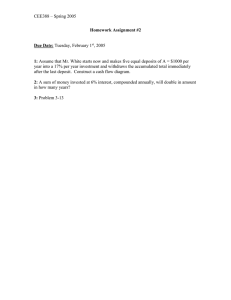

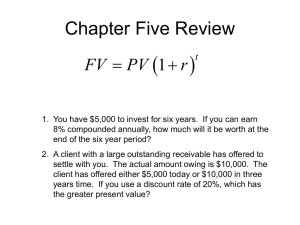

Time Value of Money Introduction • You are offered a choice between having Rs. 10000 today or having them after one year. Which one will you choose? • You are given a choice to pay Rs. 10000 today or pay after one year. Which one will you choose? • You can put the money in bank and earn some interest - In first case by accepting payment today and in second case by paying after one year. • That is the time gap allowed helps us to make some money. This incremental gain is time value of money. • Now, if the interest rate is zero, what would be the time value of money? • Interest plays important role in determining time value of money. • Interest rate is the cost of borrowing money as yearly percentage. Purpose • Why money in the future is worth less than similar money today? • Preference for present consumption – Individuals have a preference for current consumption in comparison to future consumption. In order to forego the present consumption for a future one, they need a strong incentive, eg, if the individual’s present preference is very strong, then he has to be offered a very high incentive to forego it. • Inflation - Inflation means when prices of things rise faster than they actually should. When there is inflation, the value of currency decreases over time. If the inflation is more , then the gap between the value of money today and the value of money in future is also more. So greater the inflation, greater the gap. • Risk – Risk of uncertainty in the future lowers the value of money. Eg, non receipt of payment, uncertainty of investor’s life or any other contingency which may result in non payment or reduction in payment. Simple Interest • • • • • • • • • It is the simple percentage of ORIGINAL principal amount. SI = P0 (i)(n) Where - SI = Simple interest in rupees P0 = Original principal i = Rate of interest per time period expressed in decimals n = Number of time periods Future Value at the end of n period is – FVn = P0 + SI = P0 + P0 (i) (n) Find the rate of interest per year if the amount owed after six months is Rs. 1050, borrowed amount being Rs. 1000/- Compound Interest • When interest is calculated on total of previously earned interest and the original principal, it is known as compound interest. • Illustration : Rs. 2000 (P0) is deposited in bank for two (n) years at a rate of interest of 6% (i). How much will be the balance after two years. Interest is compounded annually. • FV1 = P0+P0(n)(i) = 2000 + 2000 (1) (0.06) = 2000 + 120 = Rs. 2120 • FV2 = P1 + P1 (i)(n) = 2120 + 2120 (1) (0.06) = 2120 + 128 = Rs. 2248 • Thus, FVn = P0(1 + i )n • (1+ i)n is known as Single Payment Compound Amount Factor Compound Interest • Interest is compounded annually. The time interval between successive additions of interests is known as conversion or payment period. • In above illustration, interest is paid only once in a year. But what if there are multiple payments during a year to be compounded? • If number of payment periods per year is m, and total period is n years, then • FVn = P0 1 + i n x m m Problem : If Rs. 2000 is invested at an annual rate of interest of 10%, what is the amount after 2 years if compounding is done (a) annually (b) semi annually (c) quarterly (iv) monthly (v) Daily Example • Determine the annual rate of interest compounded annually that doubles the investment in 7 years given that 2 1/7 = 1.104090 Rule of 72 • Divide 72 by interest rate or inflation rate to determine the number of years it takes to double your money. Rule of 69 • Doubling period is equal to 0.35 + (69/Interest rate) Effective Rate of Interest • Effective rate of interest is the equivalent annual rate of interest at which investment grows in value when interest is credited more than once a year • • • • • • • Ei = 1 + i m - 1 m Where Ei = Effective rate of interest i = Rate of interest ; m = Number of payments per year If the interest is 10% per year payable quarterly, find the effective rate of interest Ei = 1 + 0.1 4 - 1 = 0.1038 or 10.38% 4 Future Value of Annuity • An annuity is a series of periodic cash flows (payments or receipts) of equal amounts. Eg., insurance premiums, recurring deposit instalments • When cash flows occur at the end of each period it is called regular annuity or deferred annuity. • When cash flows occur at the beginning of each period, it is called annuity due. • Illustration : If you deposit Rs. 1000 annually in bank for 5 years at a rate of interest of 10%, what will be the value of the series of deposits at the end of 5 Yr. • FV = 1000(1.10)4 + 1000(1.10)3 + 1000(1.10)2 + 1000(1.10)1+1000 = Rs. 6105 • FVAn = R ( [(1+i)n -1 ] / i) - The factor within bracket is called uniform series compound amount factor. R is the periodic receipt or payment. Equivalence / Present Value of Money • Equivalence indicates that different amount of money at different time periods are equivalent by considering the time value of money. • Present value is the current value of a Future Amount. • It can also be defined as the amount to be invested today at a given rate over a specified period to equal the Future Amount. • If we reverse the flow by saying that we expect a fixed amount after n number of years and we also know the current interest rate, then by discounting the future amount at that interest rate, we get the present value of investment to be made. • Discounting future amount converts it in to present value just as compounding converts present value in to future value. This is known as discounting and the interest rate is known as discount rate. • Present Value • By definition of Future Value FVn = PV(1+i)n • Therefore, PV = FVn x ( 1 / (1+i)n) • ( 1 / (1+i)n) is called discounting factor or Single Payment Present Worth Factor. • Sometimes cash flows may have to be discounted more than once a year. In such case : mn • PV = FVn 1 + 1 (1+i/m) Find the present value of Rs. 10000 to be required after 5 years if the rate of interest is 9%, given that (1.09)5 = 1.5386 (n = 5; FV = 10000 ; i = 0.09) Example • Mr. X has made real estate investment of Rs. 12,00,000 which he expects will have maturity value equivalent to interest at 12% compounded monthly for 5 years. If most saving institutions pay 8% interest compounded quarterly on a 5 year term, what is the least amount for which Mr. X should sell his property? Given that (1+i/m)mn = 1.81669670 for i = 12% and mn = 60 and that (1+i/m)mn = 1.48594 for i = 8% and mn = 20 • Hint : Find out FV at 12% interest and then find out PV at 8% interest • FV= P(1+i/m)nxm = 1200000 x(1.01)5x12 = 1.81669670 x 1200000 = Rs. 2180036 • PV = 2180036 x (1/ (1+ 0.08/4) 5x4 = 2180036/1.48594 = Rs 1467102 Present Value of Annuity • Sometimes instead of a single cash flow, the cash flows of the same amount is received for a number years. • PVAn = R + R +... R + R = R (1+i)n - 1 (1+i)1 (1+i)2 (1+i)n-1 (1+i)n i (1+i)n • The expression within brackets is also known as Uniform Series Present Worth Factor. Perpetuity • Perpetuity is an annuity in which periodic payments or receipts begin on a fixed date and continue indefinitely or perpetually. • The formula for evaluating perpetuity is relatively simple. • Important points – • The value of perpetuity is finite because receipts that are anticipated far in the future have extremely low present value (today’s value of future cash flows) • Additionally, because the principal is never repaid, there is no present value for the principal. • Formula – • PVAn = R + R + R + ....... + R = ∑R = R • (1+i)1 (1+i)2 (1+i)3 (1+i)n (1+i)n i Where R = Payment or receipt for each period; i = Interest rate per period • A construction company purchased a concrete mixer costing Rs. 600000 by making a down payment of Rs. 200000 and agreeing to make equal annual payment for 4 years for the balance amount. How much would be each payment if the interest on unpaid amount be 15% compounded annually? • Amount balance to be paid = 600000- 200000 = 400000 Rs • PVAN Factor = (1+.15)4 – 1 / 0.15(1.15)4 • = 2.855 • R = 400000/2.855 = Rs 140105 • Total payment at the end of 4 years = (4 x 140105) + 200000 • = Rs 760420 • A person plans to receive a pension of Rs. 5000 semi annually for 10 years after he retires in 18 years. Money is worth 9% compounded semi annually. • (i) How much amount is required to finance the annuity? • (ii) What amount of single deposit made now would provide funds for annuity? • Let us first find out the amount required to fund the pension. • PVAN = 5000 [(1+0.09/2)10x2 - 1] / 0.045x(1.045)2x10 • = 5000 x 13334.97 = Rs. 65039 • This is the amount required after 18 years. Therefore in order to find out the investment required today, it will be necessary to find out the PV of this amount • PV = 65000 x 1 /(1+i/m)nxm = 65039 / (1.045)36 = Rs 13326