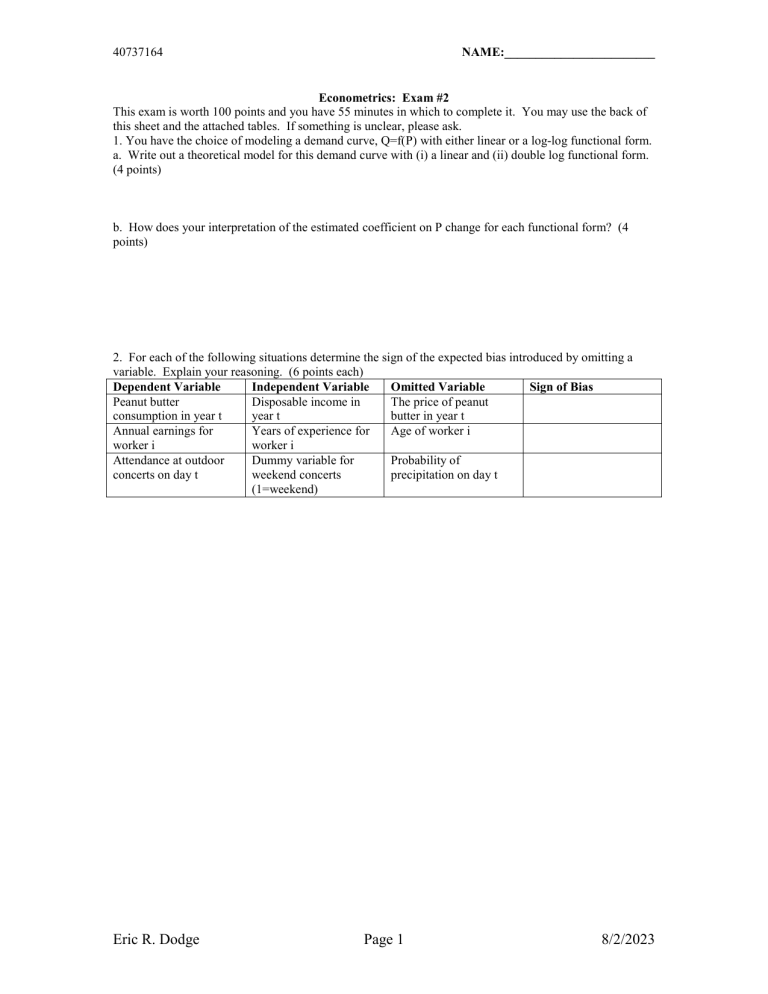

40737164 NAME:________________________ Econometrics: Exam #2 This exam is worth 100 points and you have 55 minutes in which to complete it. You may use the back of this sheet and the attached tables. If something is unclear, please ask. 1. You have the choice of modeling a demand curve, Q=f(P) with either linear or a log-log functional form. a. Write out a theoretical model for this demand curve with (i) a linear and (ii) double log functional form. (4 points) b. How does your interpretation of the estimated coefficient on P change for each functional form? (4 points) 2. For each of the following situations determine the sign of the expected bias introduced by omitting a variable. Explain your reasoning. (6 points each) Dependent Variable Independent Variable Omitted Variable Sign of Bias Peanut butter Disposable income in The price of peanut consumption in year t year t butter in year t Annual earnings for Years of experience for Age of worker i worker i worker i Attendance at outdoor Dummy variable for Probability of concerts on day t weekend concerts precipitation on day t (1=weekend) Eric R. Dodge Page 1 8/2/2023 40737164 3. a. b. c. NAME:________________________ Explain the following concepts and how you can identify them. (6 points each) A dominant independent variable. An irrelevant independent variable. A redundant independent variable. 4. A cross-sectional regression was run on a sample of 44 states in an effort to understand federal defense spending by state (standard errors in parentheses): Sˆi 148.0 .841Ci .0115Pi .0078Ei (.027) (.1664) (.0092) where: Si = annual spending (millions of dollars) on defense in the ith sate Ci = contracts (millions of dollars) awarded in the ith state (contracts are often for many years of service) per year Pi = annual payroll (millions of dollars) for workers in defense-oriented industries in the ith state Ei = the number of civilians employed in defense-oriented industries in the ith state. a. Do all of the above coefficients match your expectations? Explain your reasoning. (4 points) b. Calculate t-scores and test for significance of the above results at the 5% level. (6 points) c. The VIFs for this equation are all above 20, and those for P and C are above 30. What conclusion does this information allow you to draw? Explain. (6 points) d. What recommendation would you make for a rerun of this equation with a different specification? Explain your answer. (6 points) Eric R. Dodge Page 2 8/2/2023 40737164 NAME:________________________ 5. The table below presents results from a model of the U.S. poverty rate as a function of the U.S. unemployment rate (annual 1980-2003). Use this data to respond to the questions below. Dependent Variable: POVERTY Method: Least Squares Date: 03/23/06 Time: 09:23 Sample: 1980 2003 Included observations: 24 Variable Coefficient Std. Error t-Statistic Prob. C UNEMPLOY 9.792052 0.586614 0.611186 0.094726 16.02138 6.192734 0.0000 0.0000 R-squared Adjusted R-squared S.E. of regression Sum squared resid Log likelihood Durbin-Watson stat 0.635460 0.618890 0.676259 10.06116 -23.62207 0.323725 Mean dependent var S.D. dependent var Akaike info criterion Schwarz criterion F-statistic Prob(F-statistic) 13.47917 1.095437 2.135173 2.233344 38.34995 0.000003 a. Is the coefficient on UNEMPLOY the sign you expected? Are you confident in the statistical significance of this coefficient? Explain. (4 points) b. Where are the indicators of econometric problems? Justify your answer with intuition, relevant statistics, and hypothesis tests. (6 points) c. Given your response in part (b) explain how you would re-estimate the model and how this would fix the problems. (6 points) Eric R. Dodge Page 3 8/2/2023 40737164 NAME:________________________ 6. The table below presents results from a cross-sectional model of housing prices (P) in Monrovia, CA as a function of several characteristics of the house and neighborhood. Use this data to respond to the questions below. Dependent Variable: P Method: Least Squares Date: 03/23/06 Time: 13:50 Sample: 1 43 Included observations: 43 Variable Coefficient Std. Error t-Statistic Prob. C S A A^2 N Y 182.3031 0.086373 -1.869710 0.015699 -29.89189 0.005334 33.62101 0.011137 0.906212 0.009524 4.928443 0.001469 5.422298 7.755401 -2.063215 1.648268 -6.065179 3.630397 0.0000 0.0000 0.0462 0.1078 0.0000 0.0009 R-squared Adjusted R-squared S.E. of regression Sum squared resid Log likelihood Durbin-Watson stat 0.917860 0.906760 24.19658 21662.56 -194.7904 1.759940 Mean dependent var S.D. dependent var Akaike info criterion Schwarz criterion F-statistic Prob(F-statistic) 242.3023 79.24150 9.339088 9.584836 82.69001 0.000000 Variables: P = price (in $1000’s) of the ith house S = size (in square feet) of the ith house A = age of the ith house in years A^2 = squared age of ith house N = the quality of the neighborhood of the ith house (1 = best, 4 = worst) as rated by two local real estate agents Y = the size of the yard around the ith house (in square feet) a. Given these results, do you suspect any problems with heteroskedastic errors in this model? Why or why not? (6 points) b. A White test has been conducted and the test statistic nR2 = 18.2. Using all squared and cross-terms there were k=19 slope coefficients. Given this information, what can you say about the possibility of heteroskedasticity in the model? (6 points) c. Given your response in part (b) what kind of changes would you make to this model? Justify your decision. (6 points) Eric R. Dodge Page 4 8/2/2023