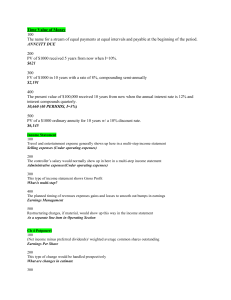

Fundamental Accounting Accounting – Is a systematic process of identifying, recording, measuring, classifying,verifying, summarizing, interpreting and communicating financial information. Income Statement – also known as The statement of operations, profit and loss statement and tatement of earnings. It is one of a company’s main financial statements. The Purpose of income statement is to report a summary of a company’s revenues,expenses, gains,losses, and the resulting net income that occurred during a year, quarter, or other period of time. Example of items appearing in the income statement The main items reported in the income statement are: Revenues – which are the amount earned through the ale of goods and/or the providing services. Expenses – which include the cost of goods sold, SG&A expenses, and interest expenses. Gains and losses - such as the sale of a non-current asset for an amount that is different from it book value. Net income - which is the result of subtracting the company’s expenses and losses from the company’s revenues and gains. Corporations with shares of common stock that are publicly traded often refer to net income a earnings and their income statements must include the earnings per share of common stocks. Components of an income statement The most common income statement items include: Cost of good sold (COGS) -