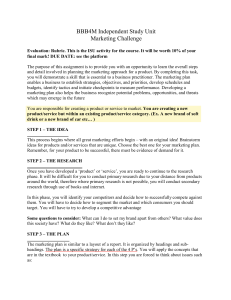

Digital Marketing: Strategy, Implementation & Practice

advertisement