© CFA Institute. For candidate use only. Not for distribution.

QUANTITATIVE

METHODS

CFA® Program Curriculum

2023 • LEVEL 1 • VOLUME 1

© CFA Institute. For candidate use only. Not for distribution.

©2022 by CFA Institute. All rights reserved. This copyright covers material written

expressly for this volume by the editor/s as well as the compilation itself. It does

not cover the individual selections herein that first appeared elsewhere. Permission

to reprint these has been obtained by CFA Institute for this edition only. Further

reproductions by any means, electronic or mechanical, including photocopying and

recording, or by any information storage or retrieval systems, must be arranged with

the individual copyright holders noted.

CFA®, Chartered Financial Analyst®, AIMR-PPS®, and GIPS® are just a few of the

trademarks owned by CFA Institute. To view a list of CFA Institute trademarks and the

Guide for Use of CFA Institute Marks, please visit our website at www.cfainstitute.org.

This publication is designed to provide accurate and authoritative information

in regard to the subject matter covered. It is sold with the understanding that the

publisher is not engaged in rendering legal, accounting, or other professional service.

If legal advice or other expert assistance is required, the services of a competent professional should be sought.

All trademarks, service marks, registered trademarks, and registered service marks

are the property of their respective owners and are used herein for identification

purposes only.

ISBN 978-1-950157-96-9 (paper)

ISBN 978-1-953337-23-8 (ebook)

2022

© CFA Institute. For candidate use only. Not for distribution.

CONTENTS

How to Use the CFA Program Curriculum Errata Designing Your Personal Study Program CFA Institute Learning Ecosystem (LES) Feedback ix

ix

ix

x

x

Learning Module 1

The Time Value of Money Introduction Interest Rates Future Value of a Single Cash Flow Non-Annual Compounding (Future Value) Continuous Compounding Stated and Effective Rates A Series of Cash Flows Equal Cash Flows—Ordinary Annuity Unequal Cash Flows Present Value of a Single Cash Flow Non-Annual Compounding (Present Value) Present Value of a Series of Equal and Unequal Cash Flows The Present Value of a Series of Equal Cash Flows The Present Value of a Series of Unequal Cash Flows Present Value of a Perpetuity Present Values Indexed at Times Other than t = 0 Solving for Interest Rates, Growth Rates, and Number of Periods Solving for Interest Rates and Growth Rates Solving for the Number of Periods Solving for Size of Annuity Payments Present and Future Value Equivalence and the Additivity Principle The Cash Flow Additivity Principle Summary Practice Problems Solutions 3

3

4

6

10

12

14

15

15

16

17

19

21

21

25

26

27

28

29

31

32

36

38

39

40

45

Learning Module 2

Organizing, Visualizing, and Describing Data Introduction Data Types Numerical versus Categorical Data Cross-Sectional versus Time-Series versus Panel Data Structured versus Unstructured Data Data Summarization Organizing Data for Quantitative Analysis Summarizing Data Using Frequency Distributions Summarizing Data Using a Contingency Table 59

59

60

61

63

64

68

68

71

77

Quantitative Methods

indicates an optional segment

iv

© CFA Institute. For candidate use only. Not for distribution.

Contents

Data Visualization Histogram and Frequency Polygon Bar Chart Tree-Map Word Cloud Line Chart Scatter Plot Heat Map Guide to Selecting among Visualization Types Measures of Central Tendency The Arithmetic Mean The Median The Mode Other Concepts of Mean Quantiles Quartiles, Quintiles, Deciles, and Percentiles Quantiles in Investment Practice Measures of Dispersion The Range The Mean Absolute Deviation Sample Variance and Sample Standard Deviation Downside Deviation and Coefficient of Variation Coefficient of Variation The Shape of the Distributions The Shape of the Distributions: Kurtosis Correlation between Two Variables Properties of Correlation Limitations of Correlation Analysis Summary Practice Problems Solutions 82

82

84

87

88

90

92

96

98

100

101

105

106

107

116

117

122

123

123

124

125

128

131

133

136

139

140

143

146

151

164

Learning Module 3

Probability Concepts Probability Concepts and Odds Ratios Probability, Expected Value, and Variance Conditional and Joint Probability Expected Value and Variance Portfolio Expected Return and Variance of Return Covariance Given a Joint Probability Function Bayes' Formula Bayes’ Formula Principles of Counting Summary References Practice Problems Solutions 173

174

174

179

191

197

202

206

206

212

218

220

221

228

Learning Module 4

Common Probability Distributions Discrete Random Variables 235

236

indicates an optional segment

Contents

© CFA Institute. For candidate use only. Not for distribution.

v

Discrete Random Variables Discrete and Continuous Uniform Distribution Continuous Uniform Distribution Binomial Distribution Normal Distribution The Normal Distribution Probabilities Using the Normal Distribution Standardizing a Random Variable Probabilities Using the Standard Normal Distribution Applications of the Normal Distribution Lognormal Distribution and Continuous Compounding The Lognormal Distribution Continuously Compounded Rates of Return Student’s t-, Chi-Square, and F-Distributions Student’s t-Distribution Chi-Square and F-Distribution Monte Carlo Simulation Summary Practice Problems Solutions 237

241

243

246

254

254

258

260

260

262

266

266

269

272

272

274

279

285

288

296

Learning Module 5

Sampling and Estimation Introduction Sampling Methods Simple Random Sampling Stratified Random Sampling Cluster Sampling Non-Probability Sampling Sampling from Different Distributions The Central Limit Theorem and Distribution of the Sample Mean The Central Limit Theorem Standard Error of the Sample Mean Point Estimates of the Population Mean Point Estimators Confidence Intervals for the Population Mean and Sample Size Selection Selection of Sample Size Resampling Sampling Related Biases Data Snooping Bias Sample Selection Bias Look-Ahead Bias Time-Period Bias Summary Practice Problems Solutions 303

304

304

305

306

308

309

313

315

315

317

320

320

324

330

332

335

336

337

339

340

341

344

349

Learning Module 6

Hypothesis Testing Introduction Why Hypothesis Testing? 353

354

354

indicates an optional segment

vi

Learning Module 7

© CFA Institute. For candidate use only. Not for distribution.

Contents

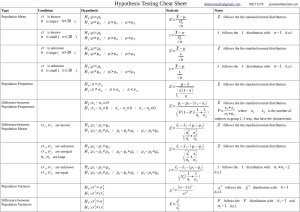

Implications from a Sampling Distribution The Process of Hypothesis Testing Stating the Hypotheses Two-Sided vs. One-Sided Hypotheses Selecting the Appropriate Hypotheses Identify the Appropriate Test Statistic Test Statistics Identifying the Distribution of the Test Statistic Specify the Level of Significance State the Decision Rule Determining Critical Values Decision Rules and Confidence Intervals Collect the Data and Calculate the Test Statistic Make a Decision Make a Statistical Decision Make an Economic Decision Statistically Significant but Not Economically Significant? The Role of p-Values Multiple Tests and Significance Interpretation Tests Concerning a Single Mean Test Concerning Differences between Means with Independent Samples Test Concerning Differences between Means with Dependent Samples Testing Concerning Tests of Variances Tests of a Single Variance Test Concerning the Equality of Two Variances (F-Test) Parametric vs. Nonparametric Tests Uses of Nonparametric Tests Nonparametric Inference: Summary Tests Concerning Correlation Parametric Test of a Correlation Tests Concerning Correlation: The Spearman Rank Correlation

Coefficient Test of Independence Using Contingency Table Data Summary References Practice Problems Solutions 355

356

357

357

358

359

359

360

360

362

363

364

365

366

366

366

366

367

370

373

377

379

383

383

387

392

393

393

394

395

Introduction to Linear Regression Simple Linear Regression Estimating the Parameters of a Simple Linear Regression The Basics of Simple Linear Regression Estimating the Regression Line Interpreting the Regression Coefficients Cross-Sectional vs. Time-Series Regressions Assumptions of the Simple Linear Regression Model Assumption 1: Linearity Assumption 2: Homoskedasticity Assumption 3: Independence 429

429

432

432

433

436

437

440

440

442

444

indicates an optional segment

397

399

404

407

408

419

Contents

© CFA Institute. For candidate use only. Not for distribution.

vii

Assumption 4: Normality Analysis of Variance Breaking down the Sum of Squares Total into Its Components Measures of Goodness of Fit ANOVA and Standard Error of Estimate in Simple Linear Regression Hypothesis Testing of Linear Regression Coefficients Hypothesis Tests of the Slope Coefficient Hypothesis Tests of the Intercept Hypothesis Tests of Slope When Independent Variable Is an

Indicator Variable Test of Hypotheses: Level of Significance and p-Values Prediction Using Simple Linear Regression and Prediction Intervals Functional Forms for Simple Linear Regression The Log-Lin Model The Lin-Log Model The Log-Log Model Selecting the Correct Functional Form Summary Practice Problems Solutions 445

447

448

449

450

453

453

456

Appendices 493

indicates an optional segment

457

459

460

464

465

466

468

469

471

474

488

© CFA Institute. For candidate use only. Not for distribution.

© CFA Institute. For candidate use only. Not for distribution.

How to Use the CFA

Program Curriculum

The CFA® Program exams measure your mastery of the core knowledge, skills, and

abilities required to succeed as an investment professional. These core competencies

are the basis for the Candidate Body of Knowledge (CBOK™). The CBOK consists of

four components:

■

A broad outline that lists the major CFA Program topic areas (www.

cfainstitute.org/programs/cfa/curriculum/cbok)

■

Topic area weights that indicate the relative exam weightings of the top-level

topic areas (www.cfainstitute.org/programs/cfa/curriculum)

■

Learning outcome statements (LOS) that advise candidates about the specific knowledge, skills, and abilities they should acquire from curriculum

content covering a topic area: LOS are provided in candidate study sessions and at the beginning of each block of related content and the specific

lesson that covers them. We encourage you to review the information about

the LOS on our website (www.cfainstitute.org/programs/cfa/curriculum/

study-sessions), including the descriptions of LOS “command words” on the

candidate resources page at www.cfainstitute.org.

■

The CFA Program curriculum that candidates receive upon exam

registration

Therefore, the key to your success on the CFA exams is studying and understanding

the CBOK. You can learn more about the CBOK on our website: www.cfainstitute.

org/programs/cfa/curriculum/cbok.

The entire curriculum, including the practice questions, is the basis for all exam

questions and is selected or developed specifically to teach the knowledge, skills, and

abilities reflected in the CBOK.

ERRATA

The curriculum development process is rigorous and includes multiple rounds of

reviews by content experts. Despite our efforts to produce a curriculum that is free

of errors, there are instances where we must make corrections. Curriculum errata are

periodically updated and posted by exam level and test date online on the Curriculum

Errata webpage (www.cfainstitute.org/en/programs/submit-errata). If you believe you

have found an error in the curriculum, you can submit your concerns through our

curriculum errata reporting process found at the bottom of the Curriculum Errata

webpage.

DESIGNING YOUR PERSONAL STUDY PROGRAM

An orderly, systematic approach to exam preparation is critical. You should dedicate

a consistent block of time every week to reading and studying. Review the LOS both

before and after you study curriculum content to ensure that you have mastered the

ix

x

© CFA Institute. For candidate use only. Not for distribution.

How to Use the CFA Program Curriculum

applicable content and can demonstrate the knowledge, skills, and abilities described

by the LOS and the assigned reading. Use the LOS self-check to track your progress

and highlight areas of weakness for later review.

Successful candidates report an average of more than 300 hours preparing for each

exam. Your preparation time will vary based on your prior education and experience,

and you will likely spend more time on some study sessions than on others.

CFA INSTITUTE LEARNING ECOSYSTEM (LES)

Your exam registration fee includes access to the CFA Program Learning Ecosystem

(LES). This digital learning platform provides access, even offline, to all of the curriculum content and practice questions and is organized as a series of short online lessons

with associated practice questions. This tool is your one-stop location for all study

materials, including practice questions and mock exams, and the primary method by

which CFA Institute delivers your curriculum experience. The LES offers candidates

additional practice questions to test their knowledge, and some questions in the LES

provide a unique interactive experience.

FEEDBACK

Please send any comments or feedback to info@cfainstitute.org, and we will review

your suggestions carefully.

© CFA Institute. For candidate use only. Not for distribution.

Quantitative Methods

© CFA Institute. For candidate use only. Not for distribution.

© CFA Institute. For candidate use only. Not for distribution.

LEARNING MODULE

1

The Time Value of Money

by Richard A. DeFusco, PhD, CFA, Dennis W. McLeavey, DBA, CFA, Jerald

E. Pinto, PhD, CFA, and David E. Runkle, PhD, CFA.

Richard A. DeFusco, PhD, CFA, is at the University of Nebraska-Lincoln (USA). Dennis W.

McLeavey, DBA, CFA, is at the University of Rhode Island (USA). Jerald E. Pinto, PhD,

CFA, is at CFA Institute (USA). David E. Runkle, PhD, CFA, is at Jacobs Levy Equity

Management (USA).

LEARNING OUTCOME

Mastery

The candidate should be able to:

interpret interest rates as required rates of return, discount rates, or

opportunity costs

explain an interest rate as the sum of a real risk-free rate and

premiums that compensate investors for bearing distinct types of

risk

calculate and interpret the future value (FV) and present value (PV)

of a single sum of money, an ordinary annuity, an annuity due, a

perpetuity (PV only), and a series of unequal cash flows

demonstrate the use of a time line in modeling and solving time

value of money problems

calculate the solution for time value of money problems with

different frequencies of compounding

calculate and interpret the effective annual rate, given the stated

annual interest rate and the frequency of compounding

INTRODUCTION

As individuals, we often face decisions that involve saving money for a future use, or

borrowing money for current consumption. We then need to determine the amount

we need to invest, if we are saving, or the cost of borrowing, if we are shopping for

a loan. As investment analysts, much of our work also involves evaluating transactions with present and future cash flows. When we place a value on any security, for

example, we are attempting to determine the worth of a stream of future cash flows.

To carry out all the above tasks accurately, we must understand the mathematics of

time value of money problems. Money has time value in that individuals value a given

amount of money more highly the earlier it is received. Therefore, a smaller amount

1

4

Learning Module 1

© CFA Institute. For candidate use only. Not for distribution.

The Time Value of Money

of money now may be equivalent in value to a larger amount received at a future date.

The time value of money as a topic in investment mathematics deals with equivalence

relationships between cash flows with different dates. Mastery of time value of money

concepts and techniques is essential for investment analysts.

The reading1 is organized as follows: Section 2 introduces some terminology used

throughout the reading and supplies some economic intuition for the variables we will

discuss. Section 3 tackles the problem of determining the worth at a future point in

time of an amount invested today. Section 4 addresses the future worth of a series of

cash flows. These two sections provide the tools for calculating the equivalent value at

a future date of a single cash flow or series of cash flows. Sections 5 and 6 discuss the

equivalent value today of a single future cash flow and a series of future cash flows,

respectively. In Section 7, we explore how to determine other quantities of interest

in time value of money problems.

2

INTEREST RATES

interpret interest rates as required rates of return, discount rates, or

opportunity costs

explain an interest rate as the sum of a real risk-free rate and

premiums that compensate investors for bearing distinct types of

risk

In this reading, we will continually refer to interest rates. In some cases, we assume

a particular value for the interest rate; in other cases, the interest rate will be the

unknown quantity we seek to determine. Before turning to the mechanics of time

value of money problems, we must illustrate the underlying economic concepts. In

this section, we briefly explain the meaning and interpretation of interest rates.

Time value of money concerns equivalence relationships between cash flows

occurring on different dates. The idea of equivalence relationships is relatively simple.

Consider the following exchange: You pay $10,000 today and in return receive $9,500

today. Would you accept this arrangement? Not likely. But what if you received the

$9,500 today and paid the $10,000 one year from now? Can these amounts be considered

equivalent? Possibly, because a payment of $10,000 a year from now would probably

be worth less to you than a payment of $10,000 today. It would be fair, therefore,

to discount the $10,000 received in one year; that is, to cut its value based on how

much time passes before the money is paid. An interest rate, denoted r, is a rate of

return that reflects the relationship between differently dated cash flows. If $9,500

today and $10,000 in one year are equivalent in value, then $10,000 − $9,500 = $500

is the required compensation for receiving $10,000 in one year rather than now. The

interest rate—the required compensation stated as a rate of return—is $500/$9,500

= 0.0526 or 5.26 percent.

Interest rates can be thought of in three ways. First, they can be considered required

rates of return—that is, the minimum rate of return an investor must receive in order

to accept the investment. Second, interest rates can be considered discount rates. In

the example above, 5.26 percent is that rate at which we discounted the $10,000 future

amount to find its value today. Thus, we use the terms “interest rate” and “discount

rate” almost interchangeably. Third, interest rates can be considered opportunity costs.

1 Examples in this reading and other readings in quantitative methods at Level I were updated in 2018 by

Professor Sanjiv Sabherwal of the University of Texas, Arlington.

Interest Rates

© CFA Institute. For candidate use only. Not for distribution.

An opportunity cost is the value that investors forgo by choosing a particular course

of action. In the example, if the party who supplied $9,500 had instead decided to

spend it today, he would have forgone earning 5.26 percent on the money. So we can

view 5.26 percent as the opportunity cost of current consumption.

Economics tells us that interest rates are set in the marketplace by the forces of supply and demand, where investors are suppliers of funds and borrowers are demanders

of funds. Taking the perspective of investors in analyzing market-determined interest

rates, we can view an interest rate r as being composed of a real risk-free interest rate

plus a set of four premiums that are required returns or compensation for bearing

distinct types of risk:

r = Real risk-free interest rate + Inflation premium + Default risk premium +

Liquidity premium + Maturity premium

■

The real risk-free interest rate is the single-period interest rate for a completely risk-free security if no inflation were expected. In economic theory,

the real risk-free rate reflects the time preferences of individuals for current

versus future real consumption.

■

The inflation premium compensates investors for expected inflation and

reflects the average inflation rate expected over the maturity of the debt.

Inflation reduces the purchasing power of a unit of currency—the amount

of goods and services one can buy with it. The sum of the real risk-free

interest rate and the inflation premium is the nominal risk-free interest

rate.2 Many countries have governmental short-term debt whose interest

rate can be considered to represent the nominal risk-free interest rate in that

country. The interest rate on a 90-day US Treasury bill (T-bill), for example,

represents the nominal risk-free interest rate over that time horizon.3 US

T-bills can be bought and sold in large quantities with minimal transaction

costs and are backed by the full faith and credit of the US government.

■

The default risk premium compensates investors for the possibility that the

borrower will fail to make a promised payment at the contracted time and in

the contracted amount.

■

The liquidity premium compensates investors for the risk of loss relative

to an investment’s fair value if the investment needs to be converted to cash

quickly. US T-bills, for example, do not bear a liquidity premium because

large amounts can be bought and sold without affecting their market price.

Many bonds of small issuers, by contrast, trade infrequently after they are

issued; the interest rate on such bonds includes a liquidity premium reflecting the relatively high costs (including the impact on price) of selling a

position.

■

The maturity premium compensates investors for the increased sensitivity

of the market value of debt to a change in market interest rates as maturity

is extended, in general (holding all else equal). The difference between the

2 Technically, 1 plus the nominal rate equals the product of 1 plus the real rate and 1 plus the inflation rate.

As a quick approximation, however, the nominal rate is equal to the real rate plus an inflation premium.

In this discussion we focus on approximate additive relationships to highlight the underlying concepts.

3 Other developed countries issue securities similar to US Treasury bills. The French government issues

BTFs or negotiable fixed-rate discount Treasury bills (Bons du Trésor àtaux fixe et à intérêts précomptés)

with maturities of up to one year. The Japanese government issues a short-term Treasury bill with maturities of 6 and 12 months. The German government issues at discount both Treasury financing paper

(Finanzierungsschätze des Bundes or, for short, Schätze) and Treasury discount paper (Bubills) with

maturities up to 24 months. In the United Kingdom, the British government issues gilt-edged Treasury

bills with maturities ranging from 1 to 364 days. The Canadian government bond market is closely related

to the US market; Canadian Treasury bills have maturities of 3, 6, and 12 months.

5

6

Learning Module 1

© CFA Institute. For candidate use only. Not for distribution.

The Time Value of Money

interest rate on longer-maturity, liquid Treasury debt and that on short-term

Treasury debt reflects a positive maturity premium for the longer-term debt

(and possibly different inflation premiums as well).

Using this insight into the economic meaning of interest rates, we now turn to a

discussion of solving time value of money problems, starting with the future value

of a single cash flow.

3

FUTURE VALUE OF A SINGLE CASH FLOW

calculate and interpret the future value (FV) and present value (PV)

of a single sum of money, an ordinary annuity, an annuity due, a

perpetuity (PV only), and a series of unequal cash flows

demonstrate the use of a time line in modeling and solving time

value of money problems

In this section, we introduce time value associated with a single cash flow or lump-sum

investment. We describe the relationship between an initial investment or present

value (PV), which earns a rate of return (the interest rate per period) denoted as r,

and its future value (FV), which will be received N years or periods from today.

The following example illustrates this concept. Suppose you invest $100 (PV =

$100) in an interest-bearing bank account paying 5 percent annually. At the end of

the first year, you will have the $100 plus the interest earned, 0.05 × $100 = $5, for a

total of $105. To formalize this one-period example, we define the following terms:

PV = present value of the investment

FVN = future value of the investment N periods from today

r = rate of interest per period

For N = 1, the expression for the future value of amount PV is

FV1 = PV(1 + r) (1)

For this example, we calculate the future value one year from today as FV1 = $100(1.05)

= $105.

Now suppose you decide to invest the initial $100 for two years with interest

earned and credited to your account annually (annual compounding). At the end of

the first year (the beginning of the second year), your account will have $105, which

you will leave in the bank for another year. Thus, with a beginning amount of $105

(PV = $105), the amount at the end of the second year will be $105(1.05) = $110.25.

Note that the $5.25 interest earned during the second year is 5 percent of the amount

invested at the beginning of Year 2.

Another way to understand this example is to note that the amount invested at

the beginning of Year 2 is composed of the original $100 that you invested plus the

$5 interest earned during the first year. During the second year, the original principal

again earns interest, as does the interest that was earned during Year 1. You can see

how the original investment grows:

Original investment

$100.00

Interest for the first year ($100 × 0.05)

5.00

Interest for the second year based on original investment ($100 × 0.05)

5.00

© CFA Institute. For candidate use only. Not for distribution.

Future Value of a Single Cash Flow

Interest for the second year based on interest earned in the first year (0.05 ×

$5.00 interest on interest)

Total

0.25

$110.25

The $5 interest that you earned each period on the $100 original investment is known

as simple interest (the interest rate times the principal). Principal is the amount of

funds originally invested. During the two-year period, you earn $10 of simple interest.

The extra $0.25 that you have at the end of Year 2 is the interest you earned on the

Year 1 interest of $5 that you reinvested.

The interest earned on interest provides the first glimpse of the phenomenon

known as compounding. Although the interest earned on the initial investment is

important, for a given interest rate it is fixed in size from period to period. The compounded interest earned on reinvested interest is a far more powerful force because,

for a given interest rate, it grows in size each period. The importance of compounding

increases with the magnitude of the interest rate. For example, $100 invested today

would be worth about $13,150 after 100 years if compounded annually at 5 percent,

but worth more than $20 million if compounded annually over the same time period

at a rate of 13 percent.

To verify the $20 million figure, we need a general formula to handle compounding

for any number of periods. The following general formula relates the present value of

an initial investment to its future value after N periods:

FVN = PV(1 + r)N (2)

where r is the stated interest rate per period and N is the number of compounding

periods. In the bank example, FV2 = $100(1 + 0.05)2 = $110.25. In the 13 percent

investment example, FV100 = $100(1.13)100 = $20,316,287.42.

The most important point to remember about using the future value equation is

that the stated interest rate, r, and the number of compounding periods, N, must be

compatible. Both variables must be defined in the same time units. For example, if

N is stated in months, then r should be the one-month interest rate, unannualized.

A time line helps us to keep track of the compatibility of time units and the interest

rate per time period. In the time line, we use the time index t to represent a point in

time a stated number of periods from today. Thus the present value is the amount

available for investment today, indexed as t = 0. We can now refer to a time N periods

from today as t = N. The time line in Exhibit 1 shows this relationship.

Exhibit 1: The Relationship between an Initial Investment, PV, and Its Future

Value, FV

0

PV

1

2

3

...

N–1

N

FVN = PV(1 + r)N

In Exhibit 1, we have positioned the initial investment, PV, at t = 0. Using Equation

2, we move the present value, PV, forward to t = N by the factor (1 + r)N. This factor

is called a future value factor. We denote the future value on the time line as FV and

7

8

Learning Module 1

© CFA Institute. For candidate use only. Not for distribution.

The Time Value of Money

position it at t = N. Suppose the future value is to be received exactly 10 periods from

today’s date (N = 10). The present value, PV, and the future value, FV, are separated

in time through the factor (1 + r)10.

The fact that the present value and the future value are separated in time has

important consequences:

■

We can add amounts of money only if they are indexed at the same point in

time.

■

For a given interest rate, the future value increases with the number of

periods.

■

For a given number of periods, the future value increases with the interest

rate.

To better understand these concepts, consider three examples that illustrate how

to apply the future value formula.

EXAMPLE 1

The Future Value of a Lump Sum with Interim Cash

Reinvested at the Same Rate

1. You are the lucky winner of your state’s lottery of $5 million after taxes.

You invest your winnings in a five-year certificate of deposit (CD) at a local

financial institution. The CD promises to pay 7 percent per year compounded annually. This institution also lets you reinvest the interest at that rate for

the duration of the CD. How much will you have at the end of five years if

your money remains invested at 7 percent for five years with no withdrawals?

Solution:

To solve this problem, compute the future value of the $5 million investment

using the following values in Equation 2:

PV = $5, 000, 000

r = 7 % = 0.07

N = 5

N

F

VN = PV (1 + r)

= $5,000,000 ( 1.07)5

= $5,000,000( 1.402552)

= $7,012,758.65

At the end of five years, you will have $7,012,758.65 if your money remains

invested at 7 percent with no withdrawals.

In this and most examples in this reading, note that the factors are reported at six

decimal places but the calculations may actually reflect greater precision. For example, the reported 1.402552 has been rounded up from 1.40255173 (the calculation is

actually carried out with more than eight decimal places of precision by the calculator

or spreadsheet). Our final result reflects the higher number of decimal places carried

by the calculator or spreadsheet.4

4 We could also solve time value of money problems using tables of interest rate factors. Solutions using

tabled values of interest rate factors are generally less accurate than solutions obtained using calculators

or spreadsheets, so practitioners prefer calculators or spreadsheets.

© CFA Institute. For candidate use only. Not for distribution.

Future Value of a Single Cash Flow

EXAMPLE 2

The Future Value of a Lump Sum with No Interim Cash

1. An institution offers you the following terms for a contract: For an investment of ¥2,500,000, the institution promises to pay you a lump sum six

years from now at an 8 percent annual interest rate. What future amount

can you expect?

Solution:

Use the following data in Equation 2 to find the future value:

PV = ¥2, 500, 000

r = 8 % = 0.08

N = 6

N

F

VN = PV (1 + r)

= ¥2, 500, 000 ( 1.08)6

= ¥2, 500, 000( 1.586874)

= ¥3, 967, 186

You can expect to receive ¥3,967,186 six years from now.

Our third example is a more complicated future value problem that illustrates the

importance of keeping track of actual calendar time.

EXAMPLE 3

The Future Value of a Lump Sum

1. A pension fund manager estimates that his corporate sponsor will make

a $10 million contribution five years from now. The rate of return on plan

assets has been estimated at 9 percent per year. The pension fund manager

wants to calculate the future value of this contribution 15 years from now,

which is the date at which the funds will be distributed to retirees. What is

that future value?

Solution:

By positioning the initial investment, PV, at t = 5, we can calculate the future

value of the contribution using the following data in Equation 2:

PV = $10 million

r = 9 % = 0.09

N = 10

N

F

VN = PV (1 + r)

= $10,000,000 ( 1.09)10

= $10,000,000( 2.367364)

= $23,673,636.75

This problem looks much like the previous two, but it differs in one important respect: its timing. From the standpoint of today (t = 0), the future

amount of $23,673,636.75 is 15 years into the future. Although the future

value is 10 years from its present value, the present value of $10 million will

not be received for another five years.

9

10

Learning Module 1

© CFA Institute. For candidate use only. Not for distribution.

The Time Value of Money

Exhibit 2: The Future Value of a Lump Sum, Initial Investment Not at

t=0

As Exhibit 2 shows, we have followed the convention of indexing today

as t = 0 and indexing subsequent times by adding 1 for each period. The

additional contribution of $10 million is to be received in five years, so it is

indexed as t = 5 and appears as such in the figure. The future value of the

investment in 10 years is then indexed at t = 15; that is, 10 years following

the receipt of the $10 million contribution at t = 5. Time lines like this one

can be extremely useful when dealing with more-complicated problems,

especially those involving more than one cash flow.

In a later section of this reading, we will discuss how to calculate the value today

of the $10 million to be received five years from now. For the moment, we can use

Equation 2. Suppose the pension fund manager in Example 3 above were to receive

$6,499,313.86 today from the corporate sponsor. How much will that sum be worth

at the end of five years? How much will it be worth at the end of 15 years?

PV = $6,499,313.86

r = 9 % = 0.09

N = 5

N

F

VN = PV (1 + r)

= $6,499,313.86 ( 1.09)5

= $6,499,313.86( 1.538624)

= $10,000,000 at the five-year mark

and

PV = $6,499,313.86

r = 9 % = 0.09

N = 15

N

F

VN = PV (1 + r)

= $6,499,313.86 ( 1.09)15

= $6,499,313.86( 3.642482)

= $23,673,636.74 at the 15-year mark

These results show that today’s present value of about $6.5 million becomes $10

million after five years and $23.67 million after 15 years.

4

NON-ANNUAL COMPOUNDING (FUTURE VALUE)

calculate the solution for time value of money problems with

different frequencies of compounding

© CFA Institute. For candidate use only. Not for distribution.

Non-Annual Compounding (Future Value)

In this section, we examine investments paying interest more than once a year. For

instance, many banks offer a monthly interest rate that compounds 12 times a year.

In such an arrangement, they pay interest on interest every month. Rather than quote

the periodic monthly interest rate, financial institutions often quote an annual interest

rate that we refer to as the stated annual interest rate or quoted interest rate. We

denote the stated annual interest rate by rs. For instance, your bank might state that

a particular CD pays 8 percent compounded monthly. The stated annual interest rate

equals the monthly interest rate multiplied by 12. In this example, the monthly interest

rate is 0.08/12 = 0.0067 or 0.67 percent.5 This rate is strictly a quoting convention

because (1 + 0.0067)12 = 1.083, not 1.08; the term (1 + rs) is not meant to be a future

value factor when compounding is more frequent than annual.

With more than one compounding period per year, the future value formula can

be expressed as

rs mN

m )

FVN = PV (1 + _

(3)

where rs is the stated annual interest rate, m is the number of compounding

periods per year, and N now stands for the number of years. Note the compatibility

here between the interest rate used, rs/m, and the number of compounding periods,

mN. The periodic rate, rs/m, is the stated annual interest rate divided by the number

of compounding periods per year. The number of compounding periods, mN, is the

number of compounding periods in one year multiplied by the number of years. The

periodic rate, rs/m, and the number of compounding periods, mN, must be compatible.

EXAMPLE 4

The Future Value of a Lump Sum with Quarterly

Compounding

1. Continuing with the CD example, suppose your bank offers you a CD with

a two-year maturity, a stated annual interest rate of 8 percent compounded

quarterly, and a feature allowing reinvestment of the interest at the same

interest rate. You decide to invest $10,000. What will the CD be worth at

maturity?

Solution:

Compute the future value with Equation 3 as follows:

PV = $10,000

r s = 8 % = 0.08

m = 4

rs / m = 0.08 / 4 = 0.02

N = 2

mN

periods

= 4(2) = 8 interest

rs mN

FVN = PV (1 + _

m )

= $10,000 ( 1.02)8

= $10,000( 1.171659)

= $11,716.59

At maturity, the CD will be worth $11,716.59.

5 To avoid rounding errors when using a financial calculator, divide 8 by 12 and then press the %i key,

rather than simply entering 0.67 for %i, so we have (1 + 0.08/12)12 = 1.083000.

11

12

Learning Module 1

© CFA Institute. For candidate use only. Not for distribution.

The Time Value of Money

The future value formula in Equation 3 does not differ from the one in Equation 2.

Simply keep in mind that the interest rate to use is the rate per period and the exponent is the number of interest, or compounding, periods.

EXAMPLE 5

The Future Value of a Lump Sum with Monthly

Compounding

1. An Australian bank offers to pay you 6 percent compounded monthly. You

decide to invest A$1 million for one year. What is the future value of your

investment if interest payments are reinvested at 6 percent?

Solution:

Use Equation 3 to find the future value of the one-year investment as follows:

PV = A$1,000,000

r s = 6 % = 0.06

m = 12

rs / m = 0.06 / 12 = 0.0050

N = 1

mN

interest

(1) = 12

= 12

periods

rs mN

FVN = PV (1 + _

m )

= A$1,000,000 ( 1.005)12

= A$1,000,000( 1.061678)

= A$1,061,677.81

If you had been paid 6 percent with annual compounding, the future

amount would be only A$1,000,000(1.06) = A$1,060,000 instead of

A$1,061,677.81 with monthly compounding.

5

CONTINUOUS COMPOUNDING

calculate and interpret the effective annual rate, given the stated

annual interest rate and the frequency of compounding

calculate the solution for time value of money problems with

different frequencies of compounding

The preceding discussion on compounding periods illustrates discrete compounding,

which credits interest after a discrete amount of time has elapsed. If the number of

compounding periods per year becomes infinite, then interest is said to compound

continuously. If we want to use the future value formula with continuous compounding, we need to find the limiting value of the future value factor for m → ∞ (infinitely

many compounding periods per year) in Equation 3. The expression for the future

value of a sum in N years with continuous compounding is

FVN = PV ers N

(4)

© CFA Institute. For candidate use only. Not for distribution.

Continuous Compounding

13

The term e rs N is the transcendental number e ≈ 2.7182818 raised to the power rsN.

Most financial calculators have the function ex.

EXAMPLE 6

The Future Value of a Lump Sum with Continuous

Compounding

Suppose a $10,000 investment will earn 8 percent compounded continuously

for two years. We can compute the future value with Equation 4 as follows:

PV = $10,000

rs = 8 % = 0.08

N = 2

r N

F

VN = PV e s

= $10,000 e0.08( 2)

= $10,000( 1.173511)

= $11,735.11

With the same interest rate but using continuous compounding, the $10,000

investment will grow to $11,735.11 in two years, compared with $11,716.59

using quarterly compounding as shown in Example 4.

Exhibit 3 shows how a stated annual interest rate of 8 percent generates different

ending dollar amounts with annual, semiannual, quarterly, monthly, daily, and continuous compounding for an initial investment of $1 (carried out to six decimal places).

As Exhibit 3 shows, all six cases have the same stated annual interest rate of 8

percent; they have different ending dollar amounts, however, because of differences

in the frequency of compounding. With annual compounding, the ending amount

is $1.08. More frequent compounding results in larger ending amounts. The ending

dollar amount with continuous compounding is the maximum amount that can be

earned with a stated annual rate of 8 percent.

Exhibit 3: The Effect of Compounding Frequency on Future Value

Frequency

Annual

rs/m

mN

8%/1 = 8%

1×1=1

Semiannual

8%/2 = 4%

2×1=2

Quarterly

8%/4 = 2%

4×1=4

Monthly

8%/12 = 0.6667%

12 × 1 = 12

Daily

8%/365 = 0.0219%

365 × 1 = 365

Continuous

Future Value of $1

$1.00(1.08)

$1.00(1.04)2

$1.00(1.02)4

$1.00(1.006667)12

$1.00(1.000219)365

$1.00e0.08(1)

Exhibit 3 also shows that a $1 investment earning 8.16 percent compounded annually

grows to the same future value at the end of one year as a $1 investment earning 8

percent compounded semiannually. This result leads us to a distinction between the

stated annual interest rate and the effective annual rate (EAR).6 For an 8 percent

stated annual interest rate with semiannual compounding, the EAR is 8.16 percent.

6 Among the terms used for the effective annual return on interest-bearing bank deposits are annual

percentage yield (APY) in the United States and equivalent annual rate (EAR) in the United Kingdom.

By contrast, the annual percentage rate (APR) measures the cost of borrowing expressed as a yearly

=

$1.08

=

$1.081600

=

$1.082432

=

$1.083000

=

$1.083278

=

$1.083287

14

Learning Module 1

© CFA Institute. For candidate use only. Not for distribution.

The Time Value of Money

Stated and Effective Rates

The stated annual interest rate does not give a future value directly, so we need a formula for the EAR. With an annual interest rate of 8 percent compounded semiannually,

we receive a periodic rate of 4 percent. During the course of a year, an investment of

$1 would grow to $1(1.04)2 = $1.0816, as illustrated in Exhibit 3. The interest earned

on the $1 investment is $0.0816 and represents an effective annual rate of interest of

8.16 percent. The effective annual rate is calculated as follows:

EAR = (1 + Periodic interest rate)m – 1 (5)

The periodic interest rate is the stated annual interest rate divided by m, where m is

the number of compounding periods in one year. Using our previous example, we can

solve for EAR as follows: (1.04)2 − 1 = 8.16 percent.

The concept of EAR extends to continuous compounding. Suppose we have a rate

of 8 percent compounded continuously. We can find the EAR in the same way as above

by finding the appropriate future value factor. In this case, a $1 investment would

grow to $1e0.08(1.0) = $1.0833. The interest earned for one year represents an effective

annual rate of 8.33 percent and is larger than the 8.16 percent EAR with semiannual

compounding because interest is compounded more frequently. With continuous

compounding, we can solve for the effective annual rate as follows:

EAR = e rs − 1

(6)

We can reverse the formulas for EAR with discrete and continuous compounding to

find a periodic rate that corresponds to a particular effective annual rate. Suppose we

want to find the appropriate periodic rate for a given effective annual rate of 8.16 percent with semiannual compounding. We can use Equation 5 to find the periodic rate:

0.0816 = ( 1 + Periodic rate)2− 1

1.0816 = ( 1 + Periodic rate)2

1.0816)1/2− 1 = Periodic rate

(

( 1.04)− 1 = Periodic rate

4% = Periodic rate

To calculate the continuously compounded rate (the stated annual interest rate with

continuous compounding) corresponding to an effective annual rate of 8.33 percent,

we find the interest rate that satisfies Equation 6:

0.0833 = ers − 1

1.0833 = e rs

To solve this equation, we take the natural logarithm of both sides. (Recall that the

natural log of e r s is ln e r s = r s .) Therefore, ln 1.0833 = rs, resulting in rs = 8 percent. We

see that a stated annual rate of 8 percent with continuous compounding is equivalent

to an EAR of 8.33 percent.

rate. In the United States, the APR is calculated as a periodic rate times the number of payment periods

per year and, as a result, some writers use APR as a general synonym for the stated annual interest rate.

Nevertheless, APR is a term with legal connotations; its calculation follows regulatory standards that vary

internationally. Therefore, “stated annual interest rate” is the preferred general term for an annual interest

rate that does not account for compounding within the year.

A Series of Cash Flows

© CFA Institute. For candidate use only. Not for distribution.

15

6

A SERIES OF CASH FLOWS

calculate and interpret the future value (FV) and present value (PV)

of a single sum of money, an ordinary annuity, an annuity due, a

perpetuity (PV only), and a series of unequal cash flows

demonstrate the use of a time line in modeling and solving time

value of money problems

In this section, we consider series of cash flows, both even and uneven. We begin

with a list of terms commonly used when valuing cash flows that are distributed over

many time periods.

■

An annuity is a finite set of level sequential cash flows.

■

An ordinary annuity has a first cash flow that occurs one period from now

(indexed at t = 1).

■

An annuity due has a first cash flow that occurs immediately (indexed at t

= 0).

■

A perpetuity is a perpetual annuity, or a set of level never-ending sequential cash flows, with the first cash flow occurring one period from now.

Equal Cash Flows—Ordinary Annuity

Consider an ordinary annuity paying 5 percent annually. Suppose we have five separate deposits of $1,000 occurring at equally spaced intervals of one year, with the first

payment occurring at t = 1. Our goal is to find the future value of this ordinary annuity

after the last deposit at t = 5. The increment in the time counter is one year, so the

last payment occurs five years from now. As the time line in Exhibit 4 shows, we find

the future value of each $1,000 deposit as of t = 5 with Equation 2, FVN = PV(1 + r)N.

The arrows in Exhibit 4 extend from the payment date to t = 5. For instance, the first

$1,000 deposit made at t = 1 will compound over four periods. Using Equation 2, we

find that the future value of the first deposit at t = 5 is $1,000(1.05)4 = $1,215.51. We

calculate the future value of all other payments in a similar fashion. (Note that we

are finding the future value at t = 5, so the last payment does not earn any interest.)

With all values now at t = 5, we can add the future values to arrive at the future value

of the annuity. This amount is $5,525.63.

Exhibit 4: The Future Value of a Five-Year Ordinary Annuity

0

|

1

$1,000

|

2

$1,000

|

3

$1,000

|

4

$1,000

|

5

$1,000(1.05)4

$1,000(1.05)3

$1,000(1.05)2

$1,000(1.05)1

=

=

=

=

$1,215.506250

$1,157.625000

$1,102.500000

$1,050.000000

$1,000(1.05)0 = $1,000.000000

Sum at t = 5

$5,525.63

16

Learning Module 1

© CFA Institute. For candidate use only. Not for distribution.

The Time Value of Money

We can arrive at a general annuity formula if we define the annuity amount as A,

the number of time periods as N, and the interest rate per period as r. We can then

define the future value as

FVN = A[ (1 + r)N−1+ ( 1 + r)N−2+ ( 1 + r)N−3+ … + (1 + r)1+ ( 1 + r)0]

which simplifies to

FVN = A[ _

]

r

(1 + r)N− 1

(7)

The term in brackets is the future value annuity factor. This factor gives the future

value of an ordinary annuity of $1 per period. Multiplying the future value annuity

factor by the annuity amount gives the future value of an ordinary annuity. For the

ordinary annuity in Exhibit 4, we find the future value annuity factor from Equation 7 as

[_

0.05 ] = 5.525631

(1.05)5− 1

With an annuity amount A = $1,000, the future value of the annuity is $1,000(5.525631)

= $5,525.63, an amount that agrees with our earlier work.

The next example illustrates how to find the future value of an ordinary annuity

using the formula in Equation 7.

EXAMPLE 7

The Future Value of an Annuity

1. Suppose your company’s defined contribution retirement plan allows you to

invest up to €20,000 per year. You plan to invest €20,000 per year in a stock

index fund for the next 30 years. Historically, this fund has earned 9 percent

per year on average. Assuming that you actually earn 9 percent a year, how

much money will you have available for retirement after making the last

payment?

Solution:

Use Equation 7 to find the future amount:

A = €20,000

r = 9% = 0.09

N = 30

(1 + r)N− 1

(1.09)30− 1

FV annuity factor = _

= _

0.09 = 136.307539

r

FVN = €20,000(136.307539)

= €2,726,150.77

Assuming the fund continues to earn an average of 9 percent per year, you

will have €2,726,150.77 available at retirement.

Unequal Cash Flows

In many cases, cash flow streams are unequal, precluding the simple use of the future

value annuity factor. For instance, an individual investor might have a savings plan

that involves unequal cash payments depending on the month of the year or lower

© CFA Institute. For candidate use only. Not for distribution.

Present Value of a Single Cash Flow

17

savings during a planned vacation. One can always find the future value of a series

of unequal cash flows by compounding the cash flows one at a time. Suppose you

have the five cash flows described in Exhibit 5, indexed relative to the present (t = 0).

Exhibit 5: A Series of Unequal Cash Flows and Their Future

Values at 5 Percent

Time

Cash Flow ($)

t=1

1,000

t=2

2,000

t=3

4,000

t=4

5,000

t=5

6,000

Future Value at Year 5

$1,000(1.05)4

$2,000(1.05)3

$4,000(1.05)2

$5,000(1.05)1

$6,000(1.05)0

Sum

=

$1,215.51

=

$2,315.25

=

$4,410.00

=

$5,250.00

=

$6,000.00

=

$19,190.76

All of the payments shown in Exhibit 5 are different. Therefore, the most direct

approach to finding the future value at t = 5 is to compute the future value of each

payment as of t = 5 and then sum the individual future values. The total future value

at Year 5 equals $19,190.76, as shown in the third column. Later in this reading, you

will learn shortcuts to take when the cash flows are close to even; these shortcuts will

allow you to combine annuity and single-period calculations.

7

PRESENT VALUE OF A SINGLE CASH FLOW

calculate and interpret the future value (FV) and present value (PV)

of a single sum of money, an ordinary annuity, an annuity due, a

perpetuity (PV only), and a series of unequal cash flows

demonstrate the use of a time line in modeling and solving time

value of money problems

Just as the future value factor links today’s present value with tomorrow’s future

value, the present value factor allows us to discount future value to present value.

For example, with a 5 percent interest rate generating a future payoff of $105 in one

year, what current amount invested at 5 percent for one year will grow to $105? The

answer is $100; therefore, $100 is the present value of $105 to be received in one year

at a discount rate of 5 percent.

Given a future cash flow that is to be received in N periods and an interest rate per

period of r, we can use the formula for future value to solve directly for the present

value as follows:

FVN = PV (1 + r)N

PV

( 1 ) N ]

= FVN[_

1 + r

(8)

PV = FVN( 1 + r)−N

We see from Equation 8 that the present value factor, (1 + r)−N, is the reciprocal

of the future value factor, (1 + r)N.

18

Learning Module 1

© CFA Institute. For candidate use only. Not for distribution.

The Time Value of Money

EXAMPLE 8

The Present Value of a Lump Sum

1. An insurance company has issued a Guaranteed Investment Contract (GIC)

that promises to pay $100,000 in six years with an 8 percent return rate.

What amount of money must the insurer invest today at 8 percent for six

years to make the promised payment?

Solution:

We can use Equation 8 to find the present value using the following data:

FVN = $100,000

r = 8 % = 0.08

N = 6

PV = FVN(1 + r)−N

= $100,000[ _

( 1 ) 6 ]

1.08

= $100,000( 0.6301696)

= $63,016.96

We can say that $63,016.96 today, with an interest rate of 8 percent, is

equivalent to $100,000 to be received in six years. Discounting the $100,000

makes a future $100,000 equivalent to $63,016.96 when allowance is

made for the time value of money. As the time line in Exhibit 6 shows, the

$100,000 has been discounted six full periods.

Exhibit 6: The Present Value of a Lump Sum to Be Received at Time

t=6

0

1

2

3

4

5

6

PV = $63,016.96

$100,000 = FV

EXAMPLE 9

The Projected Present Value of a More Distant Future

Lump Sum

1. Suppose you own a liquid financial asset that will pay you $100,000 in 10

years from today. Your daughter plans to attend college four years from today, and you want to know what the asset’s present value will be at that time.

© CFA Institute. For candidate use only. Not for distribution.

Non-Annual Compounding (Present Value)

19

Given an 8 percent discount rate, what will the asset be worth four years

from today?

Solution:

The value of the asset is the present value of the asset’s promised payment.

At t = 4, the cash payment will be received six years later. With this information, you can solve for the value four years from today using Equation 8:

VN = $100,000

F

r = 8 % = 0.08

N = 6

PV = FVN( 1 + r)−N

1

= $100,000_

(

)6

1.08

= $100,000( 0.6301696)

= $63,016.96

Exhibit 7: The Relationship between Present Value and Future Value

0

...

$46,319.35

4

...

10

$63,016.96

$100,000

The time line in Exhibit 7 shows the future payment of $100,000 that is to

be received at t = 10. The time line also shows the values at t = 4 and at t = 0.

Relative to the payment at t = 10, the amount at t = 4 is a projected present

value, while the amount at t = 0 is the present value (as of today).

Present value problems require an evaluation of the present value factor, (1 + r)−N.

Present values relate to the discount rate and the number of periods in the following

ways:

■

For a given discount rate, the farther in the future the amount to be

received, the smaller that amount’s present value.

■

Holding time constant, the larger the discount rate, the smaller the present

value of a future amount.

NON-ANNUAL COMPOUNDING (PRESENT VALUE)

calculate the solution for time value of money problems with

different frequencies of compounding

Recall that interest may be paid semiannually, quarterly, monthly, or even daily. To

handle interest payments made more than once a year, we can modify the present

value formula (Equation 8) as follows. Recall that rs is the quoted interest rate and

equals the periodic interest rate multiplied by the number of compounding periods

in each year. In general, with more than one compounding period in a year, we can

express the formula for present value as

8

20

Learning Module 1

© CFA Institute. For candidate use only. Not for distribution.

The Time Value of Money

rs −mN

PV = FVN(1 + _

m )

(9)

where

m = number of compounding periods per year

rs = quoted annual interest rate

N = number of years

The formula in Equation 9 is quite similar to that in Equation 8. As we have already

noted, present value and future value factors are reciprocals. Changing the frequency

of compounding does not alter this result. The only difference is the use of the periodic

interest rate and the corresponding number of compounding periods.

The following example illustrates Equation 9.

EXAMPLE 10

The Present Value of a Lump Sum with Monthly

Compounding

1. The manager of a Canadian pension fund knows that the fund must make a

lump-sum payment of C$5 million 10 years from now. She wants to invest

an amount today in a GIC so that it will grow to the required amount. The

current interest rate on GICs is 6 percent a year, compounded monthly.

How much should she invest today in the GIC?

Solution:

Use Equation 9 to find the required present value:

FVN = C$5,000,000

r s = 6 % = 0.06

m = 12

rs / m = 0.06 / 12 = 0.005

N = 10

= 12

(10) = 120

mN

rs −mN

PV = FVN(

1 + _

m )

C$5,000,000 ( 1.005)−120

=

= C$5,000,000( 0.549633)

= C$2,748,163.67

In applying Equation 9, we use the periodic rate (in this case, the monthly

rate) and the appropriate number of periods with monthly compounding (in

this case, 10 years of monthly compounding, or 120 periods).

© CFA Institute. For candidate use only. Not for distribution.

Present Value of a Series of Equal and Unequal Cash Flows

9

PRESENT VALUE OF A SERIES OF EQUAL AND

UNEQUAL CASH FLOWS

calculate and interpret the future value (FV) and present value (PV)

of a single sum of money, an ordinary annuity, an annuity due, a

perpetuity (PV only), and a series of unequal cash flows

demonstrate the use of a time line in modeling and solving time

value of money problems

Many applications in investment management involve assets that offer a series of

cash flows over time. The cash flows may be highly uneven, relatively even, or equal.

They may occur over relatively short periods of time, longer periods of time, or even

stretch on indefinitely. In this section, we discuss how to find the present value of a

series of cash flows.

The Present Value of a Series of Equal Cash Flows

We begin with an ordinary annuity. Recall that an ordinary annuity has equal annuity

payments, with the first payment starting one period into the future. In total, the

annuity makes N payments, with the first payment at t = 1 and the last at t = N. We

can express the present value of an ordinary annuity as the sum of the present values

of each individual annuity payment, as follows:

A

A

A

A

A

_

_

_

_

PV = _

( 1 + r)+ (1 + r)2+ (1 + r)3+ … + (1 + r)N−1+ (1 + r)N

(10)

where

A = the annuity amount

r = the interest rate per period corresponding to the frequency of annuity

payments (for example, annual, quarterly, or monthly)

N = the number of annuity payments

Because the annuity payment (A) is a constant in this equation, it can be factored out

as a common term. Thus the sum of the interest factors has a shortcut expression:

1−_

( 1 ) N

1 + r

_

V = A r

P

[

]

21

(11)

In much the same way that we computed the future value of an ordinary annuity, we

find the present value by multiplying the annuity amount by a present value annuity

factor (the term in brackets in Equation 11).

22

Learning Module 1

© CFA Institute. For candidate use only. Not for distribution.

The Time Value of Money

EXAMPLE 11

The Present Value of an Ordinary Annuity

1. Suppose you are considering purchasing a financial asset that promises to

pay €1,000 per year for five years, with the first payment one year from now.

The required rate of return is 12 percent per year. How much should you pay

for this asset?

Solution:

To find the value of the financial asset, use the formula for the present value

of an ordinary annuity given in Equation 11 with the following data:

A = €1,000

r = 12% = 0.12

N=5

1−_

( 1 ) N

1 + r

_

PV = A r

[

]

1−_

( 1 ) 5

1.12

_

= €1,000 0.12

[

]

= €1,000(3.604776)

= €3,604.78

The series of cash flows of €1,000 per year for five years is currently worth

€3,604.78 when discounted at 12 percent.

Keeping track of the actual calendar time brings us to a specific type of annuity

with level payments: the annuity due. An annuity due has its first payment occurring

today (t = 0). In total, the annuity due will make N payments. Exhibit 8 presents the

time line for an annuity due that makes four payments of $100.

Exhibit 8: An Annuity Due of $100 per Period

|

0

$100

|

1

$100

|

2

$100

|

3

$100

As Exhibit 8 shows, we can view the four-period annuity due as the sum of two parts:

a $100 lump sum today and an ordinary annuity of $100 per period for three periods.

At a 12 percent discount rate, the four $100 cash flows in this annuity due example

will be worth $340.18.7

Expressing the value of the future series of cash flows in today’s dollars gives us a

convenient way of comparing annuities. The next example illustrates this approach.

7 There is an alternative way to calculate the present value of an annuity due. Compared to an ordinary

annuity, the payments in an annuity due are each discounted one less period. Therefore, we can modify

Equation 11 to handle annuities due by multiplying the right-hand side of the equation by (1 + r):

PV(Annuity due) = A{ [1 − ( 1 + r)−N]/ r}(1 + r)

© CFA Institute. For candidate use only. Not for distribution.

Present Value of a Series of Equal and Unequal Cash Flows

EXAMPLE 12

An Annuity Due as the Present Value of an Immediate

Cash Flow Plus an Ordinary Annuity

1. You are retiring today and must choose to take your retirement benefits

either as a lump sum or as an annuity. Your company’s benefits officer presents you with two alternatives: an immediate lump sum of $2 million or an

annuity with 20 payments of $200,000 a year with the first payment starting

today. The interest rate at your bank is 7 percent per year compounded annually. Which option has the greater present value? (Ignore any tax differences between the two options.)

Solution:

To compare the two options, find the present value of each at time t = 0 and

choose the one with the larger value. The first option’s present value is $2

million, already expressed in today’s dollars. The second option is an annuity

due. Because the first payment occurs at t = 0, you can separate the annuity

benefits into two pieces: an immediate $200,000 to be paid today (t = 0) and

an ordinary annuity of $200,000 per year for 19 years. To value this option,

you need to find the present value of the ordinary annuity using Equation 11

and then add $200,000 to it.

A = $200,000

N = 19

r = 7% = 0.07

1−_

( 1 ) N

1 + r

_

PV = A r

[

]

1−_

( 1 ) 19

1.07

_

= $200,000 0.07

[

]

= $200,000( 10.335595)

= $2,067,119.05

The 19 payments of $200,000 have a present value of $2,067,119.05. Adding

the initial payment of $200,000 to $2,067,119.05, we find that the total value

of the annuity option is $2,267,119.05. The present value of the annuity is

greater than the lump sum alternative of $2 million.

We now look at another example reiterating the equivalence of present and future

values.

EXAMPLE 13

The Projected Present Value of an Ordinary Annuity

1. A German pension fund manager anticipates that benefits of €1 million per

year must be paid to retirees. Retirements will not occur until 10 years from

now at time t = 10. Once benefits begin to be paid, they will extend until

t = 39 for a total of 30 payments. What is the present value of the pension

23

24

Learning Module 1

© CFA Institute. For candidate use only. Not for distribution.

The Time Value of Money

liability if the appropriate annual discount rate for plan liabilities is 5 percent

compounded annually?

Solution:

This problem involves an annuity with the first payment at t = 10. From the

perspective of t = 9, we have an ordinary annuity with 30 payments. We can

compute the present value of this annuity with Equation 11 and then look at

it on a time line.

A = €1,000,000

r = 5% = 0.05

N = 30

1−_

( 1 ) N

1 + r

_

PV = A r

[

]

1−_

( 1 ) 30

1.05

_

= €1,000,000 0.05

[

]

= €1,000,000(15.372451)

= €15,372,451.03

Exhibit 9: The Present Value of an Ordinary Annuity with First

Payment at Time t = 10 (in Millions)

0................................ 9

10

11

1

1

12 . . . . . . . . . . . . . . . . . . . . 39

1..................

1

On the time line, we have shown the pension payments of €1 million extending from t = 10 to t = 39. The bracket and arrow indicate the process of

finding the present value of the annuity, discounted back to t = 9. The present value of the pension benefits as of t = 9 is €15,372,451.03. The problem is

to find the present value today (at t = 0).

Now we can rely on the equivalence of present value and future value. As

Exhibit 9 shows, we can view the amount at t = 9 as a future value from the

vantage point of t = 0. We compute the present value of the amount at t = 9

as follows:

FVN = €15,372,451.03 (the present value at t = 9)

N=9

r = 5% = 0.05

PV = FVN(1 + r)–N

= €15,372,451.03(1.05)–9

= €15,372,451.03(0.644609)

= €9,909,219.00

The present value of the pension liability is €9,909,219.00.

© CFA Institute. For candidate use only. Not for distribution.

Present Value of a Series of Equal and Unequal Cash Flows

Example 13 illustrates three procedures emphasized in this reading:

■

finding the present or future value of any cash flow series;

■

recognizing the equivalence of present value and appropriately discounted

future value; and

■

keeping track of the actual calendar time in a problem involving the time

value of money.

The Present Value of a Series of Unequal Cash Flows

When we have unequal cash flows, we must first find the present value of each individual cash flow and then sum the respective present values. For a series with many

cash flows, we usually use a spreadsheet. Exhibit 10 lists a series of cash flows with

the time periods in the first column, cash flows in the second column, and each cash

flow’s present value in the third column. The last row of Exhibit 10 shows the sum of

the five present values.

Exhibit 10: A Series of Unequal Cash Flows and Their

Present Values at 5 Percent

Time Period

Cash Flow ($)

1

1,000

2

2,000

3

4,000

4

5,000

5

6,000

Present Value at Year 0

$1,000(1.05)−1

$2,000(1.05)−2

$4,000(1.05)−3

$5,000(1.05)−4

$6,000(1.05)−5

Sum

=

$952.38

=

$1,814.06

=

$3,455.35

=

$4,113.51

=

$4,701.16

=

$15,036.46

We could calculate the future value of these cash flows by computing them one at a

time using the single-payment future value formula. We already know the present value

of this series, however, so we can easily apply time-value equivalence. The future value

of the series of cash flows from Table 2, $19,190.76, is equal to the single $15,036.46

amount compounded forward to t = 5:

PV = $15,036.46

N = 5

r = 5 % = 0.05

N

F

VN = PV (1 + r)

= $15,036.46 ( 1.05)5

= $15,036.46( 1.276282)

= $19,190.76

25

26

Learning Module 1

10

© CFA Institute. For candidate use only. Not for distribution.

The Time Value of Money

PRESENT VALUE OF A PERPETUITY

calculate and interpret the future value (FV) and present value (PV)

of a single sum of money, an ordinary annuity, an annuity due, a

perpetuity (PV only), and a series of unequal cash flows

Consider the case of an ordinary annuity that extends indefinitely. Such an ordinary

annuity is called a perpetuity (a perpetual annuity). To derive a formula for the present

value of a perpetuity, we can modify Equation 10 to account for an infinite series of

cash flows:

∞

PV = A∑ [ _

(1 +1 r)t]

t=1

(12)

As long as interest rates are positive, the sum of present value factors converges and

PV = _

Ar

(13)

To see this, look back at Equation 11, the expression for the present value of an ordinary annuity. As N (the number of periods in the annuity) goes to infinity, the term

1/(1 + r)N approaches 0 and Equation 11 simplifies to Equation 13. This equation will

reappear when we value dividends from stocks because stocks have no predefined

life span. (A stock paying constant dividends is similar to a perpetuity.) With the first

payment a year from now, a perpetuity of $10 per year with a 20 percent required

rate of return has a present value of $10/0.2 = $50.

Equation 13 is valid only for a perpetuity with level payments. In our development

above, the first payment occurred at t = 1; therefore, we compute the present value

as of t = 0.

Other assets also come close to satisfying the assumptions of a perpetuity. Certain

government bonds and preferred stocks are typical examples of financial assets that

make level payments for an indefinite period of time.

EXAMPLE 14

The Present Value of a Perpetuity

1. The British government once issued a type of security called a consol bond,

which promised to pay a level cash flow indefinitely. If a consol bond paid

£100 per year in perpetuity, what would it be worth today if the required

rate of return were 5 percent?

Solution:

To answer this question, we can use Equation 13 with the following data:

A = £100

r = 5 % = 0.05

PV

= A / r

= £100 / 0.05

= £2, 000

The bond would be worth £2,000.

© CFA Institute. For candidate use only. Not for distribution.

Present Value of a Perpetuity

Present Values Indexed at Times Other than t = 0

In practice with investments, analysts frequently need to find present values indexed

at times other than t = 0. Subscripting the present value and evaluating a perpetuity

beginning with $100 payments in Year 2, we find PV1 = $100/0.05 = $2,000 at a 5 percent

discount rate. Further, we can calculate today’s PV as PV0 = $2,000/1.05 = $1,904.76.

Consider a similar situation in which cash flows of $6 per year begin at the end

of the 4th year and continue at the end of each year thereafter, with the last cash

flow at the end of the 10th year. From the perspective of the end of the third year,

we are facing a typical seven-year ordinary annuity. We can find the present value of

the annuity from the perspective of the end of the third year and then discount that

present value back to the present. At an interest rate of 5 percent, the cash flows of

$6 per year starting at the end of the fourth year will be worth $34.72 at the end of

the third year (t = 3) and $29.99 today (t = 0).

The next example illustrates the important concept that an annuity or perpetuity

beginning sometime in the future can be expressed in present value terms one period

prior to the first payment. That present value can then be discounted back to today’s

present value.

EXAMPLE 15

The Present Value of a Projected Perpetuity

1. Consider a level perpetuity of £100 per year with its first payment beginning