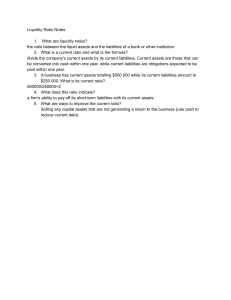

Chapter 9: Financial statements Prepared by Mr Ayyaz Statement of financial position There are two types of assets Statement of financial position: A statement which shows the assets & liabilities of a business at a certain date. Non current assets: Assets which are obtained for use & not resale, which help the business earn revenue. i.e machinery, building. Liquidity refers to the ease with which as asset can be converted to cash without affecting its market price. Statement of financial position is also known as ‘balance sheet’ Current assets: Short term assets whose amount keep on changing. They are either in the form of cash or can be turned into cash relatively easy. i.e trade receivables, bank. Both current & non current assets are shown in their increasing order of liquidity in the statement of financial position. Prepared by Mr Ayyaz Non current assets There are two types of non current assets Tangible non current assets Long term non current assets not bought for use rather than resale & have a material substance (can be seen & touched) i.e lorry, machinery, building etc Intangible non current assets Long term non current assets not bought for use rather than resale & does not have a material substance (cannot be seen & touched) i.e brand image, reputation, good will etc In Statement of financial position, intangible non current assets are shown before the tangible non current assets. Amount by the which the value of a business as a whole exceeds the value of its assets & liabilities is called the good will of that business Good will = purchase price of a business – difference between market value of assets & liabilities. Prepared by Mr Ayyaz liabilities There are three types of liabilities. Non current liabilities Amounts owed which are not due for repayment within the next 12 months. i.e mortgage, bank loans. Current liabilities Amounts owed which are not due for repayment within the next 12 months. i.e trade payables, bank overdraft. Capital: Represents the owner’s investment in the business and is the amount which the business owes to the owner. Prepared by Mr Ayyaz Statement of financial position. Same like statement of comprehensive income, statement of financial position also need to have a heading which includes the following: A date to which it relates Name under which the business trades Same like statement of comprehensive income Statement of financial position can also be prepared in two formats. Horizontal & vertical Prepared by Mr Ayyaz Statement of financial position. Hozirontal format Trial balance is used to prepare Statement of financial position. Once the items are used/ transferred in the financial statement they should be ticked in the trial balance to avoid repetition. All account in trial balance are used once in the preparation of financial statements however the notes to the trial balance are used twice. A horizontal statement of financial position is prepared in a two sided format. Assets of the debit and liabilities on the credit. Prepared by Mr Ayyaz Statement of financial position. Hozirontal format example Trial balance Balance sheet Balance on capital account increases when a business has made profit during the year. Drawings by the owner decreases the capital amount. Prepared by Mr Ayyaz Statement of financial position. Vertical format example Prepared using the same trial balance as above. Vertical format is most commonly used to prepare financial statements. Prepared by Mr Ayyaz You can start doing the practice questions Prepared by Mr Ayyaz