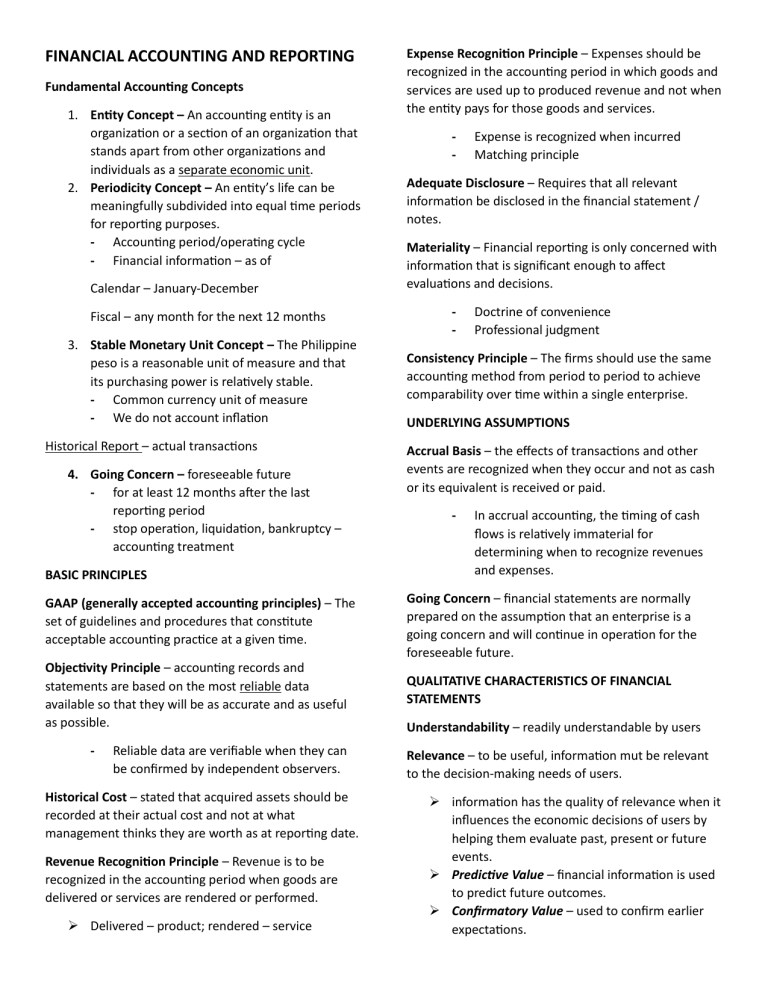

FINANCIAL ACCOUNTING AND REPORTING Fundamental Accounting Concepts 1. Entity Concept – An accounting entity is an organization or a section of an organization that stands apart from other organizations and individuals as a separate economic unit. 2. Periodicity Concept – An entity’s life can be meaningfully subdivided into equal time periods for reporting purposes. - Accounting period/operating cycle - Financial information – as of Calendar – January-December Fiscal – any month for the next 12 months 3. Stable Monetary Unit Concept – The Philippine peso is a reasonable unit of measure and that its purchasing power is relatively stable. - Common currency unit of measure - We do not account inflation Historical Report – actual transactions 4. Going Concern – foreseeable future - for at least 12 months after the last reporting period - stop operation, liquidation, bankruptcy – accounting treatment BASIC PRINCIPLES Expense Recognition Principle – Expenses should be recognized in the accounting period in which goods and services are used up to produced revenue and not when the entity pays for those goods and services. - Expense is recognized when incurred Matching principle Adequate Disclosure – Requires that all relevant information be disclosed in the financial statement / notes. Materiality – Financial reporting is only concerned with information that is significant enough to affect evaluations and decisions. - Doctrine of convenience Professional judgment Consistency Principle – The firms should use the same accounting method from period to period to achieve comparability over time within a single enterprise. UNDERLYING ASSUMPTIONS Accrual Basis – the effects of transactions and other events are recognized when they occur and not as cash or its equivalent is received or paid. - In accrual accounting, the timing of cash flows is relatively immaterial for determining when to recognize revenues and expenses. GAAP (generally accepted accounting principles) – The set of guidelines and procedures that constitute acceptable accounting practice at a given time. Going Concern – financial statements are normally prepared on the assumption that an enterprise is a going concern and will continue in operation for the foreseeable future. Objectivity Principle – accounting records and statements are based on the most reliable data available so that they will be as accurate and as useful as possible. QUALITATIVE CHARACTERISTICS OF FINANCIAL STATEMENTS - Reliable data are verifiable when they can be confirmed by independent observers. Historical Cost – stated that acquired assets should be recorded at their actual cost and not at what management thinks they are worth as at reporting date. Revenue Recognition Principle – Revenue is to be recognized in the accounting period when goods are delivered or services are rendered or performed. Delivered – product; rendered – service Understandability – readily understandable by users Relevance – to be useful, information mut be relevant to the decision-making needs of users. information has the quality of relevance when it influences the economic decisions of users by helping them evaluate past, present or future events. Predictive Value – financial information is used to predict future outcomes. Confirmatory Value – used to confirm earlier expectations. Revenue – arises in the course of the ordinary activities of the enterprise. Also referred to as sales, fees, interest, dividends, royalties, rent Gains – other items that meet the definition of income and may, or may not, arise in the course of the ordinary activities of the enterprise. Reliability – information has the quality of reliability when it is free from material error and bias Faithful Representation – information must represent faithfully the transactions and other events it represents. Substance Over Form – transactions and other events are accounted for and presented in accordance w/ substance and economic reality, and not merely in their legal form. Expenses – decreases in economic benefits during the accounting period in the form of outflows or depletions of assets Losses – other items that meet the definition of expenses Neutrality – free from bias Prudence/Conservatism – caution in the exercise of judgment Completeness – information must be complete within the bounds of materiality and cost. Comparability – compare financial statements of an enterprise through time to identify trends in its financial position and performance. ELEMENTS OF FINANCIAL STATEMENTS Financial Position Asset – resource controlled by the enterprise as a result of past events. Cash Notes receivable Accounts receivable Inventories PPE Short-term and long-term investments Liability – present obligation of the enterprise arising from past events. Notes payable Accounts payable Unearned revenues Mortgage payable Bonds payable Equity – residual interest in the assets of the enterprise after deducting all its liabilities. Performance Income – increases in economic benefits during the accounting period. Account – basic summary device of accounting Accounting equation – most basic tool of accounting ACCOUNTING CYCLE 1. 2. 3. 4. 5. 6. 7. 8. 9. 10. Identification of Events to be Recorded Transactions are Recorded in the Journal Journal Entries are Posted to the Ledger Preparation of a Trial Balance Preparation of the Worksheet Including Adjusting Entries Preparation of Financial Statements Adjusting Journal Entries are Journalized and Posted / Adjusting Accruals and Deferrals are Journalized and Posted Closing Journal Entries are Journalized and Posted Preparation of a Post-Closing Trial Balance Reversing Journal Entries are Journalized and Posted TRANSACTION ANALYSIS (STEP 1) Journal – chronological record of the entity’s transactions. - General journal is the simplest journal. Format: 1. Date – date and month are not rewritten every entry 2. Account Titles and Explanations 3. Posting Reference – used when entries are posted 4. Debit 5. Credit Simple Entry – only two accounts are affected - Compound Entry – Three or more accounts are required in a journal entry. - TRANSACTIONS ARE JOURNALIZED (STEP 2) Journalizing – process of recording a transaction The Ledger Ledger – grouping of the entity’s accounts General Ledger – reference book of the accounting system and is used to classify and summarize transactions, and to prepare data for basic financial statements. Balance sheet or permanent accounts – assets, liabilities, owner’s equity Income statement or temporary accounts – income and expenses Chart of Accounts - listing of all the accounts and their account information in the ledger Normal Balance of an Account - Side of the account where increases are recorded. Asset, owner’s withdrawal, and expense – debit Liability, owner’s equity, income – credit POSTING (STEP 3) Posting – transferring the amounts from the journal to the appropriate accounts in the ledger. Ledger Accounts After Posting Account balance is determined by footing all the debits and credits If debit is greater, the account has debit balance If credit is greater, the account has credit balance TRIAL BALANCE (STEP 4) Trial Balance – list of all accounts with their respective debit or credit balances. - Prepared to verify the equality of debits and credits in the ledger at the end of each accounting period or at any time the postings are updated. A control device that helps minimize accounting errors.