A consolidated Version of the Workers' Rights Act 2019 as at 5 August 2021

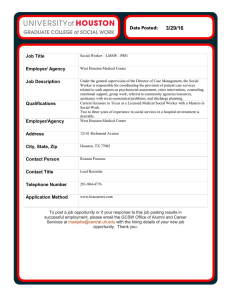

advertisement