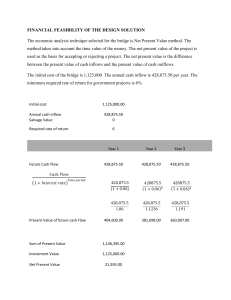

Chapter 5. EVALUATION OF SINGLE PROJECT ©2017 Batangas State University 1 Introduction All engineering economy studies of capital projects should consider the return that a given project will or should produce. A basic question this book addresses is whether a proposed capital investment and its associated expenditures can be recovered by revenue (or savings) over time in addition to a return on the capital that is sufficiently attractive in view of the risks involved and the potential alternative uses. In this chapter, we concentrate on the correct use of five methods for evaluatingthe economic profitability of a single proposed problem solution. The five methods are Present Worth (PW), Future Worth (FW), Annual Worth (AW), Internal Rate of Return (IRR), Payback Period 2 ©2017 Batangas State University Learning Objectives Discuss methods of evaluation. Critique contemporary methods of evaluation. Evaluate single project in determining project profitability. Make a decision based on the evaluation. 3 ©2017 Batangas State University Rate of Return Rate of return is a measure of the effectiveness of an investment of capital. It is a financial efficiency. When this method is used, it is necessary to decide whether the computed rate of return is sufficient to justify the investment. The advantage of this method is that it is easily understood by management and investors. The applications of the rate of return method is controlled by the following conditions. A single investment of capital at the beginning of the first year of the project life and identical revenue and cost data for each year. The capital invested is the total investment required to finance the project, whether equity or borrowed. Net Annual Profit ROR = Capital Invested 4 ©2017 Batangas State University Rate of Return Example. An investment of P270,000 can be made in a project that will produce a uniform annual revenue of P185,400 for 5 years and then have a salvage value of 10% of the investment. Out-of-pocket cost for operation and maintenance will be P81,000 per year. Taxes and insurance will be 4% of the first cost per year. The company expects capital to earn not less than 25% before income taxes. Is this a desirable investment? Use ROR Method Given: Investment = P270,000 Annual Revenue = P185,400 for 5 years Salvage Value = 10% of investment Operation and Maintenance Cost = P81,000 per year Taxes and Insurance Cost = 4% of Investment 5 ©2017 Batangas State University Rate of Return Solution: Step 1: Identify the Given Given: Investment = P270,000 Annual Revenue = P185,400 for 5 years Salvage Value = 10% of investment Operation and Maintenance Cost = P81,000 per year Taxes and Insurance Cost = 4% of Investment Step 2: Analyze what method will be used Net Annual Profit ROR = Capital Invested 6 ©2017 Batangas State University Note: Annual Proft = Annual Revenue - Annual Cost Capital Invested = First Cost or Investment Cost Rate of Return Solution: Step 3: Determine the Total Annual Cost and Total Annual Revenue Based from the problem, annual revenue = P185,000, then we need to determine what is the total cost to determine the Net Annual Profit Remember: In ROR Method, Depreciation Cost is included in the Total Cost Operation and Maintenance Cost = P81,000 Taxes and Insurance Cost = P270,000(0.04) = P10,800 Depreciation Cost = P29,609 (used Sinking Fund Method where i = 25%) Total Cost = P121,409 7 ©2017 Batangas State University Rate of Return Solution: Step 4: Determine the Net Annual Profit Net Annual Profit = Total Annual Revenue - Total Annual Cost = P185,000 - P121,409 = P63,991 Step 5: Use the formula to determine the rate of return Net Annual Profit ROR = Capital Invested 63,991 ROR = x100 270,000 RoR = 23.70% 8 ©2017 Batangas State University Rate of Return Solution: Step 6: Make a Decision *Since the computed rate of return is less than the minimum required rate of return of 25%, the investment is not desirable or not accepted. 9 ©2017 Batangas State University Rate of Return Solution using tabulated form: Determine the inflows such as income and outflows such as expenses. Annual revenue Annual costs: P185,400 Depreciation P29,609 Operation and maintenance P81000 Taxes and insurance P10800 Total Annual Cost Net annual profit RoR 10 ©2017 Batangas State University P121,409 P63,991 P63,991 P270,000 X100 23.70% Annual Worth Method In this method, interest on the original investment (sometimes called minimum required profit) is included as a cost. If the excess of the annual cash inflows over annual cash outflows is not less than zero the proposed investment is justified-is valid. This method is covered by the same limitations as the rate of return pattern a single initial investment of capital and uniform revenue and cost throughout the life of the investment. Excess = Annual Cash Inflows - Annual Cash Outflows 11 ©2017 Batangas State University Annual Worth Method Example. An investment of P270,000 can be made in a project that will produce a uniform annual revenue of P185,400 for 5 years and then have a salvage value of 10% of the investment. Out-of-pocket cost for operation and maintenance will be P81,000 per year. Taxes and insurance will be 4% of the first cost per year. The company expects capital to earn not less than 25% before income taxes. Is this a desirable investment? Use Annual Worth Method Given: Investment = P270,000 Annual Revenue = P185,400 for 5 years Salvage Value = 10% of investment Operation and Maintenance Cost = P81,000 per year Taxes and Insurance Cost = 4% of Investment 12 ©2017 Batangas State University Annual Worth Method Solution: Step 1: Identify the Given Given: Investment = P270,000 Annual Revenue = P185,400 for 5 years Salvage Value = 10% of investment Operation and Maintenance Cost = P81,000 per year Taxes and Insurance Cost = 4% of Investment Step 2: Analyze what method will be used Excess = Annual Cash Inflows - Annual Cash Outflows Note: Annual Cash Inflows includes Annual Revenue Annual Cash Outflows includes Total Cost including depreciation and interest on capital 13 ©2017 Batangas State University Annual Worth Method Solution: Step 3: Determine the Annual Cash Inflow and Annual Cash Outflow Based from the problem, annual revenue = P185,000 which is the cash inflow, we need to determine the total annual cash outflows Operation and Maintenance Cost = P81,000 Taxes and Insurance Cost = P270,000(0.04) = P10,800 Depreciation Cost = P29,609 (used Sinking Fund Method where i = 25%) Interest on Capital = P270,000(0.25) = P67,500 Total Annual Cash Outflows = P188,909 14 ©2017 Batangas State University Annual Worth Method Solution: Step 4: Determine the Excess using Annual Worth Method Excess = Annual Cash Inflows - Annual Cash Outflows = P185,400 - P188,909 Excess = (P3,509) Step 5: Make a Decision *Since the excess of annual cash inflows over annual cash outflows is less than zero (-P3,509) the investment is not desirable or not ideal. Note: If excess is positive value, then the investment is advisable, otherwise, do not invest. 15 ©2017 Batangas State University Annual Worth Method Solution using tabulated form: Annual revenue Annual costs: P185,400 Depreciation Operation and maintenance Taxes and insurance Interest on capital Total Annual Cost Excess 16 ©2017 Batangas State University P29,609 P81000 P10800 P67,500 P188,909 - P3,509 Present Worth Method This pattern for economy studies is based on the concept of present worth. If the present worth of the net cash flows is equal to, or greater than zero, the project is justified economically. The present worth method is flexible and can be used for any type of economy study. It is extensively in making economy studies in the public works field, where long-lived structures are involved. Present worth Method = PW inflows – PW outflows Here, we will just get the present value of money using the formula in money-time relationship. 17 ©2017 Batangas State University Present Worth Method Example. An investment of P270,000 can be made in a project that will produce a uniform annual revenue of P185,400 for 5 years and then have a salvage value of 10% of the investment. Out-of-pocket cost for operation and maintenance will be P81,000 per year. Taxes and insurance will be 4% of the first cost per year. The company expects capital to earn not less than 25% before income taxes. Is this a desirable investment? Use Present Worth Method 18 ©2017 Batangas State University Present Worth Method Solution: Step 1: Identify the Given Given: Investment = P270,000 Annual Revenue = P185,400 for 5 years Salvage Value = 10% of investment Operation and Maintenance Cost = P81,000 per year Taxes and Insurance Cost = 4% of Investment Step 2: Analyze what method will be used Present worth Method = PW inflows – PW outflows Note: Inflows includes the annual revenue and salvage value Outflows includes the investment and overhead cost excluding depreciation 19 ©2017 Batangas State University Present Worth Method Solution: PW of cash inflows = P185,400 (P/A, 25%, 5) + P27,000 (P/F, 25%, 5) = P185,400 (2.6893) + P27,000 (0.3277) = P506,370 Annual Cost (excluding depreciation )= 91,800 PW of cash outflows = P270,000+ P91,800 (P/A, 25%, 5) = P516,880 PW=PW of cash inflows – PW of cash outflows =P506,370 - P516,880 PW=-P10,510 Decision. *Since the PW of the net cash flows is less than zero (-P10,510) the investment is not justified or not ideal. 20 ©2017 Batangas State University Future Worth Method The future worth method for economy studies is exactly comparable to the present worth method except that all cash inflows and outflows are compounded forward to a reference point in time called the future. If the future worth of the net cash flow is equal to, or greater then zero, the project is justified economically. Future worth Method = FW inflows – FW outflows Here, we will forward the value of money in future time using also the formula in money-time relationships. 21 ©2017 Batangas State University Future Worth Method Example. An investment of P270,000 can be made in a project that will produce a uniform annual revenue of P185,400 for 5 years and then have a salvage value of 10% of the investment. Out-of-pocket cost for operation and maintenance will be P81,000 per year. Taxes and insurance will be 4% of the first cost per year. The company expects capital to earn not less than 25% before income taxes. Is this a desirable investment? Use Future Worth Method 22 ©2017 Batangas State University Future Worth Method Solution. Step 1: Identify the Given Given: Investment = P270,000 Annual Revenue = P185,400 for 5 years Salvage Value = 10% of investment Operation and Maintenance Cost = P81,000 per year Taxes and Insurance Cost = 4% of Investment Step 2: Analyze what method will be used Future worth Method = FW inflows – FW outflows Note: Inflows includes the annual revenue and salvage value Outflows includes the investment and overhead cost excluding depreciation 23 ©2017 Batangas State University Future Worth Method Solution. FW of cash inflows = P27,000 + P185,400 (F/A, 25%, 5) = P27,000 + P185,400 (8.2070) = P1,548,580 Annual Cost (excluding depreciation )= 91,800 PW of cash outflows = P91,800 (F/A, 25%, 5) + P270,000 (F/P,25%,5) = P1,577,390 FW=FW of cash inflows – FW of cash outflows =P1,548,580 – P1,577,390 FW=-P28,810 Decision *Since the FW of the net cash flows is less than zero (-P28,810) the investment is not justified or not ideal. 24 ©2017 Batangas State University Payback Period The payback period is commonly defined as the length of time required to recover the first cost of an investment from the net cash flow produced by that investment for an interest rate of zero. •Payback period (years) = investment – salvage net annual cash flow 25 ©2017 Batangas State University Payback Period Example. An investment of P270,000 can be made in a project that will produce a uniform annual revenue of P185,400 for 5 years and then have a salvage value of 10% of the investment. Out-of-pocket cost for operation and maintenance will be P81,000 per year. Taxes and insurance will be 4% of the first cost per year. The company expects capital to earn not less than 25% before income taxes. Is this a desirable investment? What is the payback period? 26 ©2017 Batangas State University Payback Period Total annual cost = P81,000 +P270,000(0.04) = P91,800 Net annual cash flows = P185,400 – P91,800 = P93,600 Payback period:= investment-salvage value Net annual cash flows = P270,000-P27,000 P93,600 = 2.6 years or 2 years and 7 months The shorter the payback period the better investment. 27 ©2017 Batangas State University Chapter Test Direction. Read and understand the given situation. Solve the problem using the given methods of evaluation. A man is considering P500,000 to open a semi-automatic auto washing business in a city of 400,000 population. The equipment can wash on the average of 12 cars per hour., using two men to operate it and to do small amount of hand work. The man plans to hire two men, in addition to himself and operate the station on an 8 hour basis, 6 days/week, 50weeks/year. He will pay his employees P25 per hour. He expects to charge P25.00 for a car wah out of pocket miscellaneous cost would be P8500/month. He would pay his employees for 2 weeks for vacation each year. Because of the length of his lease, he must write off his investment with 5 years. His capital now is earning 15% and he is employed at a steady job that pays P25,000/month. he desires a rate of return of at least 20% on his investment. Would you recommend the investment? Use the following method (ROR, Annual worth, Present, Future and Payback Period) 28 ©2017 Batangas State University