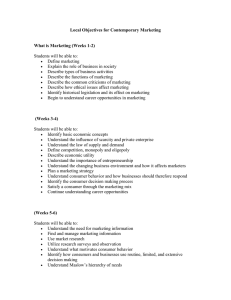

kenneth-c.-laudon-carol-traver-e-commerce-2016 -business-technology-society-2016-pearson

advertisement