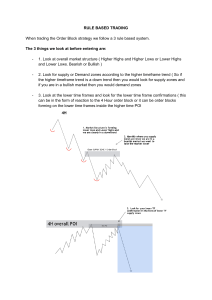

Market Structure Market Structure in my opinion is the most important factor when determining what side of the market to be on, I am sure being in the FMG group you have noticed I refer to market structure quite a lot so this segment is to clarify exactly what I mean by market structure and how it is important and also how to use this understanding to make consistent profits. Market structure can be simplified by two types; 1- Bullish Market Structure 2- Bearish Market Structure Bullish or bearish market structure both have distinct characteristic to define themselves, Bullish market structure: - Higher Highs and Higher Lows, Resistance Becomes Support Bearish market structure: -Lower Highs and Lower Lows, Support Becomes Resistance When drawing swing highs and lows always go for the most obvious ones or the ones that with a naked eye you can see suit the overall direction of the market not small pullbacks for swing points you want substantial moves away relevant to the timeframe your looking at. These characteristics reveal what type of market we are in via it be a bullish or a bearish market and once we know what type of market we are in we now know what side of the market to be on when placing a trade. Different timeframes have different market structure but from my experience it is best to go with the higher timeframes market structure because that is were the big institution and banks take trades based of. Personally I pay most attention to the monthly and weekly for direction and daily for market structure as that’s were you will be most likely to get trade setups that you can compound and also that you can zoom into to get a few intraday trades aswell, below I will show you examples of bullish and bearish market structure and examples of support becoming resistance or resistance becoming support. EURUSD- Bullish Market Structure In this example above of EURUSD Daily timeframe I have highlighted all of the clear swing points that make up the overall market structure, from this you can see how the trend started from the swing low to the swing high and then formed a higher low this indicates were are in a bullish trend, now we know what side of the market we are on we look for price to continue to make bullish market structure. In the form of higher highs and higher lows as shown in the example above the higher highs that get formed make up the resistance which then becomes the support for price once its broken, each higher low is a opportunity to enter a long position and get on the bullish train price will remain bullish as long as the market structure has not been violated, meaning as long as price does not go below the previous higher low we are still in a bullish market so longs are preferred to shorts so when we scale in into intraday timeframes like 4 hour down to 15min we know what way the trend is going so we take setups in alignment with the higher timeframes to increase the probability of the trade, which is why I don’t advise trading against the trend its better to go with it and less risky. DXY (Dollar Index) - Bearish Market Structure In this example above of DXY Daily timeframe I have highlighted all of the clear swing points that make up the overall market structure, from this you can see how the trend started from the swing high to the swing low and then formed a lower high this indicates were are in a bearish trend, now we know what side of the market we are on we look for price to continue to make bearish market structure. In the form of lower highs and lower lows as shown in the example above the lower lows that get formed make up the support which then becomes the resistance for price once its broken, each lower high is a opportunity to enter a short position and get on the bearish train price will remain bearish as long as the market structure has not been violated, meaning as long as price does not go above the previous lower high we are still in a bearish market so shorts are preferred to longs so when we scale in into intraday timeframes like 4 hour down to 15min we know what way the trend is going so we take setups in alignment with the higher timeframes to increase the probability of the trade, which is why I don’t advise trading against the trend its better to go with it and less risky.