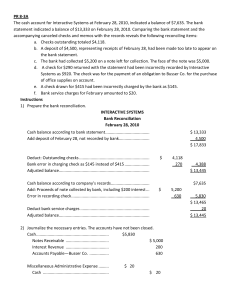

lOMoARcPSD|24189335 BANK Reconciliation TEST BANK Bachelor of science civil engineering (University of Cebu) Studocu is not sponsored or endorsed by any college or university Downloaded by Scarlett Catalyst (scarlettcatalyst22@gmail.com) lOMoARcPSD|24189335 Junior Philippine Institute of Accountants University of Cebu – Banilad Chapter BANK RECONCILIATION TEST BANK I. True or False _____1. A debit balance in Bank account in the Cash book appears as a credit balance in the Bank statement. _____2. A Bank reconciliation statement is not part of the double entry system. _____3. An overdraft in the bank statement is included in the balance sheet as a current asset. _____4. If the bank reconciliation starts with a debit balance from the Bank account in the Cash book the bank charges appearing in the Bank statement would be added. _____5. A credit entry in pass book means a credit entry in cash book. _____6. A reconciliation statement is prepared because the Bank account in the cash book is always correct and the bank statement is not. _____7. Bank Reconciliation Statement is a statement prepared by a bank. _____8. Cheques deposited in to bank are recorded on debit side of the bank column of Cash book. _____9. Direct deposits in the bank by a customer would increase the balance shown by the pass book. _____10. Savings account is an account where a passbook is required in making deposits and withdrawals. Downloaded by Scarlett Catalyst (scarlettcatalyst22@gmail.com) lOMoARcPSD|24189335 II. Multiple Choice 1. Which of the following is an appropriate reconciling item to the balance per bank in a bank reconciliation? a. Bank service charge. b. Deposit in transit. c. Bank interest. d. Chargeback for NSF check. 2. The journal entries for a bank reconciliation a. b. c. d. are taken from the "balance per bank" section only. may include a debit to Office Expense for bank service charges. may include a credit to Accounts Receivable for an NSF check. may include a debit to Accounts Payable for an NSF check. 3. When preparing a bank reconciliation, bank credits are a. b. c. d. added to the bank statement balance. deducted from the bank statement balance. added to the balance per books. deducted from the balance per books. 4. If the month-end bank statement shows a balance of $72,000, outstanding checks are $24,000, a deposit of $8,000 was in transit at month end, and a check for $1,000 was erroneously charged by the bank against the account, the correct balance in the bank account at month end is a. $55,000. b. $57,000. c. $41,000. d. $87,000. 5. In preparing its bank reconciliation for the month of April 2012, Henke, Inc. has available the following information. Balance per bank statement, 4/30/12 NSF check returned with 4/30/12 bank statement Deposits in transit, 4/30/12 Outstanding checks, 4/30/ Bank service charges for April What should be the correct balance of cash at April 30, 2012? a. $34,370 b. $33,940 Downloaded by Scarlett Catalyst (scarlettcatalyst22@gmail.com) $34,140 450 5,000 125,200 20 lOMoARcPSD|24189335 c. d. $33,490 $33,470 6. Finley, Inc.’s checkbook balance on December 31, 2012 was $42,400. In addition, Finley held the following items in its safe on December 31. (1) A check for $900 from Peters, Inc. received December 30, 2012, which was not included in the checkbook balance. (2) An NSF check from Garner Company in the amount of $1,800 that had been deposited at the bank, but was returned for lack of sufficient funds on December 29. The check was to be redeposited on January 3, 2013. The original deposit has been included in the December 31 checkbook balance. (3) Coin and currency on hand amounted to $2,900. The proper amount to be reported on Finley's balance sheet for cash at December 31, 2012 is a. $42,600. b. $40,800. c. $44,400. d. $43,550. 7. The cash account shows a balance of $90,000 before reconciliation. The bank statement does not include a deposit of $4,600 made on the last day of the month. The bank statement shows a collection by the bank of $1,880 and a customer's check for $640 was returned because it was NSF. A customer's check for $900 was recorded on the books as $1,080, and a check written for $158 was recorded as $194. The correct balance in the cash account was a. $91,024. b. $91,096. c. $91,456. d. $95,696. 8. In preparing its May 31, 2012 bank reconciliation, Catt Co. has the following information available: Balance per bank statement, 5/31/12 Deposit in transit, 5/31/12 Outstanding checks, 5/31/12 Note collected by bank in May $35,000 5,400 4,900 1,250 The correct balance of cash at May 31, 2012 is a. $40,400. b. $34,250. Downloaded by Scarlett Catalyst (scarlettcatalyst22@gmail.com) lOMoARcPSD|24189335 c. d. $35,500. $36,750. 9. In preparing its August 31, 2012 bank reconciliation, Bing Corp. has available the following information: Balance per bank statement, 8/31/12 Deposit in transit, 8/31/12 Return of customer’s check for insufficient funds, 8/30/12 Outstanding checks, 8/31/12 Bank service charges for August $18,650 3,900 600 2,750 100 At August 31, 2012, Bing's correct cash balance is a. $19,800. b. $19,200. c. $19,100. d. $17,500. 10. Tresh, Inc. had the following bank reconciliation at March 31, 2012: Balance per bank statement, 3/31/12 $37,200 Add: Deposit in transit 10,300 47,500 Less: Outstanding checks 12,600 Balance per books, 3/31/12 $34,900 Data per bank for the month of April 2012 follow: Deposits $43,700 Disbursements 49,700 All reconciling items at March 31, 2012 cleared the bank in April. Outstanding checks at April 30, 2012 totalled $6,000. There were no deposits in transit at April 30, 2012. What is the cash balance per books at April 30, 2012? a. $25,200 b. $28,900 c. $31,200 d. $35,500 11. If the balance shown on a company's bank statement is less than the correct cash a. b. c. d. balance, and neither the company nor the bank has made any errors, there must be deposits credited by the bank but not yet recorded by the company. outstanding checks. bank charges not yet recorded by the company. deposits in transit. Downloaded by Scarlett Catalyst (scarlettcatalyst22@gmail.com) lOMoARcPSD|24189335 12. If the cash balance shown in a company's accounting records is less than the a. b. c. d. correct cash balance, and neither the company nor the bank has made any errors, there must be deposits credited by the bank but not yet recorded by the company. deposits in transit. outstanding checks. bank charges not yet recorded by the company. 13. Bank statements provide information about all of the following except a. b. c. d. checks cleared during the period. NSF checks. bank charges for the period. errors made by the company. 14. Which of the following items would be added to the book balance on a bank reconciliation? a. b. c. d. 15. Outstanding checks A check written for $63 entered as $36 in the accounting records Interest paid by the bank Deposits in transit In preparing a bank reconciliation, interest paid by the bank on the account is a. added to the bank balance. b. subtracted from the bank balance. c. added to the book balance. d. subtracted from the book balance. 16. In preparing a monthly bank reconciliation, which of the following items would be added to the balance reported on the bank statement to arrive at the correct cash balance? a. Outstanding checks b. Bank service charge c. Deposits in transit d. customer's note collected by the bank on behalf of the depositor Downloaded by Scarlett Catalyst (scarlettcatalyst22@gmail.com) lOMoARcPSD|24189335 17. Bank reconciliations are normally prepared on a monthly basis to identify adjustments needed in the depositor's records and to identify bank errors. Adjustments should be recorded for a. bank errors, outstanding checks, and deposits in transit. b. all items except bank errors, outstanding checks, and deposits in transit. c. book errors, bank errors, deposits in transit, and outstanding checks. d. outstanding checks and deposits in transit. 18. Assume the following facts for Kurt Company: The month-end bank statement shows a balance of $40,000; outstanding checks total $2,000; a deposit of $8,000 is in transit at month-end; and a check for $400 was erroneously charged against the account by the bank. What is the correct cash balance at the end of the month? a. $33,600 b. $34,400 c. $45,600 d. $46,400 19. In preparing the bank reconciliation of Crews Company for the month of July, the following information is available: Balance per bank statement, 7/31 ..................... Deposits in transit, 7/31 ............................ Outstanding checks, 7/31 ............................. Deposit erroneously recorded by bank to Crews account, 7/18 ...................................... Bank service charges for July ........................ What is the correct cash balance at July 31? a. b. c. d. $52,875 $54,375 $54,450 $54,825 Downloaded by Scarlett Catalyst (scarlettcatalyst22@gmail.com) $54,075 9,375 8,625 375 75 lOMoARcPSD|24189335 20. The August 31 bank statement of Kelvin Inc. showed a balance of $113,000. Deducted in arriving at this amount was a customer's NSF check for $2,400 that had been returned. Kelvin had received no prior notice concerning this check. In addition to the bank statement, other records showed there were deposits in transit totaling $17,200 and that outstanding checks totaled $10,800. What is the cash balance per books at August 31 (prior to adjustments)? a. $121,800 b. $119,400 c. $117,000 d. $115,400 21. In preparing its bank reconciliation for the month of February, James Company has available the following information: Balance per bank statement, February 28 ................. Deposit in transit, February 28 ......................... Outstanding checks, February 28 ......................... Check erroneously deducted by bank from James' account, February 10 ........................................... Bank service charges for February ....................... $18,025 3,125 2,875 125 25 What is the corrected cash balance at February 28? a. b. c. d. 22. $18,125 $18,150 $18,275 $18,400 Ramos Company had the following bank reconciliation at March 31: Balance per bank statement, 3/31 ........................ Add: Deposit in transit ................................. Less: Outstanding checks ................................ Balance per books, 3/31 ................................. $ 93,000 20,600 $113,600 (25,200) $ 88,400 Data per bank statement for the month of April follow: Deposits .............................................. Disbursements ......................................... Downloaded by Scarlett Catalyst (scarlettcatalyst22@gmail.com) $116,800 99,400 lOMoARcPSD|24189335 All reconciliation items at March 31 cleared through the bank in April. Outstanding checks at April 30 totaled $15,000. What is the amount of cash disbursements per books in April? a. b. c. d. $89,200 $99,400 $109,600 $114,400 III. Problems 1. The information below is from the books of the Seminole Corporation on June 30: Balance per bank statement .............................. $11,164 Receipts recorded but not yet deposited in the bank ..... Bank charges not recorded ............................... 1,340 16 Note collected by bank and not recorded on books ........ 1,120 Outstanding checks ...................................... 1,100 NSF checks--not recorded on books nor redeposited ..... 160 Assuming no errors were made, compute the cash balance per books on June 30 before any reconciliation adjustments. 2. The books of Steve's Service, Inc. disclosed a cash balance of $68,757 on June 30. The bank statement as of June 30 showed a balance of $54,780. Additional information that might be useful in reconciling the two balances follows: (a) Check number 748 for $3,000 was originally recorded on the books as $4,500. (b) A customer's note dated March 25 was discounted on April 12. The note was dishonored on June 29 (maturity date). The bank charged Steve's account for $14,265, including a protest fee of $42. (c) The deposit of June 24 was recorded on the books as $2,895, but it was actually a deposit of $2,700. (d) Outstanding checks totaled $9,885 as of June 30. Downloaded by Scarlett Catalyst (scarlettcatalyst22@gmail.com) lOMoARcPSD|24189335 (e) There were bank service charges for June of $210 not yet recorded on the books. (f) Steve's account had been charged on June 26 for a customer's NSF check for $1,296. (g) Steve properly deposited $600 on June 3 that was not recorded by the bank. (h) Receipts of June 30 for $13,425 were recorded by the bank on July 2. (i) A bank memo stated that a customer's note for $4,500 and interest of $165 had been collected on June 27, and the bank charged a $36 collection fee. Prepare a bank reconciliation statement, using the form reconciling bank and book balances to the correct cash balance. 3. The Eric Manufacturing Company received its bank statement for the month ending May 31. The bank statement indicates a balance of $32,400. The cash account as of the close of business on May 31 has a balance of $8,350. In reconciling the balances, the following items are discovered. (a) Collection by bank of note for $1,500 less collection fees of $250. (b) Deposits in transit, $51,000. (c) The bank charged the depositor $800 for overdrafts. (d) Checks outstanding on May 31, $79,100. (e) A canceled check issued to Scott Corp. for $4,500 was not recorded on Eric Company's books. Prepare a bank reconciliation statement. (Use the format of reconciling bank and depositor figures to corrected cash balance.) Downloaded by Scarlett Catalyst (scarlettcatalyst22@gmail.com) lOMoARcPSD|24189335 4. The accountant for the Goshen Company assembled the following data: June 30 July 31 Cash account balance ........................ $ 15,822 $ 39,745 Bank statement balance ...................... 107,082 137,817 8,201 12,880 27,718 30,112 Deposits in transit ......................... Outstanding checks .......................... Bank service charge* ........................ 72 60 Customer's check deposited July 10, returned 8,250 by bank on July 16 marked NSF, and redeposited immediately; no entry made on books for return or redeposit .............. Collection by bank of company's notes 71,815 80,900 receivable ................................. * (Recorded on books in month following charge or collection) ........................... The bank statements and the company's cash records show these totals: Disbursements in July per bank statement ................ $218,373 Cash receipts in July per Goshen's books ................ 236,452 Checks written in July per Goshen's books ............... 212,529 Receipts in July per bank statement ..................... 249,108 Prepare a 4-column bank reconciliation as of July 31, using the form that reconciles both the book and bank balances to a correct cash amount. Downloaded by Scarlett Catalyst (scarlettcatalyst22@gmail.com) lOMoARcPSD|24189335 ANSWERS: I. True or False 1. True 2. False 3. False 4. False 5. False 6. False 7. False 8. True 9. True 10. True II. Multiple Choice 1. B 2. B 3. C 4. B (72,000 – 24,000 + 8,000 + 1, 000 = 57,000) 5. B (34,140 + 5,000 – 5,200 = 33,940) 6. C (42,400 + 900 – 1,800 +2,900 = 44,400) 7. B (90,000 + 1,880 – 640 – 180 + 36 = 91,096) 8. C (35,000 + 5,400 – 4,900 = 35,500) 9. A (18,650 + 3,900 – 2,750 = 19,800 10. A (37,200 + 43,700 – 49,700 = 31,200 (4/30 balance per bank) 31,200 – 6,000 = 25,200) 11. D 12. A 13. D 14. C 15. C 16. C 17. B 18. D 19. C 20. A 21. D 22. A Downloaded by Scarlett Catalyst (scarlettcatalyst22@gmail.com) lOMoARcPSD|24189335 III. Problems Problem #1 Balance per bank statement, June 30 ..................... Add: $11,164 Receipts not yet deposited ..................... 1,340 Bank charges ................................... 16 NSF checks ..................................... 160 $12,680 Deduct: Note collected by bank ......................... 1,120 Outstanding checks ............................. 1,100 Balance per books before reconciliation adjustments ..... $10,460 Problem #2 Balance per bank statement, June 30 ......... Add: $54,780 Deposits in transit ................ $13,425 Bank error--deposit not recorded ............ 600 14,025 $68,805 Deduct: Outstanding checks ................. 9,885 Corrected bank balance ...................... $58,920 Balance per books, June 30 .................. $68,757 Add: $ 1,500 Book error--Check No. 748 .......... Customer note collected by bank ............. 4,629 6,129 $74,886 Deduct: Dishonored note .................... Book error--improperly recorded deposit ..... NSF check ................................... Bank service charges ........................ $14,265 195 1,296 210 Downloaded by Scarlett Catalyst (scarlettcatalyst22@gmail.com) 15,966 lOMoARcPSD|24189335 Corrected book balance ...................... $58,920 Problem #3 Balance per bank statement .................. $32,400 Add deposits in transit ..................... 51,000 $83,400 Deduct outstanding checks ................... 79,100 Corrected balance ........................... $ 4,300 Balance per depositor's records ............. $ 8,350 Add note receivable collected by bank ....... 1,250 $ 9,600 Deduct: Overdrafts ................................ Book error--unrecorded check .............. $ 800 4,500 Corrected balance ........................... Downloaded by Scarlett Catalyst (scarlettcatalyst22@gmail.com) 5,300 $ 4,300 lOMoARcPSD|24189335 Problem #4 Beginning Ending Reconciliation Reconciliation June 30 Receipts Disbursement s July 31 $107,082 $249,108 $218,373 $137,817 Balance per bank statement ....... Deposits in transit: June 30 .......... 8,201 July 31 .......... (8,201) 12,880 12,880 Outstanding checks: June 30 .......... (27,718) (27,718) July 31 .......... 30,112 (30,112) NSF check redeposited ..... (8,250) (8,250) Corrected bank balance ......... $ 87,565 $245,537 $212,517 $120,585 Balance per books $ 15,822 $236,452 $212,529 $ 39,745 Bank service charge: June ............. July ............. (72) (72) 60 Collection of notes receivable: Downloaded by Scarlett Catalyst (scarlettcatalyst22@gmail.com) (60) lOMoARcPSD|24189335 June ............. 71,815 July ............. (71,815) 80,900 80,900 Corrected book balance ......... $ 87,565 $245,537 $212,517 Downloaded by Scarlett Catalyst (scarlettcatalyst22@gmail.com) $120,585