Review Test Submission: Case study 1 Assessment

Test Case study 1 Assessment

Question 1

Which of the following is not considered business risk (risk primarily associated with the property)?

The business risk for a specific investment involves analysis of four distinct areas:

1. the market environment,

2. legal environment,

3. financing environment, and

4. tax environment.

Business risk is the risk associated with the ability of an investment to generate operating income. It can

be split into static risk and dynamic risk.

1.1

Static risk (unsystematic risk) is related to physical events which are beyond the control of the

investor and which normally results in a loss. They are insurable and predictable in the long run. Examples

include:

• fire,

• earthquake and

• flood damage and

• losses due to theft or malicious mischief.

1.2

Dynamic risk (or systematic risk) can produce either a profit or a loss. Dynamic risk is external

and is not under the direct control of the investor.

Question 2

An example of pyramiding is

pyramiding - i.e. the investor borrows the maximum that can be repaid, makes selective improvements to

increase property value, then sells at a profit and reinvests in larger properties to start the process over

again

• Buy to let

• Flips

• Social Housing

• Multi-let

Question 3

Equities share values could become worthless should:

Equity share values could become worthless should the asset become insolvent.

Question 4

The popularity cycle is also referred to as:

The popularity cycle (also referred to as the bandwagon or herd cycle) typically occurs during boom-orbust periods of real estate activity

Page 1 of 34

Question 5

By establishing an investors risk/ return preference and wealth. Which step of the real estate

investment process does this apply to:

Diversification of property investment opportunities in the tremendous range of investment alternatives

that real estate offers.

Question 6

Which of the following factors form part of legislative risk?

Political risk, also known as legislative risk, refers to the risk arising from governmental action like:

• changes in legislation (e.g. rent control),

• expropriation,

• nationalisation,

• changes in property taxes or

• income tax, etc

• municipal costs

Question 7

The gross rent multiplier model cannot deal with problems such as changing revenue streams over time

and varying operating expense ratios between properties

•

•

•

The gross rent multiplier approach assumes that any project with a favourable ratio of purchase

price relative to gross rents should be accepted:

Gross rent multiplier purchase price / gross rental income

Although extremely simple to use, this model cannot deal with problems such as changing

revenue streams over time and varying operating expense ratios between properties.

Question 8

Receipts or accruals of a capital nature are excluded when calculating Gross Income

(a) -All receipts and accruals of a capital nature

(b) -All receipts and accruals from any source outside the Republic.

Question 9

The Leisure sector is considered highly speculative as it is exposed to the vagaries of the economy.

Leisure in the form of hotels, however, is considered highly speculative as it is exposed to the vagaries of

the economy

Question 10

A Grading. allowance only applies if erection or improvements of a building commenced before 4

June 1988

Page 2 of 34

A Grading allowance only applies if erection or improvements commenced before 4 June 1988.

Question 11

One of the methods of valuation when it comes to property tax and land tax systems is

•

•

•

comparative sales method;

cost method;

income method

Traditional problems associated with property tax and land tax systems include the tax base (only

unimproved land or both land and improvements) and the method(s) of valuation (comparative sales

method; cost method; income method).

Question 12

Revenue has conceded that the signing of the sale agreement does not constitute the issuing of an invoice

and hence output tax on the commission will only be due and payable when the commission is received.

Fill the gap

Revenue has conceded that the signing of the sale agreement does not constitute the issuing of an invoice

and hence "output tax" on the commission will only be due and payable when the commission is received,

or an invoice is issued to the seller for the commission, whichever is earlier, this prevents negative effects

on cash flow.

Question 13

The efficient frontier can be described as a set of investment portfolios that are expected to provide the

highest returns at a given level of risk.

An efficient frontier is a set of investment portfolios that are expected to provide the highest returns at a

given level of risk.

Question 14

In bottom up risk identification what are the core activities of Scenario building? (Page 281)

This usually involves developing two extreme scenarios:

• scenario 1 where everything occurs as expected and

• scenario 2 where everything goes wrong. This approach attempts to identify project risks by a

detail analysis of both likely and negative factors that might influence the budget.

Question 15

They are purchased by an equity investor who invests through a variety of legal entities.

Capital assets are purchased by an equity investor who invests through a variety of legal entities:

individual, partnership, close corporation, company, property unit trust, pension fund, and so forth. These

various legal entities are reviewed in Chapter

Page 3 of 34

Question 16

The definition of "goods" in the Value-Added Tax Act (No 89 of 1991) does not include

The definition of "goods" in the Value-Added Tax Act (No 89 of 1991) includes

• fixed property,

• sectional title units,

• share block units and

• timeshare units.

It therefore follows that the sale of any of these by a vendor is subject to VAT. The sale of any of the above

by a person not registered for VAT will not be subject to VAT.

Question 17

What does Risk identification involve?

This is because

Risk identification involves detailed examination of the investment strategy, through which potential

risks may be uncovered and appropriate responses formulated (Uher 1993:561).

Three approaches to risk identification can be distinguished: past experience, bottom-up approaches and

top-down risk identification approaches

Question 18

IRR is equal to the discount rate when the NPV is equal to Zero

Since the IRR is equal to the discount rate when the NPV is equal to zero

Question 19

Considering that the value of shares paid by investors do not necessarily relate to Net asset value;

we can derive that the equity share prices on the stock market could Plummet:

Equity share prices on the stock market could plummet to a fraction of their purchase price as the value

of shares paid by investors do not necessarily relate to net asset value, but rather to expectation of

earnings and share price appreciation of the investment.

Question 20

Above and below the long-term trend line, business cycle changes are are 20 percent.

Typically, business cycle changes are 20 percent above and below the long-term trend line, while real

estate cycles average as much as 40 percent above and below the trend line.

Question 21

Which of the following is not considered a component of investment management in property?

Estimation of the required rate of return should include three components:

(1) a real return (compensation for deferred consumption),

(2) an inflation premium, and

(3) a risk premium.

Page 4 of 34

Question 22

With direct property investment the institutional investor will receive a monthly income stream.

With direct property investment the institutional investor will receive a monthly income stream.

Question 23

In terms of Section 13, tax deductions granted are

Residential building allowance - Section 13 (ter)

- Residential building initial allowance - 10% of cost

- Residential building annual allowance - 2% of cost

Question 24

Which risk type is considered when there are changes in tax law, zoning and rent controls?

Legislative Risk is considered when Changes in tax law; zoning; rent controls; and other governmental

regulations

Question 25

Levies received by the share block company will not be subject to income tax in terms of section 10(1)(e).

Levies received by the share block company will not be subject to income tax in terms of section 10(1)(e).

any interest income arising as a result of the investment thereof is however subject to tax.

Page 5 of 34

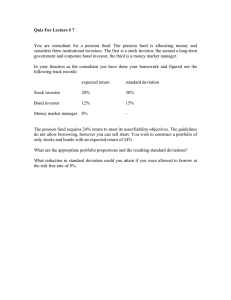

Course (222REF7XE2) REAL ESTATE FINANCE AND INVESTMENT B

Test Case Study 1 Supplementary 2

Question 1

The volatility of an investment can be measured by the standard deviation:

As discussed in Chapter 10, the volatility of an investment can be measured by the standard deviation.

Question 2

Which statement about large institutional investors is the most accurate?

Large institutional investors use the opportunity, when buying property directly, to incorporate their

name into the name of the building. This is widely practiced and is undoubtedly a valuable advertising

medium.

The large institutional investors, with their large property portfolios, invariably set up a property and

portfolio management divisions because economies of scale warrant it.

The large institutional investors, because of their investment expertise, foresight and investment

budgets, are able to not only invest in prime properties requiring large investment sums.

Large institutional investors, however, are often hamstrung by various levels of decision making, which

may cause an option to lapse should a decision not be made timeously. It is in the interests of these

large institutional investors to streamline their decision-making processes to take advantage of short

notice opportunities.

Large institutional investors use the opportunity, when buying property directly, to incorporate their

name into the name of the building. This is widely practiced and is undoubtedly a valuable advertising

medium.

Question 3

Taking into account that property values are influenced by their income earnings potential which is

guaranteed by contractual lease agreements; property values will show unless very adverse economic

growth condition prevail.

Property shares are valued closer to their net asset value. Property values are influenced by their income

earning potential which, to a large extent, is guaranteed by contractual lease agreements. Unless very

adverse economic conditions prevail, property values will show a steady growth.

Question 4

Why is the hindsight bias a potential flaw in risk identification?

A potential flaw in relying on past history is the unintentional use of "hindsight bias" (Ashley 1989). This

means that after the event the critical risks are readily identified, but that relevant information about other

risks may be disregarded.

Page 6 of 34

The biggest danger, however, in the use of history for future risk identification is the occurrence of new

events not encountered previously. This is of special importance in conditions which are changing rapidly,

as in the present-day South Africa.

Question 5

Another view of risk is that the tighter the probability distribution of expected future returns

the smaller the total risk of an investment

Another view of risk is that the tighter the probability distribution of expected future

returns the smaller the total risk of an investment.

Question 6

The Leisure sector is considered highly speculative as it is exposed to the vagaries of the economy

Leisure in the form of hotels, however, is considered highly speculative as it is exposed to the vagaries of

the economy

Question 7

Which investment is preferred according to the Risk absorption ratio?

•

•

Like the profitability index, the RA ratio is an relative measure used to compare projects of

different sizes.

If all other risk and return measures are equal, the investment with the greatest risk-absorbing

capacity will be preferred

Question 8

Large institutional investors use the opportunity, when buying property directly to incorporate their name

into the name of the building.

Large institutional investors use the opportunity, when buying property directly, to incorporate their

name into the name of the building. This is widely practiced and is undoubtedly a valuable advertising

medium

Question 9

lease premiums (rental) are deductible over the period of the lease and apportioned if the lease

commences during part of the year

Deductions of lease premiums (rental) for occupation or use of land or buildings for the production of

income. The premium is deductible over the period of the lease and is apportioned if commencing during

part of the year. The lease period referred to is limited to a maximum of 25 years.

Question 10

Which statement is correct:

Page 7 of 34

Question 11

Market risk refers to the risk associated with the market as a whole, and has nothing to do with the

specific investment

Market risk involves such factors as

• interest rates,

• business confidence,

• political unrest or

• stability, that tend to influence all investments, but not necessarily in the same way.

Question 12

Which statement about Variance of an investment is false?

1. The risk of an investment (its variance) is given by the expected variability of cash flows from the

expected value.

2. If risk is defined as the variance of expected return, then the riskier the investment, the greater

will be the variance of the expected return.

3. Useful measures of the risk (the uncertainty) are the variance and the standard deviation.

4. The variance indicates how much a variable fluctuates around the average.

5. The variance is computed by adding up the squares of all the differences between the values of

the variable and the average of the values (i.e. adding the squares of the deviations from the

mean), and then dividing by the total number of values

6. Both the variance and the standard deviation are absolute measures of risk.

7. When two investments are compared, it is often more meaningful to use a measure which

indicates the relative risk of each investment. Such a measure is the coefficient of variance

8. The risk index (RI) which is the inverse of the coefficient of variance is calculated by dividing the

return by the standard deviation. It measures the amount of return per unit of risk, if risk is

measured by the standard deviation.

9. An investment with a high RI provides a greater return for a given unit of risk

10. The risk index is subject to the same shortcoming than that of the coefficient of variance: it fails

to distinguish correctly between risky alternatives under certain conditions.

11. If a decline in the return of one asset is offset by the return on another asset, the variance of the

combination will be less than the variation of either asset held singly.

12. Portfolio decisions will maximize an investor's expected return at a given level of risk. The risk is

composed of two elements; business-related risk (known as unsystematic risk) and market risk

(called systematic risk). An asset's variance actually measures both risks.

Question 13

Which one of the following is not factor that an institutional investor should take into account?

See Question 2, page 6

Page 8 of 34

Question 14

What factors impacts the asset allocation?

•

Age:

Your age is an important factor that you must consider while deciding your asset allocation. If you

are a young investor of say 20-30 years, you should consider allocating a large percentage of your

portfolio in risky assets, such as equities. Being young gives you ample amount of time and

opportunities to recover from any possible setbacks in the value of the portfolio.

•

Income:

The amount you invest is a function of the amount of income you earn. Any appraisal in earnings, will

impact your discretionary income and hence the amount of investment. If you are into service or

employment, drawing a fixed salary every month, you can allocate your savings systematically to

both risk and safe instruments depending on your age. However if you are in the business industry,

your profits and losses are not fixed in nature.

•

Expenses:

In order to keep your financial health in pink in the long-term, it is important that you live within

means and curtail your unnecessary expenses. It is this strategy which will enable you save a large

portion of your monthly earnings, which can be deployed in suitable asset classes (depending upon

your age, income, risk appetite and nearness to goal).

•

Nearness to goal

Your nearness to your financial goal is also relevant while doing financial planning. If you are many

years away from the financial goal, you should ideally allocate maximum allocation to the equity asset

class and less towards fixed income instruments.

•

Risk Appetite

Your willingness to take risk which is a function of your age, income, expenses, nearness to goal, will

be an important determinant while framing your financial plan. So, if your willingness to take risk is

high (aggressive), you can skew your portfolio more towards the equity asset class.

•

Liabilities:

If you as an investor have high liabilities, then even though you may be willing to take high amount

of risk, your financial condition would make you a risk-averse investor. Irrespective of age, willingness

to invest, nearness to his goals, risk tolerance or any other factor, you will be forced to only make

safe investments as you cannot afford to let your investments suffer any setbacks due to market

swings.

Assets:

As an investor, it is imperative to first analyse your existing portfolio before allocating funds further.

For instance, if a huge chunk of your portfolio is dominated by real estate, then you must diversify

your assets in a manner that reduces your allocation to risk assets such as real estate or equities and

increase investments in safe instruments such as debt and cash.

Page 9 of 34

Question 15

Increasing risk of the property life cycle consists of which of the following (in order):

GLITAMAD

1. Ground floor

2. Loan commitment

3. Interim

4. Tenancy

5. Absorption

6. Maturing Process

7. Ageing process

8. Demise

Question 16

Which of the following is are the main drivers of property?

The real estate industry, much like the business world in general, has historically performed in a cyclical

fashion, driven primarily by

• the laws of supply and demand.

• Levels of construction activity,

• absorption of space in office buildings, shopping centers, and apartment complexes,

• rental rates and

• interest rates

Question 17

Which of the following statements is true when it pertains to the Sensitivity analysis?

1. The impact of uncertainties on the investment decision can also be determined by sensitivity

analysis. This is performed by varying the values of input variables (interest rates, rental levels,

etc.) to determine the effect on relevant output variables (project value, profit, NPV, IRR, etc.).

2. Additional risk information is obtained by using ratio analysis (like the debt coverage ratio and

the breakeven point) and by sensitivity analysis (where the relative effect of changes in the input

assumptions on the rate of return or other output variables are determined).

3. All the information and data collected so far are incorporated in the rigorous discounted-cashflow after-tax analysis of the property. The rate-of return and risk parameters are analyzed,

including a detailed sensitivity analysis of key variables.

4. More investors, especially larger firms, are using explicit risk adjustment in their investment

evaluation process. The three most popular techniques are

(a) adjusting upward the rate of return,

(b) adjusting downward the expected cash lows, and

(c) performing a sensitivity analysis.

5. Various techniques have been developed to determine the effect of risk on the expected return

of an investment. These include:

Page 10 of 34

(a) conservatism,

(b) risk- adjusted discount rates,

(c) the certainty equivalent approach,

(d) the risk-absorption ratio,

(e) decision trees,

(f) sensitivity analysis,

(g) probabilistic risk simulation,

(h) measures of variability, and

(i) modern capital market measures

6. Sensitivity analysis therefore enables the investor to concentrate on the essential variables and

helps prevent waste of time on trying to reduce uncertainty in variables which are not important.

7. The value of the sensitivity analysis is obviously crucially dependent upon the validity of the

assumptions. The assumptions should be as realistic as possible and should be based upon the

best possible information.

8. Note that although a sensitivity analysis provides the investor with ranges of possible returns, it

does not indicate the probabilities that these different returns will actually occur

9. A logical extension of sensitivity analysis is to incorporate probability estimates to the values of

input variables

10. The Monte Carlo technique is an extremely sophisticated technique for analysing the risk of an

investment, but requires extensive data which often does not exist. A simplified procedure can be

used, in which probabilities are assigned to the optimistic, most likely, and pessimistic forecasts

used in the sensitivity analysis

11. The wide range of risk available analysis techniques discussed (in Chapter 10) include elementary

risk analysis, sensitivity analysis, probability analysis using Monte Carlo simulation, decision trees

(and) utility functions.... The choice of technique usually depends on the type of problem, the

available experience and expertise and the computer software and hardware available"

Question 18

Which of the following are part of the classification of risk?

1.

2.

3.

4.

5.

6.

7.

8.

Business Risk

Financial Risk

Political Risk

Interest Rate Risk

Purchasing Power Risk

Management Risk

Liquidity Risk

Environmental Risk

Page 11 of 34

Question 19

The distribution of funds (dividends) from a company or CC is subject to a secondary tax rate on

companies of

1. Secondary Tax on companies is calculated on a net amount of dividends declared by a company.

The net amount is the amount by which the dividends declared exceed the dividends received

during a specific cycle ('dividend cycle')

2. The dividend cycle is the period commencing after the end of the previous dividend cycle and

ending on the date that the current dividend accrues to the shareholder/s.

3. The rate of 12.5% is payable in respect of all dividends declared on or after 14 March 1996.

Question 20

Which of the following sector has seen its capital values rising over the long-term, in line with the Net

income growth?

Retail has been the best performing sector with annualised returns of 15.0% per year. Retail is the only

sector where capital values have risen over the long-term, in line with net income growth, while vacancy

rates have remained reasonably stable

Other and All Property

See page 298

Question 21

In the Ellwood valuation model, income projections are made over the holding period of the investment

rather than its economic life

1. Income projections are made over the holding period of the investment rather than its economic life.

2. Mortgage financing and mortgage terms are considered explicitly.

3. The residual value of the property is estimated.

4. The time value of money is considered in discounting resale proceeds and mortgage flows.

Question 22

Which of the following is true regarding practicing project managers?

Practicing project managers do not find it useful to distinguish between risk and uncertainty whereas

many researchers and writers do seek to draw a distinction

Question 23

In the case of the investment of smaller sums, it is often not possible to invest in invest in prime property

because of the high cost:

In the case of the investments of smaller sums, it is often not possible to invest in prime property

because of the high cost. In this instance the investor might look at investing through a listed property

investment vehicle

Page 12 of 34

Question 24

Which of the following is not considered business risk (risk primarily associated with the property)?

Please see Page 1, Business Risk

Question 25

Which of the following describes an older investor:

The older investor generally

• Demonstrates a more conservative behaviour and greater aversion to risk.

• Cash flow may be more important (in order to augment retirement income),

• less management-intensive investments are generally preferred and tax

• Strategies and estate planning become more dominant

Page 13 of 34

Course (222REF7XE2) REAL ESTATE FINANCE AND INVESTMENT B

Test Case Study 2 Assessment

Question 1

Section 11(o) scrapping allowance applies to

Manufacturing buildings are subject to the S 11(o) scrapping allowance.

• This does not however apply in respect of buildings scrapped within a period of 10 years.

• Essentially if you make a loss on scraping it can be deductible from taxable income.

Question 2

Which of the following is not considered a component of investment management in property?

See Page 4, Question 22

Question 3

A naively diversified portfolio (+) is significantly inferior.

Once again, the naively diversified portfolio (+) is significantly inferior.

Question 4

Which of the following statements about an investor rationale is true?

- to achieve above average performance

- to diversify the asset base and thereby manage risk

- to match assets to liabilities

- to be aware of the risk-averse nature of trustees.

Question 5

In the case of listed investment vehicles, the investment portfolio is valued in terms of terms of the market

price of the units or shares

In the case of the listed investment vehicles, the investment portfolio is valued in terms of the market

price of the units or shares. The value of units or shares in listed property vehicles is thus determinable

at any point in time

Page 14 of 34

Question 6

How is a sensitivity analysis performed?

Sensitivity analysis is a Six (6) step process as follows:

A. Input variable Assumptions

1. Growth rate of possible growth income (%)

2. Growth rate of operating costs (%)

3. Growth rate of property value (%)

4. Expected occupancy level

B. IRR ON EQUITY INVESTMENT (IRRE)

1. Year 3 (%)

2. Year 7 (%)

3. Year 10(%)

C. IRR ON CAPITAL INVESTMENT (IRRTC)

1. Year 3 (%)

2. Year 7 (%)

3. Year 10(%)

D. NET OPERATING INCOME

1. Year 3 (%)

2. Year 7 (%)

3. Year 10(%)

E. BREAK-EVEN POINT

1. Year 3 (%)

2. Year 7 (%)

3. Year 10(%)

F. DEBT COVERAGE RATIO

1. Year 3 (%)

2. Year 7 (%)

3. Year 10(%)

Question 7

Which of the following describes a middle-aged investor:

The middle-aged investor typically exhibits

• greater financial mobility;

• risk-taking capacity is at its maximum;

• more sophisticated property investments can be contemplated and

• diversification is more important

Question 8

Retention is calculated on the net contract price excluding VAT.

Retention is calculated on the net contract price excluding VAT. In practice, VAT will become payable on

retention monies only once the engineer/architect has authorised or certified the release of the retention.

Page 15 of 34

Question 9

Studies show that the correlation between the underlying asset and the returns investors achieve is:

A correlation of 0 means that the returns of assets are completely uncorrelated. If two assets are

considered to be non-correlated

A negative correlation indicates that, historically, as one variable has moved up the other has

moved down.

A positive correlation means that historically both variables have generally moved in the same

direction.

We must stress that measuring correlation as such gives us information regarding the linear

relationship between two variables. A correlation of zero means that there is no linear

relationship between the two variables but does not imply that these variables are independent.

Question 10

What is the Probabilistic risk simulation?

A logical extension of sensitivity analysis is to incorporate probability estimates to the values of input

variables. Given the probability distributions of input variables, the probability of various output variables

can be calculated. This approach is known as a probabilistic risk simulation or a Monte Carlo risk

simulation

Question 11

The use of the standard deviations becomes especially important when evaluating portfolio risk.

The use of standard deviations becomes especially important when evaluating portfolio risk.

Question 12

What factors impacts the asset allocation?

See page 9 Question 14

Question 13

Which statement is true?

Question 14

Where VAT is chargeable on any supply of goods or services the price can be shown exclusively with the

VAT or inclusive with a statement to the effect that the amount includes VAT at at 14%.

Question 15

How is risk typically controlled?

Page 16 of 34

Identification - examine all resources and operations to identify what can go wrong and how it can happen,

i.e. exposures and hazards.

Measurement - calculate the potential financial losses which could result from the identified risks and also

the likelihood of occurrence.

Risk Response - Select and monitor appropriate measures based on effectiveness and economic viability.

This should include the following management options :(i)

avoid the risk or discontinue the loss-causing activity

(ii)

retain the risk and internally fund loss consequences.

(iii)

control the risk with safety programs and loss reduction plans

(iv)

transfer the risk to insurers or to third parties

Question 16

The expected return of a portfolio of properties is equal to the weighted average of the individual returns

of the properties.

Question 17

Which statement is incorrect?

•

•

•

•

Betas are the theoretically correct measure of a firm's market risk.

The correct view of real estate is to regard it as a three-dimensional concept (i.e. as artificially

delineated space),

A third way of distinguishing investment and speculation is to look at the intention of the

investor/speculator: is the primary intention to derive an income from the business venture from

earnings derived from the venture, or is the sole purpose to make a profit upon resale? This is the

distinction drawn by the Receiver of Revenue for tax purposes (cf. Chapter 7). It is suggested that

the latter interpretation is the correct one

The NPV method assumes that such cash flows are invested at the rate of the best alternative

investment, while the IRR method assumes reinvestment at a rate equivalent to the yield of the

entire project. The NPV method therefore seems to be more correct under these circumstances.

Question 18

What is the most important step in attempting to deal with risk exposure?

The first (and perhaps the most important step) in attempting to deal with exposure to risk is to identify

it. Many decision makers believe that the principal benefits of risk management come from the

identification rather than the analysis stage

Page 17 of 34

Question 19

The most sophisticated approach to risk is the

The most sophisticated approach to risk is the Monte Carlo risk simulation model. In this approach,

probability distributions are estimated for each uncertain input variable to determine a range of possible

outcomes and the probability of each

Question 20

Phase III of the real estate cycle is:

The real estate cycle is a four-phase series that reports on the status of both commercial and residential

real estate markets. The four phases are:

a. Recovery,

b. Expansion,

c. Hyper supply, and

d. Recession

Phase 1: Recovery

Low vacancies

Favourable tax

legislation

Favourable publicity

Large amounts of new capital

for development

Phase 2: Expansion

Increasing new construction

Increasing vacancies

Phase 3: Hyper-Supply

Anti-real estate tax

legislation

High vacancies Bad press

Capital flees from new

development

Phase 4: Recession

Vacancies decrease

Rents rise

Little new

construction

Page 18 of 34

Question 21

Which statement is correct pertaining to the results presented by the Decision tree approach?

•

Decision tree analysis requires the analyst to estimate the likelihood of each outcome at every

expected decision point in the future.

•

A 'tree' of choices is built up, with each of the 'branches' being successive decision points.

•

To each branch should be allocated a probability of occurrence, as well the value of that

outcome.

•

By multiplying the probability with the value of that specific alternative, one arrives at the value

of that alternative.

•

The decision tree is a graphical means of bringing together the information needed to make

alternative investment decisions. It shows the present possible courses of action and all future

outcomes, each with a probability value indicating its likelihood of occurrence.

•

Decision tree analysis has formed the basis of a number of developments in risk analysis

techniques.

•

Project risk models have been developed which combine this approach with other analytical

methods such as probability analysis

Question 22

What is best describes the relationship between the degree of risk and the level of return on an investment?

Return and risk are fundamental concepts to the financing of a property investment. There is usually an

inverse correlation between the degree of risk and the level of return on an investment

Question 23

The equity-cash flow model is a one-year model model

The equity-cash flow valuation model is also a one-year model. It does not explicitly consider the time

value of money, equity buildup, changing revenues and expenses, income taxes, or property value

increases or decreases over time. It is, however, quite useful as a preliminary evaluation technique.

Question 24

Which of the following statements is false?

Question 25

A real estate investor must continually analyse the basic:

A real estate investor must continually analyze the basic social, cultural and political changes occurring

in society and their possible effects on changing real estate needs, returns and risks.

Page 19 of 34

Course (222REF7XE2) REAL ESTATE FINANCE AND INVESTMENT B

Test Case Study 3 Assessment

Question 1

Institutional investors are entrusted with __________ or ____________.

Institutional investors are entrusted with insurance premium income or pension fund contributions for

the ultimate benefit of the policy holders on retirement, or in favour of their dependants upon the

death of the policy holder.

Question 2

Which of the following is a difficulty of using the conservatism approach to risk analysis?

The difficulties in using this approach are

• firstly that it is difficult to decide the degree to which the income and costs should be revised

downwards and upwards respectively, and

• secondly that an overly-conservative approach can lead to a possible investment being turned

down. One can make such conservative assumptions that no investment is regarded as being

acceptable, and to do nothing at all is contrary to the goal of wealth maximisation.

Question 3

The rate of return method involves comparing the expected rate of return with the

•

Competition would force prices of properties to their correct levels and the net present values of

all investments would be zero; investors would purchase properties and would earn the market

rate of return on each property. In this case, the rate of return would equal the risk-free rate.

•

The relation between the required return on the 305 Chapter 10 Risk analysis investment and

the market portfolio return is therefore a straight line

Question 4

The chance or probability that the investor will not receive the expected or required rate of return on the

investment is a description of …

The chance or probability that the investor will not receive the expected or required rate of return on the

investment is called Risk

Question 5

Which statement is incorrect:

Page 20 of 34

Question 6

What are variables that are regarded fixed called under Probabilistic risk simulation?

This approach is known as a probabilistic risk simulation or a Monte Carlo risk simulation. Those variables

that are regarded as fixed are called control variables (single-value estimates), while the variables to

which probability distributions are assigned, are called state variables

Question 7

A large sums of capital allows the Institutional Investor to invest in is called?

The larger institutions generally prefer placing larger sums of money. In most cases they would be in a

position to invest in prime property directly. Where the investment is particularly large and the institution

wishes to share the risk, then it may elect to invest in partnership with other large institutions

Question 8

Repairs for aesthetic improvements are regarded as capital improvements.

Question 9

Section 11(o) scrapping allowance applies to

Manufacturing buildings are subject to the S 11(o) scrapping allowance.

• This does not however apply in respect of buildings scrapped within a period of 10 years.

• Essentially if you make a loss on scraping it can be deductible from taxable income.

Question 10

Income earnings potential is guaranteed by:

Property values are influenced by their income earning potential which, to a large extent, is guaranteed

by contractual lease agreements.

Question 11

Which of the following is not a benefit of risk management?

Benefits of risk management are:

•

•

•

•

•

it enables decision making to be more systematic and less subjective

it allows the robustness of projects to specific uncertainties to be compared

it makes the relative importance of each risk readily apparent

it gives an improved understanding of the project through identifying the risks and thinking

through response scenarios

it has a powerful impact on management by forcing a realisation that there is a range of possible

outcomes for a project.

Question 12

Which of the following statements correctly describes The Risk – absorption ratio?

Page 21 of 34

The risk-absorption (RA) ratio measures

• The amount of risk a project can absorb while still remaining acceptable to the investor.

• The ratio is calculated by dividing the annualized net present value (ANPV) of equity cash flows by

the required equity investment The ANPV is the maximum amount by which the cash flow each

year could be reduced without reducing the net present value below zero (a NPV < 0 would make

the investment unacceptable).

• Like the profitability index, the RA ratio is a relative measure used to compare projects of different

sizes.

• If all other risk and return measures are equal, the investment with the greatest risk-absorbing

capacity will be preferred.

Question 13

The expected return of a portfolio of properties is equal to the

The expected return of a portfolio of properties, is equal to the weighted average of the individual

returns of the properties.

Question 14

In terms of Section 13, tax deductions granted are

Residential building allowance - Section 13 (ter)

- Residential building initial allowance - 10% of cost

- Residential building annual allowance - 2% of cost

Question 15

Which investment is preferred according to the Risk absorption ratio?

If all other risk and return measures are equal, the investment with the greatest risk-absorbing capacity

will be preferred.

Question 16

Once the general economy picks up:

Once the general economy picks up, vacancy levels fall and rentals rise faster than building cost.

Question 17

Currently the practice has developed that the transferring attorney has to guarantee to the _______ that

the VAT will be paid over in the correct tax period of the seller. Fill in the gap.

Currently the practice has developed that the transferring attorney has to guarantee to the South African

Revenue Service that the VAT will be paid over in the correct tax period of the seller.

Question 18

Inability to adapt and make effective decisions in response to economic events(changes) is?

Page 22 of 34

The MIRR has attracted a wide following. However, Pyhrr et al (1989:224) caution that "...both the FMRR

and the MIRR are said to examples of mathematical overkill. The investor might better spend his or her

time worrying about the underlying economic and market assumptions than worrying about multiple

reinvestment rate assumptions that will rarely change an investment decision in the real world the IRR

(or PV) is only one of many pieces of information that will be used to make the

investment decision.

Too exclusive a focus on any single investment criterion is generally a mistake

Question 19

The efficient frontier can be described as:

The efficient market hypothesis expounds a theory that reflects the view that shares are always in

equilibrium, and that it is not possible to consistently do better than the market. According to Reekie and

Lingard (1986 53) "if a share price fully reflects all available information pertaining to that security and

the benefits which can be expected to accrue from holding it, the market is said to be efficient

Question 20

With ____________ the institutional investor will receive a monthly income stream.

With direct property investment the institutional investor will receive a monthly income stream.

Question 21

Risk identification is susceptible to which of the following biases?

1. Quite apart from individual biases and preferences,

2. actors inherent in the human cognitive system which especially contribute to faulty decisionmaking include

a. the undue emphasis on short-term decision frameworks,

b. simplistic generalizations and

c. the inability to deal with uncertainty.

Question 22

In a typical IRR calculation, all future investments are discounted to the present to

Measure the

In a typical IRR calculation, all future investments are discounted to the present to measure the so-called

initial investment

Question 23

The use of the standard deviations becomes especially important when evaluating

The use of standard deviations becomes especially important when evaluating portfolio risk.

Question 24

The present value of improvements over the period of the lease is referred to as

Page 23 of 34

The Lessors Allowance (section 11(8)) amounts to the present value of improvements over the period of

the lease, discounted currently at 6% per annum. In practice this amount is taxed in the hands of the lessor

when the improvements have been completed.

Question 25

If the distribution of probable rates cannot be estimated then there is…

A distinction is sometimes made between risk and uncertainty, on the basis of whether the probability

distribution of outcomes is known (or can be estimated) or not. If the distribution is known or can be

estimated, risk is said to exist. If the distribution is not known or cannot be estimated, uncertainty is said

to prevail.

Page 24 of 34

Course (222REF7XE2) REAL ESTATE FINANCE AND INVESTMENT B

Test Case Study 4 Assessment

Question 1

_____ is the total amount, whether in cash or otherwise received by or accrued to a

person in the year on assessment

Gross Income

This is the total amount, whether in cash or otherwise received by or accrued to a

person in the year of assessment.

Question 2

Fund managers and trustees:

Both fund managers and trustees of pension funds act in a fiduciary capacity and therefore need to be

aware of risk

Question 3

Which one of the following statements about institutional investors is most accurate?

Large institutional investors use the opportunity, when buying property directly, to incorporate their

name into the name of the building. This is widely practiced and is undoubtedly a valuable advertising

medium.

The large institutional investors, with their large property portfolios, invariably set up a property and

portfolio management divisions because economies of scale warrant it. Within these property

management divisions there will be several departments which will include legal, leasing, building

management, building maintenance and administration.

The large institutional investors, because of their investment expertise, foresight and investment budgets,

are able to not only invest in prime properties requiring large investment sums, but also in

underdeveloped or undeveloped land which they "land bank" until the market is ripe for a development

to take place on this land.

Large institutional investors, however, are often hamstrung by various levels of decision making, which

may cause an option to lapse should a decision not be made timeously. It is in the interests of these large

institutional investors to streamline their decision-making processes to take advantage of short notice

opportunities.

Large institutional investors use the opportunity, when buying property directly, to incorporate their

name into the name of the building. This is widely practiced and is undoubtedly a valuable advertising

medium.

Question 4

Which statement is incorrect?

Page 25 of 34

Question 5

The present value of improvements over the period of the lease is referred to as

The Lessors Allowance (section 11(8)) amounts to the present value of improvements over the period of

the lease, discounted currently at 6% per annum. In practice this amount is taxed in the hands of the lessor

when the improvements have been completed.

Question 6

If the distribution of probable rates cannot be estimated then there is…

A distinction is sometimes made between risk and uncertainty, on the basis of whether the probability

distribution of outcomes is known (or can be estimated) or not. If the distribution is known or can be

estimated, risk is said to exist. If the distribution is not known or cannot be estimated, uncertainty is said

to prevail.

Question 7

Which of the following sector has seen its capital values rising over the long-term, in

line with the Net income growth?

Retail has been the best performing sector with annualised returns of 15.0% per year. Retail is the only

sector where capital values have risen over the long-term, in line with net income growth, while vacancy

rates have remained reasonably stable

Other and

All Property

See page 298

Question 8

In order to qualify for a residential building allowance, the following must not be met

In order to qualify for deduction:

- must be a housing project

- consist of at least 5 residential units

- let for purposes of profit or occupied by employees.

Question 9

In bottom-up risk identification what are the core activities of Scenario building?

This usually involves developing two extreme scenarios:

scenario 1 where everything occurs as expected and

scenario 2 where everything goes wrong. This approach attempts to identify project risks by a detail

analysis of both likely and negative factors that might influence the budget.

Page 26 of 34

Question 10

Which of the following are statements regarding risk and return is true?

If all other risk and return measures are equal, the investment with the greatest risk-absorbing capacity

will be preferred

Question 11

The forward yield of listed property instruments on the stock market refers to

In fixed property, yields refer to a forward yield. In other words, the anticipated before tax net income for

the property for the next 12 months is calculated as a percentage of the purchase price for investment.

This ratio is often referred to as the initial yield or capitalisation rate.

Question 12

Which of the following is not considered an element of property portfolio strategy?

Question 13

An investment is

In general, an investment is the sacrifice of a (certain) present value for a (possibly uncertain) future value.

The investment decision is therefore essentially a choice between having whatever is of value at present,

and having a value sometime in the future (or, consumption now against consumption later).

Question 14

Which one of the following methods of investment provide the investor with limited liability?

An investor's liability through a property unit trust or loan stock company is limited. If, for any reason,

claims are made against the company, the risk is limited purely in terms of the investment

Question 15

A naively diversified portfolio (+) is significantly

Once again, the naively diversified portfolio ( +) is significantly inferior.

Question 16

How many stages of the ownership cycle are there?

Three stages

The life cycle of property consists of three phases: “Acquisition,” “In-Service,” and “Excess

Question 17

Once the general economy picks up:

Page 27 of 34

Once the general economy picks up, vacancy levels fall and rentals rise faster than building cost.

Question 18

By adding to a portfolio of shares or properties a share or property whose beta is lower than 1, the portfolio's

riskiness is?

By adding to a portfolio of shares or properties a share or property whose beta is lower than 1, the

portfolio's riskiness is reduced.

Question 19

The best fit model is subject to criticism of

The most popular calculation in modern real estate investment analysis is the internal rate of return.

Although this model is subject to criticism about some of its assumptions (as is the net present value model),

this rate of return measure is superior to several others in that it provides a "rate of return per annum" and

properly evaluates the return over the entire period under analysis.

Question 20

Risk identification is susceptible to which of the following biases?

1. Quite apart from individual biases and preferences,

2. actors inherent in the human cognitive system which especially contribute to faulty decisionmaking include

d. the undue emphasis on short-term decision frameworks,

e. simplistic generalizations and

f. the inability to deal with uncertainty.

Question 21

Receipts or accruals of a capital nature are excluded when calculating

Gross Income

This is the total amount, whether in cash or otherwise received by or accrued to a person in the year of

assessment less

(a) -All receipts and accruals of a capital nature

(b) -All receipts and accruals from any source outside the Republic.

Question 22

Section 11(a) and 11(b) can be referred to as the sections that govern

These deductions are governed by what is known as "The general deduction formula". Sections 11(a) and

11(b) can be referred to as the sections that govern the general deduction formula.

Page 28 of 34

Question 23

Which statement about the Expected return on an investment is false?

It is not possible, however, to completely eliminate risk, as there is always a possibility that certain factors

that may occur in the future will influence the expected return on the investment

The most serious effect of risk on an investment is that the expected return on the investment is not

realised more specifically, that the actual return turns out to be less than the expected return.

The expected return on investment, E(R), is the most likely return when the investor is uncertain about

the actual return the investment will produce. It is the weighted average of all possible returns, where the

weights are the probabilities of occurrence

Question 24

A deduction of leasehold improvements will only be granted if the improvements are included in

Deduction in respect of leasehold improvements to land and buildings, the land and buildings must be

used in the production of income. This deduction will only be granted if the improvements are included

in the lessor's gross income and spread over the lesser of the initial lease or 25 years.

Question 25

The ability of the investor to construct a securities portfolio of assets with varying unsystematic risk allow

for:

An investor may now select a portfolio that eliminates unsystematic risk through diversification and is

equally tailored to provide maximum return for a given level of market or systematic risk

Page 29 of 34

Course (222REF7XE2) REAL ESTATE FINANCE AND INVESTMENT B

•

Question 1

4 out of 4 points

A lessor's allowance is currently discounted at an annual rate of

The Lessors Allowance (section 11(8)) amounts to the present value of improvements over the

period of the lease, discounted currently at 6% per annum

•

Question 2

0 out of 4 points

If the distribution of probable rates cannot be estimated then there is…

. If the distribution is not known or cannot be estimated, uncertainty is said to prevail.

•

Question 3

4 out of 4 points

Fund managers and trustees:

Both fund managers and trustees of pension funds act in a fiduciary capacity and therefore need to

be aware of risk

•

Question 4

4 out of 4 points

Which risk type is considered when there are changes in tax law, zoning and rent controls?

Legislative Risk is considered when Changes in tax law; zoning; rent controls; and other

governmental regulations

•

Question 5

4 out of 4 points

Which of the following is the securities are risk-free?

•

•

•

•

government securities,

the bank or on

fixed deposit. (

Question 6

4 out of 4 points

Decreasing risk of the property life cycle consists of which of the following (in order):

•

•

•

Absorption,

Maturing process,

Ageing Process and

Page 30 of 34

•

•

Demise

Question 7

4 out of 4 points

Where the shareholder subsequently converts to sectional title, ________ will be payable on the

conversion.

The sale of the shares and loan obligation will both be subject to VAT. Where the shareholder

subsequently converts to sectional title, no transfer duty will be payable on the conversion

•

Question 8

4 out of 4 points

In bottom up risk identification what are the core activities of the questionnaire and check list

approach?

Questionnaire and check-list approach which

• Isolates events and records them by combining the experience of more managers and more

projects

• It produces a check-list of possible events.

• These can often be further refined into step-by- step procedures such as hierarchical trees

which will guide the decision maker into different paths of thought

•

Question 9

4 out of 4 points

Equal cash flow streams occur when a project is leased for an agreed

Equal cash flow streams occur when a project is leased for an agreed fixed income

•

Question 10

4 out of 4 points

What is the bottom-line approach?

Aggregate or bottom-line approach is essentially the adding-on of a certain percentage for

contingency.

•

Question 11

0 out of 4 points

What is the fundamental issue to consider when judging the plausibility of bubbles theories?

The bubble theory is based on the recognition that market prices, especially commodity, real estate,

and financial asset prices, occasionally experience rapidly rising prices as investors begin

buying beyond what may seem like rational prices.

Page 31 of 34

The hypothesis includes the idea that the rapid rise in market prices will be followed by a sudden

crash as investors move out of overvalued assets with little or no clear indicators for the

timing of the event.

•

Question 12

4 out of 4 points

The equity-cash flow model is a ________ model

The equity-cash flow valuation model is also a one-year model.

•

Question 13

0 out of 4 points

Which statement is incorrect:

•

Question 14

4 out of 4 points

The quoted companies on the stock exchange are generally not able to react to investment

opportunity at short notice is because:

The quoted companies on the stock exchange are generally not able to react quickly to raise the

necessary cash for an investment at short notice.

•

Question 15

4 out of 4 points

In which market is information most difficult to find accurate find?

"The investor may have noneconomic goals (including some that are irrational!), may work in a

highly imperfect market in which accurate information is difficult to obtain, and may have

considerable power to influence the final outcome.

•

Question 16

4 out of 4 points

IRR is equal to the discount rate when the NPV is equal to

Since the IRR is equal to the discount rate when the NPV is equal to zero

•

Question 17

4 out of 4 points

In bottom up risk identification what are the core activities of the Flow chart approach?

Flow chart approach attempts to identify risks by charting the company operations

•

Question 18

4 out of 4 points

Page 32 of 34

Another view of risk is that the ___________ the probability distribution of expected future

returns the __________ the total risk of an investment

Another view of risk is that the tighter the probability distribution of expected future

returns the smaller the total risk of an investment.

•

Question 19

0 out of 4 points

What are the risk response steps?

Risk Response - Select and monitor appropriate measures based on effectiveness and economic

viability. This should include the following management options :

•

(i)

avoid the risk or discontinue the loss-causing activity

(ii)

retain the risk and internally fund loss consequences.

(iii)

control the risk with safety programs and loss reduction plans

(iv)

transfer the risk to insurers or to third parties

Question 20

0 out of 4 points

Which of the following is not an approach to determine the investment value of a project?

Three approaches are commonly used to determine the investment value of a project:

• the generalized model of investment value,

• the equity-cash flow valuation model and

• the Ellwood valuation model.

•

Question 21

4 out of 4 points

Provided that the property investment in ungeared as in the case of investments by

institutional investors, there is

Provided the property investment is ungeared as in the case of investments by institutional

investors, there is always an underlying intrinsic value

•

Question 22

0 out of 4 points

Phase IV of the real estate cycle is:

Page 33 of 34

Demand is slow, vacancies reach unacceptable levels

•

•

•

•

•

•

Supply is so great, and demand so soft that rental rates decrease.

This decline may be evidenced by actual rate reductions or by concessions, so called 'free

rent'.

This is a 'tenant's market'.

Constructions slows to a halt or to minimum levels.

Borrowers, especially those who are inexperienced or who have become undercapitalized,

are unable to support property operations and meet debt service.

Question 23

0 out of 4 points

_________ land can be taxed in various ways: the income from land

Due to its visibility and immobility, Land can be taxed in various ways: the income from land (e.g. an

agricultural income tax); ownership or occupation of land (e.g. property tax); acquisition of land (e.g.

transfer duty or stamp duty) and the alienation of land (e.g. VAT). South Africa is no exception to this

rule: "tithes" were introduced in 1677, transfer duty in 1686 and recognition fees in 1714 (Franzsen

1990).

•

Question 24

4 out of 4 points

Equities share values could become worthless should

Equity share values could become worthless should the asset become insolvent.

•

Question 25

0 out of 4 points

When is the case-based approach used in top down risk identification?

The case-based approach uses the assumption that similar projects are often the best starting

point for identifying reasonable risk events. This approach is reasonable when a new investment

with similar characteristics are considered, but is less useful when the new investment is particularly

unique

Page 34 of 34