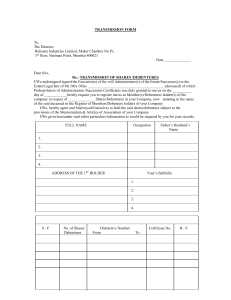

FINANCIAL ACCOUNTING AND ANALYSIS Name : Kingsley Chapwanya Student Id: 2124/463485 Unit Reference Number : R/617/6015 Submission Date : 11 June 2023 FUNDAMETALS OF ACCOUNTING According to Schroeder, (2022) the core principles of accounting cover record keeping, which is its main purpose. it is mainly used for information recovery when needed, a firm must employ industry-standard methods of storing and maintaining data. For all transaction-related objectives, complete and accurate record storage is crucial. The documentation of the various transactions that take place within the company is the first and greatest goal of accounting. The process of identifying transactions and establishing them as records is known as bookkeeping, and it also goes by this name. The recording part is the sole item that bookkeeping takes into account. For the purpose of recording, accounting keeps a few books. A methodical approach is used to maintaining the technique. WHAT IS ACCOUNTING cronym ALOE is fundamental to accounting. The term ALOE is crucial to the field of accounting and our hension of what it means to be an accountant( Lev,2018). This is what the abbreviation "A-L-O-E" stands for. Assets Liabilities - Owner’s Equity s one of the fundamental ideas in accounting. The equation is as follows: ities + Owner's Equity equals Assets s: The things that you own and are considered to be your assets (Weber,2021), these then have a "value" and ca you with cash in return for it. A few examples of assets are a car, a house, . ilities: Everything that the business has is a liability. Even a bank loan that a business obtains to purchase any k a liability. r's Equity is the total sum of money that a person (or anyone) invests in a business. The investment made need be monetary. They may also be in the shape of stocks. . OBJECTIVES OF ACCOUNTING ord keeping ounting is the spoken language of transactions, (Wahlen,2022). The human brain capacity is limited. Therefore, accounting the responsibility of maintaining the records of all business transactions within a company. and Loss its directly correlate with business. Profits are the only thing that matter. The business's financial performance is shown on th nting chart of profit and loss. Profit and loss are determined by income and expenses. of resources ources are a vital component of any organization, and they are essential to the efficient operation of any business. The record duty to inform the company about the various operations and their timing. As a result, it is simple for management to pay on to the specifics before investing the funds. cial Position Estimation ganization needs to know not only how much money his company makes and loses, but also how much money it owes to its ors and how much it must pay to its debtors (Weygandt,2019). He drafts a statement with all of these data recorded for this e. The balance sheet is the name of this declaration. . The financial status of the company can be understood with the use of e sheet. ates Decision-Making ons can be made using all the information from the records that have been kept by adhering to accounting procedures, which tely aids in the organization's efficient operation. THE RELATIONSHIP BETWEEN ACCOUNTING AND OTHER BUSINESS FUNCTION collaborating with purchasing departments : The purchasing department is entrusted with informing the accounting department of any products acquired or returned, as well as sending copies of purchase orders and validating the legitimacy of invoices submitted by suppliers. Every time an invoice is paid, the accounting team notifies the purchasing department. sales and marketing departments coordination: The sales team must transmit copies of sales orders as well as confirmations of products delivered to clients in order for the receivables ledger segment to function. Information about received payments is communicated by the accounting team. coordinating with the debt collecting team :The accounting team creates monthly statements and a list of past-due accounts. Interdepartmental coordination in the finance department : The management accounting team may provide information about inventory records to the financial accounting team so that they may value closing inventories.According to( Bengtsson,2021) The financial accounting team is in charge of generating financial accounts.. SHARES According to (Waldenström,2018) units of equity ownership in a firm are called shares. For some organisations, shares are a form of financial property that guarantee an equitable dividend distribution of any declared residual earnings. A company that does not pay dividends do not distribute its income to its shareholders. The two main forms of shares are equity shares and preference shares. Equity shares give their owners the right to vote at the company's AGMs and a share of the company's profits. Such a shareholder is obligated to share in the company's gains and losses. Preference shares, on the other hand, solely grant their holders fixed dividends with no voting rights. The true proprietors of the corporation are known as equity stockholders. The primary market is where the corporation first offers its shares for sale directly to the public; meanwhile, the secondary market is where shares are traded. SHARE CAPITAL hare capital he money raised by the sale of preferred or common stock is referred to as a company's share arabarbounis,2018). The highest amount that a company has been permitted to raise through a public offe own as authorized share capital. If a firm wants to raise the share capital on its balance sheet, it may decide to esh offer of stock. A firm can raise share capital by issuing preferred or common stock. With further public offerings, a company's ancing or share capital may alter over time .The maximum amount a corporation may raise during a public offe authorized share capital, though it can raise additional funds by making more shares available. These sales' re accounted for as "additional paid-in capital." This sum represents the actual cost of purchasing the shares. he two most popular categories of share capital are registered and authorized, however there are numerous oth JOINT-STOCK COMPANY nt-Stock Company is co-owned by its stockholders. The amount of stocks a shareholder owns determines their o ge. Only to the degree of their stake are they accountable. Additionally, there are no limitations on the transfer of ders.A corporation uses this structure to raise a lot of money by issuing shares and debentures to the gene OVA,2022). These organizations have a corporate-like structure but also enjoy the benefits of limited liability . its of a Joint Stock Company embers' restricted liability of a joint stock corporation is one of its main attractions. Their responsibility is only cap ing balance on their shares. are urged to participate in joint stock enterprises since their personal money is secure. vantages of a Joint Stock Company int stock company's complex and drawn-out establishment process is one of its drawbacks. This is both time-consumin nsive, taking up to several weeks. public firms are required by the firms Act of 2013 to give the registrar access to their financial records and other pertin rs. Therefore, these records are open to public access and are considered public documents. This results in the corpora ng no confidentiality at all. ntSHARES ures AND DEBENTURES OVERVIEW Overview Shares and Debentures Overview In order to raise cash for businesses, shares and debentures are both financial instruments that can be sold to investors. Their main distinction is that shares are owned by shareholders, whereas debentures are loans made by investors to the debenture issuer. According to (Kimmel,2020) Shares signify a portion of ownership in a company, whereas debentures are financial instruments that have a fixed rate of interest that is paid over a predetermined length of time. Owners of shares have a say in corporate decisions, are entitled to dividends when announced, and share in the company's profits. Debentures typically do not have voting rights or dividends, but they do continue to pay regular coupon payments until they mature. DIFFERENCE BETWEEN ISSUING SHARES AND DEBENTURES rganization can raise capital by issuing shares. Debentures are one type of long-term financing that a b ain. Debentures are loan instruments, not equity instruments, and they represent a loan that the compan with interest accruing at a specified rate. is the main distinction between issuing debentures and shares. Shares, on the other hand, stand for ow and voting privileges. Holders of debentures are the company's creditors, but its shares are its owners. s money and creates a liability when it issues debentures. m sells ownership interests when it offers shares, thus it is not liable. To sum up, a company's two p of outside funding are shares and debentures. s allow investors access to liquidity, transferability, and limited liability as well as representing a por hip in a corporation (Freedeman, 2019) . ntures are debt securities that corporations issue to raise money from investors to fund their operations. Ty an understanding that the debt will be repaid at a later time, along with interest payments.Investors should we s and dangers of both types of investments before making a choice. e investing their money in either shares or debentures, investors should be aware of the distinctions between th investor must ultimately determine which financial instrument best meets their interests and level of risk tolera REFERENCEE LIST der, R. G., Clark, M. W., & Cathey, J. M. (2022). Financial accounting theory and analysis: text and cases. John Wiley & Sons. (2018). The deteriorating usefulness of financial report information and how to reverse it. Accounting and Business Research, 48(5), 465-493. . R. I. I. (2020). A fundamental reshaping of finance. nsen, H. B., Hail, L., & Leuz, C. (2019). Adoption of CSR and sustainability reporting standards: Economic analysis and review. , J. M., Baginski, S. P., & Bradshaw, M. (2022). Financial reporting, financial statement analysis and valuation. Cengage learning. um, D. O., Piechocki, M., & Weber, C. (2021). Is there a conflict between principles-based standard setting and structured electronic reporting Available at SSRN 3837235. ndt, J. J., Kimmel, P. D., & Kieso, D. E. (2018). Financial Accounting with International Financial Reporting Standards. John Wiley & Sons. on, E., & Waldenström, D. (2018). Capital shares and income inequality: Evidence from the long run. The Journal of Economic History, 78(3 rbounis, L., & Neiman, B. (2019). Accounting for factorless income. NBER Macroeconomics Annual, 33(1), 167-228. ., Signer, J., & Fieberg, J. (2020). Accounting for individual‐specific variation in habitat‐selection studies: Efficient estimation of mixed‐effect ing Bayesian or frequentist computation. Journal of Animal Ecology, 89(1), 80-92. el, P. D., Weygandt, J. J., & Kieso, D. E. (2020). Financial accounting: tools for business decision-making. John Wiley & Sons. OVA, G. (2022). Female Entrepreneurs as Board Directors of the Largest Russian Joint‐Stock Companies, 1870–1900. The Russian Review, 8 nov, S. (2020). World Experience of Stock Exchange Operations. Архив научных исследований, 33(1). man, C. E. (2018). Joint-stock enterprise in France, 1807-1867: from privileged company to modern corporation. UNC Press Books.

![THE COMPANIES ORDINANCE, 1984 [Section 82]](http://s2.studylib.net/store/data/015174202_1-c77c36ae791dae9b4c11c6213c9c75e5-300x300.png)