Bookkeeping and Financial Statements: A Comprehensive Guide for Australian Businesses

advertisement

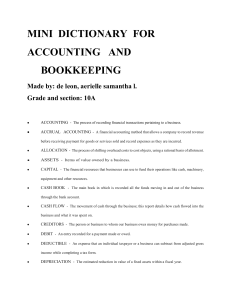

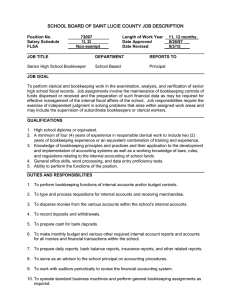

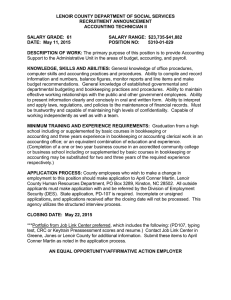

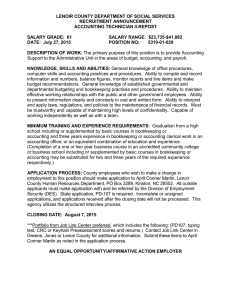

Bookkeeping and Financial Statements: A Comprehensive Guide for Australian Businesses 0400 755 855 / 0421 000 541 milan@imtaaa.com.au / imraz@imtaaa.com.au https://www.imtaaa.com.au/ 0400 755 855 / 0421 000 541 Welcome to our comprehensive guide to bookkeeping and financial statements for Australian businesses. In this article, we will delve into the essential aspects of bookkeeping, the role of financial advisors, and how they benefit businesses in Australia. Whether you run a small startup or a large enterprise, understanding the significance of bookkeeping and financial statements is crucial for sustainable growth and success. What is Bookkeeping and Why is it Important for Australian businesses? Bookkeeping is the systematic recording, organizing, and storing of financial transactions in a business. It entails keeping track of your income, expenses, assets, liabilities, and equity. For Australian businesses, accurate bookkeeping is crucial for several reasons: Compliance: Proper bookkeeping ensures that your business complies with Australian tax laws and regulations, avoiding penalties and fines. Financial Decision-Making: Up-to-date and accurate financial records enable informed decision-making, helping you identify areas for improvement and growth. Financial Health: Bookkeeping provides insights into your business’s financial health, allowing you to gauge profitability and manage cash flow effectively. https://www.imtaaa.com.au/ 0400 755 855 / 0421 000 541 The Role of Bookkeeping Firms in Australia Bookkeeping can be a time-consuming task, especially for small business owners who are juggling multiple responsibilities. This is where bookkeeping firms come in to play a crucial role. Bookkeeping firms in Australia offer professional services to manage your financial records efficiently. Some key roles of bookkeeping firms include: Data Entry and Recording: Bookkeeping firms ensure that all financial transactions are accurately recorded and categorized. Reconciliation: They reconcile bank statements, invoices, and receipts to identify any discrepancies and ensure accuracy. Financial Reports: Bookkeeping firms generate financial reports, providing valuable insights into your business’s financial performance. Tax Preparation: These firms help you stay compliant with tax regulations and assist in preparing tax returns. Understanding Financial Statements: A Deep Dive Balance Sheet: The balance sheet is a snapshot of your company’s financial position at a given point in time. It is made up of three major components: assets, liabilities, and equity. Assets represent what the business owns; liabilities are the debts and obligations, and equity is the owner’s stake in the business. Income Statement: The income statement, also known as the profit and loss statement, presents your business’s revenues and expenses over a specific period. It shows whether your business is operating at a profit or loss. https://www.imtaaa.com.au/ 0400 755 855 / 0421 000 541 Cash Flow Statement: The cash flow statement tracks the cash inflows and outflows of your business. It helps assess your business’s ability to generate cash and meet its financial obligations. Statement of Retained Earnings: The statement of retained earnings shows the changes in retained earnings over time. It indicates how much of the company’s profits are reinvested in the business. Choosing the Right Financial Advisor in Australia Selecting the right financial advisor is crucial for the success of your business. A financial advisor can offer valuable insights and expert guidance in managing your finances. When choosing a financial advisor in Australia, consider the following factors: Experience and Expertise: Look for a financial advisor with experience in your industry and a proven track record. Services Offered: Assess the range of services the advisor provides and whether they align with your business needs. Fees and Charges: Understand the advisor’s fee structure and ensure it fits your budget. What are the benefits of hiring a financial advisor? Hiring a financial advisor offers several advantages to your Australian business: Objective Insights: A financial advisor provides unbiased advice based on data and analysis. Goal Setting: They help you set realistic financial goals and create a roadmap to achieve them. https://www.imtaaa.com.au/ 0400 755 855 / 0421 000 541 Risk Management: Advisors assist in identifying and mitigating financial risks. Investment Strategies: They provide personalized investment strategies that align with your business objectives. Conclusion In conclusion, bookkeeping and financial statements play a vital role in the success of Australian businesses. By understanding the significance of accurate financial records and seeking the guidance of experienced financial advisors, you can make informed decisions and foster the growth of your business. Remember, bookkeeping firms and financial advisors are valuable partners in your entrepreneurial journey, providing essential support and expertise along the way. https://www.imtaaa.com.au/