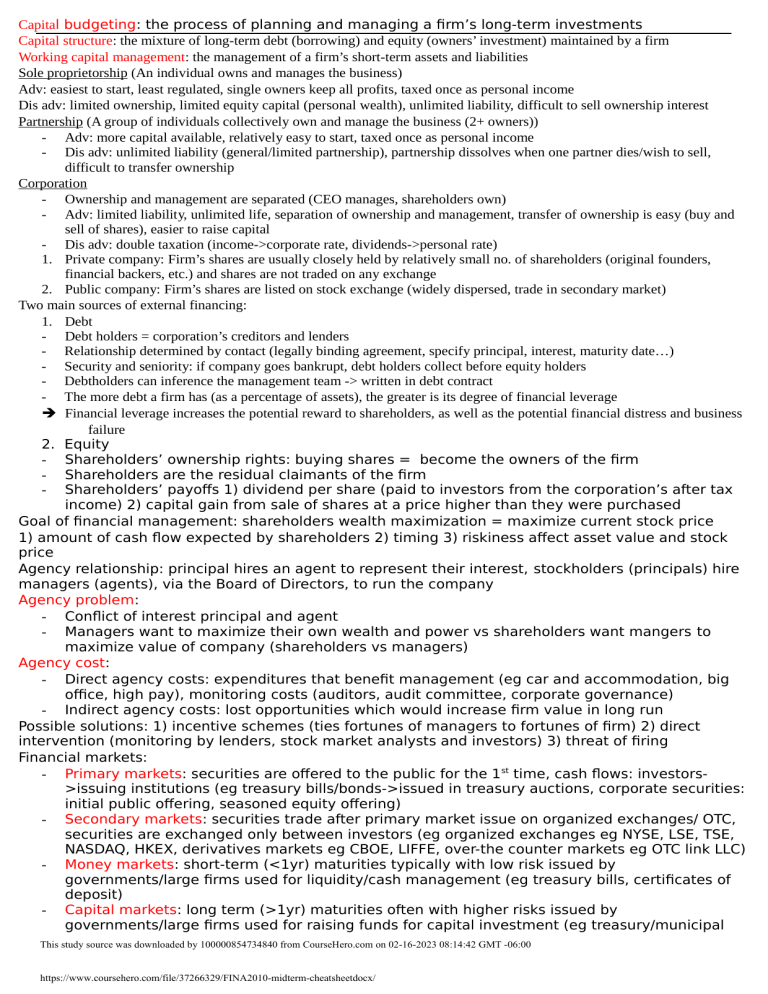

Capital budgeting: the process of planning and managing a firm’s long-term investments Capital structure: the mixture of long-term debt (borrowing) and equity (owners’ investment) maintained by a firm Working capital management: the management of a firm’s short-term assets and liabilities Sole proprietorship (An individual owns and manages the business) Adv: easiest to start, least regulated, single owners keep all profits, taxed once as personal income Dis adv: limited ownership, limited equity capital (personal wealth), unlimited liability, difficult to sell ownership interest Partnership (A group of individuals collectively own and manage the business (2+ owners)) - Adv: more capital available, relatively easy to start, taxed once as personal income - Dis adv: unlimited liability (general/limited partnership), partnership dissolves when one partner dies/wish to sell, difficult to transfer ownership Corporation - Ownership and management are separated (CEO manages, shareholders own) - Adv: limited liability, unlimited life, separation of ownership and management, transfer of ownership is easy (buy and sell of shares), easier to raise capital - Dis adv: double taxation (income->corporate rate, dividends->personal rate) 1. Private company: Firm’s shares are usually closely held by relatively small no. of shareholders (original founders, financial backers, etc.) and shares are not traded on any exchange 2. Public company: Firm’s shares are listed on stock exchange (widely dispersed, trade in secondary market) Two main sources of external financing: 1. Debt - Debt holders = corporation’s creditors and lenders - Relationship determined by contact (legally binding agreement, specify principal, interest, maturity date…) - Security and seniority: if company goes bankrupt, debt holders collect before equity holders - Debtholders can inference the management team -> written in debt contract - The more debt a firm has (as a percentage of assets), the greater is its degree of financial leverage Financial leverage increases the potential reward to shareholders, as well as the potential financial distress and business failure 2. Equity - Shareholders’ ownership rights: buying shares = become the owners of the firm - Shareholders are the residual claimants of the firm - Shareholders’ payoffs 1) dividend per share (paid to investors from the corporation’s after tax income) 2) capital gain from sale of shares at a price higher than they were purchased Goal of financial management: shareholders wealth maximization = maximize current stock price 1) amount of cash flow expected by shareholders 2) timing 3) riskiness affect asset value and stock price Agency relationship: principal hires an agent to represent their interest, stockholders (principals) hire managers (agents), via the Board of Directors, to run the company Agency problem: - Conflict of interest principal and agent - Managers want to maximize their own wealth and power vs shareholders want mangers to maximize value of company (shareholders vs managers) Agency cost: - Direct agency costs: expenditures that benefit management (eg car and accommodation, big office, high pay), monitoring costs (auditors, audit committee, corporate governance) - Indirect agency costs: lost opportunities which would increase firm value in long run Possible solutions: 1) incentive schemes (ties fortunes of managers to fortunes of firm) 2) direct intervention (monitoring by lenders, stock market analysts and investors) 3) threat of firing Financial markets: - Primary markets: securities are offered to the public for the 1 st time, cash flows: investors>issuing institutions (eg treasury bills/bonds->issued in treasury auctions, corporate securities: initial public offering, seasoned equity offering) - Secondary markets: securities trade after primary market issue on organized exchanges/ OTC, securities are exchanged only between investors (eg organized exchanges eg NYSE, LSE, TSE, NASDAQ, HKEX, derivatives markets eg CBOE, LIFFE, over-the counter markets eg OTC link LLC) - Money markets: short-term (<1yr) maturities typically with low risk issued by governments/large firms used for liquidity/cash management (eg treasury bills, certificates of deposit) - Capital markets: long term (>1yr) maturities often with higher risks issued by governments/large firms used for raising funds for capital investment (eg treasury/municipal This study source was downloaded by 100000854734840 from CourseHero.com on 02-16-2023 08:14:42 GMT -06:00 https://www.coursehero.com/file/37266329/FINA2010-midterm-cheatsheetdocx/ bonds, equity, corporate bonds) Market value vs book value: book value = provided in balance sheet, market value = price that assets, lia, equity can actually be bought/sold = stock price x shares outstanding - Balance sheet shows historical costs - Book value can be > market value: market has lost confidence in ability of company’s assets to generate future profits and cash flows - Book value can be < market value: market has faith in the earning power of company’s assets - **marketing value is more important to decision-making process Income statement: any interest payments are deducted from Earnings Before Interests and Taxes (EBIT) before the calculation of Taxes (Interest tax shield) & dividend payments not tax deductible Earnings per share = Net income/Total shares outstanding Return on equity = Net income/Total equity Time value of $: today > same amount of money received after a certain period ∵uncertainty and loss, to stratify present need, existing investment opportunity Interest rate = discount rate = opportunity cost of capital = required rate of return Simple interest: 𝐹𝐹 = 𝐹𝐹 + 𝐹 × 𝐹 × 𝐹(accrual period) (interest) Compound interest: 𝐹𝐹 = 𝐹𝐹 × (1+𝐹)� Multiple compounding: 𝐹𝐹 = 𝐹𝐹 × (1+r/N)N×T (N=frequency) Continuous compounding: FV = PV × lim(N->∞) (1+r/N)N×T FV = PV × e-r×T PV = FV × e-r×T r = 1/T × In(FV/PV) Discounting: PV = FV × 1/(1+r/N)N×T Multiple cash flow assumption: 1) cash flows occur at the end of each period 2) we are at time 0 Annuity-finite series of equal payments that occur at regular intervals Ordinary annuity: 1st payment occurs at the end of period / Annuity due: 1st payment occurs at the beginning Perpetuity: infinite series of equal payments / Growing perpetuity: infinite series of payments grow at rate g PV for ordinary annuity = C × 1/r [1-1/(1+r)t] (if not paid annually, r/N and t/N) FV for ordinary annuity = C × [(1+r)t-1]/r PV for annuity due = PV for ordinary annuity × (1+r) / FV for annuity due = FV for ordinary annuity × (1+r) PV for perpetuity = C × 1/r / PV for growing perpetuity = C × 1/(r-g) Annual percentage rate (APR) is the quoted rate ≠ actual interest in 1 yr = period rate × number of periods per year Effective annual rate (EAR) is actual rate paid/received = (1+APR/N) N – 1 Bond: fixed-income investments (less risky than stock) -> obligated to repay debt Face value/par value; principal amount of loan to be repaid / Coupon: stated interest payments at specified dates Maturity: no. of years until face value is paid / Coupon bond: P0 for the bond = value of bond / at maturity, receive last coupon C + face value F / Coupon rate = stated annual interest rate / Coupon amount (C) = R/N × F Bone value today = PV of coupons + PV of par value = 1/r [1-1/(1+r)t] × C + 1/(1+r)t × F (inversely related to level interest rates required in market) Yield to maturity = yield = market interest rate = interest rates required in market -> measure of the average rate of return will earn over the bond’s life if hold it to maturity (coupon rate > YTM) bond sells for < face value = discount bond (coupon rate < YTM) / bond sells for > face value = premium bond Zero-coupon bonds = no coupon payments are made during the bond’s lifetime->interest = diff between PV 0 & F P0 = F/(1+y/2)T×2 Bond risks: 1) Interest rate risk: change in investment's value ∵change in the level of market interest rate (longer time to maturity, greater IR risk/greater coupon rate-> lower IR risk) Bond rate of return = (coupon income + price change)/investment Bond prices fall when market interest rates rise 2) Default risk (eg corporate bonds (large corporations for LT borrowing-> credit risk: hard times and cannot repay debts, owner bears risk that issuing firm may default) Value of stock = PV of dividends + PV of sales of shares P0 = D1/(1+r)1 + D2/(1+r)2 + … Dividend: not required to pay, not liability, not tax deductible Special cases in estimating dividends: 1) constant dividend P0 = D/r (or r/N) 2) constant dividend growth (grow at constant rate) P0 = D1/(r-g) (D1 = D0 × (1+g)) if cal stock price growth: eg P4 = P0 × (1+G)4 **limitation: need r>g 3) non-constant dividend growth/supernormal growth-> stock is expected to have higher than normal growth in dividend payments for some period in the future r = D1/P0 + g D1/P0 = dividend yield g = capital gains yield Market orders: no price indication (trade a quantity at best price currently available in market) Pro: quick / Con: may get worse price (pay bid-ask spread) Limit orders: price indication (trade at best price available if it is no worse than specified limit price) Pro: may get good price for trade / Con: execution risk Execution sequence: limit orders offering best prices 1 st, for limit orders at same price, follow submission order This study source was downloaded by 100000854734840 from CourseHero.com on 02-16-2023 08:14:42 GMT -06:00 https://www.coursehero.com/file/37266329/FINA2010-midterm-cheatsheetdocx/ Bond market: over-the-counter (OTC) market: customers place orders with dealers Stock Market: Centralized, Transparent, Standardized securities (all shares are identical and no diff in value) Bond Market: Decentralized, Less transparent, Non-standardized securities (diff bonds have diff maturity & coupon rate) This study source was downloaded by 100000854734840 from CourseHero.com on 02-16-2023 08:14:42 GMT -06:00 https://www.coursehero.com/file/37266329/FINA2010-midterm-cheatsheetdocx/ Powered by TCPDF (www.tcpdf.org)