FRK 121 Ch 5 Par 5.1 to 5.4 Example 5.1 and Exercise 5.1

advertisement

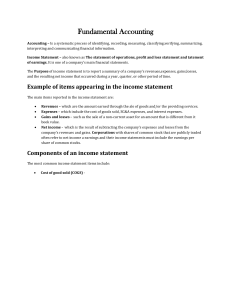

Department of Accounting FRK121 Chapter 5: Presentation of financial statements • • • Par 5.1-5.4 (Qualitative characteristics & SPLOCI) Example 5.1 (SPLOCI) Exercise 5.1 (Homework) Learning outcomes of Chapter 5 Explain the purpose of the accounting policy note to the financial statements; Implement the following adjustments in the financial statements: Inventory and inventory losses Asset realisation Intangible assets and amortization Depreciation Impairment of assets Loans and interest on loans Prepare a statement of profit or loss and other comprehensive income; Prepare a statement of change in equity; Prepare a statement of financial position; Prepare the notes that accompany the financial statements Introduction Objective of financial statements (FS) is: to provide information that is useful for decision making to various users (e.g. Investors, Lenders, Owners, Managers, Employees), about: Objective of qualitative characteristics of FS is to achieve this Qualitative characteristics QUALITATIVE CHARACTERISTICS Understandability Prudence Relevance Completeness Materiality Comparability Reliability Timeliness Substance over form Benefit vs Cost Qualitative characteristics - Understandability information should be presented in a way that makes it understandable to users who have a reasonable knowledge of business and economic activities and accounting, and a willingness to study the information with reasonable diligence Qualitative characteristics - Relevance Information presented must be relevant to the decision-making needs of users Information is relevant if capable of influencing the economic decisions of users by helping them evaluate past, present or future events Qualitative characteristics - Materiality Information is material if its omission or misstatement could influence the economic decisions of users Materiality depends on the size and nature of the omission or misstatement Size: large ZAR amount, e.g. pending lawsuit of R1m Nature: e.g. theft of assets by director Qualitative characteristics - Reliability Information is reliable if it is free from material error and bias and represents faithfully Financial statements should not skew information to achieve a predetermined result or outcome Example: use accruals to smooth income to make a bad year of profits look good Qualitative characteristics - Substance over form Transactions and other events and conditions should be accounted for and presented in accordance with their substance and not merely their legal form. Example: car purchased on finance lease Qualitative characteristics - Prudence Prudence is using a degree of caution when exercising judgement to ensure that estimates of assets or income are not overstated and liabilities or expenses are not understated Qualitative characteristics - Completeness Information in financial statements must be complete - an omission can cause information to be false or misleading Qualitative characteristics - Comparability Financial statements must be: comparable over time to identify trends comparable with different entities How to achieve? Account for similar transactions consistently over time and across other entities state accounting policies used to prepare FS Qualitative characteristics - Timeliness Financial information must be presented within the decision-making time frame to influence the economic decisions of users. Undue reporting delays may render information irrelevant Example: reporting results too long after year-end, e.g. Steinhoff Qualitative characteristics - Balance between benefit and cost The benefits derived from information should exceed the cost of providing it - judgemental process Example: sophisticated inventory system may produce better inventory valuations, but may be excessive in cost Complete set of financial statements (Par 5.3) A complete set of financial statements must include: 1. 2. 3. 4. 5. Statement of profit or loss and other comprehensive income (SPLOCI) or (SOPL); Statement of changes in equity (SOCIE); Statement of financial position (SOFP); Statement of cash flows (SOCF), and Notes to the financial statements More than just FS…integrated reporting Interaction between statements Total Equity • SOP/L • Income minus Expenses Profit or loss • Statement of changes in equity • Movement in equity • Includes profit or loss • SOFP • Notes SOCF • Movement in cash A=E+L Example: MTN Group Limited 2021 Notes to the financial statements Accounting policies are principles applied by an entity in preparing FS and serve to inform users on what basis the FS were prepared Examples of accounting policies: Measurement basis, e.g. historic cost Depreciation policy for tangible non-current assets Measuring of inventories, e.g. FIFO Notes to the financial statements Examples of notes to the financial statements: Property, plant and equipment Intangible assets Inventories Trade receivables Other current assets Cash and cash equivalents Long-term loan Trade and other payables Example 5.1 Step 1: Prepare a template Dynamic Dynamite Statement of profit or loss and other comprehensive income for the year ended 30 June 20.18 R Revenue Cost of sales Gross profit Other income Rent income Credit losses recovered Other expenses Sundry operating expenses Adjustment to the allowance for expected credit losses Depreciation Loss on damaged vehicles Amortisation Finance costs Interest expense Profit for the year Step 2: Use and interpret information Dynamic Dynamite Statement of profit or loss and other comprehensive income for the year ended 30 June 20.18 R Revenue Cost of sales Gross profit Other income Rent income (R6 850 Credit losses recovered Other expenses Sundry operating expenses (R60 000 Adjustment to the allowance for expected credit losses (R9 000 Depreciation Loss on damaged vehicles Amortisation Finance costs Interest expense Profit for the year 845 840 Information 1 & 2 and calculations: Information from the trial balance: Depreciation: Equipment Calculation of interest 1 Jul 20.17 30 Jun 20.18 1 Jun 20.18 SOPL = accrual concept R500 000 x 15% x 1/12 = R6 250 Step 3: Complete the statement Dynamic Dynamite Statement of profit or loss and other comprehensive income for the year ended 30 June 20.18 R Revenue Cost of sales Gross profit Other income Rent income (R6 850 Credit losses recovered Other expenses Sundry operating expenses (R60 000 Adjustment to the allowance for expected credit losses (R9 000 Depreciation (R130 000 + R8 750 Loss on damaged vehicles Amortisation Finance costs Interest expense (R6 250 Profit for the year 845 840 Information 3 and calculations: Calculation of depreciation and loss on damaged vehicle THIS YEAR 1 Jul 20.15 1 Jan 20.16 30 Jun 20.16 1 Jul 20.16 1 Jan 20.17 30 Jun 20.17 1 Jul 20.17 1 Jan 20.18 28 Feb 20.18 30 Jun 20.18 Calculation: Loss on damaged vehicle Calculation: Depr on remaining vehicles [(R400 000 – R100 000) – (R58 000 – R14 500)] x 10% = R25 650 Step 3: Complete the statement Dynamic Dynamite Statement of profit or loss and other comprehensive income for the year ended 30 June 20.18 R Revenue Cost of sales Gross profit 845 840 Other income Rent income (R6 850 Credit losses recovered Other expenses Sundry operating expenses (R60 000 Adjustment to the allowance for expected credit losses (R9 000 Depreciation (R130 000 + R8 750 + R5 850 + R25 650) Loss on damaged vehicles Amortisation Finance costs Interest expense (R6 250 Profit for the year (9 650) Information 4 and calculations: Rent income (according to the Trial balance) R6 850 1 Jul 20.17 1 Jan 20.18 30 Jun 20.18 July Let x = rent before 10% increase, Implies rent after 10% increase is 1.1x Therefore 6 months between 1 July 20.17 to 31 Dec 20.17 is 6x, and 7 months between 1 Jan 20.18 to 31 July 20.18 (remember one month extra paid), is 7.7x Therefore: 6x + 7.7x = R6 850 13.7x = R6 850 x = R500 1.1x = R550 Therefore, rent to be disclosed is R6850 – R550 = R6 300 Step 3: Complete the statement Dynamic Dynamite Statement of profit or loss and other comprehensive income for the year ended 30 June 20.18 R Revenue Cost of sales Gross profit Other income Rent income (R6 850 – R550) Credit losses recovered Other expenses Sundry operating expenses (R60 000 Adjustment to the allowance for expected credit losses (R9 000 Depreciation (R130 000 + R8 750 + R5 850 + R25 650) Loss on damaged vehicles Amortisation Finance costs Interest expense (R6 250 Profit for the year 845 840 6 300 (9 650) Information 5 & 6 Additional information 5. A debtor, Mr Bombastic, who owed R500, was declared insolvent. His account was written off and recorded as irrecoverable. In February 20.18, a direct deposit was received from him for the amount of R430. This transaction was not recorded. 6. The allowance for expected credit losses must be adjusted to R9 000. Allowance for expected credit losses per TB is R6 700 Solution - Calculations 5. Debit Bank, Credit Credit losses recovered R430 6. Credit losses adjustment: R9 000 – R6 700 = R2 300 Increase in risk = Increase in expenses Debit Adjustment to the allowance for expected credit losses Credit Allowance for expected credit losses R2 300 R2 300 Step 3: Complete the statement Dynamic Dynamite Statement of profit or loss and other comprehensive income for the year ended 30 June 20.18 R Revenue Cost of sales Gross profit Other income Rent income (R6 850 – R550) Credit losses recovered Other expenses Sundry operating expenses (R60 000 Adjustment to the allowance for expected credit losses (R9 000 – R6 700) Depreciation (R130 000 + R8 750 + R5 850 + R25 650) Loss on damaged vehicles Amortisation Finance costs Interest expense (R6 250 Profit for the year 845 840 6 300 430 (2 300) (170 250) (9 650) Information 7 Additional information 7. Development costs should be amortised over a period of five years according to the straight-line method commencing from 1 July 20.17. Solution: Calculations Amortisation: R875 330 / 5 = R175 066 Development costs per TB R875 330 Step 3: Complete the statement Dynamic Dynamite Statement of profit or loss and other comprehensive income for the year ended 30 June 20.18 Revenue Cost of sales Gross profit Other income Rent income (R6 850 – R550) Credit losses recovered Other expenses Sundry operating expenses (R60 000) Adjustment to the allowance for expected credit losses (R9 000 – R6 700) Depreciation (R130 000 + R8 750 + R5 850 + R25 650) Loss on damaged vehicles Amortisation R xxx (xxx) 845 840 6 730 6 300 430 (417 266) (60 000) (2 300) (170 250) (9 650) (175 066) Finance costs Interest expense (R6 250) (6 250) Profit for the year 429 054 Exercise 5.1 - Question Exercise 5.1 - Solution Exercise 5.1 - Solution