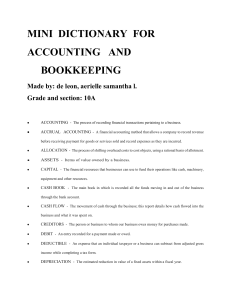

What is a bookkeeping company? 0400 755 855 / 0421 000 541 milan@imtaaa.com.au / imraz@imtaaa.com.au https://www.imtaaa.com.au In the world of business and finance, maintaining accurate and organized financial records is a crucial aspect that ensures smooth operations and compliance with various regulations. This is where a bookkeeping company comes into play. In this comprehensive guide, we will delve into the depths of what a bookkeeping company is, its role, its benefits, and why partnering with one could be a game-changer for your business. Understanding the Role of a Bookkeeping Company A bookkeeping company is a specialized firm that offers professional financial management services to businesses of all sizes. Its primary role revolves around recording, organizing, and managing financial transactions, ensuring that every financial activity is accurately documented. These transactions encompass a wide range of activities, including expenses, revenues, purchases, sales, payroll, and more. The Importance of Accurate Bookkeeping Accurate bookkeeping serves as the foundation upon which informed business decisions are made. It provides a clear snapshot of a company's financial health, enabling business owners, stakeholders, and managers to understand the company's profitability, cash flow, and overall financial performance. Moreover, precise bookkeeping is essential for tax purposes, as it ensures compliance with tax regulations and facilitates filing taxes. Key Services Offered by Bookkeeping Companies 1. Recording Financial Transactions: Bookkeeping companies meticulously record every financial transaction, categorizing them appropriately. This comprehensive record-keeping forms the basis of financial statements and reports. 2. Accounts Receivable and Payable Management: Managing incoming and outgoing payments is crucial. Bookkeepers monitor accounts receivable (money owed to the company) and accounts payable (money owed by the company) to maintain a healthy cash flow. 3. Payroll Processing: Bookkeeping companies handle payroll processing, ensuring that employees are paid accurately and on time while adhering to tax regulations. 4. Bank Reconciliation: Regular reconciliation of bank statements with financial records helps identify discrepancies and maintain accuracy. 5. Financial Reporting: Bookkeepers generate essential financial reports like balance sheets, income statements, and cash flow statements. These reports provide information about the company's financial performance. 6. Expense Tracking: Tracking expenses helps in identifying costsaving opportunities and optimizing financial resources. Benefits of Outsourcing to a Bookkeeping Company Outsourcing bookkeeping services can offer numerous advantages to businesses, including: Expertise: Bookkeeping companies comprise professionals with expertise in financial management and regulations. Their knowledge ensures accurate and compliant record-keeping. Time Savings: Delegating bookkeeping tasks frees up valuable time for business owners to focus on core operations and growth strategies. Cost-Effectiveness: Outsourcing eliminates the need to hire and train in-house bookkeeping staff, reducing HR and operational costs. Scalability: Bookkeeping companies can seamlessly scale their services as your business grows, accommodating changing needs. Access to Technology: These companies often employ advanced bookkeeping software and tools, ensuring efficiency and accuracy. Choosing the Right Bookkeeping Company When selecting a bookkeeping company, consider the following factors: Experience and Reputation: Look for a company with a proven track record and positive client reviews. Services Offered: Ensure that the company offers the specific services your business requires. Technology Used: Inquire about the software and technology the company uses to manage financial data. Customization: A reliable bookkeeping company should be willing to tailor its services to align with your business's unique needs. In Conclusion In the intricate web of business operations, a bookkeeping company stands as a pillar of financial organization and accuracy.- Its role goes beyond mere number-crunching; it empowers businesses to make informed decisions, maintain compliance, and drive growth. By outsourcing your bookkeeping needs to a reputable company, you unlock a world of expertise, efficiency, and strategic financial management. So, consider partnering with a bookkeeping company to pave the way for a financially sound and prosperous business journey.