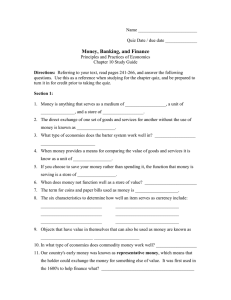

Financial Markets Tutorial: Bank Operations & Regulations

advertisement

1 FIN226: Financial Markets and Institutions Week 3 Tutorial Textbook Chapter 2 Questions 2, 5. Textbook Chapter 3: Questions 4, 5, 13. Plus additional question Chapter 2 – Commercial Bank Operations 2 ‘Decades after the commencement of deregulation in the financial markets, the international capital markets remain a relatively unimportant source of funds for commercial banks.’ Analyse and discuss this statement. The statement suggests that no matter how many regulations are being put in the financial industry with the commercial banks and not just to commercial banks and international capital markets. However with some deregulations in the financial markets like the commercial bank operations there has been a far more variety of investments and funding with deregulations of the financial markets. Relatively unimportant sources of funds for commercial banks are the cost, budgeting and risks, regulations like ASIC given to commercial banks and provide limited access and ability to trade in international capital markets, local funding as well as current account deposits, term deposits bill acceptable liabilities and debt liabilities. Chapter 2.1 commercial banking 5 Commercial banks are the principal providers of loan finance to the household sector. Identify five different types of loan finance that a bank offers to individuals. Briefly explain the structure and operation of each of these types of loans. The commercial banks provide the five different types of loans that the banks offer to each individual and that is: 1. Mortgage originators - which are lenders and refinance people mortgage through securitization 2. Amortised loan instalments - equal loan instalments when current payments are due and principal loan repayments as well. 3. Investment property finance - borrower to purchasers through rent or lease from a third party 4. Fixed term loan - loan providers to purchase goods and services 5. Credit cards - electronic distribution systems to give and provide consumers funds needed eg. ATM and EFTPOS Chapter 3 – Non-bank Financial Institutions 4 Typically, an investment bank will act on behalf of a company involved in a merger and acquisition. What are the main areas to which the investment bank will draw the client’s attention? The main particular areas an investment bank that will draw clients attention when merger and acquisition is being involved when a company takes over is: - Analysis of the target company - Valuation of the company Establishment of contacts Transaction structure Negotiation Due diligence Nature of the takeover Communication with the market Project management and integration 5 Managed funds are often categorised by the type of investments purchased by the fund. These include capital stable funds, balanced growth funds and managed capital growth funds. For each of these funds, discuss the types of investments the fund might accumulate and explain the purpose of the investment strategies. ? need assistance for this question in tutorial class 13 Because hedge funds are usually only accessible to high-net-worth individuals, hedge funds should not be regulated. Discuss this statement. The reasons as to why high net worth individuals should not be regulated from hedge funds are due low suspicion and are not necessarily harmful; however hedge funds have very small activities with transactions but have very large amounts of leverage and trading in order to make large amounts of profits. Additional question: What are the main regulatory bodies and frameworks overseeing the operations of commercial banks in Australia, and how do these regulations contribute to maintaining financial stability and consumer protection within the country's banking sector? The main regulatory bodies overseeing the operation in commercial banks are the 1. Australian securities and investment commission (ASIC) - financial industries are being observed and enforcing regulations to protect consumers from corruption or scams. 2. Reserve bank of Australia (RBA) - which is Australia's central bank to provide economic and financial stability in the country as well as monetary policy 3. Australian prudential regulation authority (APRA) - supervision of credit unions, commercial banks, insurance companies and superannuation. Other legal frameworks like legislation and act are the Banking act 19 Reference for additional question: https://www.rba.gov.au/fin-stability/reg-framework/overview.html59.