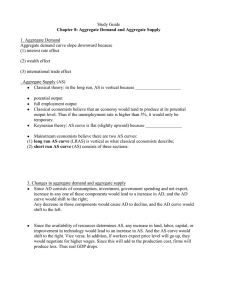

TOPIC 1: MEASURING A NATION’S INCOME WHAT IS MACROECONOMICS? Macroeconomics is the study of the economy as a whole, addresses many topical issues: Why some countries are rich while many other are poor? What policies might help poor countries grow out of poverty? Why does the cost of living keep rising? Why are millions of people unemployed, even when the economy is booming? What causes recessions? Can the government do anything to combat recessions? Why does the country have such a huge trade deficit? What is the government budget deficit? How does it affect the economy? WHAT IS MACROECONOMICS? Macroeconomics deals with major issues of Current output and long run economic growth Inflation Unemployment The effect of globalization upon the domestic economy GROSS DOMESTIC PRODUCT Gross domestic product (GDP) is a measure of the total output of an economy. GDP is the total market value of all final goods and services produced within a country in a given period of time. GROSS DOMESTIC PRODUCT “GDP is the Market Value . . .” “. . . Of All. . .” Includes all items produced in the economy and legally sold in markets “. . . Final . . .” Output is valued at market prices. It records only the value of final goods, not intermediate goods. “. . . Goods and Services . . .” It includes both tangible goods (food, clothing, cars) and intangible services (haircuts, art performing, doctor visits). GROSS DOMESTIC PRODUCT “. . . Produced . . .” “ . . . Within a Country . . .” It includes goods and services currently produced, not transactions involving goods produced in the past. It measures the value of production within the geographic confines of a country. “. . . In a Given Period of Time.” It measures the value of production that takes place within a specific interval of time, usually a year or a quarter. WHAT IS NOT COUNTED IN GDP? Items that are produced and consumed at home and that never enter the marketplace. Items produced and sold illicitly, such as illegal drugs. Nonproduction transactions Financial transactions Public transfer payments Private transfer payments Stock market transactions Secondhand sales HOW TO MEASURE GDP? There are 3 methods to measure GDP Output method Expenditure method Income method MEASUREMENT OF GDP BY OUTPUT METHOD GDP is measured as sum of market value of all final goods and services produced within a country in a given period of time. The value of the final goods already includes the value of the intermediate goods, so including intermediate goods in GDP would be double-counting. Use value added method to exclude intermediate goods. Value added is the market value of a firm’s output minus the value of the intermediate goods the firm used to produce that output. GDP = value of final goods produced = sum of value added at all stages of production VALUE ADDED METHOD Stage of Sales Value of Production Materials or Product Value Added Firm A, Sheep ranch $150 $150 Firm B, wool processor $200 $50 Firm C, suit manufacturer $270 $70 Firm D, retail clothier $350 $80 Total value added GDP = $350 $350 MEASUREMENT OF GDP BY EXPENDITURE METHOD GDP is measured as the total expenditure on domestically produced final goods and services. GDP = C + I + G + NX C: Household consumption I: Gross private domestic investment G: Government spending NX: Net exports THE COMPONENTS OF GDP Household consumption expenditures (C) is total spending by households for goods and services, with the exception of purchases of new housing. Durable consumer goods: last a long time ex: cars, home appliances … Nondurable consumer goods: last a short time ex: food, clothing … Consumer expenditures for services: work done for consumers ex: dry cleaning, entertainment, air travel … THE COMPONENTS OF GDP Gross private domestic investment (I) is spending on goods bought for future use including: Purchases of machinery, equipment and tools by business enterprises; Constructions such as commercial and residential structures; Changes in business inventories. THE COMPONENTS OF GDP Government spending (G) is government consumption and investment. Government consumption: Expenditures for goods and services that government consumes in providing public services. Government investment: Expenditures for social capital which have long lifetimes. Note: Government transfer payments are excluded from government spending because they are not made in exchange for currently produced goods or services. THE COMPONENTS OF GDP Net exports (NX) is the difference between exports and imports Exports (X): are domestically produced goods and services that are sold abroad. Imports (M): are foreign produced goods and services that are consumed domestically. NX = X – M THE COMPONENTS OF GDP IN VIETNAM, 2016 SOURCE: WORLD BANK MEASUREMENT OF GDP BY INCOME METHOD GDP is measured as the total income earned by domestically located factors of production. GDP = Compensation of employees + Rents + Interests + Proprietors’ income + Corporate profits + Indirect business taxes + Depreciation – Receipts of factor income from overseas + Payments of factor income to foreigners REAL VERSUS NOMINAL GDP Nominal GDP values the current production of goods and services at current prices. Real GDP values the current production of goods and services at constant prices. Changes in nominal GDP can be due to changes in prices changes in quantities of output produced Changes in real GDP can only be due to changes in quantities, because real GDP is constructed using constant base-year prices. EXAMPLE: REAL VERSUS NOMINAL GDP Good 2010 2016 2017 Quantity Price Quantity Price Quantity Price Hotdog 250 $2 300 $3 400 $4 Hamburger 500 $5 600 $6 650 $6 GDP DEFLATOR The GDP deflator is defined as the ratio of nominal GDP to real GDP times 100. The GDP deflator tells us what portion of the rise in nominal GDP that is attributable to a rise in prices rather than a rise in the quantities produced. The GDP deflator reflects what’s happening to the overall level of prices in the economy. It measures the price of output relative to its price in the base year. NOMINAL GDP, REAL GDP AND GDP DEFLATOR IN VIETNAM, 2016 SOURCE: WORLD BANK Nominal GDP in 2016 (at 2016 price): VND 4,502.7 trillion Real GDP in 2016 (at 2010 price): VND 3,054.4 trillion The GDP deflator in 2016 is 147. REAL GDP IN VIETNAM (TRILLION VND IN 2010 PRICE) SOURCE: WORLD BANK SHORTCOMINGS OF GDP Nonmarket activities Leisure Improved product quality The underground economy GDP and the environment Composition and distribution of output Noneconomic sources of well-being GDP, GNP AND GNI Gross National Product (GDP) measures the value of output produced in a country. Gross National Product (GNP) measures the value of output produced by the domestic residents’ owned economic resources regardless of where they are domiciled. GNP = GDP + Net foreign factor incomes = GDP + (Receipts of factor income from overseas – Payments of factor income to foreigners) Gross National Income (GNI) measures the total income earned by a nation’s residents. GNI = Compensation of employees + Rents + Interests + Proprietors’ Income + Corporate Profits TOPIC 2. INFLATION INFLATION Inflation exists when there is a sustained increase in the economy’s general price level. The economy’s general price level refers to the overall price of all goods and services in the economy. The inflation rate is the percentage change in the general price level from the previous period. If the inflation rate is positive: price level increases → inflation. If the inflation rate is negative: price level decreases → deflation. If the inflation rate is zero: stale prices. Disinflation occurs when the inflation rate decreases. THE CONSUMER PRICE INDEX The consumer price index (CPI) is used as a measurement for the general price level. CPI is a measure of the overall cost of a basket of goods and services bought by a typical household. It is used to monitor changes in the cost of living over time. When the CPI rises, the typical family has to spend more dollars to maintain the same standard of living. HOW THE CONSUMER PRICE INDEX IS CALCULATED? 1. Fix the basket Identifies a market basket of goods and services that the typical household buys. 2. Compute the basket’s cost in base year. Find the price of each of the goods and services in the basket in base year and calculate the cost of the basket. 3. Compute the basket’s cost in year t. Find the price of each of the goods and services in the basket in year t and calculate the cost of the basket in that year. HOW THE CONSUMER PRICE INDEX IS CALCULATED? 4. Compute the index Compute the index by dividing the cost of the basket in year t by the cost of the basket in the base year and multiplying by 100. 5. Compute the inflation rate The inflation rate is the percentage change in the consumer price index from the preceding period. EXAMPLE: CALCULATING THE CONSUMER PRICE INDEX AND THE INFLATION RATE Basket of goods: 4 hotdogs and 2 hamburgers Prices of goods: Year Price of hotdogs Price of hamburgers 2010 $1 $2 2016 $2 $3 2017 $3 $4 EXAMPLE: CALCULATING THE CONSUMER PRICE INDEX AND THE INFLATION RATE Base year is 2010. Basket of goods in 2010 costs $1,200. The same basket in 2017 costs $1,236. CPI = ($1,236/$1,200) 100 = 103. Prices increased 3% between 2010 and 2017. PROBLEMS IN MEASURING THE COST OF LIVING The CPI is an accurate measure of the selected goods that make up the typical bundle, but it is not a perfect measure of the cost of living. Substitution bias Introduction of new goods Unmeasured quality changes PROBLEMS IN MEASURING THE COST OF LIVING Substitution bias The basket does not change to reflect consumer reaction to changes in relative prices. Consumers substitute toward goods that have become relatively less expensive. → The CPI overstates the true cost of living by not considering consumer substitution. PROBLEMS IN MEASURING THE COST OF LIVING Introduction of new goods The basket does not reflect the change in purchasing power brought on by the introduction of new products. New products result in greater variety, which in turn makes each dollar more valuable. Consumers need fewer dollars to maintain any given standard of living. → The CPI overstates the true cost of living. PROBLEMS IN MEASURING THE COST OF LIVING Unmeasured quality changes If the quality of a good rises from one year to the next, the value of a dollar rises, even if the price of the good stays the same → The CPI overstates the true cost of living. If the quality of a good falls from one year to the next, the value of a dollar falls, even if the price of the good stays the same → The CPI understates the true cost of living. THE GDP DEFLATOR VERSUS THE CONSUMER PRICE INDEX Both consumer price index and GDP deflator can be used to measure the general price level. There are two differences between the indexes that can cause them to diverge. THE GDP DEFLATOR VERSUS THE CONSUMER PRICE INDEX The GDP deflator reflects the prices of all goods and services produced domestically, whereas... …the consumer price index reflects the prices of all goods and services bought by consumers. THE GDP DEFLATOR VERSUS THE CONSUMER PRICE INDEX The GDP deflator compares the price of currently produced goods and services to the price of the same goods and services in the base year, where as … … the consumer price index compares the price of a fixed basket of goods and services to the price of the basket in the base year. TWO MEASURES OF INFLATION IN VIETNAM SOURCE: ASIAN DEVELOPMENT BANK CORRECTING ECONOMIC VARIABLES FOR THE EFFECTS OF INFLATION Price indexes are used to correct for the effects of inflation when comparing dollar figures from different times. Do the following to convert dollar values from year t into today’s dollars: Amount in today’s dollars = Amount in year t’s dollars Price level today Price level in year t THE MOST POPULAR MOVIES OF ALL TIMES, INFLATION ADJUSTED REAL AND NOMINAL INTEREST RATES Interest represents a payment in the future for a transfer of money in the past. The nominal interest rate is the interest rate usually reported and not corrected for inflation. It is the interest rate that a bank pays. The real interest rate is the interest rate that is corrected for the effects of inflation. REAL AND NOMINAL INTEREST RATES IN VIETNAM SOURCE: ASIAN DEVELOPMENT BANK THE COSTS OF INFLATION Shoeleather costs Menu costs Relative price variability Tax distortions Confusion and inconvenience Arbitrary redistribution of wealth SHOELEATHER COSTS Shoeleather costs are the resources wasted when inflation encourages people to reduce their money holdings. Inflation reduces the real value of money, so people have an incentive to minimize their cash holdings. Less cash requires more frequent trips to the bank to withdraw money from interest-bearing accounts. The actual cost of reducing your money holdings is the time and convenience you must sacrifice to keep less money on hand. Also, extra trips to the bank take time away from productive activities. MENU COSTS Menu costs are the costs of adjusting prices. During inflationary times, it is necessary to update price lists and other posted prices. This is a resource-consuming process that takes away from other productive activities. RELATIVE-PRICE VARIABILITY AND THE MISALLOCATION OF RESOURCES Inflation distorts relative prices. Consumer decisions are distorted, and markets are less able to allocate resources to their best use. INFLATION-INDUCED TAX DISTORTION The income tax treats the nominal interest earned on savings as income, even though part of the nominal interest rate merely compensates for inflation. The after-tax real interest rate falls, making saving less attractive. CONFUSION AND INCONVENIENCE Inflation erodes the real value of money. It causes dollars at different times to have different real values. Therefore, with rising prices, it is more difficult to compare real revenues, costs, and profits over time. A SPECIAL COST OF UNEXPECTED INFLATION: ARBITRARY REDISTRIBUTION OF WEALTH Unexpected inflation redistributes wealth among the population in a way that has nothing to do with either merit or need. These redistributions occur because many loans in the economy are specified in terms of the monetary unit of account. TOPIC 3: UNEMPLOYMENT IDENTIFYING UNEMPLOYMENT Categories of unemployment The problem of unemployment is usually divided into two categories, the long run problem and the short run problem. Long run problem: the natural rate of unemployment Short run problem: the cyclical rate of unemployment HOW IS UNEMPLOYMENT MEASURED? Natural rate of unemployment The natural rate of unemployment is the unemployment rate that exists when the economy is at full employment output. Cyclical unemployment Cyclical unemployment refers to the year-to-year fluctuations in unemployment around its natural rate. It is associated with short-term ups and downs of the business cycle. BUSINESS CYCLE Business cycle refers to the ups and downs in the level of economic activity. It shows how real output fluctuates around its growth trend. A business cycle has four phases Peak: the real output is at nearly maximum level, high income, low unemployment, the price level is likely to rise. Recession: a period of decline in total output, income, employment and trade. Trough: the real output is at the lowest level, low income, high unemployment. Recovery: a period of rising in total output, income, employment and trade. UNEMPLOYMENT RATE IN THE U.S. SINCE 1960 Percent of Labor Force 10 Unemployment rate 8 6 Natural rate of unemployment 4 2 0 1960 1965 1970 1975 1980 1985 1990 1995 2000 2005 HOW IS UNEMPLOYMENT MEASURED? Unemployment is measured by the Bureau of Labor Statistics. The total population is divided into 2 groups: Children: people less than 16 years of ages Adult population: people at 16 years of ages and over. Not in labor force: adults who are potential workers but are not employed nor seeking work. Labor force: adults who are able and willing to work. HOW IS UNEMPLOYMENT MEASURED? Labor force The labor force is the total number of workers, including both the employed and the unemployed. Labor force = Employed + Unemployed Employed: people who have paid jobs (employees and self-employed workers). Unemployed: people who have no jobs but actively seeking for job (new entrants, re-entrants, lost job, quit job, laid off). HOW IS UNEMPLOYMENT MEASURED? The labor force participation rate is the percentage of the adult population that is in the labor force. Labor force participation rate = (Labor force / Adult population) × 100% The unemployment rate is the percentage of the labor force that is unemployed. Unemployment rate = (Unemployed / Labor force) × 100% LABOR FORCE PARTICIPATION RATES FOR MEN AND WOMEN IN THE U.S. SINCE 1950 Labor force participation rate 100 80 Men 60 40 Women 20 0 1950 1955 1960 1965 1970 1975 1980 1985 1990 1995 2000 2005 LABOR FORCE PARTICIPATION RATE AND UNEMPLOYMENT RATE IN VIETNAM SOURCE: WORLD BANK LABOR STRUCTURE BY ECONOMIC SECTOR IN VIETNAM, 2015 SOURCE: GSO PROBLEMS IN MEASURING UNEMPLOYMENT It is difficult to distinguish between a person who is unemployed and a person who is not in the labor force. Discouraged workers: people who would like to work but have given up looking for jobs after an unsuccessful search, don’t show up in unemployment statistics. Other people may claim to be unemployed in order to receive financial assistance, even though they aren’t looking for work. ECONOMIC COSTS OF UNEMPLOYMENT Individual cost Society cost Unequal burden Occupation: low-skilled workers and high-skilled workers Age: teenagers and adults Race and ethnicity Gender: men and women Education: less educated and more educated workers Duration FRICTIONAL UNEMPLOYMENT Frictional unemployment refers to the unemployment that results from the time that it takes to match workers with jobs. In other words, it takes time for workers to search for the jobs that are best suit their tastes and skills. Workers are “between jobs” Some workers quit their current jobs to find better ones. Some workers have been fired and are seeking reemployment. Some workers are temporarily laid of because of changes in seasonal demand. Workers first enter the labor force and searching for their first jobs. Frictional unemployment consists of search unemployment and wait unemployment. Frictional unemployment is inevitable but desirable. JOB SEARCH Job search is the process by which workers find appropriate jobs given their tastes and skills. It results from the fact that it takes time for qualified individuals to be matched with appropriate jobs. Unemployment is caused by the time spent searching for the “right” job. WHY SOME FRICTIONAL UNEMPLOYMENT IS INEVITABLE? Search unemployment is inevitable because the economy is always changing. Changes in the composition of demand among industries or regions are called sectoral shifts. It takes time for workers to search for and find jobs in new sectors. PUBLIC POLICY AND JOB SEARCH Government programs can affect the time it takes unemployed workers to find new jobs. These programs include the following: Government-run employment agencies Public training programs Unemployment insurance PUBLIC POLICY AND JOB SEARCH Government-run employment agencies give out information about job vacancies in order to match workers and jobs more quickly. Public training programs aim to ease the transition of workers from declining to growing industries and to help disadvantaged groups escape poverty. PUBLIC POLICY AND JOB SEARCH Unemployment insurance is a government program that partially protects workers’ incomes when they become unemployed. Offers workers partial protection against job losses. Offers partial payment of former wages for a limited time to those who are laid off. PUBLIC POLICY AND JOB SEARCH Unemployment insurance increases the amount of search unemployment. reduces the search efforts of the unemployed. may improve the chances of workers being matched with the right jobs. STRUCTURAL UNEMPLOYMENT Structural unemployment is the unemployment that results because the number of jobs available in some labor markets is insufficient to provide a job for everyone who wants one. It occurs when the quantity of labor supplied exceeds the quantity demanded. Why is there structural unemployment? Minimum wage laws Unions Efficiency wages MINIMUM WAGE LAWS When the minimum wage is set above the level that balances supply and demand, it creates unemployment. FIGURE 5. UNEMPLOYMENT FROM A WAGE ABOVE THE EQUILIBRIUM LEVEL Wage Labor supply Surplus of labor = Unemployment Minimum wage WE Labor demand 0 LD LE LS Quantity of Labor UNION AND COLLECTIVE BARGAINING A union is a worker association that bargains with employers over wages, benefits and working conditions. A union is a type of cartel attempting to exert its market power. The process by which unions and firms agree on the terms of employment is called collective bargaining. UNION AND COLLECTIVE BARGAINING A strike will be organized if the union and the firm cannot reach an agreement. A strike occurs when the union organizes a withdrawal of labor from the firm. A strike makes some workers better off and other workers worse off. Workers in unions (insiders) reap the benefits of collective bargaining, while workers not in the union (outsiders) bear some of the costs. THE THEORY OF EFFICIENCY WAGES Efficiency wages are above equilibrium wages paid by firms in order to increase worker productivity. The theory of efficiency wages states that firms operate more efficiently if wages are above the equilibrium level. THE THEORY OF EFFICIENCY WAGES A firm may prefer higher than equilibrium wages for the following reasons: Worker health: Better paid workers eat a better diet and thus are more productive. Worker turnover: A higher paid worker is less likely to look for another job. Worker quality: Higher wages attract a better pool of workers to apply for jobs. Worker effort: Higher wages motivate workers to put forward their best effort. TOPIC 4. PRODUCTION AND GROWTH PRODUCTION AND GROWTH A country’s standard of living is measured by real GDP per person. Within a country there are large changes in the standard of living over time. Among countries, there are significant variation in living standards. ECONOMIC GROWTH IN SOME COUNTRIES THE GROWTH RATE OF REAL GDP, POPULATION AND REAL GDP PER CAPITA IN VIETNAM, 1986-2016 SOURCE: WORLD BANK PRODUCTIVITY: ITS ROLE AND DETERMINANTS A country’s standard of living depends on its ability to produce goods and service or the productivity of its workers. Productivity refers to the amount of goods and services that a worker can produce from each hour of work. Productivity plays a key role in determining living standards for all nations in the world. PRODUCTIVITY: ITS ROLE AND DETERMINANTS To understand the large differences in living standards across countries, we must focus on the production of goods and services. The inputs used to produce goods and services are called the factors of production. The factors of production directly determine productivity. The factors of production Physical capital Human capital Natural resources Technological knowledge PRODUCTIVITY: ITS ROLE AND DETERMINANTS Physical capital: is the stock of equipment and structures that are used to produce goods and services such as tools, equipment, machinery, factories, buildings, roads … Human capital: is the knowledge and skills that workers acquire through education, training, and experience. Natural resources: inputs used in production that are provided by nature, such as land, rivers, and mineral deposits. Technological knowledge: society’s understanding of the best ways to produce goods and services. THE PRODUCTION FUNCTION Economists often use an aggregate production function to describe the relationship between the quantity of inputs used in production and the quantity of output from production. THE PRODUCTION FUNCTION Y = A F(L, K, H, N) Y = quantity of output A = available production technology L = quantity of labor K = quantity of physical capital H = quantity of human capital N = quantity of natural resources F( ) is a function that shows how the inputs are combined. THE PRODUCTION FUNCTION Production function with constant returns to scale Y/ L = A F(1, K/ L, H/ L, N/ L) Where: Y/L = output per worker K/L = physical capital per worker H/L = human capital per worker N/L = natural resources per worker ECONOMIC GROWTH AND PUBLIC POLICY Government policies that raise productivity and living standards Encourage saving and investment. Encourage investment from abroad Encourage education and training. Establish secure property rights and maintain political stability. Promote free trade. Promote research and development. FOREIGN INVESTMENT Governments can increase capital accumulation and long term economic growth by encouraging investment from foreign sources. Investment from abroad takes several forms: Foreign Direct Investment: capital investment owned and operated by a foreign entity. Foreign Portfolio Investment: investments financed with foreign money but operated by domestic residents. EDUCATION For a country’s long run growth, education is at least as important as investment in physical capital. An educated person might generate new ideas about how best to produce goods and services, which in turn, might enter society’s pool of knowledge and provide an external benefit to others. One problem facing some poor countries is the brain drain - the emigration of many of the most highly educated workers to rich countries. PROPERTY RIGHTS AND POLITICAL STABILITY Property rights refer to the ability of people to exercise authority over the resources they own. An economy-wide respect for property rights is an important prerequisite for the price system to work. It is necessary for investors to feel that their investments are secure. FREE TRADE Trade is, in some ways, a type of technology. A country that eliminates trade restrictions will experience the same kind of economic growth that would occur after a major technological advance. RESEARCH AND DEVELOPMENT The advance of technological knowledge has led to higher standards of living. Most technological advance comes from private research by firms and individual inventors. Government can encourage the development of new technologies through research grants, tax breaks, and the patent system. POPULATION GROWTH Economists and other social scientists have long debated how population growth affects a society. Population growth interacts with other factors of production: Stretching natural resources Diluting the capital stock Promoting technological progress TOPIC 5: SAVING, INVESTMENT AND THE FINANCIAL SYSTEM THE MEANING OF SAVING AND INVESTMENT TO ECONOMIC GROWTH Stock of physical capital determines economic growth. Investment increases the stock of physical capital. Saving provides the sources of funds for investment. Savers are those people whose incomes exceed their consumption. Borrowers are firms that borrow money to make their investment. SAVING, INVESTMENT, AND THE FINANCIAL SYSTEM The financial system consists of the group of institutions in the economy that help to match one person’s saving with another person’s investment. It moves the economy’s scarce resources from savers to borrowers. Financial institutions can be grouped into two different categories: Financial markets Financial intermediaries FINANCIAL INSTITUTIONS Financial markets are the institutions through which savers can directly provide funds to borrowers. Stock market Bond market Financial intermediaries are financial institutions through which savers can indirectly provide funds to borrowers. Banks Mutual Funds FINANCIAL MARKETS The Bond Market A bond is a certificate of indebtedness that specifies obligations of the borrower to the holder of the bond. Characteristics of a Bond Term: The length of time until the bond matures. Credit Risk: The probability that the borrower will fail to pay some of the interest or principal. Tax Treatment: The way in which the tax laws treat the interest on the bond. Municipal bonds are federal tax exempt. FINANCIAL MARKETS The Stock Market Stock represents a claim to partial ownership in a firm and is therefore, a claim to the profits that the firm makes. The sale of stock to raise money is called equity financing. Compared to bonds, stocks offer both higher risk and potentially higher returns. FINANCIAL MARKETS The Stock Market Most newspaper stock tables provide the following information: Price (of a share) Volume (number of shares sold) Dividend (profits paid to stockholders) Price-earnings ratio FINANCIAL INTERMEDIARIES Banks A bank is a financial intermediary that takes deposits from people who want to save and use the deposits to make loans to people who want to borrow. It pays depositors interest on their deposits and charges borrowers higher interest on their loans. FINANCIAL INTERMEDIARIES Mutual Funds A mutual fund is an institution that sells shares to the public and uses the proceeds to buy a portfolio, of various types of stocks, bonds, or both. Mutual funds allow people with small amounts of money to easily diversify. SAVING AND INVESTMENT IN THE NATIONAL INCOME ACCOUNT For an open economy: Y = C + I + G + NX For a closed economy: the economy does not engage in international trade: Y=C+I+G National saving is equal to: S=Y–C–G S = (Y – T – C) + (T – G) For the economy as a whole, saving must be equal to investment. S=I SAVING AND INVESTMENT National saving Private saving National saving is the total income in the economy that remains after paying for consumption and government purchases. Private saving is the amount of income that households have left after paying their taxes and paying for their consumption. Private saving = (Y – T – C) Public saving Public saving is the amount of tax revenue that the government has left after paying for its spending. Public saving = (T – G) SAVING AND INVESTMENT Government budget If T > G, the government runs a budget surplus because it receives more money than it spends. The surplus of T - G represents public saving. If T < G, the government runs a budget deficit because it spends more money than it receives in tax revenue. If T = G, the government runs a balanced budget. THE MARKET FOR LOANABLE FUNDS Financial markets coordinate the economy’s saving and investment in the market for loanable funds. The market for loanable funds is the market in which those who want to save supply funds and those who want to borrow to invest demand funds. SUPPLY AND DEMAND FOR LOANABLE FUNDS Loanable funds refers to all income that people have chosen to save and lend out, rather than use for their own consumption. The supply of loanable funds comes from people who have extra income they want to save and lend out. The demand for loanable funds comes from households and firms that wish to borrow to make investments. SUPPLY AND DEMAND FOR LOANABLE FUNDS Interest rate the price of the loan the amount that borrowers pay for loans and the amount that lenders receive on their saving Financial markets work much like other markets in the economy. The equilibrium of the supply and demand for loanable funds determines the real interest rate. THE MARKET FOR LOANABLE FUNDS Interest Rate S Equilibrium Interest rate I 0 Equilibrium quantity of lf Quantity of Loanable Funds HOW POLICIES AFFECT THE LOANABLE FUNDS MARKET Taxes and saving Taxes and investment Government budget deficits and surpluses POLICY 1: SAVING INCENTIVES Taxes on interest income substantially reduce the future payoff from current saving and, as a result, reduce the incentive to save. A tax decrease increases the incentive for households to save at any given interest rate. The supply of loanable funds curve shifts right. The equilibrium interest rate decreases. The quantity demanded for loanable funds increases. AN INCREASE IN THE SUPPLY OF LOANABLE FUNDS Interest Rate S1 S2 1. Tax incentives for saving increase the supply of loanable funds . . . 5% 4% 2. . . . which reduces the equilibrium interest rate . . . I 0 $1,200 $1,600 3. . . . and raises the equilibrium quantity of loanable funds. Loanable Funds (in billions of dollars) POLICY 2: INVESTMENT INCENTIVES An investment tax credit increases the incentive to borrow. Increases the demand for loanable funds. Shifts the demand curve to the right. Results in a higher interest rate and a greater quantity saved. INVESTMENT INCENTIVES INCREASE THE DEMAND FOR LOANABLE FUNDS Interest Rate S 1. An investment tax credit increases the demand for loanable fund s . . . 6% 5% 2. . . . which raises the equilibrium interest rate . . . 0 I2 I1 $1,200 $1,400 3. . . . and raises the equilibrium quantity of loanable funds. Loanable Funds (in billions of dollars) POLICY 3: GOVERNMENT BUDGET DEFICITS AND SURPLUSES When the government spends more than it receives in tax revenues, the short fall is called the budget deficit. Government budget deficit reduces national saving which in turns reduces the supply of loanable funds available to finance investment by households and firms. This fall in investment is referred to as crowding out. The deficit borrowing crowds out private borrowers who are trying to finance investments. POLICY 3: GOVERNMENT BUDGET DEFICITS AND SURPLUSES A budget deficit decreases the supply of loanable funds. Shifts the supply curve to the left. Increases the equilibrium interest rate. Reduces the equilibrium quantity of loanable funds. THE EFFECT OF A GOVERNMENT BUDGET DEFICIT Interest Rate S2 S1 1. A budget deficit decreases the supply of loanable funds . . . 6% 5% 2. . . . which raises the equilibrium interest rate . . . I 0 $800 $1,200 3. . . . and reduces the equilibrium quantity of loanable funds. Loanable Funds (in billions of dollars) POLICY 3: GOVERNMENT BUDGET DEFICITS AND SURPLUSES A budget deficit decreases the supply of loanable funds, raises the interest rate, and dicourages investment. A budget surplus increases the supply of loanable funds, reduces the interest rate, and stimulates investment. TOPIC 6: THE MONETARY SYSTEM MONEY: DEFINITION Money is the stock of assets that can be readily used to make transactions. THE FUNCTIONS OF MONEY Money is an asset that performs the 3 basic functions: Medium of exchange: It is readily acceptable as payment, is usable for buying and selling goods and services. Unit of account: monetary units are used as yardstick for measuring the relative worth of a wide variety of goods, services and resources. Store of value: It enables people to transfer purchasing power from the present to the future. THE KINDS OF MONEY Commodity money takes the form of a commodity with intrinsic value. Examples: gold, silver, precious mental. Fiat money is used as money because of government decree. It does not have intrinsic value. Examples: coins and notes. SUPPLY OF MONEY The money supply is the quantity of money available in the economy. Monetary base Mo: currency (notes and coins) issued by the Central Bank. Money supply M1 = Currency circulated in public + Demand deposits Money supply M2 = Money supply M1 + Saving deposits + Small time deposits + Money market mutual funds MONEY SUPPLY MEASURES IN VIETNAM (IN BILLION VND), 2016 SOURCE: ASIAN DEVELOPMENT BANK 8 THE BANKING SYSTEM The banking system has 2 layers: the Central Bank and commercial banks. The Central Bank is designed to oversee the banking system and regulates the quantity of money in the economy. Commercial banks are financial intermediaries that perform two basic functions: accept deposits of money and make loans. THE BALANCE SHEET OF A COMMERCIAL BANK The balance sheet of a commercial bank is a statement of assets and liabilities that summarizes the financial position of the bank at a certain time. Assets: things that the bank owns or owed by others. Liabilities: things that the bank owes or owned by others. The balance sheet must balance Assets = Liabilities THE BALANCE SHEET OF A COMMERCIAL BANK Reserves are the cash that the banks keep. The required reserve ratio is the minimum fraction of deposits that banks are required to keep as reserves. In a fractional-reserve banking system, banks hold a fraction of the money deposited as reserves and lend out the rest. THE BALANCE SHEET OF A COMMERCIAL BANK Actual reserves (AR): amount of cash that the bank actually keeps. Required reserves (RR): amount of cash that the bank is required to keep. Excess reserves (ER): amount of cash that the bank keeps beyond its required level. ER = AR - RR Whenever the bank has excess reserves, it can make a loan of up to its excess reserves. Loan = ER THE BALANCE SHEET OF A COMMERCIAL BANK This T-Account shows a bank that… accepts deposits, keeps a portion as reserves, and lends out the rest. It assumes a reserve ratio of 10%. First National Bank Assets Reserves $10.00 Liabilities Deposits $100.00 Loans $90.00 Total Assets $100.00 Total Liabilities $100.00 HOW BANKS CREATE MONEY? Banks create money by making loans. When a person deposits money into a bank, the bank has excess reserve and can make a loan of up to its excess reserve. When the bank makes a loan, the money supply increases by the amount of the loan. When the bank loans money, that money may be deposited into another bank → Another bank has excess reserve and can make a loan. This process keeps going: creates more deposits and more reserves to be lent out. How much money that the banking system can create from an initial deposit? THE BANKING SYSTEM: MULTIPLE-DEPOSIT EXPANSION The banking system’s lending potential The reserve ratio for all commercial banks is 20%. Initially all banks are meeting this 20% reserve requirement exactly. No excess reserves exist. Suppose a person deposits $100 in Bank A. BALANCE SHEET: BANK A Entry 1: Customer deposits $100 Assets Reserves Liabilities $100 Checkable deposits $100 Entry 2: A loan is made Assets Liabilities Reserves $20 Loan $80 Checkable deposits $100 BALANCE SHEET: BANK B Entry 1: Acquires the deposits of $80 Assets Liabilities Reserves $80 Checkable deposits Entry 2: A loan is made Assets Reserves $16 Loan $64 $80 Liabilities Checkable deposits $80 BALANCE SHEET: BANK C Entry 1: Acquires the deposits of $64 Assets Liabilities Reserves $64 Checkable deposits Entry 2: A loan is made Assets Reserves $12.8 Loan $51.2 $64 Liabilities Checkable deposits $115.2 EXPANSION OF THE MONEY SUPPLY BY THE COMMERCIAL BANKING SYSTEM Bank Bank A Bank B Bank C Bank D Bank E Bank F Bank G ….. Acquire reserves and deposits $100 80 64 51.2 40.96 32.77 26.21 Required reserves $20 16 12.8 10.24 8.19 6.55 5.24 Total amount of money created Excess reserve Loans $80 64 51.2 40.96 32.77 26.21 20.97 $80 64 51.2 40.96 32.77 26.21 20.97 $400 THE MONEY MULTIPLIER The money multiplier is the amount of money the banking system generates with each dollar of reserves. The money multiplier is the reciprocal of the required reserve ratio: Money multiplier = 1/ Required reserve ratio HOW BANKS CREATE MONEY? Initial deposit: D0 Required reserve ratio: r Initial excess reserve = (1- r) × D0 Total loans that the banking system can make = Initial excess reserve × Money multiplier = (1- r) × D0 × (1/r) Total money created by banks = Total loans that the banking system can make HOW BANKS CREATE MONEY? Total loans created = Initial excess × Money by the banking system reserves multiplier If the required reserve ratio of 50%, $100 in cash deposited would allow the banking system to create maximum loans of Total loans = 50 x (1/0.5) = $100 If the required reserve ratio of 5%, $100 in cash deposited would allow the banking system to create maximum loans of Total loans = 95 x (1/0.05) = $1900 THE CENTRAL BANK The roles of the Central Bank Issue currency Acts as a banker to banks Hold reserves of commercial banks Clearing checks among banks Lender of the last resort Acts a banker to government Supervise and regulate banks Control the money supply THE CENTRAL BANK’S TOOLS OF MONETARY CONTROL The Central Bank has three monetary instruments Open market operations Nghiep vu thi truong mo Changing the reserve requirement Changing the discount rate THE CENTRAL BANK’S TOOLS OF MONETARY CONTROL Open market operations The Central Bank conducts open market operations when it buys government bonds from or sells government bonds to the public. When the Central Bank sells government bonds, the money supply decreases. When the Central Bank buys government bonds, the money supply increases. THE CENTRAL BANK’S TOOLS OF MONETARY CONTROL Changing the reserve requirements The required reserve ratio is the minimum fraction of deposits that banks are required to keep as reserves. When the Central Bank lowers the required reserve ratio, money supply increases. When the Central Bank raises the required reserve ratio, money supply decreases. THE CENTRAL BANK’S TOOLS OF MONETARY CONTROL Changing the discount rate The discount rate is the interest rate the Central Bank charges banks for loans. When the Central Bank lowers the discount rate, money supply increases. When the Central Bank raises the discount rate, money supply decreases. PROBLEMS IN CONTROLLING THE MONEY SUPPLY The Central Bank’s control of the money supply is not precise. The Central Bank must wrestle with two problems that arise due to fractional-reserve banking. The Central Bank does not control the amount of money that households choose to hold as deposits in banks. The Central Bank does not control the amount of money that bankers choose to lend. TOPIC 7: AGGREGATE DEMAND AND AGGREGATE SUPPLY THREE KEY FACTS ABOUT ECONOMIC FLUCTUATIONS Fluctuations in the economy are often called the business cycle. Economic fluctuations are irregular and unpredictable. Most macroeconomic variables fluctuate together. As output falls, unemployment rises. SHORT RUN ECONOMIC FLUCTUATIONS (a) Real GDP Billions of 2000 Dollars $10,000 9,000 8,000 7,000 Real GDP 6,000 5,000 4,000 3,000 2,000 1965 1970 1975 1980 1985 1990 1995 2000 2005 SHORT RUN ECONOMIC FLUCTUATIONS (b) Investment Spending Billions of 2000 Dollars $1,500 1,000 Investment Spending 500 0 1965 1970 1975 1980 1985 1990 1995 2000 2005 SHORT RUN ECONOMIC FLUCTUATIONS (c) Unemployment Rate Percent of Labor Force 12% 10 Unemployment Rate 8 6 4 2 1965 1970 1975 1980 1985 1990 1995 2000 2005 THE MODEL OF AGGREGATE DEMAND AND AGGREGATE SUPPLY Economist use the model of aggregate demand and aggregate supply to explain short run fluctuations in economic activity around its long run trend. Two variables are used to develop a model to analyze the short run fluctuations. The economy’s output of goods and services measured by real GDP. The average level of prices measured by the CPI or the GDP deflator. THE MODEL OF AGGREGATE DEMAND AND AGGREGATE SUPPLY The aggregate demand curve shows the total output of goods and services that all sectors of the economy want to buy at each price level. The aggregate supply curve shows the total output of goods and services that firms choose to produce and sell at each price level. THE AGGREGATE DEMAND CURVE The four components of GDP contribute to the aggregate demand for goods and services. AD = C + I + G + NX THE AGGREGATE DEMAND CURVE Price Level P P2 1. A decrease in the price level . . . 0 Aggregate demand Y Y2 2. . . . increases the quantity of goods and services demanded. Quantity of Output WHY THE AGGREGATE DEMAND CURVE IS DOWNWARD SLOPING? The wealth effect The price level and consumption A lower price level raises the real value of money and makes consumers wealthier, which encourages them to spend more. This increase in consumer spending means a larger quantity of goods and services demanded. WHY THE AGGREGATE DEMAND CURVE IS DOWNWARD SLOPING? The interest rate effect The price level and investment A lower price level reduces the interest rate and makes borrowing less expensive, which encourages greater spending on investment goods. This increase in investment spending means a larger quantity of goods and services demanded. WHY THE AGGREGATE DEMAND CURVE IS DOWNWARD SLOPING? The exchange rate effect The price level and net exports A lower price level causes the domestic goods become relatively cheaper compared to foreign goods which stimulates the net exports. The increase in net export spending means a larger quantity of goods and services demanded. WHY THE AGGREGATE DEMAND CURVE MIGHT SHIFT? Shifts in aggregate demand curve might arise from changes in: Consumption Investment Government purchases Net exports THE AGGREGATE SUPPLY CURVE In the long run, the aggregate supply curve is vertical because the price level does not affect long run determinants of real GDP. In the short run, the aggregate supply curve is upward sloping. THE LONG RUN AGGREGATE SUPPLY CURVE In the long run, an economy’s production of goods and services depends on its supplies of labor, capital, and natural resources and on the available technology used to turn these factors of production into goods and services. The long run aggregate supply curve is vertical at the natural rate of output, which is the production of goods and services that an economy achieves in the long run when unemployment is at its normal rate. This level of production is also referred to as potential output or full employment output. THE LONG RUN AGGREGATE SUPPLY CURVE Price Level Long-run aggregate supply P P2 2. . . . does not affect the quantity of goods and services supplied in the long run. 1. A change in the price level . . . 0 Natural rate of output Quantity of Output WHY THE LONG RUN AGGREGATE SUPPLY CURVE MIGHT SHIFT? Any change in the economy that alters the natural rate of output shifts the long run aggregate supply curve. Shifts might arise from changes in: Labor Capital Natural resources Technological knowledge THE SHORT RUN AGGREGATE SUPPLY CURVE In the short run, an increase in the overall level of prices in the economy tends to raise the quantity of goods and services supplied. A decrease in the level of prices tends to reduce the quantity of goods and services supplied. As a result, the short run aggregate supply curve is upward sloping. THE SHORT RUN AGGREGATE SUPPLY CURVE Price Level Short-run aggregate supply P P2 2. . . . reduces the quantity of goods and services supplied in the short run. 1. A decrease in the price level . . . 0 Y2 Y Quantity of Output WHY THE AGGREGATE SUPPLY CURVE SLOPES UPWARD IN THE SHORT RUN? The Sticky Wage Theory Nominal wages are slow to adjust to changing economic conditions, or are “sticky” in the short run Nominal wages do not adjust immediately to a fall in the price level. A lower price level makes employment and production less profitable. This induces firms to reduce the quantity of goods and services supplied. WHY THE AGGREGATE SUPPLY CURVE SLOPES UPWARD IN THE SHORT RUN? The theory suggests that output deviates in the short run from the natural rate when the actual price level deviates from the price level that people had expected to prevail. Quantity of output supplied = Natural rate of output + a Actual price level Expected price level WHY THE SHORT RUN AGGREGATE SUPPLY CURVE MIGHT SHIFT? Shifts might arise from changes in: Labor Capital Natural resources Technology Expected price level Per unit cost of production WHY THE AGGREGATE SUPPLY CURVE MIGHT SHIFT? An increase in the expected price level reduces the quantity of goods and services supplied and shifts the short run aggregate supply curve to the left. A decrease in the expected price level raises the quantity of goods and services supplied and shifts the short run aggregate supply curve to the right. THE LONG RUN EQUILIBRIUM Price Level Long-run aggregate supply Short-run aggregate supply A Equilibrium price Aggregate demand 0 Natural rate of output Quantity of Output TWO CAUSES OF ECONOMIC FLUCTUATIONS Shifts in aggregate demand In the short run, shifts in aggregate demand cause fluctuations in the economy’s output of goods and services. In the long run, shifts in aggregate demand affect the overall price level but do not affect output. Policymakers who influence aggregate demand can potentially mitigate the severity of economic fluctuations. A CONTRACTION IN AGGREGATE DEMAND 2. . . . causes output to fall in the short run . . . Price Level Long-run aggregate supply Short-run aggregate supply, AS AS2 3. . . . but over time, the short-run aggregate-supply curve shifts . . . A P B P2 P3 1. A decrease in aggregate demand . . . C Aggregate demand, AD AD2 0 Y2 Y 4. . . . and output returns to its natural rate. Quantity of Output TWO CAUSES OF ECONOMIC FLUCTUATIONS Shifts in aggregate supply Consider an adverse shift in aggregate supply A decrease in one of the determinants of aggregate supply shifts the curve to the left. Output falls below the natural rate of employment. Unemployment rises. The price level rises. Adverse shifts in aggregate supply cause stagflation - a period of recession and inflation. AN ADVERSE SHIFT IN AGGREGATE SUPPLY 1. An adverse shift in the shortrun aggregate-supply curve . . . Price Level Long-run aggregate supply AS2 Short-run aggregate supply, AS B P2 A P 3. . . . and the price level to rise. Aggregate demand 0 Y2 2. . . . causes output to fall . . . Y Quantity of Output TOPIC 8: THE INFLUENCE OF MONETARY AND FISCAL POLICY ON AGGREGATE DEMAND THE THEORY OF LIQUIDITY PREFERENCE Keynes developed the theory of liquidity preference in order to explain what factors determine the economy’s interest rate. According to the theory, the interest rate adjusts to balance the supply and demand for money. Liquidity preference theory attempts to explain both nominal and real rates by holding constant the rate of inflation. THE THEORY OF LIQUIDITY PREFERENCE Money Supply The money supply is controlled by the Central Bank through Open market operations Changing the reserve requirements Changing the discount rate Because it is fixed by the Central Bank, the quantity of money supplied does not depend on the interest rate. The fixed money supply is represented by a vertical supply curve. THE THEORY OF LIQUIDITY PREFERENCE Money Demand Money demand is determined by several factors. According to the theory of liquidity preference, one of the most important factors is the interest rate. People choose to hold money instead of other interest earning assets because money can be used to buy goods and services. The opportunity cost of holding money is the interest that could be earned on interest earning assets. An increase in the interest rate raises the opportunity cost of holding money. As a result, the quantity of money demanded is reduced. THE THEORY OF LIQUIDITY PREFERENCE Equilibrium in the money market According to the theory of liquidity preference: The interest rate adjusts to balance the supply and demand for money. There is one interest rate, called the equilibrium interest rate, at which the quantity of money demanded equals the quantity of money supplied. THE DOWNWARD SLOPE OF THE AGGREGATE DEMAND CURVE The price level is one determinant of the demand for money. A higher price level increases the quantity of money demanded for any given interest rate. Higher money demand leads to a higher interest rate. The quantity of goods and services demanded falls. The end result of this analysis is a negative relationship between the price level and the quantity of goods and services demanded. THE MONEY MARKET AND THE SLOPE OF THE AGGREGATE DEMAND CURVE (a) The Money Market Interest Rate (b) The Aggregate Demand Curve Price Level Money supply 2. . . . increases the demand for money . . . P2 r2 Money demand at price level P2 , MD2 r 3. . . . which increases the equilibrium 0 interest rate . . . Money demand at price level P , MD Quantity fixed by the Fed Quantity of Money 1. An P increase in the price level . . . 0 Aggregate demand Y2 Y Quantity of Output 4. . . . which in turn reduces the quantity of goods and services demanded. CHANGES IN THE MONEY SUPPLY The Central Bank can shift the aggregate demand curve when it changes monetary policy. An increase in the money supply shifts the money supply curve to the right. Without a change in the money demand curve, the interest rate falls. Falling interest rates increase the quantity of goods and services demanded at each price level. The aggregate demand curve shifts to the right. A MONETARY INJECTION (b) The Aggregate Demand Curve (a) The Money Market Interest Rate r 2. . . . the equilibrium interest rate falls . . . Money supply, MS Price Level MS2 1. When the Fed increases the money supply . . . P r2 AD2 Money demand at price level P 0 Quantity of Money Aggregate demand, AD 0 Y Y Quantity of Output 3. . . . which increases the quantity of goods and services demanded at a given price level. MONETARY POLICY Monetary policy is conducted when the government controls the money supply. Expansionary monetary policy: Money supply increases. Contractionary monetary policy: Money supply decreases. HOW MONETARY POLICY INFLUENCES AGGREGATE DEMAND When the government conducts expansionary monetary policy, money supply increases which lowers the interest rate and increases investment at any given price level → aggregate demand increases and the AD curve shifts to the right. When the government conducts contractionary monetary policy, money supply decreases which increases the interest rate and reduces investment at any given price level → aggregate demand decreases and the AD curve shifts to the left. HOW FISCAL POLICY INFLUENCES AGGREGATE DEMAND Fiscal policy is conducted when the government changes government spending and/or taxes. Expansionary fiscal policy: Increase government spending and/or lower taxes. Contractionary fiscal policy: Decrease government spending and/or higher taxes. CHANGES IN GOVERNMENT PURCHASES When the government alters its own purchases of goods or services, it shifts the aggregate demand curve directly. There are two macroeconomic effects from the change in government purchases: The multiplier effect The crowding out effect THE MULTIPLIER EFFECT Government purchases are said to have a multiplier effect on aggregate demand. Each dollar spent by the government can raise the aggregate demand for goods and services by more than a dollar. The multiplier effect refers to the additional shifts in aggregate demand that result when expansionary fiscal policy increases income and thereby increases consumer spending. THE MULTIPLIER EFFECT The formula for the multiplier is If the MPC = 0.75, then the multiplier will be Multiplier = 1/(1 – 0.75) = 4 Multiplier = 1/(1 – MPC) The marginal propensity to consume (MPC) is the fraction of extra income that a household consumes rather than saves. In this case, a $20 billion increase in government spending generates $80 billion of increased demand for goods and services. A larger MPC means a larger multiplier in an economy. THE CROWDING OUT EFFECT Fiscal policy may not affect the economy as strongly as predicted by the multiplier. An increase in government purchases causes the interest rate to rise. A higher interest rate reduces investment spending and thus aggregate demand. This reduction in demand that results when a fiscal expansion raises the interest rate is called the crowding out effect. The crowding out effect tends to dampen the effects of fiscal policy on aggregate demand. CHANGES IN TAXES When the government cuts personal income taxes, it increases households’ take-home pay. Households save some of this additional income. Households also spend some of it on consumer goods. Increased household spending shifts the aggregate demand curve to the right. CHANGES IN TAXES The size of the shift in aggregate demand resulting from a tax change is affected by the multiplier and crowding out effects. It is also determined by the households’ perceptions about the permanency of the tax change. AUTOMATIC STABILIZERS Automatic stabilizers are changes in fiscal policy that stimulate aggregate demand when the economy goes into a recession without policymakers having to take any deliberate action. Automatic stabilizers include the tax system and some forms of government spending. USING POLICY TO STABILIZE THE ECONOMY Economic stabilization has been an explicit goal of U.S. policy since the Employment Act of 1946, which states that: “it is the continuing policy and responsibility of the federal government to…promote full employment and production.” The Employment Act has two implications: The government should avoid being the cause of economic fluctuations. The government should respond to changes in the private economy in order to stabilize aggregate demand. THE CASE AGAINST ACTIVE STABILIZATION POLICY Some economists argue that monetary and fiscal policy destabilizes the economy. Monetary and fiscal policy affect the economy with a substantial lag. They suggest the economy should be left to deal with the short run fluctuations on its own. TOPIC 9: OPEN ECONOMY MACROECONOMICS: BASIC CONCEPTS OPEN ECONOMY MACROECONOMICS: BASIC CONCEPTS Open and closed economies A closed economy is one that does not interact with other economies in the world. There are no exports, no imports, and no capital flows. An open economy is one that interacts freely with other economies around the world. THE INTERNATIONAL FLOW OF GOODS AND CAPITAL An open economy interacts with other countries in two ways. It buys and sells goods and services in world product markets. It buys and sells capital assets in world financial markets. The flow of goods: Net exports The flow of financial resources: Net capital outflow THE FLOW OF GOODS: EXPORTS, IMPORTS, NET EXPORTS Exports are goods and services that are produced domestically and sold abroad. Imports are goods and services that are produced abroad and sold domestically. Net exports (NX) are the value of a nation’s exports minus the value of its imports. Net exports are also called the trade balance. THE FLOW OF GOODS: EXPORTS, IMPORTS, NET EXPORTS A trade deficit is a situation in which net exports (NX) are negative. A trade surplus is a situation in which net exports (NX) are positive. Imports > Exports Exports > Imports Balanced trade refers to when net exports (NX) are zero. Exports = Imports THE FLOW OF GOODS: EXPORTS, IMPORTS, NET EXPORTS Factors that affect net exports The tastes of consumers for domestic and foreign goods. The prices of goods at home and abroad. The exchange rates at which people can use domestic currency to buy foreign currencies. The incomes of consumers at home and abroad. The costs of transporting goods from country to country. The policies of the government toward international trade. THE INTERNATIONALIZATION OF THE U.S. ECONOMY Percent of GDP 15 Imports 10 Exports 5 0 1950 1955 1960 1965 1970 1975 1980 1985 1990 1995 2000 2005 THE FLOW OF FINANCIAL RESOURCES: NET CAPITAL OUTFLOW Net capital outflow refers to the purchase of foreign assets by domestic residents minus the purchase of domestic assets by foreigners. When a U.S. resident buys stock in Telmex, the Mexican phone company, the purchase raises U.S. net capital outflow. When a Japanese residents buys a bond issued by the U.S. government, the purchase reduces the U.S. net capital outflow. THE FLOW OF FINANCIAL RESOURCES: NET CAPITAL OUTFLOW Variables that influence net capital outflow The real interest rates being paid on foreign assets. The real interest rates being paid on domestic assets. The perceived economic and political risks of holding assets abroad. The government policies that affect foreign ownership of domestic assets. THE EQUALITY OF NET EXPORTS AND NET CAPITAL OUTFLOW For an economy as a whole, NX and NCO must balance each other so that: NCO = NX SAVING, INVESTMENT, AND THEIR RELATIONSHIP TO THE INTERNATIONAL FLOWS Total output National saving Since then Y = C + I + G + NX S=Y–C–G S = I + NX NCO = NX S = I + NCO National saving = Domestic investment + Net capital outflow INTERNATIONAL FLOWS OF GOODS AND CAPITAL: SUMMARY NATIONAL SAVING, DOMESTIC INVESTMENT, AND NET FOREIGN INVESTMENT (a) National Saving and Domestic Investment (as a percentage of GDP) Percent of GDP 20 Domestic investment 18 16 14 National saving 12 10 1960 1965 1970 1975 1980 1985 1990 1995 200 0 2005 NATIONAL SAVING, DOMESTIC INVESTMENT, AND NET FOREIGN INVESTMENT (b) Net Capital Outflow (as a percentage of GDP) Percent of GDP 2 Net capital outflow 1 0 1 2 3 4 5 6 1960 1965 1970 1975 1980 1985 1990 1995 2000 2005 THE PRICES FOR INTERNATIONAL TRANSACTIONS: REAL AND NOMINAL EXCHANGE RATES International transactions are influenced by international prices. The two most important international prices are the nominal exchange rate and the real exchange rate. NOMINAL EXCHANGE RATES The nominal exchange rate is the rate at which a person can trade the currency of one country for the currency of another. NOMINAL EXCHANGE RATES The nominal exchange rate is expressed in two ways: In units of foreign currency per one unit of domestic currency. In units of domestic currency per one unit of the foreign currency. NOMINAL EXCHANGE RATES Appreciation refers to an increase in the value of a currency as measured by the amount of foreign currency it can buy. Depreciation refers to a decrease in the value of a currency as measured by the amount of foreign currency it can buy. If a dollar buys more foreign currency, there is an appreciation of the dollar. If a dollar buys less foreign currency there is a depreciation of the dollar. REAL EXCHANGE RATES The real exchange rate is the rate at which a person can trade the goods and services of one country for the goods and services of another. REAL EXCHANGE RATES The real exchange rate depends on the nominal exchange rate and the prices of goods in the two countries measured in local currencies. Real exchange rate = Nominal exchange rate × Domestic price Foreign price The real exchange rate is a key determinant of how much a country exports and imports. REAL EXCHANGE RATES A depreciation (fall) in the real exchange rate Domestic goods have become cheaper relative to foreign goods. This encourages consumers both at home and abroad to buy more domestic goods and less foreign goods. As a result, exports rise and imports fall which cause net exports to rise. Conversely, an appreciation (rise) in the real exchange rate causes net exports to fall. A FIRST THEORY OF EXCHANGE RATE DETERMINATION: PURCHASING POWER PARITY The purchasing power parity theory is the simplest and most widely accepted theory explaining the variation of currency exchange rates. Purchasing power parity is a theory of exchange rates whereby a unit of any given currency should be able to buy the same quantity of goods in all countries. THE BASIC LOGIC OF PURCHASING POWER PARITY The theory of purchasing power parity is based on a principle called the law of one price. According to the law of one price, a good must sell for the same price in all locations. If the law of one price were not true, unexploited profit opportunities would exist. The process of taking advantage of differences in prices in different markets is called arbitrage. If arbitrage occurs, eventually prices that differed in two markets would necessarily converge. IMPLICATIONS OF PURCHASING POWER PARITY When the central bank prints large quantities of money, the money loses value both in terms of the goods and services it can buy and in terms of the amount of other currencies it can buy. MONEY, PRICES, AND THE NOMINAL EXCHANGE RATE DURING THE GERMAN HYPERINFLATION Indexes (Jan. 1921 = 100) 1,000,000,000,000,000 Money supply 10,000,000,000 Price level 100,000 1 Exchange rate .00001 .0000000001 1921 1922 1923 1924 1925 LIMITATIONS OF PURCHASING POWER PARITY Many goods are not easily traded or shipped from one country to another. Tradable goods are not always perfect substitutes when they are produced in different countries. TOPIC 10: A MACROECONOMIC THEORY OF THE OPEN ECONOMY A MACROECONOMICS THEORY OF THE OPEN ECONOMY Key macroeconomic variables in an open economy Net exports Net foreign investment Real interest rates Real exchange rates A MACROECONOMICS THEORY OF THE OPEN ECONOMY Basic assumptions of a macroeconomic model of an open economy Considers a large open economy. Takes the economy’s GDP as given. Takes the economy’s price level as given. THE MARKET FOR LOANABLE FUNDS The market for loanable funds S = I + NCO At the equilibrium interest rate, the amount that people want to save exactly balances the desired quantities of investment and net capital outflows. The supply of loanable funds comes from national saving (S). The demand for loanable funds comes from domestic investment (I) and net capital outflows (NCO). THE MARKET FOR LOANABLE FUNDS The supply and demand for loanable funds depend on the real interest rate. A higher real interest rate encourages people to save and raises the quantity of loanable funds supplied. The interest rate adjusts to bring the supply and demand for loanable funds into balance. At the equilibrium interest rate, the amount that people want to save exactly balances the desired quantities of domestic investment and net foreign investment. THE MARKET FOR LOANABLE FUNDS Real Interest Rate Supply of loanable funds (from national saving) Equilibrium real interest rate Demand for loanable funds (for domestic investment and net capital outflow) Equilibrium quantity Quantity of Loanable Funds THE MARKET FOR FOREIGN CURRENCY EXCHANGE The two sides of the foreign currency exchange market are represented by NCO and NX. NCO represents the imbalance between the purchases and sales of capital assets. NX represents the imbalance between exports and imports of goods and services. THE MARKET FOR FOREIGN-CURRENCY EXCHANGE The demand curve is downward sloping because a higher exchange rate makes domestic goods more expensive. The supply curve is vertical because the quantity of dollars supplied for net capital outflow is unrelated to the real exchange rate. The price that balances the supply and demand for foreign currency exchange is the real exchange rate. THE MARKET FOR FOREIGN CURRENCY EXCHANGE Real Exchange Rate Supply of dollars (from net capital outflow) Equilibrium real exchange rate Demand for dollars (for net exports) Equilibrium quantity Quantity of Dollars Exchanged into Foreign Currency THE MARKET FOR FOREIGN CURRENCY EXCHANGE The real exchange rate adjusts to balance the supply and demand for dollars. At the equilibrium real exchange rate, the demand for dollars to buy net exports exactly balances the supply of dollars to be exchanged into foreign currency to buy assets abroad. EQUILIBRIUM IN THE OPEN ECONOMY In the market for loanable funds, supply comes from national saving and demand comes from domestic investment and net capital outflow. In the market for foreign currency exchange, supply comes from net capital outflow and demand comes from net exports. EQUILIBRIUM IN THE OPEN ECONOMY Net capital outflow links the loanable funds market and the foreign currency exchange market. The key determinant of net capital outflow is the real interest rate. HOW NET CAPITAL OUTFLOW DEPENDS ON THE INTEREST RATE Real Interest Rate Net capital outflow is negative. 0 Net capital outflow is positive. Net Capital Outflow SIMULTANEOUS EQUILIBRIUM IN TWO MARKETS Prices in the loanable funds market and the foreign currency exchange market adjust simultaneously to balance supply and demand in these two markets. As they do, they determine the macroeconomic variables of national saving, domestic investment, net foreign investment, and net exports. THE REAL EQUILIBRIUM IN AN OPEN ECONOMY (a) The Market for Loanable Funds Real Interest Rate (b) Net Capital Outflow Real Interest Rate Supply r r Demand Net capital outflow, NCO Quantity of Loanable Funds Net Capital Outflow Real Exchange Rate Supply E Demand Quantity of Dollars (c) The Market for Foreign-Currency Exchange HOW POLICIES AND EVENTS AFFECT AN OPEN ECONOMY The magnitude and variation in important macroeconomic variables depend on the following: Government budget deficits Trade policies Political and economic stability GOVERNMENT BUDGET DEFICITS In an open economy, government budget deficits Reduce the supply of loanable funds, Drive up the interest rate, Crowd out domestic investment, Cause net capital outflow to fall, Increase the real exchange rate, Reduce the net exports. THE EFFECTS OF GOVERNMENT BUDGET DEFICIT (a) The Market for Loanable Funds Real Interest Rate r2 S 1. A budget deficit reduces (b) Net Capital Outflow the supply of loanable funds . . . Real Interest Rate S B r2 A r 2. . . . which increases the real interest rate . . . r 3. . . . which in turn reduces net capital outflow. Demand NCO Quantity of Loanable Funds Net Capital Outflow Real Exchange Rate E2 E1 5. . . . which causes the real exchange rate to appreciate. S S 4. The decrease in net capital outflow reduces the supply of dollars to be exchanged into foreign currency . . . Demand Quantity of Dollars (c) The Market for Foreign-Currency Exchange TRADE POLICY A trade policy is a government policy that directly influences the quantity of goods and services that a country imports or exports. Tariff: A tax on an imported good. Import quota: A limit on the quantity of a good produced abroad and sold domestically. EFFECT OF AN IMPORT QUOTA The impose of import quota leads to An increase in net exports, A rise in the real exchange rate, Domestic goods become relatively more expensive that encourages imports and discourages exports, The fall in net exports offsets the initial increase in it that leads net exports unchanged. THE EFFECTS OF AN IMPORT QUOTA (a) The Market for Loanable Funds Real Interest Rate (b) Net Capital Outflow Real Interest Rate Supply r r 3. Net exports, however, remain the same. Demand NCO Quantity of Loanable Funds Net Capital Outflow Real Exchange Rate E2 2. . . . and causes the real exchange rate to appreciate. Supply 1. An import quota increases the demand for dollars . . . E D D Quantity of Dollars (c) The Market for Foreign-Currency Exchange POLITICAL INSTABILITY AND CAPITAL FLIGHT Capital flight is a large and sudden reduction in the demand for assets located in a country. Capital flight has its largest impact on the country from which the capital is fleeing, but it also affects other countries. If investors become concerned about the safety of their investments, capital can quickly leave an economy. Interest rates increase and the domestic currency depreciates. THE EFFECTS OF CAPITAL FLIGHT (a) The Market for Loanable Funds in Mexico Real Interest Rate (b) Mexican Net Capital Outflow Real Interest Rate Supply r2 r2 r1 r1 3. . . . which increases the interest rate. 1. An increase in net capital outflow. . . D2 D1 NCO1 Quantity of 2. . . . increases the demand Loanable Funds for loanable funds . . . NCO2 Net Capital Outflow Real Exchange Rate E 5. . . . which causes the peso to depreciate. S S2 4. At the same time, the increase in net capital outflow increases the supply of pesos . . . E Demand Quantity of Pesos (c) The Market for Foreign-Currency Exchange