Topic 1

Lecturer

:

:

THE FIRM’S INVESTMENT DECISION

SHELLEY DONNELLY

donnellys@ukzn.ac.za

Required reading:

Chapters 8, 9, 10 and 15 of your prescribed text: Correia, C. (2019) Financial Management

9th Edition. Juta Press.

Timetable:

LECTURES &

TUTS

DATE

TOPIC

Lectures 1 & 2

25/07

Lectures 3 & 4

27/07

Revision of Incremental cash flows, OCF, and Estimating cash

flows.

Inflation and Capital Budgeting.

Taxation effects

Capital rationing

Lectures 5 & 6

02/09

Risk and Uncertainty

Tut 1.1

02/09

Questions provided on Learn

Lectures 7 & 8

04/09

Risk and Uncertainty concluded

Lectures 9 & 10

08/08

Projects with Unequal Lives

The Replacement Decision

Lectures 11 & 12

10/08

The Replacement Decision concluded

Leasing

Topic 1 Revision

15/08

Tut 1.2

15/08

Questions provided on Learn

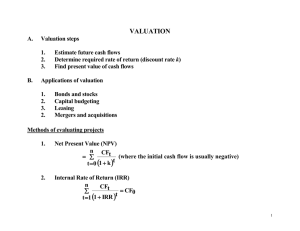

TOPIC 1:

THE FIRM’S INVESTMENT

DECISION

Incremental Cash Flows and estimating Cash Flows

revised

Inflation and Taxation and Capital Budgeting

Capital Rationing (including PI)

Risk and Uncertainty:

•

Adjusting the Discount rate

•

Certainty Equivalents

•

Sensitivity and Scenario Analysis

•

Break Even NPV Analysis

•

Probability Analysis and Decision Trees

•

Comprehensive Example – SEC.

Unequal Lives – EAC method

Replacement Decision

Leasing

RECAPTHE INVESTMENT DECISION IN PREVIOUS

COURSES:

Financial Managers face three main decisions,

one of which pertains to Capital Budgeting –

what Long Term investments should the firm

take on?

FINA202

Topic 2 included the Investment Decision.

You learned how to use various capital budgeting

techniques such as the NPV, IRR, Payback and Discounted

Payback periods (Profitability Index to come).

You should recall the importance we placed on NPV due to

its many advantages over the other techniques.

We learned about incremental cash flows and how to arrive

at the OCF’s and estimated cash flows.

In this topic we will further develop a number of these concepts, hence it is

vital that you review your notes from last year as it will be assumed that you

have.

INCREMENTAL CASH FLOWS

The cash flows that should be included in a

capital budgeting analysis are those that will

only occur if the project is accepted

These cash flows are incremental cash flows

The stand-alone principle allows us to analyze

each project in isolation from the firm simply

by focusing on incremental cash flows

You should always ask yourself “Will this cash flow

occur ONLY if we accept the project?”

If the answer is “yes”, it should be included in the analysis

because it is incremental

If the answer is “no”, it should not be included in the

analysis because it will occur anyway

If the answer is “part of it”, then we should include the part

that occurs because of the project

INCREMENTAL CASH FLOWS REVISED

Sunk costs

Opportunity costs

Only include those that are exclusive to the project

Changes in NWC

Positive side effects – benefits to other projects

Negative side effects – costs to other projects, sometimes known

as Erosion Costs

Overheads

Costs of lost options (eg using property the firm already owns –

what else could it have been used for/ what could it have been

sold or rented out for)

Side effects/Spillover effects/Externalities

Costs that have accrued in the past/are accrued regardless of

project being accepted or not.

When the project winds down, NWC is recovered

Financing costs

We do not include interest paid or other financing costs – we are

interested in cash flow from assets (not to lenders or

shareholders). Avoid double counting.

ESTIMATING CASH FLOWS - REVISED

TOTAL CASH FLOW CALCULATION (Cash Flow from assets)

Total Cash flow

= Operating Cash Flow (OCF) – Additions to NWC –

Capital Spending

CALCULATION OF OCF:

S = sales C = operating costs

rate

D = Depreciation

TC =Corporate tax

Conventional method:

OCF

= PBIT + D - Taxes

Top-Down method:

OCF

= (S – C) – (S – C – D) x TC

Bottom-Up method:

OCF

= Net Profit + D

Tax-shield Approach:

OCF

= (S – C) x (1 - TC ) + (D x TC )

Which to use??

REVISION EXERCISE

Best Manufacturing Company new investment proposal.

Corporate tax rate 34%.

Appropriate discount rate 12%.

Projected year-end accounting data (R 000’s) as follows:

YEAR

Sales

revenue

Operating

costs

Investment

Depreciation

NWC

0

1

7 000

2

7 000

3

7 000

4

7 000

2 000

2 000

2 000

2 000

2 500

250

2 500

300

2 500

200

2 500

0

10 000

200

Calculate OCF using four known techniques

Calculate project NPV

INFLATION AND CAPITAL BUDGETING

Investors should have an expectation of future inflation. It affects both cash

flows and the discount rate used.

The Reserve Bank includes the effects of expected inflation in deciding on

interest rate policy. The cost of capital will include an inflation premium to

protect investors against a decline in purchasing power, hence it is usually

nominal.

There are two methods of adjusting for inflation:

1. Estimate cash flows in NOMINAL terms and use a NOMINAL discount

rate (nominal cash flow = prices expected to rule when cash flow occurs.

Inflation not applied to deprecation which uses historical value).

This is the more commonly used method.

Nominal cash flows have already been adjusted for inflation.

Costs of Capital (used to determine the discount rate) are usually

inclusive of inflation so already nominal.

OR

Method 2 overleaf..

INFLATION AND CAPITAL BUDGETING

2. Estimate cash flows in REAL terms and use a REAL discount rate

(real cash flows = future cash flows expressed in terms of Date 0

purchasing power).

Real flows exclude inflation effects.

Need to convert nominal discount rates to real to remove inflation

effects.

Use the Fisher Effect which expresses the relationship between

NOMINAL and REAL rates of return:

1 + Nom rate = (1 + Real rate) x (1 + inflation rate)

(R)

(r)

hence R = (1 + r) (1 + h) – 1 or

(h)

r= 1+R

1+h

-1

INFLATION – AN EXAMPLE

Dixie Co has a nominal RRR of 20% at a time where

there is an 8% inflation expectation. An NPV

analysis is required of the following project:

Initial outlay: R50 000

Project lifespan: 4 years (zero salvage value)

Current estimation of after-tax cash savings from

the project: R30 000 p.a.

Use both the NOMINAL and REAL methods of

adjusting for inflation, to perform the NPV analysis.

INFLATION EXAMPLE SOLUTION

1. Using nominal RRR and nominal cash flows:

Inflate the cash flows:

yr 1 = 30 000 x 1.08 = 32 400

yr 2 = 30 000 x 1.082 = 34 992

yr 3 = 30 000 x 1.083 = 37 791

yr 4 = 30 000 x 1.084 = 40 815

NPV using a fin. calculator:

-50 000 CF0; 32 400 CF1; 34 992 CF2; 37 791 CF3;

40 815 CF4; 20 I/YR; NPV = R42 852.95

2. Using real RRR and real cash flows:

r = (1.20 / 1.08) – 1 = 11.11%

NPV using a fin. calculator:

-50 000 CF0; 30 000 CF1; 4 Nj; 11.11 I/YR;

NPV = R42 855.20

ANOTHER EXAMPLE OF CAPITAL BUDGETING UNDER

INFLATION

Sony International has an investment opportunity

to produce a new stereo color TV.

The required investment on January 1 of this year

is $32 million. The firm will depreciate the

investment to zero using the straight-line method,

over the project’s lifespan of 4 years. The firm is in

the 34% tax bracket.

The price of the product on January 1 will be $400

per unit. The price will stay constant.

Labour costs will be $15 per hour on January 1.

They will increase at 2% per year.

Energy costs will be $5 per unit; they will increase

3% per year.

12 and

The inflation rate is 5%. Revenues are received

costs are paid at year-end.

EXAMPLE OF CAPITAL BUDGETING UNDER INFLATION

GIVEN:

Year 1

Year 2

Year 3

Year 4

Physical

Production

(units)

100 000

200 000

200 000

150 000

Labour Input

(hours)

2 000 000

2 000 000

2 000 000

2 000 000

Energy input,

physical units

200 000

200 000

200 000

200 000

The real discount rate is 3.81%.

Calculate the NPV, using the nominal method of adjusting for

13

inflation.

YEAR 1 AFTER-TAX NOMINAL CASH FLOWS

Real Cash Flows

Price: $400 per unit with zero annual price increase

Labour: $15 per hour with 2% annual wage increase

Energy: $5 per unit with 3% annual energy cost increase

Year 1 After-tax nominal Cash Flows:

Revenues

= $400 × 100 000

= $40 000 000

Labour costs = $15 × 1.02 × 2 000 000

= $30 600 000

Energy costs = $5 × 1.03 × 200 000

= $1 030 000

After-tax operating profit =

($40 000 000 – $30 600 000 – $1 030 000) x (1 – 0.34) 14

= $8 370 000 x 0.66

= $5 524 200

YEAR 2 AFTER-TAX NOMINAL CASH FLOWS

Real Cash Flows

Price: $400 per unit with zero annual price increase

Labour: $15 per hour with 2% annual wage increase

Energy: $5 per unit with 3% annual energy cost increase

Year 2 After-tax nominal Cash Flows:

Revenues

Labour costs

Energy costs

= $400 × 200 000

= $80 000 000

= $15 × 1.022 × 2 000 000

= $31 212 000

= $5 × 1.032 × 200 000

= $1 060 900

After-tax operating profit

=

($80 000 000 – $31 212 000 – $1 060 900) x (1 – 0.34)

= $47 727 100 x 0.66

= $31 499 886

15

YEAR 3 AFTER-TAX NOMINAL CASH FLOWS

Real Cash Flows

Price: $400 per unit with zero annual price increase

Labour: $15 per hour with 2% annual wage increase

Energy: $5 per unit with 3% annual energy cost increase

Year 3 After-tax nominal Cash Flows:

Revenues

= $400 × 200 000

= $80 000 000

Labour costs = $15 × 1.023 × 2 000 000

= $31 836 240

Energy costs = $5 × 1.033 × 200 000

= $1 092 727

After-tax operating profit =

($80 000 000 – $31 836 240 – $1 092 727) x (1 – 0.34)

16

= $47 071 033 x 0.66

= $31 066 882

YEAR 4 AFTER-TAX NOMINAL CASH FLOWS

Real Cash Flows

Price: $400 per unit with zero annual price increase

Labor: $15 per hour with 2% annual wage increase

Energy: $5 per unit with 3% annual energy cost increase

Year 4 After-tax nominal Cash Flows:

Revenues

= $400 × 150 000

= $60 000 000

Labour costs = $15 × 1.024 × 2 000 000

= $32 472 964.80

Energy costs = $5 × 1.034 × 200 000

= $1 125 508.81

After-tax operating profit =

($ 60 000 000 – $ 32 472 964.80 – $ 1 125 508.81) x (1 – 0.34)

17

= $26 401 526.39 x 0.66

= $17 425 007

EXAMPLE OF CAPITAL BUDGETING UNDER INFLATION

The depreciation tax shield is a nominal cash

flow, and must therefore be discounted at

the nominal rate.

Project life = 4 years

Annual depreciation expense:

$32 000 000

= $8 000 000

4 years

Depreciation tax shield

= $8 000 000 × 0.34

= $2 720 000 per annum

18

EXAMPLE OF CAPITAL BUDGETING UNDER INFLATION

[OCF = (S – C) (1 – TC) + (D X TC)]

OCF

0

$32 000 000

$5 524 200

$31 499 886

$31 066 882

$17 425 007

+ 2 720 00

+ 2 720 000

+ 2 720 00

+ 2 720 000

= 8 244 200

= 34 219 886

= 33 786 882

= 20 145 007

1

2

3

4

The project NPV can now be computed by discounting the nominal

cash flows at the nominal discount rate:

Nominal rate (R) = (1.0381 x 1.05) – 1 = 9%

NPV:

-$32 000 000 CF0; 8 244 200 CF1; 34 219 886 CF2; 33 786 882 CF3;

20 145 007 CF4; 9 I/YR; NPV = $44 726 582.62 Accept 19

TAXATION AND INVESTMENT APPRAISAL

Tax definitely a cash outflow, therefore after-tax

cash flows of projects need to be evaluated

2 Rules:

Accommodate INCREMENTAL tax effects

Get the timing right

2 specific items need to be dealt with:

Depreciation and

Salvage values

DEPRECIATION

Non-cash expense, so only has cash flow implications

insofar as it influences the tax bill

When claimed as an expense for tax purposes, depreciation

is termed a “wear and tear allowance”

Firms can use the straight-line or declining balance

method. The former is more advantageous from a cash flow

perspective due to higher wear and tear allowances in the

early years (illustrated on next slide).

There may be a difference between Receiver of Revenue

allowances, and the rate at which the firm may choose to

depreciate its assets, in which case 2 separate asset

registers are maintained.

Firms who choose a lower depreciation rate, will reflect a

higher profit figure. They use this approach in the belief

that the wear and tear allowance does not reflect the true

operating life of the asset, and that the higher profit

figures are more realistic.

DIFFERENT DEPRECIATION METHODS:

Declining/Reducing Balance

Straight-Line method

Opening Book

Wear and Tear

Closing Book

Open Wear & Tear Closing

Value

@ 33.3% of decl.

Value

Book

@ 33.3%

Book

Value

of cost

Value

Book Value

300 000

100 000

200 000

300 000 100 000

200 000

200 000

66 666

133 334

200 000 100 000

100 000

133 334

44 444

88 890

100 000 100 000

0

88 890

29 630

59 260

59 260

19 753

39 507

39 507

13 169

26 338

etc

CHOOSING A LOWER DEPRECIATION RATE:

Purchase price of asset: R180 000

Wear and Tear allowance: 33.3% of cost per annum

Firm wishes to depreciate over 4 years

Tax rate = 35%

For Tax Purposes

Own Books

Operating Profit (before depr.)

150 000

150 000

Wear & Tear allowance (33.3%)

60 000

Depreciation (180 000/4)

45 000

Profit before Tax

90 000

105 000

Tax @ 35% on R90 000

31 500

31 500

Net Profit after Tax

58 500

73 500

SALVAGE VALUES

If Market Value = Book Value, then asset has been

depreciated correctly and taxes have been correctly paid.

If Market Value exceeds Book Value, then the asset has

been over-depreciated and too little was paid in taxes.

Example:

Market value R15 000, Book value R8 000.

Then R7 000 too much was deducted in wear and tear.

Therefore R7 000 x 35% too little was paid in taxes i.e. R2 450 is owed

in tax (cash outflow).

Sale of vehicle is treated as a ‘profit’ for tax purposes.

If Book Value exceeds Market value, then too little

depreciation was deducted and too much tax was paid.

Example:

Market value R4 000, Book value R8 000.

Then R4 000 too little was deducted as wear and tear.

Therefore R4 000 x 35% in taxes need to be recouped from Revenue

Services (cash inflow of R1 400 ).

Sale of vehicle treated as a ‘loss’ for tax purposes.

WORKING EXAMPLE

Harry is financial manager of a company. He is nearing retirement and you have

been appointed as his deputy with a view to taking over from him in 12 months

time.

The company is considering an investment in a new product that will cost

R1 200 000 in new machinery and will result in profit before depreciation and tax of

R375 000 per annum in real terms for 5 years. At the end of the 5 years, the

machinery can be sold for its written-down book value. The investment will require

working capital at the beginning of each year as follows (figures in real terms):

Year

Amount (R)

1

100 000

2

200 000

3

300 000

4

400 000

5

500 000

Harry is proposing to evaluate the investment using the company’s nominal

weighted average cost of capital (WACC) of 16%.

The following notes are relevant:

At the end of Year 5, the total working capital can be released in cash back to

the company.

Inflation is expected to be 4% per annum on all operating cash flows and

working capital for the period under review.

The company pays tax at the rate of 33%. There is a 12-month time lag for

tax payments or refunds.

Tax relief is available on capital expenditure at 25% on a reducing balance.

Assume all cash flows occur at year-end except the purchase of the new

machinery and the working capital. Both these items of expenditure occur at

the beginning of the year.

You are required to:

Evaluate the investment using the company’s WACC, as suggested by Harry.

WORKING EXAMPLE SOLUTION

Cash flows (R’000)

Time

0

1

2

3

4

5

6

Pre tax/depn profit (W2)

390

405.6

421.82

438.70

456.25

Capital allowances (W3)

(300)

(225)

(168.75)

(126.56)

(94.92)

90

180.6

253.07

312.14

361.33

(29.7)

(59.60)

(83.51)

(103.01)

(119.24)

90

150.9

193.47

228.63

258.32

(119.24)

+ Capital allowances

300

225

168.75

126.56

94.92

OCF

390

375.9

362.22

355.19

353.24

PBIT

Tax on profits @ 33%

NPAT

Machinery

Working capital (W1)

Net cash flow*

(1 200)

(119.24)

284.77

(W3)

(100)

(108)

(116.48)

(125.47)

(134.98)

584.93

(1 300)

282

259.42

236.75

220.21

1 222.94

(119.24)

Net present value = R (57 493)

-1 300 CF0; 282 CF1; 259.42 CF2; 236.75 CF3; 220.21 CF4; 1 222.94 CF5; -119.24 CF6; 16 I/YR

The negative NPV indicates that the project is not acceptable when appraised at the WACC

WORKING EXAMPLE SOLUTION NOTES

1.

Working capital

The relevant cash flow is the increase in working capital required from one year to the

next:

Time

0

1

2

3

4

5

200

300

400

500

x

x

x

x

(1.04)

(1.04)2

(1.04)3

(1.04)4

W/cap balance

(nominal terms)

R’000

100

208

324.48

449.95

584.93

Cash injection

(outflow)

R’000

-100

-108

-116.48

-125.47

-134.98

W/cap recovered

R’000

+584.93

2.

Pre-tax/depreciation profit

These figures are obtained by applying the inflation rate of 4% for the appropriate

number of years, eg, for time 3: R375 000 x (1.04)3 = R421 824

3.

Capital allowances/scrap value

Time

Book Value

0

1

25%

2

25%

3

25%

4

25%

5

25%

Scrap value

R’000

1,200

(300)

900

(225)

675

(168.75)

506.25

(126.56)

379.69

(94.92)

284.77

Capital allowance

(depreciation)

R’000

300

225

168.75

126.56

94.92

CAPITAL RATIONING IN CAPITAL BUDGETING

We now need to drop the unrealistic assumption that there

are no finance limits in capital budgeting.

CAPITAL RATIONING is when funds are not available to

finance ALL wealth-enhancing projects

There are 2 types of capital rationing:

- SOFT RATIONING = internal management-imposed

limits on investment expenditure e.g. Mgmt may want to

maintain a fixed debt/asset ratio

- HARD RATIONING = relates to capital from external

sources. Financial institutions won’t supply unlimited

capital, despite +’ve projected NPV’s. Banks don’t like to

see debt ratio’s exceed certain parameters either (risk

control).

We also need to look at ONE-PERIOD capital rationing (for

divisible and indivisible projects), as well as MULTIPERIOD capital rationing.

ONE-PERIOD CAPITAL RATIONING DIVISIBLE PROJECTS

This is where limits are placed on finance availability for one year only

(thereafter unlimited funds), and the projects can be undertaken in part or in

full.

2 methods:

Can rank according to absolute NPV’s e.g.

(R million)

TIME 0

1

2

NPV @ 10%

A

-2

6

1

4.281

B

-1

1

4

3.215

All positive, so all

C

-1

1

3

2.389

acceptable

D

-3

10

10

14.355

PROJECT

But capital rationed to R4.5m for 1 year…

ONE-PERIOD CAPITAL RATIONING

CONTINUED - DIVISIBLE PROJECTS:

Method 1: Ranking according to highest absolute NPV

OUTLAY

NPV

All of project D

3

14.355

3/4 of project A

1.5

3.211

4.5

17.566

This method will often give an incorrect result and is

biased towards the larger projects. Sometimes

investing in a number of smaller projects will be

better.

ONE-PERIOD CAPITAL RATIONING

CONTINUED - DIVISIBLE PROJECTS:

Method 2: Use the PROFITABILITY INDEX or the BENEFIT-COST RATIO

Profitability Index =

Gross Present Value (without deducting initial outlay)

Initial Outlay

Benefit -Cost Ratio =

Net Present Value

Initial Outlay

Both provide a measure of profitability per R1 invested. The choice between the

2 is a personal one. You would choose one method and then arrange the projects

in order of highest P.I or B-C Ratio. Then work down the list until the capital

limit is reached

For the purposes of our example, we will choose the Profitability Index:

ONE-PERIOD CAPITAL RATIONING DIVISIBLE PROJECTS CONCLUDED

Project

NPV @ 10%

GPV @ 10%

P.I

A

4.281

6.281

6.281 / 2 = 3.14

4.281 / 2 = 2.14

B

3.215

4.215

4.215 / 1 = 4.215

3.215 / 1 = 3.215

C

2.389

3.389

3.389 / 1 = 3.389

2.389 / 1 = 2.389

D

14.355

17.355

17.355 / 3 = 5.785

14.355 / 3 = 4.785

Ranking according to highest P.I:

Project

P.I.

Initial Outlay

NPV

D

5.785

3

14.355

B

4.215

1

3.215

1/2 OF C

3.389

0.5

1.195

0 OF A

3.14

0

0

4.5

18.765

Via this method, an extra R1.199m is created for shareholders

(than via the absolute NPV method).

So always use Method 2 with divisible projects!

B-C Ratio

ONE-PERIOD CAPITAL RATIONING INDIVISIBLE PROJECTS:

Easiest approach is to examine the total NPV values of all feasible

alternative COMBINATIONS of whole projects (trial and error):

Assume same projects but a capital constraint of R3m:

Combination

1

2

NPV

R2m in A

4.281

R1m in B

3.215

Answer:

7.496

You would choose

R2m in A

4.281

Comb.4 (highest NPV)

R1m in C

2.389

6.670

Note that any

unutilized

capital could be

3

4

R1m in B

3.215

invested, giving rise to

R1m in C

2.389

an additional NPV, to

5.604

be added to the total

14.355

NPV.(e.g. Comb.3)

R3m in D

MULTI-PERIOD CAPITAL RATIONING:

This is a more complicated issue. We are

talking about capital constraints in more

than one period e.g. Capital limit of R240

000 at time 0, and a further constraint of

R400 000 at time 1.

To solve, a mathematical program is

required and a computer would be

employed. If projects are divisible, linear

programming is used; if indivisible,

integer programming is used.

(beyond the scope of this course)

RISK AND UNCERTAINTY IN CAPITAL BUDGETING INTRO

Businesses operate in an uncertain environment. There is an

upside (earning more than expected) and a downside (earning

less than expected) to uncertainty.

The presence of risk in capital budgeting decisions means the

possibility exists of more than one outcome. Probabilities can be

assigned to possible outcomes, with the probability of all

possible outcomes summing to one.

Some of the approaches we have learnt so far do make

adjustments for risk. With the PBP for example, by insisting on

early cut-off dates, the chance of distant cash flow forecasts

proving unreliable, is eliminated (hence risk is reduced). Even

within the discounting process there is a safeguard included for

risk: the present value of a future cash flow is worth less the

further into the future it will be received.

Now we will focus on various other ways in which we can

accommodate the risk of uncertain future outcomes into an

NPV analysis:

1. ADJUSTING FOR RISK THROUGH THE DISCOUNT RATE

This method recognizes that there is a reward for bearing risk. In this approach, a

number of % points (the premium) are added to the risk-free discount rate, which

is then used to calculate NPV in the normal manner. In this way, marginally

profitable projects are less likely to have a +‘ve NPV.e.g.

Level of Risk

Risk-free rate

Risk premium

Risk-adjusted

rate

Low

9%

+ 3%

12%

Medium

9%

+ 6%

15%

High

9%

+ 10%

19%

The project to be evaluated has the following cash flows:

Time(years)

0

1

2

Cash flow(R)

-100

55

70

If project judged low risk: -100 CF0; 55 CF1; 70 CF2; 12 I/YR; NPV = R4.91

ACCEPT

If project judged med risk: -100 CF0; 55 CF1; 70 CF2; 15 I/YR; NPV = R0.76

ACCEPT

If project judged high risk : -100 CF0; 55 CF1; 70 CF2; 19 I/YR; NPV = -R4.35

REJECT

Drawbacks: Subjective risk assessment and arbitrary selection of risk premiums.

2. CERTAINTY EQUIVALENT METHOD

Expected “risky “cash flows are converted to “riskless” or “certainty

equivalent” values, and discounted at a risk-free discount rate. e.g.

Year

Cash flow

NPV: 10 I/YR

0

- 9 000

CF0

1

7 000

CF1

2

5 000

CF2

3

5 000

CF3

NPV = 5 252.44

Project appears worthwhile, but management are uncertain of

future cash flows, so take only 70% of year 1 flow, 60% of year 2 flow

and 50% of year 3 flow:

Hence above cash flows will be adjusted to R4 900 (year 1), R3 000

(year 2) and R2 500 (year 3).

The risk-adjusted NPV of the project would then be -R188 (if we use

10% as the risk-free rate) i.e. Reject.

Disadvantage of this method: Subjectivity and arbitrariness in

selecting certainty equivalents.

3. SENSITIVITY ANALYSIS

NPV analysis relies on assumptions about crucial variables

e.g. the selling price of a particular product.

‘What if’ these variables were to change? How would these

changes influence the viability of the project?

This approach measures how sensitive NPV is to changes in

underlying assumptions/values.

The greater the volatility in NPV in relation to a specific

variable, the larger the forecasting risk associated with that

variable and the more attention we want to pay to its

estimation.

One variable is analysed at a time and the results are

examined.

SA is usually a computer-driven exercise, but we can do a

few manual ‘what-if’s’ by way of illustration:

SENSITIVITY ANALYSIS

Expected cash flow of Project X: R300 000 p.a for 4

years.

RRR = 15%

Initial investment = R800 000.

Likely annual demand for product = 1 000 000 units.

Sale price / unit = R1.

Total costs R0.70 / unit (labour 0.20, materials 0.40,

overhead 0.10).

Cash flow / unit = R0.30 (hence the R300 000 annual

cash flow).

-800 000 CF0; 300 000 CF1; 4 Nj; 15 I/YR;

NPV = +56 493.51 (accept)

SENSITIVITY ANALYSIS

What if price is only R0.95?

Annual cash flow = R0.25 x 1 000 000 = R250 000

-800 000 CF0; 250 000 CF1; 4 Nj; 15 I/YR;

NPV = -R86 255.41 (reject)

What if demand is 10% less than expected?

Annual cash flow = R0.30 x 900 000 = 270 000

-800 000 CF0; 270 000 CF1; 4 Nj; 15 I/YR;

NPV = -R29 155.84 (reject)

What if the discount rate is 20% higher than originally assumed? i.e. 18%

as opposed to 15%?

-800 000 CF0; 300 000 CF1; 4 Nj; 18 I/YR;

NPV = R7 018.54 (accept)

SENSITIVITY ANALYSIS

Advantages:

At the very least it allows decision-makers to be

more informed regarding project sensitivities, to

know how much margin they have for judgemental

error, and to decide whether they are prepared to

accept the project risks or not.

It points out the most crucial variables, thereby

saving time and money.

Contingency plans can be developed once the key

variables have been identified.

Disadvantages:

Absence of any formal assignment of probabilities to

the variations of parameters.

Sensitivity analysis alters each variable in isolation,

when in reality some variables are likely to be

related.

SCENARIO ANALYSIS

What happens to NPV under different cash flows

scenarios?

At the very least look at:

Best case – revenues are high and costs are low

Worst case – revenues are low and costs are high

Measure of the range of possible outcomes

Best case and worst case are not necessarily

probable, they can still be possible.

Sensitivity Analysis is a subset of Scenario

analysis.

Scenario analysis addresses the main drawback of

sensitivity analysis (that only one variable is

changed at a time).

4. BREAK-EVEN ANALYSIS

A common finding is that sales volume is seen to be a crucial

variable.

Break-even analysis is a common tool in analysing the

relationship between sales volume and profitability.

The accounting break-even point is where sales = costs i.e.

the point where the project generates no profits or losses. As

long as sales are above this point, the firm will make a profit. It

can be calculated as:

Sales Break-even = (Fixed Costs + Depreciation) x (1 - T)

(Sales price - variable cost) x (1 - T)

Accounting break-even takes into account accounting expenses

but it fails to account for the economic opportunity cost of the

initial outlay of the investment.

Firms that breakeven on an accounting basis might really be

losing money because they are losing the opportunity cost of the

initial investment.

BREAK-EVEN ANALYSIS

With Present Value Break-even, we ascertain the extent to

which some variables can change, before the decision to

accept changes to a decision to reject (the point at which

NPV swings from +’ve to -’ve).

This method also indicates the sensitivity of the project to

certain key variables.

Example:

Given a discount rate of 15%, we have:

Unit Sales

NPV(Rm)

0

-5 120

1 000

-2 908

3 000

1 517

10 000

17 004

The NPV is negative if 1 000 units are sold, and positive if 3

000 units are sold. Obviously the zero NPV point occurs

between the 2 sales units.

PV BREAK-EVEN CONTINUED

The firm originally invested R1.5m. We need to annualize this

like all the other variables in the equation, so we express it as a 5year EAC (equivalent annual cost), by solving for PMT on the

financial calculator:

-1 500 000 PV; 5 N; 15 I/YR; PMT = R447 473.33

PV Breakeven point = EAC + Fixed Costs x (1-T) – (D x T)

(in sales units)

(sales price - Variable cost) x (1-T)

By calculating the PV break-even point, we learn what the

minimum sales level needs to be in order for a project to breakeven (Zero NPV). If we consider this minimum unlikely we would

not risk investing in the project.

BREAK-EVEN EXAMPLE

1.

2.

3.

Consider a project to supply UKZN with 10 000 dormitory beds

annually for each of the next three years. Your firm has half of

the wood-working equipment to get the project started; it was

bought years ago for R200 000, is fully depreciated and has a

market value of R60 000. The remaining R90 000 of equipment

will have to be purchased. The engineering department

estimates that you will need an initial net working capital

investment of R10 000. Annual fixed costs will be R25 000, and

the variable costs should be R90 per bed. The initial fixed

investment with be depreciated straight line to zero over three

years. The salvage value of all equipment is estimated to be

R10 000. The marketing department estimates that the sales

price per bed will be R200. You require an 8% return and face

a tax rate of 34%.

Should your firm proceed with this project?

What is the break-even price per bed for this project?

What is the present value break-even sales volume (in units)?

BREAK-EVEN EXAMPLE – SOLUTION TO Q1.

Year 0

Year 1

Year 2

Year 3

Net Capital Spending

New Equipment

Opportunity cost of not selling

old equipment

-90 000

-60 000 (1-0.34)

Salvage Value

TOTAL NCS

10 000 (1-0.34)

-129 600

6 600

Total Cash Flows

Sales (10 000 x R200)

Fixed Costs

Variable Costs (10 000 x R90)

Depreciation (90 000 / 3)

PBIT

Less Taxes (34%)

NPAT

+ Depreciation

OCF

Net Working Capital

2 000 000

2 000 000

2 000 000

-25 000

-25 000

-25 000

-900 000

-900 000

-900 000

-30 000

-30 000

-30 000

1 045 000

1 045 000

1 045 000

-355 300

-355 300

-355 300

689 700

689 700

689 700

30 000

30 000

30 000

719 700

719 700

719 700

-10 000

10 000

NCS (from above)

-129 600

6 600

TOTAL CASH FLOWS

-139 600

719 700

719 700

736 300

BREAK-EVEN EXAMPLE – Q1 SOLUTION CONCL.

NPV:

-139 600 CF0; 719 700 CF1; 2 Nj;

736 300 CF2; 8 I/YR; NPV = R1 728 314.32

Therefore, the firm should proceed with the project

as the NPV is positive.

BREAK-EVEN PRICE – Q2 SOLUTION.

We

should be concerned with the break-even price i.e.

what should we put our bid in for in order to win the

contract. Therefore we need to find the revenue that

gives us a zero NPV.

The PV of the costs of this project is the sum of the NCS

and NWC required today (R139 600) less the PV of the

salvage value and return of NWC in year 3 (16 600)

16 600 FV; 3 N; 8 I/YR; PV = 13 177.62

Add the -139 600: -139 600 + 13 177.62 = -126 422.38

Now we need to find the operating cash flow that the

project must produce each year to break-even i.e. solve

for PMT.

-126 422.38 PV; 3 N; 8 I/YR; PMT = 49 056.12

BREAK-EVEN PRICE – Q2 SOLUTION CONTD.

Years 1 -3

Sales

10 000 x BE Price

983 872.91

Fixed Costs

-25 000

Variable Costs

-900 000

Depreciation

-30 000

PBIT

28 872.91

Less Taxes

-9 816.79

NPAT

19 056.12

Depreciation

OCF

30 000

49 056.12

Working backwards from the OCF up to Break-Even sales, the breakeven price per bed is 983 872.91 / 10 000 = R98.39.

BREAK-EVEN SALES VOLUME- Q3 SOLUTION

To calculate the break-even sale volume, we need to

annualise the PV of the non-OCF cash flows We already did

this when calculating the break-even price:

PV of non-OCF cash flows = -126 422.38

PMT = 49 056.12 (EAC in PV break-even

formula)

PV Break-even:

= [49 056.12 + (25 000 x 0.66) – (30 000 x 0.34)]

[(200 - 90) x 0.66]

= 763 beds

PROBABILITY ANALYSIS AND DECISION TREES

Satisfies

the drawbacks of Sensitivity Analysis in

that probabilities of certain outcomes are

obtained to help with the capital budgeting

decision

There is usually a sequence of decisions in NPV

analysis, and Decision Trees are a useful tool to

identify such sequential decisions, in the face of

uncertainty.

A Decision Tree is a diagram showing decision

points, alternatives and possible outcomes with

assigned probabilities.

DECISION TREES

Decision

trees are relevant when projects involve

sequential investment decisions, or where project

cash flows are partially correlated over time.

For example, a company needs to develop and test

prototypes and undertake a pilot production prior to

investing in a large plant for full-scale production.

There are two decisions. The decision to develop

prototypes is dependent on the NPV from undertaking

full scale production.

A company may undertake product tests which will

have a 70% chance of success followed by an

investment in plant at a cost of R40m and possible

cash flows of either R50m or R10m per year for two

years.

53

DECISION TREES

54

DECISION TREE EXAMPLE

Project cost in year 0 is R300 000 and the discount

rate is 10%. Cash flows for project are:

Probability

If Cash Flow in

Year 1 is

Probability

Cash Flow in

Year 2

0.25

100 000

0.25

0

0.50

100 000

0.25

200 000

0.25

100 000

0.50

200 000

0.25

300 000

0.25

200 000

0.50

300 000

0.25

350 000

0.5

0.25

200 000

300 000

DECISION TREE

DECISION TREE ANALYSIS

Top Branch of the Decision tree

Expected Payoff in Yr 2 = (0.25 x 0) + (0.5 x 100 000) + (0.25 x 200 000) = 100 000

Cash Flow in Yr 1 = 100 000

PV at time 0:

0 CF0; 100 000 CF1; 100 000 CF2; 10 I/YR; NPV = 173 553.72 (25% probability)

Middle Branch of the Decision tree

Expected Payoff in Yr 2 = (0.25 x 100 000) + (0.5 x 200 000) + (0.25 x 300 000) =

200 000

Cash Flow in Yr 1 = 200 000

PV at time 0:

0 CF0; 200 000 CF1; 200 000 CF2; 10 I/YR; NPV = 347 107.44 (50% probability)

Bottom Branch of the tree

Expected Payoff in Yr 2 = (0.25 x 200 000) + (0.5 x 300 000) + (0.25 x 350 000) =

287 500

Cash Flow in Yr 1 = 300 000

PV at time 0:

0 CF0; 300 000 CF1; 287 500 CF2; 10 I/YR; NPV = 510 330.58 (25% probability)

E (NPV) at time 0

-300 000 + (173 553.72 x 0.25) + (347 107.44 x 0.5) + (510 330.58 x 0.25) = R44 525

Therefore accept the project.

COMPREHENSIVE EXAMPLE – DECISION TREE,

SENSITIVITY ANALYSIS AND BREAK EVEN.

Solar

Electronics Corporation (SEC) are

considering the development of a solar airplane.

Stage 1 involves the development of proto-types

and test marketing which will last one year and

cost R100 mil (now). The firm believes that there

is a 75% chance of success.

Stage 2 follows once Stage 1 is complete. This

stage involves full scale production, costing

R1 500 mil and taking 5 years. The R1 500

million cost is made upfront (at the beginning of

Stage 2).

The appropriate discount rate is 15%.

SEC - DECISION TREE

The firm has two decisions to make:

1

To test or not to test (at T0).

To invest or not to invest (at T1).

Succes

s

75%

Test

-100m

Failure

-1500m

900

m

p.a.

Do not

invest

NPV = $0

25%

Do not

test

NPV = $0

Invest

-1500m

-630m

p.a.

59

0

Invest

2–6

SEC – NPV ANALYSIS

Cash flow forecasts (in millions) are given as follows:

Investments

Year 1

Revenues

Variable Costs

Fixed Costs

Depreciation

Pre-tax Profit

Tax (34%)

Net Profit

Cash Flow

Initial Costs

Successful in year 1

Years 2 - 6

6000

(3000)

(1791)

(300)

909

(309)

600

900

Unsuccessful in year 1

Years 2 -6

3000

(1839)

(1791)

(300)

-930

0

-930

-630

(1500)

NPV1 (successful) = R1 516.94

-1500 CF0; 900 CF1; 5 Nj; 15 I/YR

NPV1 (unsuccessful) = -R3 611.86 (therefore don’t invest)

-1500 CF0; -630 CF1; 5 Nj; 15 I/YR

SEC - DECISION TREE

Decisions are made in reverse order

Should the firm invest the R1 500 million? If tests are

successful the SEC should invest because the NPV > 0. If

tests are unsuccessful the SEC should not invest as the NPV

< 0.

Should the firm invest R100 million now in order to obtain a

75% chance of R1 517million in a year’s time?

Expected Payoff = (Prob of success x payoff if

successful) + (Prob of failure x payoff if fail)

Should we test and develop?

Expected Payoff1 = (0.75 x 1 517) + (0.25 x 0) = R1 138 mil

NPV0 : -100 CF0 ; 1 138 CF1; 15 I/YR; NPV = R890 mil

Therefore the firm should test the market for solar-powered

jet engines.

SEC - SENSITIVITY ANALYSIS

The SEC Sales Team estimates the following revenues (in the

event of a successful test):

No. of engines sold

Sales Revenue

= Market share x Size of market

= 0.3 x 10 000 = 3 000

= No. of engines sold x Price per engine

= 3 000 x R2mil = R6 000 mil

Therefore revenue estimates depend on three assumptions:

(1) market share, (2) the size of the engine market and (3) the

price per engine.

Costs are divided into:

(1) variable costs, which change as output changes and are

zero when production is zero, and

(2) fixed costs, which are independent of production.

SEC - SENSITIVITY ANALYSIS

The cost breakdown is as follows:

Variable cost = variable cost/ unit x no. of engines sold =

R1mil x 3 000 = R3 000 mil

Total cost = Variable cost + fixed cost =

R3 000 mil + R1 791 mill = R4 791 mil

Remember with Sensitivity analysis, one variable is changed

in isolation and the resultant effect on NPV is calculated.

Question 1: Imagine the managers

have overestimated the market size

believe it may only be 5 000 units.

with the project with this change in

15% is required.

are concerned that they

in their calculations and

Should the firm proceed

market size? A return of

QUESTION 1 ANSWER

No. of engines sold = Market share x Size of market

= 0.3 x 5 000 = 1 500

Sales Revenue = No. of engines sold x Price per engine

= 1 500 x R2 mil = R3 000 mil

Variable cost

= variable cost/ unit x no. of engines sold

= R1 mil x 1 500 = R1 500 mil

Total cost

= Variable cost + fixed cost

= R1 500 mil + R1 791 mil = R3 291 mil

Cash flow:

(S – C – D) (1 – Tc) + D

= {(3 000 – 3 291 – 300) x (1 - 0.34)} + 300

= -90.06

NPV = -R1 801.90

-1 500 CF0; -90.06 CF1; 5 Nj; 15 I/YR

Now the project doesn’t look so good.

SCENARIO ANALYSIS

The assumptions on which the NPV were originally

based are shown in the column (best estimate) and in

the other two columns the pessimistic and optimistic

calculations are shown.

The NPV can be computed for each new scenario,

where several variables are changed at a time.

VARIABLE

PESSIMISTIC

BEST ESTIMATE

OPTIMISTIC

Market share

Market size (per year)

Price

Variable Cost (per plane)

20%

5000

R1.9 mill

R1.2 mill

30%

10000

R2 mill

R1 mill

50%

20000

R2.2 mill

R0.8 mill

Fixed Cost (per year)

Investment

R1891 mill

R1900 mill

R1791 mill

R1500 mill

R1741 mill

R1000 mill

SCENARIO ANALYSIS ANSWER

NPV Calculations as of date 1 using scenario analysis (R

millions and rounded off):

Scenario

Pessimistic

Best estimate

Optimistic

Revenues

1 900

6 000

22 000

Costs

(1 200)

(3 000)

(8 000)

Fixed Costs

(1 891)

(1 791)

(1 741)

(380)

(300)

(200)

(1 571)

909

12 059

(1 037)

600

7 959

(657)

900

8 159

(4 102)

1 517

26 350

Depreciation

. PBT

NPAT

OCF (NPAT+D)

NPV @ 15%

SCENARIO ANALYSIS CONCL.

If

the probabilities of each scenario occurring are 35%

(pessimistic), 55% (best estimate) and 10% (optimistic)

respectively:

E(NPV) = (0.35 x -4 102) + (0.55 x 1 517) +

(0.10 x 26 350)

= +2 034 (Accept)

SEC – PV BREAK-EVEN ANALYSIS

For SEC, the annual sales are varied and the NPV is computed

as detailed in the table below. It is clear that the present value

break-even sales quantity lies between 1 000 and 3 000 units.

Initial

Inv.

(Yr 1)

Unit

Sales

p.a.

Sales

rev.

Var.

Costs

Fixed

Costs

Depr.

Tax

(34%)

Net

Profit

Cash

Flows

NPV

(date 1)

1500 mil

0

0

0

-1791

-300

711

-1380

-1080

-5120

1500 mil

1000

2000

-1000

-1791

-300

371

-720

-420

-2908

1500 mil

3000

6000

-3000

-1791

-300

-309

600

900

1517

1500 mil

10000

20000 -10000 -1791

-300

-2689

5220

5520

17004

SEC – ACCOUNTING BREAK-EVEN ANALYSIS

Accounting B-E Sales = (FC + Depreciation) x (1 – Tc)

(Sales price – VC) x (1 - Tc)

Considering the SEC example:

Accounting Break-Even sales

= (1 791 + 300) x 0.66

(2-1) x 0.66

= 2 091 units

The denominator is known as the contribution margin as it

measures how much each product contributes towards certain

costs (fixed and depreciation). Thus, the accounting break-even

sales amount effectively measures how many engines must be

sold to offset the after-tax fixed costs and depreciation.

SEC – BREAK-EVEN ANALYSIS

The PV B-E is computed as:

EAC + (FC x (1-Tc)) – (Depreciation x Tc)

(Sales price – VC) x (1 - Tc)

(the Depreciation tax shield is subtracted from the total costs, as it

represents a saving).

where the EAC = annualised PV of Initial Investment

(PMT)

1 500 PV; 5 N; 15 I/YR; PMT = 447.5mil

PV Break-Even Sales = 447.5 + (1 791 x 0.66) – (300 x 0.34)

(2-1) x 0.66

= 2 314 units

Accounting break-even understates the true costs of recovering the

initial investment. If we take into account that the R1 500 mill

could have been invested at 15%, the true cost is R447.5mil p.a.

and not R300 mil p.a. Thus, companies that break-even in an

accounting sense are really losing money because they are losing

the opportunity cost of the initial investment.

WHICH RISK ADJUSTMENT METHODS ARE USED IN PRACTICE IN

SOUTH AFRICA?

(Source: Correia and Cramer, 2008:39)

INVESTMENTS OF UNEQUAL LIVES

There are times when application of the NPV rule can lead to the

wrong decision. One such time is when evaluating 2 mutually

exclusive projects with (1) unequal lives, and (2) when the project is

something that will be replaced at the end of it’s lifespan i.e it is

something that the firm cannot ‘do without’.

In such instances, we could use the following techniques:

Replacement Chain

Repeat the projects forever, find the PV of that perpetuity.

Assumption: Both projects can and will be repeated.

Matching Cycle

Repeat projects until they begin and end at the same time (LCM).

Compute NPV for the “repeated projects”.

The Equivalent Annual Cost Method (EAC or ANPV):

The Equivalent Annual Cost is the value of the level payment

annuity that has the same PV as our original set of cash

flows. (solve for PMT)

72

EXAMPLE: EAC

Cape

Town Cargo is considering the purchase of a

new crane. They have a choice between two models.

Machine A will cost R10 000 upfront with annual

maintenance of R1 375 and an expected life of 3

years.

Machine B will cost R12 000 with annual

maintenance of R937.50 and an expected life of 4

years.

The firm depreciates its assets on a straight-line

basis to zero. The appropriate discount rate for both

projects is 11% and the firm pays tax at 20%.

Salvage values are assumed to be zero.

EXAMPLE

SOLUTION

Present value of costs:

Machine A:

0

1

After-tax maint

-1 100

Depr. Tax Shield

666.67

Initial Cost

-10 000

Total

-10 000

-433.33

NPV = -R11 058.93

-10 000CF0; -433.33 CF1; 3 Nj; 11 I/YR

Machine B:

0

1

After-tax maint

-750

Depr. Tax Shield

600

Initial Cost

-12 000

Total

-12 000

-150

NPV = -R12 465.37

-12 000CF0; -150 CF1; 4 Nj; 11 I/YR

2

-1 100

666.67

3

-1 100

666.67

-433.33

-433.33

2

-750

600

3

-750

600

4

-750

600

-150

-150

-150

Whilst project A has a lower PV of costs, Machine B has a longer life, so we

need to calculate their respective EAC’s.

EXAMPLE

SOLUTION CONCLUDED

Using the PV of costs calculated on the previous slide, we can

calculate an equivalent annual cost by solving for PMT using an

I/YR of 11%, and N of 3 and 4 years respectively:

Machine A:

-11 058.93 PV; 3 N; 11 I/YR; PMT = -R4 525.46

Machine B:

-12 465.37 PV; 4 N; 11 I/YR; PMT = -R4 017.92

Therefore, Machine B should be chosen as it has a lower EAC

than A.

Importantly, we do not consider the revenues that will be

generated as we assume that these will be the same for both

machines. However, if the revenues did differ, it would be easy

to expand the analysis.

EAC is not confined to the examination of costs – if your PV of

costs or cash flows were positive, you then choose the project

which had the highest equivalent annual cash flow (also EAC,

but ‘C’ would stand for cash flow, not cost).

THE REPLACEMENT DECISION

It is often wise to examine the business assets used in the production

process to see if they should be replaced with a new improved version

This is a continuous process and even if the existing machine has years

of useful life left, the right decision may still be to dispose of the old and

and bring in the new (if your firm does not produce at lowest cost,

someone else will)

In making the replacement decision, the increased costs associated with

the purchase and installation of the new machine have to be weighed

against the savings from switching to the new method of production i.e.

INCREMENTAL CASH FLOWS remain the focus of attention.

There are 2 different situations to be dealt with:

1. Replacement of an asset with a new, identical asset.

Question: How frequently must the asset be replaced? Assumes zero

technological advancement, so unrealistic.

2. Replacement of an existing asset with a different (more advanced)

asset. Called Non-Identical Replacement.

Question: At what stage should we replace the old with the new?

1. IDENTICAL ASSET REPLACEMENT

Assumptions

upon which this analysis is based:

That production, with the identical type of equipment,

will continue to perpetuity

That the estimates of the maintenance costs and scrap

values are accurate to maturity

That the cost of capital is known and will not change

That the cash flows always arise at the year-end

EXAMPLE – IDENTICAL REPLACEMENT

Claremont Bicycle Rentals is considering a new standard type of bicycle

and a choice has to be made between three alternative regular

replacement cycles. Details are as follows:

Bicycle Cost

Replacement options

Salvage Value

Maintenance Costs

1

2

3

10 000

10 000

10 000

After one year

After two years

After three years

7 000

5 000

3 000

500

900

1 200

The bicycles are not worth keeping for more than three years due to

breakdowns. Revenue streams and other costs are unaffected by the

cycle selected. All cash flows occur at annual intervals. The bicycles

will be depreciated straight-line to zero over their optimal lifespan.

The appropriate discount rate is 10% and all cash flows are taxed at

20%. Determine the optimum replacement cycle.

EXAMPLE SOLUTION

Because the ‘projects’ have unequal lifespans, and the bikes

are standard and will be replaced once sold, an EAC analysis is

required.

The cash flows are as follows:

Project 1: (replace in a year):

0

1

After-tax Maint.

-400

Depr. Tax shield

2 000

ATSV

5 600

Initial Cost

-10 000

Total

-10 000

7 200

PV of costs:-10 000 CF0; 7 200 CF1: 10 I/YR; NPV = -3 454.55

EAC: -3 454.55 PV; 1 N; 10 I/YR; PMT = -3 800

EXAMPLE SOLUTION

Project 2: (replace in 2 years time)

0

1

2

After-tax Maint.

-400

-720

Depr. Tax shield

1 000

1 000

ATSV

4 000

Initial Cost

-10 000

Total

-10 000

600

4 280

PV of costs:-10 000 CF0; 600 CF1: 4 280 CF2; 10 I/YR;

NPV = -5 917.36

EAC: -5 917.36 PV; 2 N; 10 I/YR; PMT = -3 409.52

EXAMPLE SOLUTION

Project 3: (replace after 3 years)

0

1

2

3

After-tax Maint.

-400

-720

-960

Depr. Tax shield

666.67

666.67

666.67

ATSV

2 400

Initial Cost

-10 000

Total

-10 000

266.67

-53.33

2 106.67

PV of costs:

-10 000 CF0; 266.67 CF1: -53.33 CF2; 2 106.67 CF3; 10 I/YR;

NPV = -8 218.87

EAC: -8 218.87 PV; 3 N; 10 I/YR; PMT = -3 304.93

Project 3 has the lowest EAC and therefore the optimum

replacement cycle is every 3 years.

2. NON-IDENTICAL ASSET REPLACEMENT

When

switching from one kind of machine to another,

businesses have to decide on the timing of such a

switch.

The best option may not be to dispose of the old

machine right away. It may be better to wait for a year

or two because the costs of running the old machine

may amount to LESS than the EQUIVALENT

ANNUAL COST of starting a regular cycle with the

replacement.

However eventually, the old machine will become more

costly due to its lower efficiency, increased repairs

and/or declining scrap value.

EXAMPLE: NON-IDENTICAL REPLACEMENT

Milnerton

Manufacturing is considering the purchase of

a new machine to replace their existing one. The new

machine costs R24 000 and will require maintenance of

R1 875 at the end of each year for eight years. At the end

of eight years the machine can be sold for R10 000. The

new asset will be depreciated on a straight-line basis to

zero.

The existing machine requires increasing amounts of

maintenance each year, and its salvage value falls each

year, as shown in the next table. This asset has been

depreciated in full to a book value of zero. The firm pays

tax at 20% and the appropriate discount rate is 8%.

EXAMPLE CONTD.

YEAR

MAINTENANCE COSTS

SALVAGE VALUE

0

0

7 500

1

1 250

5 000

2

2 500

3 750

3

3 750

3 125

4

5 000

0

This table tells us that if the firm sells the existing

machine now they will receive R7 500. If they sell it in one

year’s time they will receive R5 000 but the machine will

require maintenance for the year of R1 250, and so on.

EXAMPLE SOLUTION

Firstly, we want to calculate the equivalent annual cost of

the new machine:

0

1-7

8

After-tax maint.

-1 500

-1 500

Depr. Tax shield

600

600

NCS

-24 000

Total

-24 000

8 000

-900

7 100

PV of costs:

-24 000 CF0; -900 CF1: 7 Nj; 7 100 CF2; 8 I/YR;

NPV = -24 849.82

EAC: -24 849.82 PV; 8 N; 8 I/YR; PMT = -4 324.24

EXAMPLE SOLUTION CONTINUED

Secondly, we want to calculate the cost of keeping the existing

machine for another year at each year-end (we are not

calculating the present value of the costs at time zero for each

year, but rather the total costs at the end of each year).

If MM keeps the old machine for one more year they will lose

out on receiving R7 500 now (which is an opportunity cost),

which is subject to tax and which could have earned interest

in that year at 8%, hence the opportunity cost at the end of

year 1 equals the FV of the ATSV invested now at 8% for one

year. They will also have to pay maintenance at the end of the

year of R1 250 (brought onto an after-tax basis). They will

receive R5 000 for the sale of the machine at year-end

however, to offset these expenses (also has to be brought onto

an after-tax basis.

Thus the cost of keeping the old machine for one more year is:

-7 500 (1-0.2) (1.08)1 - 1 250 (1-0.2) + 5 000 (0.8)

= -R3 480

EXAMPLE SOLUTION CONCLUDED

The total costs of keeping the existing machine for another 1,

2, 3 and 4 years respectively are presented as follows:

1

2

3

4

FV of opport. cost

-6 480

-4 320

-3 240

-2 700

After-tax maint

-1 000

-2 000

-3 000

-4 000

4 000

3 000

2 500

0

-3 480

-3 320

-3 740

-6 700

ATSV

Total Cost

The EAC of the new machine (-R4 324.24) is only less than the

annual cost of keeping the old machine for a 4th year and thus

the firm should replace the machine at the end of year 3.

LEASING

TERMINOLOGY:

Lease

– contractual agreement for

use of an asset in return for a series

of payments

Lessee – user of an asset; makes

payments

Lessor – owner of the asset; receives

payments

TYPES OF LEASES

Operating

lease

Shorter-term lease

Lessor is responsible for insurance, taxes and maintenance

Often cancelable

Financial lease

Longer-term lease

Lessee is responsible for insurance, taxes and maintenance

Generally not cancelable

Specific capital leases

Tax-oriented

Leveraged

Sale and leaseback

LEASE ACCOUNTING

Leases

are governed primarily by IAS17

Financial leases are essentially treated as debt

financing

Present value of lease payments must be included

on the statement of financial position (of the lessee)

as a liability

Same amount shown under the assets of the lessee

as the “capitalized value of leased assets”

Operating leases are still “off-statement of

financial position” and do not have any impact

on the statement of financial position itself

LEASING VERSUS BUYING

24-91

INCREMENTAL CASH FLOWS

For a lessee:

After-tax lease payment (outflow)

Lease

payment x (1 – T)

Lost depreciation tax shield (outflow)

Depreciation

x tax rate for each year

Initial cost of machine (inflow)

Inflow

because we save the cost of purchasing the

asset now

May have incremental maintenance, taxes or insurance

depending on the type of lease and whether the leased asset is

replacing one currently owned

EXAMPLE: LEASE CASH FLOWS

ABC

Ltd needs some new equipment. The equipment would

cost R100,000 if purchased and would be depreciated straightline over 5 years. No salvage is expected. Alternatively, the

company can lease the equipment for R25 000 per year. The

marginal tax rate is 40%.

What are the incremental cash flows?

After-tax lease payment = 25 000 (1 – 0,4) = 15 000

(outflow years 1 - 5)

Lost depreciation tax shield = (100 000 / 5) x 0.4 = 8 000

(outflow years 1 – 5)

Cost of machine = 100 000 (inflow year 0)

LEASE OR BUY?

The

company needs to determine whether it

is better off borrowing the money and

buying the asset, or leasing

Compute the NPV of the incremental cash

flows

Appropriate discount rate is the after-tax

cost of debt since a lease is essentially the

same risk as a company’s debt. Also the

alternative to leasing is LT borrowing so the

after-tax cost of such borrowing is the

relevant benchmark.

NET ADVANTAGE TO LEASING

The

net advantage to leasing (NAL) is

the same thing as the NPV of the

incremental cash flows

If NAL > 0, the firm should lease

If NAL < 0, the firm should buy

Consider

the previous example. Assume

the firm’s cost of debt is 10%.

After-tax cost of debt = 10 (1 – 0.4) = 6%

NAL:

100 000 CF0; -23 000 CF1; 5 Nj; 6 I/YR; NPV = 3 115.63

Should

the firm buy or lease?

GOOD REASONS FOR LEASING

Taxes

may be reduced

May reduce some uncertainty

May have lower transaction costs

May require fewer, if any, restrictive

covenants

Leasing may encumber fewer assets

than secured borrowing

DUBIOUS REASONS FOR LEASING

Statement

of financial position, especially

leverage ratios, may look better if the

lease does not have to be accounted for on

the statement of financial position

100% financing – except leases normally do

require either a down-payment or security

deposit

Low cost – some may try to compare the

“implied” rate of interest to other market

rates, but this is not directly comparable

LEASING EXAMPLE - ANOTHER

What

is the net advantage to leasing for

the following project, and should the firm

lease or buy?

Equipment

would cost R250 000 if purchased

It would be depreciated straight-line to zero

salvage over 5 years.

Alternatively, it may be leased for R65 000/yr.

The firm’s after-tax cost of debt is 6%, and its

tax rate is 40%

SOLUTION

After-tax lease payment = (1 – 0.4) x R65 000

= R39 000

Lost tax shield = 0.4 x R50 000 = R20 000

Year

CF

0

250 000

1-5

-R39 000 – R20 000 = -R59 000

Discount at 6%

NAL: 250 000 CF0; -59 000 CF1; 5 Nj; 6 I/YR; NPV = R1 470.54

(positive)

Lease it!

SUPPLEMENTARY NOTES ON LEASING

WHAT IS LEASING?

Terminology:

the lessee (user of the asset, makes the payments)

The lessor (owner of the asset, receives the payments)

The lease contract specifies the payment frequency (monthly, semiannual etc.), with the first payment normally due as soon as the

contract is signed; that is, the lessee tends to pay in advance for the

use of the asset.

In corporate finance, leasing is the process by which a firm can obtain

the use of various fixed assets for which it must make a series of

contractual, periodic, tax-deductible payments.

When a lease is terminated, the leased equipment reverts to the

lessor. However, the lease agreement often gives the lessee the option

to purchase the equipment or take out a new lease.

TYPES OF LEASES

1. Operating Leases:

short-term: whilst they can be renewed, it is unlikely that

ownership will ever transfer to the lessee. Generally, the total

payments made by the lessee to the lessor are less than the

lessor’s initial cost of the leased asset. Consequently, the

lessor either expects to lease the asset again or sell it at the

end of the lease agreement i.e. assets that are leased under

operating leases have a usable life that is longer than the

term of the lease.

The lessor usually maintains the asset (insurance, taxes and

maintenance), but these costs will be incorporated into the

lease payment by the lessee. Therefore known as full-service

or rental leases.

Can be cancelled by the lessee during the contract period, but

the lessee may be required to pay a penalty for cancellation. If

the lessee cancels the contract the asset will be returned to

the lessor.

2. Financial

Leases (capital or full-payout leases):

Long-term: they extend over most of the estimated economic

life of the asset and cannot be cancelled (or if it is cancelled, it

is with a substantial penalty).

All the risks and rewards incidental to ownership are

transferred to the lessee (e.g. insurance, maintenance of the

asset etc). Therefore known as net leases.

Financial leases are a source of financing (borrowing) - there

is an immediate cash inflow because the lessee is relieved of

having to pay for the asset, but the lessee also assumes a

binding obligation to make the payments specified in the lease

contract. Thus the cash flow consequences of leasing and

borrowing are similar. In either case, the firm raises cash now

and pays it back later. Failure to make the lease payment can

result in bankruptcy for the lessee.

May include a purchase option.

According to the Accounting Practices Board, a lease can be

considered a financial lease provided one of the following

conditions is met:

The lease transfers ownership of the asset to the lessee by

the end of the lease term

Cancellation costs are borne by the lessee.

The lease term is for the majority of the estimated economic

life of the asset (more than 80%), even if ownership is not

transferred.

At the beginning of the lease, the PV of the lease payments

is equal to 90% or more of the fair market value of the

leased asset.

If the asset is of such a specialized nature that only the

lessee can use it without major modifications being made.

If the lessee has the ability to continue the lease for a

secondary period at a rent that is substantially below

market rent.

FORMS OF LEASE AGREEMENTS

Direct leases: the lessee identifies the equipment,

arranges for a leasing company to buy it from the

manufacturer, and signs a contract with the leasing

company.

Sales-Type leases: the manufacturer leases the asset

straight to the lessee.

Sale-and-lease-back: the firm sells an asset it already

owns and leases it back from the buyer. Common in

real estate, as a company might want to raise cash by

selling a factory but still retain use of it.

Leveraged leases: these are financial leases in which

the lessor borrows part of the purchase price of the

leased asset (up to 80%), using the lease contract as

security for the loan, and the lease payments to

service the debt. This does not, however, change the

lessee’s obligations.

THE LEASING PARADOX

So

far we have looked at the cash flows of the lease versus buy

decision from the perspective of the lessee. What do the cash

flows look like from the perspective of the Leasing Company?

They have to buy the machine upfront (outflow)

They will depreciate it for which they will receive a tax shield

(inflow)

They have to maintain the asset (outflow)

They will receive the annual lease payment (inflow)

They will sell the asset at the end of the lease agreement to

the lessee (inflow)

That is, the cash flows are the exact opposite to the lessee!

This makes sense, because Radebe and the Leasing Company

are the only parties to the lease agreement, and hence leasing is

a zero-sum game. That is, if the lease is a positive NPV activity

to one party it will be a negative NPV activity to the other

party. The leasing company thus hopes Radebe will buy rather

than lease the machine.

WHY LEASE? (IN THE FORM OF FINANCIAL LEASES)

IF ONE PARTY MUST INEVITABLY LOSE OUT IN A LEASE WHY DO THEY STILL HAPPEN?

1. Tax Advantages

By far the most important reason for leasing is income tax

deferral because firms may pay different tax rates; a

potential tax shield which cannot be used effectively by one

firm can be transferred to another via leasing. Any tax

benefits from leasing can be split between the two firms by

setting the lease payments at the appropriate level, and the

shareholders of both firms will benefit from this

arrangement. Thus SARS is the loser, as the leasing contract

allows the lessor to take advantage of the depreciation and

interest tax shields that cannot be used by the lessee.

2. A Reduction in Uncertainty

At the end of the useful life of the asset it may be sold for its

salvage value. This amount is uncertain at the time the asset

is purchased. A lease contract transfers this uncertainty from

the lessee to the lessor. This makes sense when the lessor is

better able to absorb the risk.

However, this transfer of uncertainty from the lessee to the

lessor is effectively insurance for the lessee and will thus

implicitly be included in the lease payments.

But, if the firm leases instead of buying it gives up the salvage

value which is a cost of the lease agreement.

3. Fewer Restrictions and Security Requirements

If the firm borrows to purchase the asset, certain restrictions

in the form of protective covenants, will be placed on their

activities (e.g. minimum liquidity, subsequent borrowing and

cash dividends). This is not the case with a lease agreement.

Also, in order to secure the loan the firm may have to use

other assets as collateral, but with the lease only the leased

asset is pledged.

Therefore, leasing gives management more balance sheet

flexibility.

Operating Leases are advantageous:

Lower Transaction Costs/More Convenient

The transaction costs of buying and selling an asset many times

during its useful life are high, and thus the justification behind

many short-term leases is the reduction in transaction costs. A

reduction in transaction costs however, is not really a sufficient

justification for long-term leases.

Sometimes the cost of short-term rentals may seem prohibitively

high, or it may be difficult to rent at any price. This can happen

for equipment that is easily damaged by careless use. The owner

knows that short-term users are unlikely to take the same care

that they would their own equipment. When the danger of abuse

becomes too high, short-term rental markets do not survive.

Maintenance is provided

For operating leases, which are full-service leases, the lessee

receives maintenance and other services. However, these

benefits will be incorporated into higher lease payments.