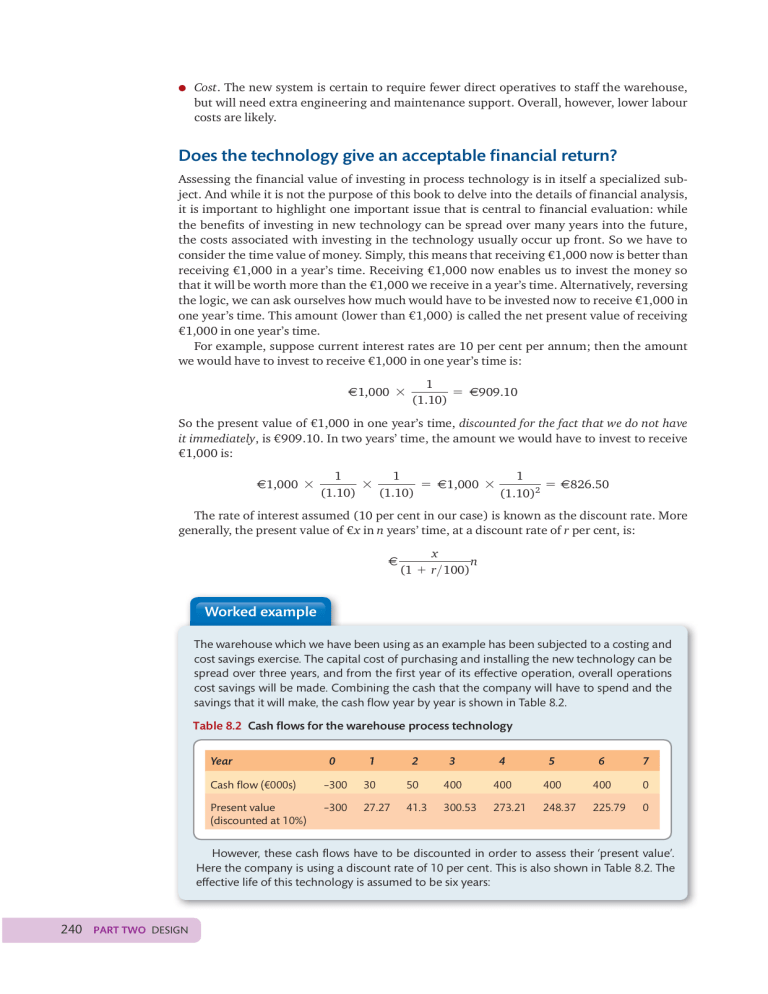

● Cost. The new system is certain to require fewer direct operatives to staff the warehouse, but will need extra engineering and maintenance support. Overall, however, lower labour costs are likely. Does the technology give an acceptable financial return? Assessing the financial value of investing in process technology is in itself a specialized subject. And while it is not the purpose of this book to delve into the details of financial analysis, it is important to highlight one important issue that is central to financial evaluation: while the benefits of investing in new technology can be spread over many years into the future, the costs associated with investing in the technology usually occur up front. So we have to consider the time value of money. Simply, this means that receiving €1,000 now is better than receiving €1,000 in a year’s time. Receiving €1,000 now enables us to invest the money so that it will be worth more than the €1,000 we receive in a year’s time. Alternatively, reversing the logic, we can ask ourselves how much would have to be invested now to receive €1,000 in one year’s time. This amount (lower than €1,000) is called the net present value of receiving €1,000 in one year’s time. For example, suppose current interest rates are 10 per cent per annum; then the amount we would have to invest to receive €1,000 in one year’s time is: :1,000 * 1 = :909.10 (1.10) So the present value of €1,000 in one year’s time, discounted for the fact that we do not have it immediately, is €909.10. In two years’ time, the amount we would have to invest to receive €1,000 is: :1,000 * 1 1 1 * = :1,000 * = :826.50 (1.10) (1.10) (1.10)2 The rate of interest assumed (10 per cent in our case) is known as the discount rate. More generally, the present value of € x in n years’ time, at a discount rate of r per cent, is: : x n (1 + r>100) Worked example The warehouse which we have been using as an example has been subjected to a costing and cost savings exercise. The capital cost of purchasing and installing the new technology can be spread over three years, and from the first year of its effective operation, overall operations cost savings will be made. Combining the cash that the company will have to spend and the savings that it will make, the cash flow year by year is shown in Table 8.2. Table 8.2 Cash flows for the warehouse process technology Year 0 1 2 3 4 5 6 7 Cash flow (€000s) –300 30 50 400 400 400 400 0 Present value (discounted at 10%) –300 27.27 41.3 300.53 273.21 248.37 225.79 0 However, these cash flows have to be discounted in order to assess their ‘present value’. Here the company is using a discount rate of 10 per cent. This is also shown in Table 8.2. The effective life of this technology is assumed to be six years: 240 PART TWO DESIGN total cash flow (sum of all the cash flows) = €1.38 million However, net present value (NPV) = €816,500 This is considered to be acceptable by the company. Calculating discount rates, although perfectly possible, can be cumbersome. As an alternative, tables are usually used such as the one in Table 8.3. So now the net present value, P = DF * FV where: DF = the discount factor from Table 8.3 FV = future value To use the table, find the vertical column and locate the appropriate discount rate (as a percentage). Then find the horizontal row corresponding to the number of years it will take to receive the payment. Where the column and the row intersect is the present value of €1. You can multiply this value by the expected future value, in order to find its present value. Table 8.3 Present value of €1 to be paid in future Years 3.0% 4.0% 5.0% 6.0% 7.0% 8.0% 9.0% 10.0% 1 €0.970 €0.962 €0.952 €0.943 €0.935 €0.926 €0.918 €0.909 2 €0.942 €0.925 €0.907 €0.890 €0.873 €0.857 €0.842 €0.827 3 €0.915 €0.889 €0.864 €0.840 €0.816 €0.794 €0.772 €0.751 4 €0.888 €0.855 €0.823 €0.792 €0.763 €0.735 €0.708 €0.683 5 €0.862 €0.822 €0.784 €0.747 €0.713 €0.681 €0.650 €0.621 6 €0.837 €0.790 €0.746 €0.705 €0.666 €0.630 €0.596 €0.565 7 €0.813 €0.760 €0.711 €0.665 €0.623 €0.584 €0.547 €0.513 8 €0.789 €0.731 €0.677 €0.627 €0.582 €0.540 €0.502 €0.467 9 €0.766 €0.703 €0.645 €0.592 €0.544 €0.500 €0.460 €0.424 10 €0.744 €0.676 €0.614 €0.558 €0.508 €0.463 €0.422 €0.386 11 €0.722 €0.650 €0.585 €0.527 €0.475 €0.429 €0.388 €0.351 12 €0.701 €0.626 €0.557 €0.497 €0.444 €0.397 €0.356 €0.319 13 €0.681 €0.601 €0.530 €0.469 €0.415 €0.368 €0.326 €0.290 14 €0.661 €0.578 €0.505 €0.442 €0.388 €0.341 €0.299 €0.263 15 €0.642 €0.555 €0.481 €0.417 €0.362 €0.315 €0.275 €0.239 16 €0.623 €0.534 €0.458 €0.394 €0.339 €0.292 €0.252 €0.218 17 €0.605 €0.513 €0.436 €0.371 €0.317 €0.270 €0.231 €0.198 18 €0.587 €0.494 €0.416 €0.350 €0.296 €0.250 €0.212 €0.180 19 €0.570 €0.475 €0.396 €0.331 €0.277 €0.232 €0.195 €0.164 20 €0.554 €0.456 €0.377 €0.312 €0.258 €0.215 €0.179 €0.149 CHAPTER 8 PROCESS TECHNOLOGY 241 Worked example A health-care clinic is considering purchasing a new analysis system. The net cash flows from the new analysis system are as follows: Year 1: -€10,000 (outflow of cash) Year 2: €3,000 Year 3: €3,500 Year 4: €3,500 Year 5: €3,000 Assuming that the real discount rate for the clinic is 9 per cent, using the net present value table ( Table 8.4), demonstrate whether the new system would at least cover its costs. Table 8.4 shows the calculations. It shows that, because the net present value of the cash flow is positive, purchasing the new system would cover its costs, and will be ( just) profitable for the clinic. Table 8.4 Present value calculations for the clinic Year Cash flow Table factor Present value 1 (€10,000) * 1.000 = (€10,000.00) 2 €3,000 * 0.917 = €2,752.29 3 €3,500 * 0.842 = €2,945.88 4 €3,500 * 0.772 = €2,702.64 5 €3,000 * 0.708 = €2,125.28 Net present value = €526.09 HOW ARE PROCESS TECHNOLOGIES IMPLEMENTED? Implementating process technology means organizing all the activities involved in making the technology work as intended. No matter how potentially beneficial and sophisticated the technology, it remains only a prospective benefit until it has been implemented successfully. So implementation is an important part of process technology management. Yet it is not always straightforward to make general points about the implementation process because it is very context dependent. That is, the way one implements any technology will very much depend on its specific nature, the changes implied by the technology and the organizational conditions that apply during its implementation. In the remainder of this chapter we look at three particularly important issues that affect technology implementation: the idea of resource and process ‘distance’; the need to consider customer acceptability; and the idea that if anything can go wrong, it will. Resource and process ‘distance’ The degree of difficulty in the implementation of process technology will depend on the degree of novelty of the new technology resources and the changes required in the operation’s processes. The less that the new technology resources are understood (influenced perhaps by the degree of innovation), the greater their ‘distance’ from the current technology resource base of the operation. Similarly, the extent to which an implementation requires an operation 242 PART TWO DESIGN Figure 8.6 Learning potential depends on both technological resource and process ‘distance’ to modify its existing processes, the greater the process ‘distance’. The greater the resource and process distance, the more difficult any implementation is likely to be. This is because such distance makes it difficult to adopt a systematic approach to analysing change and learning from mistakes. Those implementations which involve relatively little process or resource ‘distance’ provide an ideal opportunity for organizational learning. As in any classic scientific experiment, the more variables that are held constant, the more confidence you have in determining cause and effect. Conversely, in ✽ Operations principle an implementation where the resource and process ‘distance’ means The difficulty of process technology that nearly everything is ‘up for grabs’, it becomes difficult to know implementation depends on its degree what has worked and what has not. More importantly, it becomes of novelty and the changes required in difficult to know why something has or has not worked.8 This idea is the operation’s processes. illustrated in Figure 8.6. Customer acceptability When an operation’s customers interact with its process technology it is essential to consider the customer interaction when evaluating it. If customers are to have direct contact with technology, they must have some idea of how to operate it. Where customers have an active interaction with technology, the limitations of their understanding of the technology can be the main constraint on its use. For example, even some domestic technology such as DVD recorders cannot be used to their full potential by most owners. Other customer-driven technologies can face the same problem, with the important addition that if customers cannot use technologies such as internet banking, there are serious commercial consequences for a bank’s customer service. Staff in manufacturing operations may require several years of training before they are given control of the technology they operate. Service operations may not have the same opportunity for customer training. Walley and Amin9 suggest that the ability of the operation to train its customers in the use of its technology depends on three factors: complexity, repetition, and the variety of tasks performed by the customer. If services are complex, higher levels of ‘training’ may be needed; for example, the technologies in theme parks and fast-food outlets rely on customers copying the behaviour of others. Frequency of use is CHAPTER 8 PROCESS TECHNOLOGY 243