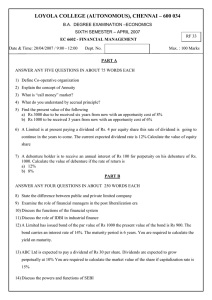

LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034

LOYOLA COLLEGE (AUTONOMOUS), CHENNAI – 600 034

B.A. DEGREE EXAMINATION –ECONOMICS

SUPPLEMENTARY EXAMINATION – JUNE 2007

EC 6602 - FINANCIAL MANAGEMENT

Date & Time: 26/06/2007 / 1:00 - 4:00 Dept. No. Max. : 100 Marks

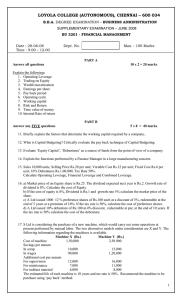

PART A

ANSWER ANY FIVE QUESTIONS IN ABOUT 75 WORDS EACH

1.

Define Cost of capital

2.

What are the components of Financial system?

3.

Explain the term Financial management

4.

Define Sole proprietorship

5.

Calculate the yield on debenture of Rs. 1000 having a current market value of Rs 800 and carrying interest rate at 10% p@

6.

A person is required to pay four equal annual payments of Rs 5,000 each in his deposit account that pays 8% interest per year. Find out the future value of annuity at the end of 4 years

7.

State the assumptions of dividend capitalization approach

PART B

ANSWER ANY FOUR QUESTIONS IN ABOUT 250 WORDS EACH

8.

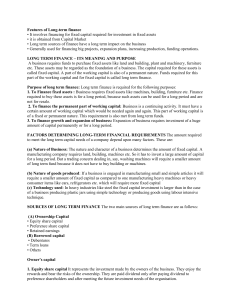

Discuss the indicators of financial Development

9.

Explain the Equilibrium in financial markets

10.

Discuss the salient features of Corporate income Tax

11.

Highlight the New Industrial Policy 1991

12.

A debenture of Rs 1000 carries a coupon rate of 13% the required rate of return is 15% Calculate the value of debenture if a) The period of maturity is 8 years b) The period of maturity is 7 years

13.

Mr. C holds an equity share giving him an annual dividend of Rs 20. He expects to sell the share for Rs 180 at the end of a year. Calculate the value of the share if the required rate of return is 12%

14.

A company offers for public subscription equity shares of Rs.10 each at a premium of 10%. The company pays 5% of the issue price as underwriting commission. The rate of dividend expected by the equity shareholders is 20%

You are required to calculate the cost of equity capital

Will your cost of capital be different if it is calculated on the present market value of the equity shares, which is Rs.16?

PART C

ANSWER ANY TWO QUESTIONS IN ABOUT 900WORDS EACH

15.

Discuss various forms of Organization

16.

Elucidate the role of financial institutions in fostering industrial growth through industrial finance.

17.

A company raised preference share capital of Rs. 1, 00,000 by an issue of Rs 10% preference shares of Rs 10 each. Calculate the cost of preference share capital when they are issued at (i) at par (ii) a 10%

Premium(iii) 10% discount b) if brokerage is paid at 4% what will be the debentures if

Issue is at premium and discount.

18.

a) A firm issues debentures of Rs 1, 00,000 and allowing2% commission to brokers. The debentures carry an interest rate of 10%. The debentures are due for maturity at the end of the 10 th

year. You are required to calculate the effective cost of debt after tax.[If the tax bracket is 55%] b) Briefly explain the features of debentures and preference shares.

*************

2