Anandam Manufacturing Company - Analysis of Financial Statement - Case Study

advertisement

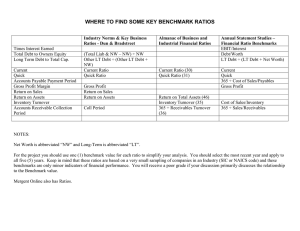

Browse Essays / Business / Anandam Manufacturing Company -... Anandam Manufacturing Company - Analysis of Financial Statement Essay by Shaira Nami • August 28, 2017 • Case Study • 2,693 Words (11 Pages) • 10,183 Views Essay Preview: Anandam Manufacturing Company-Analysis of Financial Statement Page 1 of 11 Anandam Manufacturing Company: Analysis of Financial Statement Submitted by: Bito-on, Jessa Marie O. Jalon, Erna Kaye Puy, Lauderdale Sadioa, Leonette Ann G. Sampang, Hazlin Zuzanna Finance 211-A Submitted to: Mr. John Carlos P. Wee I. Case Summary Businesses, once expanded, is invulnerable of arising financial problems that eventually heightens in the going concern of the company. Agarwal, the owner of the Anandam Manufacturing Company, a garment business, approached his loan officer and confidently raised and discussed his company’s financial needs. He submitted a detailed proposal and a project report to the bank, alongside with their financial statements of previous years to be further analyzed and processed for loan sanctioning. He seeks to be funded for the amount of 50 million in sustenance for his developing company since he also believed that their performance was excellent in a highly competitive market. The money is required to carry out smooth operations and expand the business. He is in dire need of the loan to meet with his company’s cash and investment requirements. II. Objective of the Analysis To conduct a financial analysis of the company with the assistance of prior knowledge about financial statement analysis and go over their financial statements: income statement and the statement of financial position/balance sheet to be supplied with adequate information regarding the financial health of the firm with the aid of calculating financial statement ratios through horizontal or trend analysis. Through this analysis, this will serve as the gateway in finding out whether the said company is worthy of sanctioning the loan or the other side of the coin. III. Outline and Assessment of the Internal and External Environment of the Company Strengths Weaknesses Modern stylish dresses for children. Skilled labor Expertise in Garments for children below 12 years. Anand Agarwal kept using both short-term and long-term borrowings for business expansion. So he was not aware of the risks involved in simultaneous use of short-term and long term borrowings. Opportunities Growth of Textile Industry in India Increase in per capita income and consumerism. Exports to USA/ High demand in USA Increase in labor cost in China Favorable trade policies. Threats More and more entrepreneurs would potentially enter to other sectors Large players in the market could probably receive huge boost in the form of FDI. IV. Analysis and Comparison of the Financial Position and Results of Operation of the Company 1. Liquidity 1. Current Ratio The current ratio of Anandam Manufacturing Company shows a decreasing trend. In the year 2012-2013, the liquidity of the company is at 2.54%, a little bit higher compared to the average ratio of the over-all industry. However, in the succeeding years, it drop to 1.79 (2013-2014) and eventually at 1.6% in the year 2014-2015. Anandam Company is not as liquid as the other corporations of the same industry, thus these ratios show unfavorable results to the company. 1. Quick Ratio The quick ratio for Anandam Corporation shows a decreasing trend. In the year 2012-2013, the company's ability to service short-term obligations is at 1.31%, at least 11% higher compared to the average ratio of the industry. However, in the next succeeding years, the ratio dropped by 38% (2013-2014) which resulted to 0.98 and eventually 0.79 in the year 2014-2015. This is an unfavorable implication to Anandam Corporation; the corporation’s ability to meet its short term obligations is not satisfactory. This also implies that Anandam company cannot immediately convert its current liabilities to finance short term debts. 1. Efficiency 1. The Accounts Receivable Turnover ratio for Anandam Corporation is used to quantify the company’s effectiveness in extending credit and in collecting debts on that credit. The company’s ratio compared to the industry is lower. In 20122013, it shows that the company can still manage to collect its receivables for 6 times, however, this number gets lower and lower as years pass. In 2013, the ratio drop to 2.88 times and increases at 3.42 times in the year 2014-2015. In the first years of operations, the company still needs to improve its policy on the collection of receivables. Unfortunately, in the year 2013, there was a huge drop which may be due to the company’s inefficiency in collecting and extending credits to the customer. Over all, the ratio reported is not a good sign for the company. Their performance in terms of extending credit is not good and should be improved. 2. The Days Sales Outstanding for the receivables of Anandam Corporation shows a large difference compared to the industry. This is unfavorable for the company because it takes so long for them to collect the receivables. In the next two years, the gap is even getting larger. This may be attributed to the poor policy implementation of the company. 3. Anandam Corporation’s inventory turnover, measures how effective the company is in the management of its inventory. The ratios formulated from the company’s financial statements are still lower when compared to the industries average ratio. For year 2013-2015, a drop of the values is reflected. This is unfavorable for the operation of the company. It may imply weak sales for Anandam’s garments and, therefore, an excess inventory. 4. The Days Supply in Inventory ratio for Anandam Corporation measures the number of days before the inventories are sold or distributed. The ratios for the company’s two-year operating period show a really large difference between the average ratio of the industry. From 116 days in year 2 up to 141 days in year 3. The number of days for the company to sold the inventories is much more higher compare to the 75 days in the industry. This result is not favorable to the company’s operation. 1. Leverage 1. The Debt to Equity Ratio of the company indicates how much debt a company is using to finance its assets relative to the amount of value represented in shareholders’ equity. The debt to equity ratio Anandam Company shows an increasing trend, from 0.64 in the first year which increased to 1.12 and eventually rises to 1.36. A high debt/equity ratio generally means that a company has been aggressive in financing its growth with debt. The higher the debt incurred by the company, the riskier it becomes. 2. The Times Interest Earned ratio measures the firm’s ability to make contractual payments. The ratio of the company for three consecutive years is lower compared to the average ratio of the industry. This imply an unfavorable result to the company, and the fact that there is a decresing pattern makes it more unsatisfactory. Lower values of TIE ratio highlight that the company may not be in a position to meet its debt obligations. 3. The total asset turnover ratio is an efficiency ratio that measures a company's ability to generate sales from its assets by comparing net sales with average total assets.When compared to the industry’s ratio of 1.1, the company’s ratio for its three-year operation is lower although in an increasing trend. This implies that the company isn't using its assets efficiently and most likely have management or production problems. 4. The company’s fixed asset turn over ratio is lower when compared to the industry’s average ratio. From 1.05 in 2012, 1.92 in 2013 and 1.7 in 2014, although the increase-decrease trend is manisfested this may still be considerable because the operation of the firm may differ from one period to another,still low ratio means inefficient or under-utilization of fixed assets.Thus, this is an unfavorable implication for the company. 1. Profitability 1. The Gross Profit Ratio of the the company shows a stable flow. Although there is a slight decrease on the third year, the decrease is still manageable. Compared to the over all average ratio of 40%, the company’s profitability is favorable to the part of both the company and its shareholders. Higher ratios mean the company is selling their inventory at a higher profit percentage. 2. Net profit (NP) ratio is a useful tool to measure the overall profitability of the business. Anandam Company’s Net Profit Ratio shows a decreasing trend. During 2012, there is 0.182 ratio, 0.14 in the second year until it reached to approximately 0.11 in the third year. When compared to the industry’s ratio of 0.18, this is not favorable to the profitability of the company. 3. Anandam’s Return on Equity ratio shows a positive sign to the company. The average ratio of the industry is at 22%, and the company generated a 30%, 40%, 40%, respectively for its three-year operation. Since ROE measures the ability of a firm to generate profits from its shareholders investments in the company. This implies that the company is using its investors' funds effectively and is favorable on the part of its investors. 4. The ratio on the return of total asset of Anandam Company shows a decreasing flow, from 0.14 in 2012, 0.12 in 2013 and 0.09 in 2014. When compared to the over all ratio of the industry, this value is approxiamtely close to the .10 ratio. Since ROA shows how efficiently a company can convert the money used to purchase assets into net income or profits, this implies a favorable result on the part of the investors and the company as well. A positive ROA ratio usually indicates an upward profit trend as well. 5. The Working Capital Turnover Ratio of Anandam Company is at 5% in 2012, 3.50 in 2013 and 4.77 in 2014. These ratios are still lower when compared to the industry’s over-all ratio. It shows company’s efficiency in generating sales revenue using total working capital available in the business during a particular period of time.A low ratio indicates inefficient utilization of working capital during the period and thus, unfavorable to the company. 201213 2013-14 2014-15 INDUSTRY Current Ratio 2.54 1.79 1.6 2.30:1 Quick Ratio 1.31 0.93 0.79 1.20:1 Receivable Turnover Ratio 6 times 2.88 times 3.42 times 7 times Recievable Days 60 days 125 days 105 days 52 days Inventory Turnover Ratio ̵̵ 3.11 2.56 4.85 times Inventory Days - 116 days 141 days 75 days Long-term debt to total debt 0.74 0.42 0.48 24% Debt-to-equity ratio 47.06% 46.89% 64.50% 35% Gross profit ratio 0.38 0.41 0.4 40% Net profit ratio 0.182 0.14 0.105 18% Return on Equity 30.33% 42 42 22% Return on total assets 0.14 0.12 0.09 10% Total asset turnover ratio 0.78 0.86 0.87 1.1 Fixed asset turnover ratio 1.05 1.92 1.7 2 30.03 1.55 1.8 3 Times interest earned ratio 9.67 7.08 4.53 10 Working capital turnover ratio - 5.42 2.21 8 Current asset turnover ratio Return on fixed assets 0.19 0.27 0.18 24% ... ... Continue for 10 more pages » Download as: txt (17.2 Kb) pdf (138.4 Kb) docx (18.4 Kb) Read Full Essay Citation Generator Save APA MLA Only available on OtherPapers.com MLA 7 CHICAGO (2017, 08). Anandam Manufacturing Company - Analysis of Financial Statement. OtherPapers.com. Retrieved 08, 2017, from https://www.otherpapers.com/essay/Anandam-Manufacturing-CompanyAnalysis-of-Financial-Statement/61587.html Similar Essays An Analysis of Financial Statement Fraud Financial Statement Analysis Issues Corporate fraud is extremely costly in the United States and costs corporations and consumers millions of dollars annually in lost revenues, increased consumer prices, HI Financial Statement Analysis * from looking at the graph wall mart didn't have big change in his liquidity for the past three years.. the 1,271 Words | 6 Pages 429 Words | 2 Pages Financial Statement Analysis Project -- a Comparative Analysis of Oracle Corporation and Microsoft Corporation Financial Statement Analysis of Blockbuster and Netflix http://www.oracle.com/us/corporate/investorrelations/sec/index.html http://www.microsoft.com/investor/SEC/default.aspx? year=2007 This course contains a course project where you will be required to submit parts of the project at various Financial Statement Analysis of Blockbuster and Netflix Introduction In this memorandum, I will analyze the competitive environment that Blockbuster and Netflix face. In addition, I 1,380 Words | 6 Pages Financial Statement Analysis Costco Wholesale Corporation Financial Statement Analysis (a) Financial Statement Analysis University of Phoenix Learning Team A Boucher, Allison; Brown, John; Davis, Margaret; Funk, Jason; and McLeod, Odette ACC/561 Professor Carla Ross November Costco Wholesale Corporation Financial Statement Analysis (A) Case Study What are the main elements of Costco's strategy? Compare and contrast its strategy with its competitors 2,122 Words | 9 Pages 1,109 Words | 5 Pages Danieli - Consolidated Financial Statements Analysis Anandam Manufacturing Company Case Study ________________ About the company The Danieli Group, or Danieli & C Officine Meccaniche SpA, is an Italian company that operates primarily in the iron, steel, Stakeholder Description Rand Water The primary and main sponsor of the project. The project is mandates by Rand Water and therefore it is imperative that 1,315 Words | 6 Pages 389 Words | 2 Pages Similar Topics Ford Motor Company Business Analysis Analysis Orwells The Spike How Global Financial Crisis 2008 Metabical Case Analysis Company Manufacturing Marketing AmazonCom Financial Analysis Case Study High Quality Essays and Term Papers Join 391,000+ other students Get Better Grades Sign up © 2010–2023 OtherPapers.com Browse Essays Site Map Join now! Help Privacy Policy Login Support Terms of Service Facebook