for formal overconfidence modal. A lead-lag relationship between market return and turnover confirms the formal theories of investor overconfidence Phan et al. (2012) determined four prominent behavioral biases of individual investors that is Overconfidence, Excessive Optimism, Psychology of Risk and Herd Behavior. It sent a caution about influence of behavioral biases in decision-making process Rostami and Dehaghani (2015) worked on impact of overconfidence on investment decision-making and result stated that there is significant role of biases and investing in stock exchange 222 Table 8. Review of overconfidence biases effect, whereas less experienced investors trade more frequently because of the effect of disposition. Some of the findings are listed in Table 9. 5.1.3 Herd instinct. Herd behavior is commonly evident among Indian investors. Investors usually track the advices of investment firm, brokerage house and other peer groups to save their investment and also to change their investment decision based on their output. Number of researchers have documented the role of herd behavior in decisionmaking, which are listed in Table 10. 5.1.4 Availability biases. Availability bias was first studied by Kahneman and Tversky (1974), who concluded that frequency events are easier to recall or imagine. People can access the availability with reasonable speed and accuracy. Few important works on this bias are presented in Table 11. 5.1.5 Hind sight biases. Researchers stated that young investors are more affected by hind sight biases rather than experienced investor. Shiller (2000) describes hindsight bias as “the tendency to think that one would have known actual events were coming before they happened, had one be present then or had reason to pay attention.” Review of this biases are tabulated in Table 12. 5.1.6 Self-attribution biases. Research on this biases documented that this bias is the second step ahead of overconfidence biases. This works on an individualist approach where investors are not only over confident about investment decision but also give credit to themselves. It is an emotional biases and is inbuilt in the investor nature. Review is presented in Table 13. Table 9. Review of disposition effect Behavior biases Finding Disposition effect Stearns and Berkeley (2005) stated that trading experience in a financial market can reduce the magnitude of the disposition effect Ben-David and Doukas (2006) addressed the effect of disposition effect and the result are consistent with overconfidence in trading driving the disposition effect Goetzmann and Massa (2003) indicated a strong negative correlation between the disposition effect and stock return, volatility, and trading volume Lakshmi et al. (2013) indicated that long-term investors’ decision-making is significantly and positively influenced by disposition effect Therefore, it is clear from the review of literature in this arena that behavior factors and biases play a key role in investment decision-making process at micro level. Individual investor is the unit of study. Cognitive psychology of investor plays an important role in investment decision-making process. “Behavioral Finance is becoming an integral part of Behavior biases 223 Behavior biases Finding Herd instict Salamouris and Gulnur Muradoglu (2010) empirically stated that a positive and significant relation is found between the accuracy of analysts’ earnings forecasts and herding behavior Patro and Kanagaraj (2012) summarized that the level of herding is more in Indian stock market as compared to developed markets Huei-Wen Lin (2012) showed that more impetuous investors would be prone to herding bias directly, but rather exhibit higher risk tolerance Luu Thi Bich Ngoc (2014) showed that individuals tend to consider the information of stock market: general information, past trends of stock price and current stock price changes carefully before making their investment Behavior biases Finding Availability biases Kahneman and Tversky (1973) first worked on Availability biases. Availaibility biases are frequency events, easier to recall or imagine. People can access the availability with reasonable speed and accuracy Bian et al. (2014) indicated that the prior gains and losses of the stock that the investor plans to sell have significant impact on the aggressiveness of the sell order Kudryavtsev et al. (2013) analyzed the effect of availability heuristic on the mechanism of stock market decision-making. Results revealed that stock market investors are likely to run to extreme and affected by a few of behavior biases Moradian et al. (2013) established the relationship between personality dimension and behavioral biases and stated high impact of availability biases among the investors in Tehran stock exchange Behavior biases Finding Hind sight biases Seppälä (2009) concluded in his thesis that people in general are exposed to the studied behavioral biases but the degree and impact are affected by experience and other characteristics. Investment advisors are generally less exposed to hindsight bias than other people Rahul Subash (2012) in his thesis revealed that the degree of exposure to the biases separated the behavioral pattern of young and experienced investors. Hindsight biases were seen to affect the young investors significantly more than experienced investors Mary Metilda (2013) conceptually proved that hindsight bias may hinder rational thinking in investors. One of the most obvious results of hindsight bias is overconfidence among investors Hussain, Muntazir et al. (2013) reported strong impact of hindsight bias in asset selection effect that stock market investor are more exposed to the hindsight bias, whereas, in sign of return effect the bank financial managers are more exposed to hindsight effect Table 10. Review of herd behavior Table 11. Review of availability biases Table 12. Review of hind sight biases QRFM 14,2 224 decision-making process because it heavily influences the investors’ performance” (Banerjee, 2011). As the investment environment of Indian financial system is open to all categories of product and services, oversea players and customized product. Individual earnings are doubled during the past decade and play an important role in investment market. Therefore, it is important to know more about Indian individual investors, role of behavior biases in their investment decision and how to improve the decision. The above discussions coupled with an extensive literature review helps to identify the following research gaps: Identifying and confirmation of behavioral biases prevailing among Indian investors is required to establish their respective role in behavior of individual investors and their decision-making. Measuring the significance level to which Indian individual investors tend to be influenced by identified behavioral biases is required. Finding the correlation among the biases is needed. If any relation exists, then it would be easier to correct them vide single step. Corrective remedial action required to take appropriate decision is necessary to minimize the effect of biases and improve the investment decision. 6. Conclusion Although this comprehensive review of literature is not enough to examine all aspects of behavior biases, few identified biases have been reviewed. The presence of behavior factors in investment decision-making is documented earlier by number of studies. The individual decision to invest in the financial market, especially equity, is greatly influenced by the variety of benefits each individual wants from owning a particular stock. Now, it is important to identify them at the micro level and measure their effect on individual and institution levels. The degree of deviation depends on expertise, skill, knowledge and experience in the field of finance. If an investor identify these biases in early stage of investment that would help in better investment decision and tends toward market portfolio as described by Fama (1960’s) in efficient market hypothesis. It is also suggested that understanding the behavior of individual investors could help explain the stock market anomalies. Last but not least, considering the behavior aspect can lead to some approaches that individual investors should put into practice when investing in the financial market. Table 13. Review of selfattribution biases Behavior biases Finding Self-attribution Jain and Wadhwa (2013) indicated that presence of biases can be attributed to whether a person is a broker or non-broker in case of self-attribution biases Hoffmann and Post (2014) used ba unique combination of survey data and trading record to demonstate how individual portfolio return actually affect investor score on a survey measure of self-attribution biases Shepperd et al. (2008) self-serving bias is neither wholly motivated nor wholly cognitive. Self-serving attributions occasionally reflect a calculated attempt influence audience perceptions or a desperate attempt to defend a desirable self-view References Ben-David, I. and Doukas, J. (2006), “Overconfidence, trading volume, and the disposition effect: evidence from the trades of institutional investors”, Working Paper, University of Chicago and Old Dominion University. Bian, J. Chan, K. Shi, D. and Zhou, H. (2014), “Do behavioral biases affect order aggressiveness?”, available at SSRN 2312134. Daniel, K., Hirshleifer, D. and Subrahmanyam, A. (1998), “Investor psychology and security market under-and overreactions”, The Journal of Finance, Vol. 53 No. 6, pp. 1839-1885. Fama, E.F. (1998), “Market efficiency, long-term returns, and behavioral finance”, Journal of Financial Economics, Vol. 49 No. 3, pp. 283-306. Fellner, G. and Maciejovsky, B. (2003), “The equity home bias: contrasting an institutional with a behavioral explanation”, Max Planck Institute for Research into Economic Systems, Papers on Strategic Interaction, (3-2003). Goetzmann, W.N. and Massa, M. (2003), Disposition Matters: Volume, Volatility and Price Impact of a Behavioral Bias (No. w9499), National Bureau of Economic Research. Kahneman, D. and Tversky, A. (1974), “Subjective probability: a judgment of representativeness”, The Concept of Probability in Psychological Experiments, Springer Netherlands, pp. 25-48. Kudryavtsev, A., Cohen, G. and Hon-Snir, S. (2013), “‘Rational’ or ‘intuitive’: are behavioral biases correlated across stock market investors?”, Contemporary Economics, Vol. 7 No. 2, pp. 31-53. Lakshmi, P., Visalakshmi, S., Thamaraiselvan, N. and Senthilarasu, B. (2013), “Assessing the linkage of behavioural traits and investment decisions using SEM approach”, International Journal of Economics and Management, Vol. 7 No. 2. Mary Metilda, J. (2013), “Hindsight bias and its significance to investor decision making”, Indian Journey of Applied Research, Vol. 3 No. 4. Odean, T. (1998), “Are investors reluctant to realize their losses?”, Journal of Finance, Vol. 53 No. 5, pp. 1775-1798. Salamouris, I.S. and Gulnur Muradoglu, Y. (2010), “Estimating analyst’s forecast accuracy using behavioural measures (herding) in the United Kingdom”, Managerial Finance, Vol. 36 No. 3, pp. 234-256. Seppälä, A. (2009), “Behavioral biases of investment advisors – the effect of overconfidence and hindsight bias”, Doctoral dissertation. Further reading Agnew, J.R. (2006), “Do behavioral biases vary across individuals? Evidence from individual level 401 (k) data”, Journal of Financial and Quantitative Analysis, Vol. 41 No. 4, pp. 939-962. Alghalith, M., Floros, C. and Dukharan, M. (2012), “Testing dominant theories and assumptions in behavioral finance”, The Journal of Risk Finance, Vol. 13 No. 3, pp. 262-268. Alti, A. and Tetlock, P.C. (2013), “Biased beliefs, asset prices, and investment: a structural approach”, Journal of Finance, Forthcoming. Babajide, A.A. and Adetiloye, K.A. (2012), “Investors’ behavioural biases and the security market: an empirical study of the nigerian security market”, Accounting and Finance Research, Vol. 1 No. 1, pp. 219-229. Barber, B.M. and Odean, T. (2011), “The behavior of individual investors”, available at SSRN 1872211. Barberis, N. and Thaler, R. (2003), “A survey of behavioral finance”, Handbook of the Economics of Finance, Elsevier Science B.V, pp. 1054-1056. Baron, J. and Hershey, J.C. (1988), “Outcome bias in decision evaluation”, Journal of Personality and Social Psychology, Vol. 54 No. 4, pp. 569-579. Behavior biases 225 QRFM 14,2 226 Bashir, T., Javed, A., Ali, U., Meer, U.I. and Naseem, M.M. (2013), “Empirical testing of heuristics interrupting the investor’s rational decision making”, European Scientific Journal, Vol. 9 No. 28. Bashir, T., Scholar, M.S., Rasheed, U., Raftar, M.S.S., Fatima, M.S.S. and Maqsood, S.M. (2013), “Impact of behavioral biases on investors decision making: male vs female”. Belsky, G. and Gilovich, T. (1999), available at: http://introduction.behaviouralfinance.net/ (February 2012). Benartzi, S. and Thaler, R.H. (2007), “Heuristics and biases in retirement savings behavior”, The Journal of Economic Perspectives, Vol. 21 No. 3, pp. 81-104. Bernstein, P.L. (1998), Against the Gods: The Remarkable Story of Risk, John Wiley and Sons. Bhattacharya, R. (2012), “Behavioral finance: an insight into the psychological and sociological biases affecting financial decision of investors”, ZENITH International Journal of Business Economics and Management Research, Vol. 2 No. 7, pp. 147-157. Bikhchandani, S., Hirshleifer, D. and Welch, I. (1998), “Learning from the behavior of others: conformity, fads, and informational cascades”, The Journal of Economic Perspectives, Vol. 12 No. 3, pp. 151-170. Bluethgen, R., Gintschel, A., Hackethal, A. and Müller, A. (2007), “Financial advice and individual investors portfolios”, European Business School Working paper. Brabazon, T. (2000), Behavioral Finance: A New Sunrise or a False Dawn?, University of Limerick, pp. 1-7. Bukszar, E. and Connolly, T. (1988), “Hindsight bias and strategic choice: some problems in learning from experience”, Academy of Management Journal, Vol. 31 No. 3, pp. 628-641. Bushee, B. (1998), “The influence of institutional investors on myopic R&D investment behavior”, Accounting Review, Vol. 73, pp. 305-333. Bushee, B. (2001), “Do institutional investors prefer near-term earnings over long-run value?”, Contemporary Accounting Research, Vol. 18 No. 2, pp. 207-246. Byrne, P., Jackson, C. and Lee, S. (2013), “Bias or rationality? The case of UK commercial real estate investment”, Journal of European Real Estate Research, Vol. 6 No. 1, pp. 6-33. Cen, L., Hilary, G. and Wei, K.C. (2013), “The role of anchoring bias in the equity market: evidence from analysts’ earnings forecasts and stock returns”, Journal of Financial and Quantitative Analysis, Vol. 48 No. 1. Chandra, A. (2008), Decision Making in the Stock Market: Incorporating Psychology with Finance, New Delhi. Chandra, A. and Kumar, R. (2011), “Determinants of individual investor behaviour: an orthogonal linear transformation approach”, Chopra, V.K. (1998), “Why so much error in analysts’ earnings forecasts?”, Financial Analyst Journal, Vol. 54 No. 6, pp. 30-37. Chuanga, W., I. and Susmelb, R. (2010), “Who is the more overconfident trader?”, Individual versus Institutional Investors. Clement, M. (1998), “Analyst forecast accuracy: do ability resources and portfolio complexity matter?”, Austin Working Paper University of Texas. Cronqvist, H. and Siegel, S. (2012), “Why do individuals exhibit investment biases”, Claremont McKenna College Robert Day School of Economics and Finance Research Paper, (2012-01). Cronqvist, H. and Siegel, S. (2014), “The genetics of investment biases”, Journal of Financial Economics, Vol. 113 No. 2, pp. 215-234. Das, S., Levine, C.B. and Sivaramakrishnan, K. (1998), “Earnings predictability and bias in analysts’ earnings forecasts”, Accounting Review, Vol. 73, pp. 277-294. De Haan, L. and Kakes, J. (2011), “Momentum or contrarian investment strategies: evidence from dutch institutional investors”, Journal of Banking and Finance, Vol. 35 No. 9, pp. 2245-2251. Deaves, R., Lüders, E. and Schröder, M. (2005), “The dynamics of overconfidence: evidence from stock market forecasters”, ZEW Discussion Paper, No. 05-83. DeBondt Werner, F.M. and Thaler, R.H. (1990), “Do security analysts overreact?”, American Economic Review Papers and Proceedings, Vol. 80, pp. 52-57. Dechow, P.M., Hutton, A.P. and Sloan, R.G. (1998), “The relation between analysts’ forecasts of longterm earnings growth and stock price performance following equity offerings”, Working Paper, University of Michigan. Dreman, D. and Berry, M. (1995), “Analyst forecasting errors and their implications for security analysis”, Financial Analysts Journal, Vol. 51 No. 3, pp. 30-42. Elan, L.S. (2010), Behavioral Patterns and Pitfalls of US Investors, Federal research Division, Library of Congress. Feng, L. and Seasholes, M.S. (2005), “Do investor sophistication and trading experience eliminate behavioral biases in financial markets”, Review of Finance, Vol. 9 No. 3, pp. 305-351. Gorter, J. and Bikker, J.A. (2013), “Investment risk taking by institutional investors”, Applied Economics, Vol. 45 No. 33, pp. 4629-4640. Grant, J. (2007), “Local futures traders and behavioural biases: evidence from Australia”, Thesis Collection, University of Wollongong, p. 762. Hoffmann, A.O. Shefrin, H. and Pennings, J.M. (2010), “Behavioral portfolio analysis of individual investors”, available at SSRN 1629786. Jagullice, E.O. (2013), “The effect of behaviourial biases on individual investor decisions: a case study of initial public offers at the Nairobi Securities Exchange”, Doctoral dissertation, University of Nairobi. Jain, P. (2019), “Investor sentiment and stock returns”, Doctoral dissertation. Jones, H. and Martinez, J.V. (2014), “Institutional investor expectations, manager performance, and fund flows”, Manager Performance, and Fund Flows (accessed 4 July 2014). Kahneman, D. and Lovallo, D. (1993), “Timid choices and bold forecasts: a cognitive perspective on risk taking”, Management Science, Vol. 39 No. 1, pp. 17-31. Kahneman, D. and Riepe, M.W. (1998), “Aspects of investor psychology”, The Journal of Portfolio Management, Vol. 24 No. 4, pp. 52-65. Kahneman, D. and Tversky, A. (1979), “Prospect theory: an analysis of decision under risk”, Econometrica: Journal of the Econometric Society, Vol. 47 No. 2, pp. 263-291. Korniotis, G.M. and Kumar, A. (2011), “Do behavioral biases adversely affect the macro-economy?”, Review of Financial Studies, Vol. 24 No. 5, pp. 1513-1559. Lim, T. (2001), “Rationality and analysts’ forecast bias”, Journal of Finance, Vol. LVI No. 1, pp. 369-385. Mohammad, H.G., Shakerinia, I. and Sabet, S. (2013), “The role of behavior biases on investment decisions, case study: Tehran stocks”, International Research Journey of Applied and Basic Science, Vol. 4 No. 4, pp. 819-824. Moradi, M., Mostafaei, Z. and Meshki, M. (2013), “A study on investors’ personality characteristics and behavioral biases: conservatism bias and availability bias in the Tehran stock exchange”, Management Science Letters, Vol. 3 No. 4, pp. 1191-1196. Muradoglu, G. and Harvey, N. (2012), “Behavioural finance: the role of psychological factors in financial decisions”, Review of Behavioural Finance, Vol. 4 No. 2, pp. 68-80. Nagel, S. (2005), “Short sales, institutional investors, and the cross-section of stock returns”, Journal of Financial Economics, Vol. 78 No. 2, pp. 277-309. Ng, L. and Wu, F. (2007), “The trading behavior of institutions and individuals in Chinese equity markets”, Journal of Banking and Finance, Vol. 31 No. 9, pp. 2695-2710. Omullo, B.N. (2013), “The effect of behavioral biases on the mutual fund choices by investors in Kenya”, Doctoral dissertation, University of Nairobi. Behavior biases 227 QRFM 14,2 228 Ofir, M. and Wiener, Z. (2009), “Investment in financial structured products from a rational choice perspective”, available at SSRN 1442855. Oh, N.Y., Parwada, J.T. and Walter, T.S. (2008), “Investors’ trading behavior and performance: online versus non-online equity trading in Korea”, Pacific-Basin Finance Journal, Vol. 16 Nos 1/2, pp. 26-43. Park, J., Konana, P., Gu, B., Kumar, A. and Raghunathan, R. (2010), “Confirmation bias, overconfidence, and investment performance: evidence from stock message boards”, McCombs Research Paper Series No. IROM-07-10. Samuelson, W. and Zeckhauser, R. (1988), “Status quo bias in decision making”, Journal of Risk and Uncertainty, Vol. 1 No. 1, pp. 7-59. Scharfstein, D.S. and Stein, J.C. (1990), “Herd behavior and investment”, American Economic Review, Vol. 80, pp. 465-479. Shikuku, R.M. (2012), “The effects of behavioural factors on investment decision making by unit trust companies in Kenya”, Doctoral dissertation. Sinha, P.L., Brown, L. and Das, S. (1997), “A re-examination of financial analysts’ differential earnings forecast accuracy”, Contemporary Accounting Research, Vol. 14 No. 1, pp. 1-42. Suresh, A. (2013), “Understanding behavioral finance through biases and traits of trader vis-à-vis investor”, Journal of Finance, Accounting and Management, Vol. 4 No. 2, pp. 11-25. Suto, M., Menkhoff, L. and Beckmann, D. (2005), “Behavioural biases of institutional investors under pressure from customers: Japan and Germany vs the US”, Corporate Finance and Governance: Europe and Japan Comparisons. Joint Conference with CEPR and REITI, (September 2005). Tversky, A. and Kahneman, D. (1974), “Judgment under uncertainty: heuristics and biases”, science, Vol. 185 No. 4157, pp. 1124-1131. Tversky, A. and Kahneman, D. (1981), “The framing of decisions and the psychology of choice”, Science (New York, N.Y.), Vol. 211 No. 4481, pp. 453-458. Tversky, A. and Kahneman, D. (1986), “Rational choice and the framing of decisions”, The Journal of Business, Vol. 59 No. S4, pp. S251-S278. Tversky, A. and Kahneman, D. (1991), “Loss aversion in riskless choice: a reference-dependent model”, The Quarterly Journal of Economics, Vol. 106 No. 4, pp. 1039-1061. Tversky, A. and Kahneman, D. (1992), “Advances in prospect theory: cumulative representation of uncertainty”, Journal of Risk and Uncertainty, Vol. 5 No. 4, pp. 297-323. Van Campenhout, G. and Verhestraeten, J.F. (2010), “Herding behavior among financial analysts: a literature review (no. 2010/39)”. Von Beschwitz, B. and Massa, M. (2013), “Biased shorts: stock market implications of short sellers’ disposition effect”, available at SSRN 2348583. Zipporah, N.O. (2010), “The impact of behavior biases on investor decision in Kenya: male vs women”, available at ISSN (P) 2347-4564. Corresponding author Satish K. Mittal can be contacted at: satishkmittal@gmail.com For instructions on how to order reprints of this article, please visit our website: www.emeraldgrouppublishing.com/licensing/reprints.htm Or contact us for further details: permissions@emeraldinsight.com