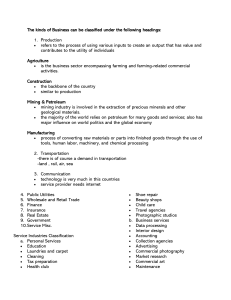

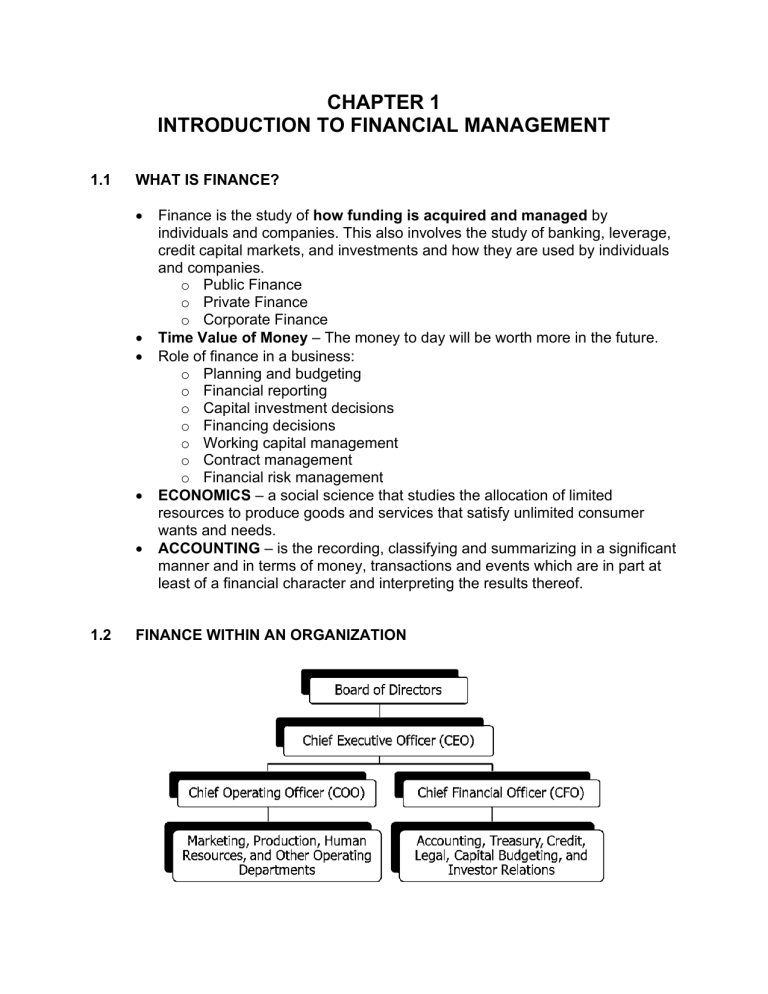

CHAPTER 1 INTRODUCTION TO FINANCIAL MANAGEMENT 1.1 WHAT IS FINANCE? • • • • • 1.2 Finance is the study of how funding is acquired and managed by individuals and companies. This also involves the study of banking, leverage, credit capital markets, and investments and how they are used by individuals and companies. o Public Finance o Private Finance o Corporate Finance Time Value of Money – The money to day will be worth more in the future. Role of finance in a business: o Planning and budgeting o Financial reporting o Capital investment decisions o Financing decisions o Working capital management o Contract management o Financial risk management ECONOMICS – a social science that studies the allocation of limited resources to produce goods and services that satisfy unlimited consumer wants and needs. ACCOUNTING – is the recording, classifying and summarizing in a significant manner and in terms of money, transactions and events which are in part at least of a financial character and interpreting the results thereof. FINANCE WITHIN AN ORGANIZATION 1. Board of Directors • Top-governing body • Chairperson – highest ranking individual 2. Chief Executive Officer (CEO) • May also be the Chairperson of the board 3. Chief Operating Officer (COO) • Firm’s president 4. Chief Financial Officer (CFO) • Senior Vice President • Sarbanes-Oxley Act – a law passed by the Congress that requires the CEO and CFO to certify that their firm’s financial statements are accurate. 1.3 FORMS OF BUSINESS ORGANIZATIONS PROPRIERTERSHIPS An unincorporated business owned by one individual PROPRIERTERSHIPS ADVANTGES: ➢ Ease of information ➢ Subject to fewer regulations ➢ No corporate income taxes ➢ Less expensive to setup DISADVANTAGES: ➢ Unlimited liability ➢ Difficult to raise capital ➢ Limited life PARTNERSHIPS .An incorporated business owned by two or more persons. Some partners may have different rights, privileges, and responsibilities than other partners. CORPORATIONS A legal entity created by a state, separate and distinct from its owners and manage, having unlimited life, easy transferability of ownership, and limited liability. PARTNERSHIPS CORPORATIONS ADVANTGES: ADVANTGES: ➢ Ease of information ➢ Unlimited life ➢ Subject to fewer ➢ Easier transfer of regulations ownership ➢ No corporate ➢ Limited liability income taxes ➢ Greater ability to ➢ Less expensive to acquire funds setup ➢ Legal capacity to act as a legal entity DISADVANTAGES: DISADVANTAGES: ➢ Easily dissolved ➢ Double taxation when a partner ➢ Cost of setup and withdraws or dies. report filing ➢ Mutual agency and ➢ Subject to heavier unlimited liability. taxation ➢ Limited life 1.4 BALANCING SHARHOLDER VALUE AND THE INTERESTS OF SOCIETY • • 1.5 The primary financial goal of management is shareholder’s wealth maximization which translates to maximizing stock price. o Value if any asset is the present value of cash flow stream to owners.. o Most significant decisions are evaluated in terms of their financial consequences. o Stock prices change and as investors obtain new information about a company’s prospects. Managers recognize that being socially responsible is not inconsistent with maximizing shareholder value. INTRINSIC VALUES, STOCK PRICES, AND EXECUTIVE CONMPENSATION • • • • • • • Intrinsic value o Is a long-run concept – maximize the firm’s intrinsic value not the current market price. o An estimate of a stock’s ‘true’ value based in accurate risk and return data. o Can be estimated but not measured precisely. Market price o The stock value based on perceived but possibly incorrect information as seen by the marginal investor. Marginal Investor o Determines the actual stock price In equilibrium, a stock’s price should equal its “true” or intrinsic value. To the extent that investor perceptions are incorrect, a stock’s price in the short run may deviate from its intrinsic value. Ideally, managers should avoid actions that reduce intrinsic value, even if those decisions increase the stock price in the short run. Determinants of Intrinsic Values and Stock Prices ✓ If the market price is above the stock’s intrinsic value, then the stock is overvalued and should be sold. ✓ If the market price is below the stock’s intrinsic value, then the stock is undervalued and should be a good buy. 1.6 IMPORTANT BUSINESS TRENDS • • • • 1.7 Recent corporate scandals have reinforced the importance of business ethics, and have spurred additional regulations and corporate oversight. Increased globalization of business. The effects of ever-improving information technology have had a profound effect on all aspects of business finance. Corporate governance – the way the top managers operate and interface with stockholders. – active investors are able to vote out underperforming managers BUSINESS ETHICS • All employees, whether top managerial employees or mid ranking to lowranking employees, are liable for any unethical behaviors that they may decide to commit for their own benefit or even if they are orders from their supervisors. 1.8 CONFLICTS BETWWEN MANAGERS, STOCKHOLDERS, AND BONDHOLDERS 1. Managers vs Stockholder • The role of the managers is to maximize the average price of the stock’s intrinsic value over the long run. The stock’s intrinsic value should be close to the actual stock price. • • However, managers are naturally inclined to act in their own best interests (which are not always the same as the interest of stockholders). They may opt to maximize the price on a specific day or period where they will benefit most. The following factors affect managerial behavior: o Managerial compensation packages o Direct intervention by shareholders o The threat of firing o The threat of takeover 2. Stockholders vs Bondholders Stockholders Bondholders ➢ Stockholders are more likely to ➢ Bondholders receive fixed prefer riskier projects, because payments regardless of they receive more of the upside if company’s performance and are the project succeeds. more interested in limiting risk since there is a possibility that they will lose more than stockholders. ➢ Bondholders are particularly concerned about the use of additional debt. ➢ Bondholders attempt to protect themselves by including covenants in bond agreements that limit the use of additional debt and constrain managers’ actions.