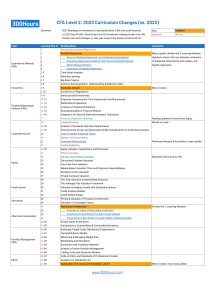

CFA Level 2: 2024 Curriculum Changes (vs. 2023) Summary: - 2024's L2 curriculum is largely similar to 2023's. New Updated - L2 2024 has 47 LMs: 3 LMs removed and 1 added vs 2023. Removed Moved - Overall, not much changes vs. 2023 except a chapter in FSA, Equity and Alt Investment. Topic Quantitative Methods (QM) Economics Financial Statement Analysis (FSA) Corporate Issuers Equity Fixed Income Derivatives Alternative Investments Portfolio Management (PM) Ethics Learning Mod. # Reading Name 1 Basics of Multiple Regression and Underlying Assumptions Comments 2 Evaluating Regression Model Fit and Interpreting Model Results 3 Model Misspecification 4 Extensions of Multiple Regression 5 Time-Series Analysis 6 Machine Learning 7 Big Data Projects 8 Currency Exchange Rates: Understanding Equilibrium Value 9 Economic Growth 10 Economics of Regulations 11 Intercorporate Investments 12 Employee Compensation: Post Employment and Share-based 13 Multinational Operations 14 Analysis of Financial Institutions 15 Evaluating Quality of Financial Reports 16 Integration of Financial Statement Analysis Techniques 17 Financial Statement Modeling 18 Analysis of Dividends and Share Repurchases 19 Environmental, Social, and Governance (ESG) Considerations in Investment Analysis 20 Cost of Capital: Advanced Topics 21 Corporate Restructuring 22 Equity Valuation: Applications and Processes 23 Discounted Dividend Valuation 24 Free Cash Flow Valuation 25 Market-Based Valuation: Price and Enterprise Value Multiples 26 Residual Income Valuation 27 Private Company Valuation 28 The Term Structure & Interest Rate Dynamics 29 The Arbitrage Free Valuation Framework 30 Valuation & Analysis of Bonds with Embedded Options 31 Credit Analysis Models 32 Credit Default Swaps 33 Pricing & Valuation of Forward Commitments 34 Valuation of Contingent Claims 39 35 Introduction to Commodities & Commodity Derivatives 35 36 Overview of Types of Real Estate Investment 36 Investment in Real Estate Through Private Vehicles 37 Investments in Real Estate Through Publicly Traded Securities 38 Private Equity Investments 38 Hedge Fund Strategies 40 39 Exchange-Traded Funds: Mechanics & Applications 41 40 Using Multifactor Models 42 41 Measuring & Managing Market Risk 43 42 Backtesting and Simulation 44 43 Economics and Investment Markets 45 44 Analysis of Active Portfolio Management 46 Trading Costs and Electronic Markets 47 45 Code of Ethics and Standards of Professional Conduct 48 46 Guidance for Standards I-VII 49 47 Application of the Code and Standards: Level II Major revision: all LOS changed, 1 added. Major revision: 1 LOS removed, 4 updated. www.300Hours.com

![FORM 0-12 [See rule of Schedule III]](http://s2.studylib.net/store/data/016947431_1-7cec8d25909fd4c03ae79ab6cc412f8e-300x300.png)