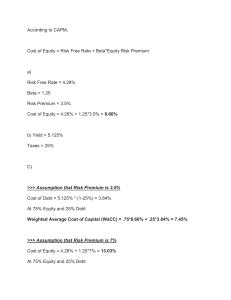

Final Project Best Practices in Estimating the Cost of Capital University Canada West Fnce 623: Financial Management Professor: Thomas Leung June 15th, 2021 Abstract Capital cost is a subject of many theories. The researchers updated the cost of capital and estimates in this report to identify current best practices. In this report, researchers have provided theoretical frameworks for capital cost estimation and highlighted many aspects of estimation. On the other hand, there are abundant options such as choosing interest-free beta, equity premium rates and adjusting capital expenditures for specific investment risks. Although some things have changed since the late 1990s, there are still many practical issues to be resolved. The article concludes with messages for financial advisors and researchers, as well as recommendations for best practices. Keywords: cost of capital, estimates, interest-free, beta, equity premium rates, adjusting capital expenditures. Introduction Approximately 93% of companies use a weighted average cost of capital in their capital budgeting process, as well as some form of discounting. Additionally, Small businesses often use the Capital Asset Pricing Model (CAPM) and Weighted-average cost of capital (WACC) when determining the cost of equity (Barry, 1980). Discrepancies between firms, as well as both methods, will be discussed below. Summary of Article The weighted-average cost of capital (WACC) is a standard by which corporations can compare capital market alternatives based on the weighted average cost of capital. Furthermore, since capital is an opportunity cost for investors, if a business does not generate a profit that exceeds its cost of capital, the investors cannot make any profit. In a WACC model, the key variables are "K" to represent the component cost of capital, "W" to represent the weight of each component, so it represents the percent of capital, and "t" to represent the marginal tax rate. WACC must be calculated using certain methods and is subject to certain difficulties (Blume 1971). It is imperative that the costs are always current and comparable to later cash flow expectations of the investors. Secondly, the weights should always be based on the current market rates, which according to studies is the most common practice. As a third consideration, it is important to factor in the cost of debt after tax, which is typically calculated using marginal pre-tax costs and marginal tax rates. What's more, coming up with a cost of equity capital is the most difficult part of calculating WACC. For the cost of equity, it is impossible to use observations or rates; therefore, indirect methods and judgment are necessary. According to surveys, CAPM is the most commonly used model for estimating equity costs; however, it is not continuously applied in all cases. It is a good investment tool to estimate equity costs based on the Capital Asset Pricing Model. Several forward-looking variables are used to calculate the cost of equity, equity, including the returns on risk-free bonds, the stock's equity beta, and the market risk premium. Risk-free bond yields (Rf) are determined by selecting a yield between 90-day Treasury bills and long-term Treasury bonds. Considering this, surveys reveal that seventy percent of corporations and financial advisors rely on Treasury bond yields that are ten years or longer in maturity (Rely on it for what?). Stock's equity beta indicates the riskiness of the stock. Estimates are dependent on proxy measures. Historical data, typically from Bloomberg, can be used to calculate the beta (Campbell et al., 2009). In order to estimate beta, historical data is combined with a formula illustrating beta as a slope coefficient of the market of returns. Consequently, people may need to make compromises when choosing the number of time periods, the sample size, or the market index to use in determining a sufficient beta estimate. When determining the equity cost, it is vital to factor in the market risk premium (Rm - Rf). Calculating the historical average equity return is the primary cause of discrepancies (Elton et al., 1978). As a further inquiry, when arithmetically calculating the equity returns, both current and previous returns are averaged using the assumption that all returns are independent, constant, and equally distributed across periods. By contrast, when calculating equity returns geometrically, an internal rate of return between a single outlay and future receipts is calculated. This rate describes the return an investor has experienced over the past few years (Fisher et al.,1985). The arithmetic approach does the best job of computing expected returns, whereas the geometric approach performs the best job at describing historical investment performance. Furthermore, neither of the methods is necessarily better than the other, but arithmetic means tend to be used more than geometric means for T-bills. Nevertheless, their focus remains on past returns, while the CAPM method focuses on future returns. Differential terms must be used to express forward-looking variables reflecting market risk premia. WACC also considers risk adjustment factors (Frazzini et al., 2014). WACC should be considered as only one factor when the WACC serves as a standard for the firm's average risk investments. It is also necessary to pay premiums to obtain more capital, the amount of which is based on risk. The discount rate of these risks is also affected by factors such as terminal value, synergies, and multi-sector companies. Despite these differences, companies and financial advisors do consider these risks in different ways. Risks are dealt with using a variety of methods and applications (Graham et al., 2001). With an advisor, a company should adjust its cost of capital when reviewing synergies and investment opportunities to reflect the risk involved; however, the report states that only 26 percent of firms do this, and 33 percent to 50 percent of firms fail to do so. For instance, sometimes advisors adjust the cash flows instead of the discount rates. In the corporate world, they must decide whether their processes are centralized or decentralized, and they need to calculate rate adjustments across departments, leases, and investments (Jacquier et al., 2005). Therefore, some risks are adjusted using discount rates, and other risks are adjusted using internal methods. As the case shows, risk is calculated in one way or another. Because there is no objective benchmark for financial market rates, advisors may not adjust risk; however, regardless of whether the cash flows are adjusted or relying on internal focus, the risks will be considered, just maybe not in the WACC. Analysis of the Article ¨Best Practice in Estimating Cost of Capital¨ The primary objective of a financial decision is to focus on ways to increase the financial structures. The cost of capital plays a significant role to achieve that objective. It is defined as a financial medium to analyze the opportunity cost of any investment based on different factors such as feasibility, rate of return, years of investment, capital volume, etc. These factors could just be regarded as primary factors. When a corporation plans to invest in a certain field, it first needs to estimate the investment required. The investment could be based on debt or equity or some other medium. The investment is usually huge in size. So, the company should select the right project among various alternatives. Through the cost of capital, a corporation can calculate the opportunity cost gaining the best return of investment through the best project. While measuring a significant theory, for example, financing another gathering plant, the cost of capital tends to the return rate the association could acquire if it put cash in an elective endeavor, with a comparative threat applied. That is the explanation business investigators contrast the cost of capital and the possible cost of an association using financial capital for an immense errand. The article discussed the best way to estimate the cost of capital for the investors among several financial market opportunities and benchmarking the corporate usage of capital against capital market alternatives. It talks about the general standard way to calculate the cost of capital i.e., Weighted average cost of capital (WACC). WACC = (W debt (1-t) K debt) + (W equity * K equity) where: K = component cost of capital. W = weight of each component as percent of total capital. t = marginal corporate tax rate. It should be noted that the cost of debt and equity are to be based on the current market value. Similarly, the cost of debt also should be mentioned after deducting the corporate tax that gives a financial edge in interest tax deductibility. But the difficulty arises when the corporation tries to estimate the cost of equity. The Capital Asset Pricing Model (CAPM) has been the major model to calculate the return rate on assets or the cost of equity. Even though this model has disadvantages, it is still continuously used by most world’s leading corporations. The article demonstrates the way of calculating the required return (K) on asset as: K = Rf+ β (Rm-Rf), (2) where: Rf = interest rate available on a risk-free asset. Rm = return required to attract investors to hold the broad market portfolio of risky assets. β = the relative risk of the particular asset. The companies have been adjusting the discount rates based on the risk complexities with WACC. WACC should be danger changed reflect differences among different associations in an undertaking. For instance, financial counsels discover the corporate WACC to be ill-advised for regarding different bits of an association. Given exchanged on a publicly traded company in different associations, such risk change suggests just modest adjustment in the WACC and CAPM pushes toward successfully used. Associations in like manner allude to the need to change capital costs across open cut-off points. In conditions where market mediators for a particular kind of risk class are not available, best practice incorporates finding distinctive means to address danger contrasts. Principle Issues with WACC After an exhaustive analysis of the paper in question, which deals with the best practices to estimate the cost of capital, it has been found that there are certain variables that are left out and can generate problems in the calculation of the WACC such as Equity Market Risk Premium, Divisional Cost of Capital and Flotation cost and Weighted Average Cost of Capital. Equity Market Risk Premium There is a significant shift over the long run in the equity market risk premium which is connected to changes in long haul financing costs, credit spreads on corporate securities, and expected unpredictability in the value market. Therefore, utilizing a consistent market risk premium creates a wrong estimate which exaggerates the reaction of investor return disregarding key changes. Financial specialists regularly estimate the market risk premium using the historical average. According to Harris & Marston, this historical information is assumed to have gradually changed over many years, expecting that MRP is consistent (or experiencing a slow change without a doubt) over a long period. For example, a huge number of investigators refer to Morningstar (formally known as Ibbotson Associates) information on the US market dated as far back as 1926 (Harris & Marston, 2015). Recommendations The expected MRP can be obtained by utilizing an alternative method such as the expectational data. This alternative method incorporates the security yield, the stock profit yield and the normal profit development rate, which can vary from time to time (Jagannathan et al., 2001). “According to the Gordon & Shapiro model which assumes that stocks' dividends "g" grows yearly, the share price is derived by limiting the profits which results in the formula P0 = EPS1 / (Ke –g) implying Ke = (EPS1/P0) + g. Substituting for Ke, the expected return which must match with the anticipated return, we have But Ke = E(RM) = RF + PM Subsequently, PM = (EPS1/P0) + g - RF Applying the last articulation to the market overall, (EPS1/P0) is the normal profit-based market return, g is the dividend growth expected by "the market", and RF is the risk-free rate. We can estimate the dividend growth expected by "the market" to determine the expected MRP” (Fernández, 2014, p. 6). Divisional Cost of Capital According to this analysis, which the paper does not mention, the calculation of the WACC is complicated when having more than one line of business. Another point to consider in this regard is that different business units have different perceived risks. In this case, the company is mixing different costs of capital with different risks, which generates another aspect that is not considered according to the common calculation practices of the WACC is what happens if these resource units compete or need the resources of the company? which one is assigned more? For this question, the perceived risk must be analyzed since the higher the risk, the greater the return should be received, and the potential profits of the other project are another aspect that is ignored in the calculation of the WACC at the time of this calculation. One of the critical advantages of Divisional Cost of Capital is choosing a project more efficiently and effectively with its limitations. Of course, it is not a perfect system; because it can also cause decision-making errors, like selecting and rejecting a wrong project. However, this process does a great job of eliminating errors. In order to make an error-free decision, Each project should be determined and analyzed thoroughly, but that is not possible due to the limitation of data, cash, and time; therefore, these kinds of research can not give a hundred percent accuracy; hence, it is the only practical solution to do Recommendations Therefore, to solve this point, it would be recommended to develop separate capital costs for each business unit that the company owns. With the above, an error can be avoided when making the respective calculations of capital costs, by doing it in a particular way it is possible to know with greater certainty whether or not it is feasible to take the project, however, if it is not done in this way There is a risk that a project or profitable area of the company is financing without knowing it a project that had to be rejected previously. One of the critical advantages of Divisional Cost of Capital is choosing a project more efficiently and effectively with its limitations. Of course, it is not a perfect system; because it can also cause decision-making errors, like selecting and rejecting a wrong project. However, this process does a great job of eliminating errors. In order to make an error-free decision, Each project should be determined and analyzed thoroughly, but that is not possible due to the limitation of data, cash, and time; therefore, these kinds of research cannot give a hundred percent accuracy; hence, it is the only practical solution to do. Flotation cost and Weighted Average Cost of Capital From this perspective, when a company starts a new project, it requires having or collecting enough capital to start the project either through debt or by selling shares. In other words, the company resorts to expenses that are not necessarily linked to the project, therefore, from this perspective, it is suggested to adjust upwards the non-direct costs of the project in order to have these associated costs between the calculations of the cost of capital. We must bear in mind that this approach may present a fault since the required return on the investment strictly depends on the risk of the investment, not where the funds come from to finance the project, however, this does not mean that the costs should be ignored. associated costs, since they are outflows of money that are relevant to calculate and include them in the project that is being analyzed. An example of this may be that the company XYZ needs to raise 1 million dollars for its expansion project of a point of sale, after analyzing the floating costs of collecting that money is 15%, that is, at the time of collecting it, it goes to receive 15% of the stipulated value, that is, 850 thousand dollars, therefore the real value of what must be collected must be calculated to offset the costs of said issuance of shares. Amount raised: 1,000,000/0,85 =1,176,470. Therefore, in the previous case, the amount to be collected would be 1,176,470 instead of 1 million exact dollars. Recommendations To carry out a good analysis of the cost of capital, it is necessary to calculate the additional costs that the project brings with it when issuing shares as a means of financing the operation. In other words, all associated expenses must be taken into account, on the one hand, making a good analysis of the cost of capital and, on the other, making a correct valuation of the project. The advantages of flotation cost are that it allows the business industries to provide employees extra incentives by giving them a share option that would encourage the workers to do better. Furthermore, this would give the companies new capital income and business to make an acquisition, increasing the trust between suppliers and customers. In addition, the proper use of current floatation saves an industry from financial mismanagement. However, this process brings floatation cost significant outcomes for public businesses when they issue new stock in the market. Therefore, the financial analysts consider flotation cost investment effective for the companies’ stability and success. Conclusion One can see the differences in practices that arise after describing the two suitable methods for estimating the cost of capital and the cost of equity. In this case, the purpose was to determine "best practices" for estimating capital expenditures. The estimation of WACC differed between companies, but a consensus was found. This paper examines several similarities between the WACC and the CAPM, including the market-value weight, after-tax cost of debt, and the CAPM used to determine the cost of equity. The CAPM uses a published beta value based on historical equity returns; likewise, the risk-free rate is based on U.S. Treasury bonds with ten or more years to maturity, and the market risk premium is one of the most controversial variables with different estimations methods and values. Finally, whether the WACC is adjusted, or any other internal method employed must be risk-adjusted. Despite these methods' general agreement, the case suggests that perhaps companies and advisors should not be sticking to the finance theory too closely. The specification of equity market risk premium, beta variation, and risk assessment can all affect the result of the WACC. When managers consider WACC when planning their capital budgets, these important implications will influence their decisions. In addition, the case recommends following these "best practices" to determine the WACC estimates; however, the figures should not be entirely relied upon, as there are several implications that should be considered. References Barry, C. B. (1980). Bayesian betas and deception: a comment. Journal of Financial Research, 3(1), 85-90. Blume, M. E. (1971). On the assessment of risk. journal of Finance 26 (March): 1—11.. 1975. Betas and Their Regression Tendencies," Journal of Finance, 30, 785-795 Campbell, J. Y., Sunderam, A., & Viceira, L. M. (2009). Inflation bets or deflation hedges? The changing risks of nominal bonds (No. w14701). National Bureau of Economic Research. Elton, E. J., Gruber, M. J., & Urich, T. J. (1978). Are betas best?. The Journal of Finance, 33(5), 1375-1384. Fisher, L., & Kamin, J. H. (1985). Forecasting systematic risk: estimates of" raw" beta that take account of the tendency of beta to change and the heteroskedasticity of residual returns. Journal of Financial and Quantitative Analysis, 127-149. Frazzini, A., & Pedersen, L. H. (2014). Betting against beta. Journal of Financial Economics, 111(1), 1-25. Graham, J. R., & Harvey, C. R. (2001). The theory and practice of corporate finance: Evidence from the field. Journal of financial economics, 60(2-3), 187-243. Harris, R. S., & Marston, F. C. (2015, November 12). Changes in the Market Risk Premium and the Cost of Capital: Implications for Practice. SSRN. https://www.ssrn.com/abstract=2686739. Jacquier, E., Kane, A., & Marcus, A. J. (2005). Optimal estimation of the risk premium for the long run and asset allocation: A case of compounded estimation risk. Journal of Financial Econometrics, 3(1), 37-55. Borad, S. B. (2014, June 20). Evaluating New Projects with Weighted Average Cost of Capital (WACC). EFinanceManagement. https://efinancemanagement.com/investment- decisions/evaluating-new-projects-with-weighted-average-cost-of-capital-wacc