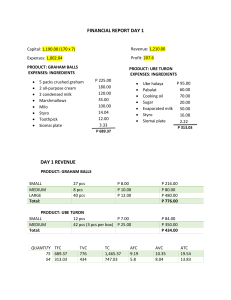

FINANCIAL REPORT DAY 1 Capital: 1,190.00 (170 x 7) Revenue: 1,210.00 Expenses: 1,002.04 Profit: 207.6 PRODUCT: GRAHAM BALLS EXPENSES: INGREDIENTS PRODUCT: UBE TURON EXPENSES: INGREDIENTS 5 packs crushed graham 2 all-purpose cream 2 condensed milk Marshmallows Milo Styro Toothpick Siomai plate P 225.00 180.00 120.00 35.00 100.00 14.04 12.00 3.33 P 95.00 Ube halaya 60.00 Pabalat Cooking oil 70.00 Sugar 20.00 Evaporated milk 50.00 Styro 16.08 Siomai plate 2.22 P 313.03 P 689.37 DAY 1 REVENUE PRODUCT: GRAHAM BALLS SMALL MEDIUM LARGE Total: 27 pcs 8 pcs 40 pcs P 8.00 P 10.00 P 12.00 PRODUCT: UBE TURON SMALL 12 pcs P 7.00 MEDIUM 42 pcs (3 pcs per box) P 25.00 Total: QUANTITY TFC 75 689.37 54 313.03 TVC 776 434 TC 1,465.37 747.03 AFC 9.19 5.8 P 216.00 P 80.00 P 480.00 P 776.00 P 84.00 P 350.00 P 434.00 AVC 10.35 8.04 ATC 19.54 13.83 FINANCIAL REPORT DAY 2 BALANCE: P 1,210.00 Revenue: 1,010.00 Expenses: 743.00 Profit: 267.00 PRODUCT: UBE TURON LESS EXPENSES: INGREDIENTS PRODUCT: MINI PANCAKE LESS EXPENSES: INGREDIENTS P 100.00 48.00 88.00 30.00 35.00 58.00 25.00 Ube halaya Pabalat Cooking oil Sugar Evaporated milk Cheese Plastic roll P 384.00 P 41.00 10.00 69.00 15.00 50.00 10.00 25.00 24.00 40.00 75.00 Flour Yeast Milo Sugar Evaporated milk Margarine Plastic fork Styro Egg Butaine P 359.00 DAY 2 REVENUE PRODUCT: MINI PANCAKE 36 pcs Total: 18 boxes (2 pcs each) P 25.00 P 450.00 P 450.00 PRODUCT: UBE TURON 84 pcs 28 packs (3 pcs each) Total: P 20.00 P 560.00 P 560.00 QUANTITY TFC 36 359 84 384 TVC 450 560 TC 809 944 AFC 9.97 4.57 AVC 12.5 6.67 ATC 22.47 11.24 FINANCIAL REPORT DAY 3 BALANCE: P 1,190.00 Revenue: 960 Expenses: 648 Profit: 312 PRODUCT: MINI PANCAKE LESS EXPENSES: INGREDIENTS PRODUCT: S’mores LESS EXPENSES: INGREDIENTS Marshmallows Biscuits Siomai Plate P 65.00 50.00 15.00 P 130.00 Flour Milo Sugar Evaporated milk Margarine Styro Egg P 93.00 161.00 60.00 70.00 28.00 12.00 94.00 P 518.00 DAY 3 REVENUE PRODUCT: S’MORES 69 pcs Total: 3pcs (per plate for 10) PRODUCT: MINI PANCAKE SMALL 28 pcs MEDIUM 36 pcs Total: QUANTITY TFC 69 130 64 518 TVC 230 730 TC 360 1,248 P 230.00 P 450.00 P 230.00 P 20.00 P 25.00 P 280.00 P 450.00 P 730.00 AFC 1.88 8.09 AVC 3.33 11.41 ATC 5.22 19.5 Tomas, Aleah Kyla E. BSA -1B Reaction Paper The article of Economists - Solon explains the positive impact of depreciation of Peso in Philippine economy. He clearly stated that despite of peso actually helps the economy. Solon became an eye opener of many minds to have wider perspective about economy status of Philippines. In addition, Economist - Solin shows some argument that some viewed as weakest point of peso depreciation. He clearly emphasizes that it has positive impact on economy as the value dollar contra peso risen, It offers larger growth percentage on Gross Domestic Product on Philippines. This shows that increase in value of dollar was good indication of better growth in remittance toward OFWs and BPO sectors. Which allows family of OFWs to have larger number of figures if dollar was translated in Peso. Similar, to BPO sectors that is currently knows as booming job industry in Philippine which offers higher salary figures as a result of depreciation in Peso contra Dollars. Therefore, I strongly agree on his statement because Economist - Solon offers Global wide range perspective about economy. Indeed, economy doesn’t stop in one nation but work as a Global Complex System to achieve nation’s growth to one another. It clearly shows how Globalization influence the nation’s economy. It shows progress and growth as strong dollar remittance influence Philippine economy. Angeles, Cyrylle L. BSA-1B Reaction Paper Solon explained how the weak peso actually helped the Philippine Economy. The National Government was thrilled about the economy’s growth in terms of Gross Domestic Products (GDP) In the third Quarter of 2022. Many perspectives have been filled; some says that the weak peso has a positive impact for the Philippine Economy. Salceda claims that OFW remittance data increased in august, or close to the conclusion of the Third qurter. According to (BSP) cash remittances transmitted through banks were 2.72 billion dollars. In the end, the economist-solon predicted that the Philippine peso may still reach P62 per US dollar. Weak peso means weak Economy. In our country we are much relying on the important goods for our necessities. A weak peso means higher prices for commodities. Including, gasoline and agricultural products. One of the main causes of a weak peso is because of our growing independence on import products rather than our own products. The third quarter report shows (GDP) posted a growth of 7.6% in the third quarter of 2022. It shows how the import and exports in goods have increased. On the other hand, in a senate hearing last week, Philippine finance secretary Diokno said, a weak peso benefits the country’s economy as a dollar-earning exporters and families of OFW’s who send cash remittances get more value for their income. In conclusion, I am not fully agreed with this issue of a weak peso. Though this will help our kababayan working overseas, but unfortunately, many Filipinos’ working and living in the Philippines will suffer. A weaker peso would lead to low income. At the same time, it would also lead to higher prices of goods and overall inflation. Once the cost of goods increases, ordinary citizens can spend less on the same item. Once the peso depreciates against the US dollars, the currency purchases power weakens. Apostol, Karen Kyrah B. BSA 1-B Reaction Paper Knowing our economy's situation helps in understanding why prices and bills increases or decreases. Given that we live in a world where everything can be found online it is easy to be updated with today's current events so, latest updates about our country's situation is very much accessible online. Every quarter of the year the Philippine Statistics Office releases the report regarding the country's economy to keep us posted and for us to be aware. Thus, we must grab this opportunity to be involved. The third quarter report for the year 2022 of our country's GDP has already been out which showed growth of 7.6%. Reading Rep. Joey Salceda's argument regarding the positive impact of weak peso currency made me analyze and check my own understanding. I have always believed that weak peso currency impacts the economy negatively because it implies high prices on imported commodities such as petroleum. Given this understanding brought me to disagree with his claim. I read the report released by PSA and was able to back up my thoughts on why I am disagreeing with him. I was able to know that what affected the growth in our country's economy are mostly the agricultural sector, wholesale and retail, automotive, household consumptions, and other factors which made me come to the conclusion that the growth of the economy has something to do with the lifting of COVID-19 restrictions. As we start to lessen the strict guidelines of faceto-face classes and the government became a lot more lenient with the pandemic restrictions, the retail and the consumptions, like spending in restaurants and travel, helped in the positive impact on the GDP. Though I do see where Rep. Salceda's point is coming from that the weak power of peso did drive in the increase of employment in the bpo industry and remittance. The way I see it though is that it is a mere driving force and not really impacting the economy data wise. As a student in the field of business and accountancy being aware and updated of the current events is necessary because it helps us especially when we start working for it affects the work that we do. Understanding how the economy works also opens our eyes to the country's issues and how relevant we are in its growth.