Money, Banking, and Finance

advertisement

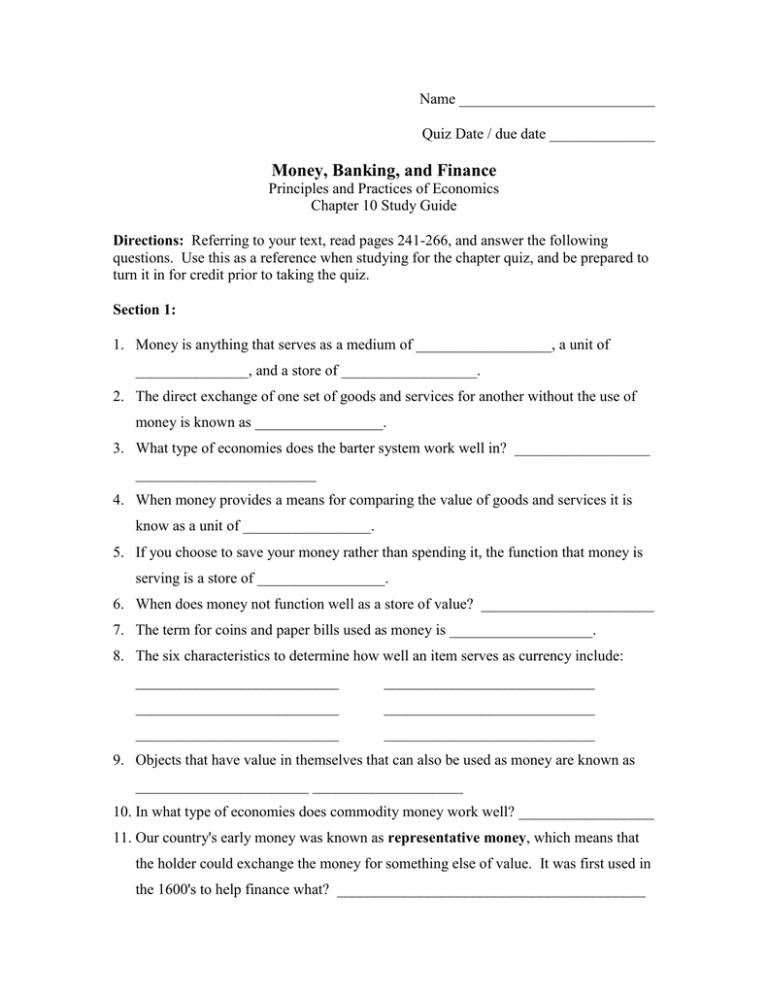

Name __________________________ Quiz Date / due date ______________ Money, Banking, and Finance Principles and Practices of Economics Chapter 10 Study Guide Directions: Referring to your text, read pages 241-266, and answer the following questions. Use this as a reference when studying for the chapter quiz, and be prepared to turn it in for credit prior to taking the quiz. Section 1: 1. Money is anything that serves as a medium of __________________, a unit of _______________, and a store of __________________. 2. The direct exchange of one set of goods and services for another without the use of money is known as _________________. 3. What type of economies does the barter system work well in? __________________ ________________________ 4. When money provides a means for comparing the value of goods and services it is know as a unit of _________________. 5. If you choose to save your money rather than spending it, the function that money is serving is a store of _________________. 6. When does money not function well as a store of value? _______________________ 7. The term for coins and paper bills used as money is ___________________. 8. The six characteristics to determine how well an item serves as currency include: ___________________________ ____________________________ ___________________________ ____________________________ ___________________________ ____________________________ 9. Objects that have value in themselves that can also be used as money are known as _______________________ ____________________ 10. In what type of economies does commodity money work well? __________________ 11. Our country's early money was known as representative money, which means that the holder could exchange the money for something else of value. It was first used in the 1600's to help finance what? _________________________________________ 12. During the American Revolution, more representative money was issued to finance the war against what country? ____________________________ The unfortunate part about this money was that few people were able to actually collect on these bills because the government had no power to collect taxes. 13. What year did the government set up a system to collect taxes? __________ 14. When the government has decreed that money is "legal tender" and is an acceptable means to pay debts, the money is known as _____________ money. Section 2: 15. When did the government establish the first bank in the U.S.? __________ For how long was its charter valid? ________ years 16. When the federal bank's charter ran out, and it was not renewed in 1811, states ran their own banks. What was the problem with these banks? 17. When was the second bank of the U.S. chartered? __________ 18. What is the name for the nations first true central bank? _________________ _________________ __________________. What year was it founded? _________ 19. The severe economic decline that began in 1929 and lasted more than a decade was known as the ______________ ____________________. 20. During this time, the combination of unpaid loans and ____________ ____________ resulted in the failure of thousands of banks across the country. 21. What is the name of the organization that insures depositors' money up to $100,000? _________________ _________________ ________________ ________________ Section 3: 22. All the money available in the United States is known as the _______________ ________________. 23. The money supply is divided into two categories, known as M1 and M2. Write what each represents: M1: M2: 24. The ability to use or quickly convert assets to cash is known as __________________ 25. Another term for M2 is ________________ ___________________. 26. Funds in checking accounts are also known as ______________ ________________ 27. What is the possible disadvantage to saving money in a Certificate of Deposit (CD)? 28. Fractional Reserve Banking refers to a system in which banks only keep a fraction of the funds on hand, and do what with the remainder of the money? _____________________________ 29. When a person does not pay his or her loan back, they have done what with the loan? _______________________ 30. A specific loan used to buy real estate is known as a ________________________ 31. The price paid for the use of borrowed money is ____________________ 32. The amount borrowed for a loan is known as the ______________________ 33. When interest is paid on both the principal and accumulated interest, it is known as what kind of interest? ___________________________ 34. Why do finance companies generally charge higher rates of interest than banks or credit unions? 35. Read the chapter summary on page 266 carefully. Answer items 1-8 from the Key Terms activity on page 266, by writing the correct matching term in the appropriate blanks below. 1. ___________________________________ 2. ___________________________________ 3. ___________________________________ 4. ___________________________________ 5. ___________________________________ 6. ___________________________________ 7. ___________________________________ 8. ____________________________________