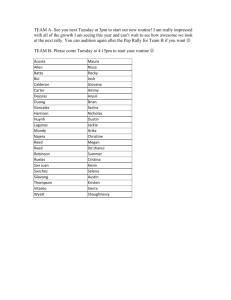

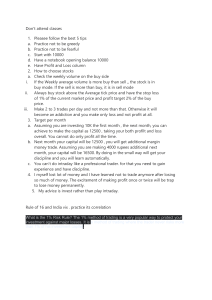

FINANSYA TRADING ACADEMY Website: finansya.com Drop Base Rally VS Rally Base Drop Patterns (PDF) The Forex world is constantly evolving, but that doesn’t mean that classic trading tools like chart patterns such as drop base rally pattern are irrelevant. The trick to getting used to Forex trading is learning how to spot these patterns and knowing what to do when you find them. In this article, we’ll cover Drop Base Rally (DBR), rally base rally, and drop base drop modes. These are useful formations that come up frequently, so it’s a good idea to familiarize yourself with them. Table of contents: 1. What is Drop Base Rally in Trading ? 2. How to identify Drop Base Rally pattern ? 3. What does this pattern tell forex traders ? 4. Rally base rally Pattern Strategy 5. Drop base drop Pattern Strategy 1 FINANSYA TRADING ACADEMY Website: finansya.com What is Drop Base Rally in Trading? The drop base rally pattern in technical analysis is a chart pattern that appears when the market falls, then enters a period of sideways price action, and finally, shows explosive upward movements. Market makers open buy orders from demand zones to have a long position in trading. This is some kind of study for technical analysis known as DBR. These patterns are the basis of supply logics. You can not master trading without mastering these basic patterns correctly. Here is what that sounds like: 2 FINANSYA TRADING ACADEMY Website: finansya.com The story behind the pattern above is something like this: After a steep drop, the sale finally stopped, leaving bulls the option of buying at lower prices. However, purchasing power at that point was insufficient to reverse the market. Instead, the market starts moving sideways because neither buyers nor sellers could defeat the other party. Eventually, the market recovered back to higher prices. How to identify Drop Base Rally pattern? The drop base rally pattern contains three waves. As shown in the figure below. 1. Bearish wave: drop. 2. Sideways wave: base. 3. Bullish wave (rally). 3 FINANSYA TRADING ACADEMY Website: finansya.com When those three waves form in the above order on the chart, it means that a drop base rally pattern has been formed. We can also consider another case where we analyze a higher timeframe candlesticks chart that has a larger body and small shadows on a lower timeframe. Then you will see a full impulsive wave over the lower timeframe. When you analyze the higher timeframe base candlestick chart, you will see a sideways market wave over the lower timeframe. According to what we mentioned before, instead of analyzing a wave which is a quite difficult part. Pattern Formula You should, however, analyze candlesticks. So it is better to follow the following formula to spot a demand zone on the chart. Drop base rally pattern = impulsive bearish candlestick + base of the candlestick + impulsive bullish candlestick. When the trader is trying to identify the drop base rally pattern, he should pay attention to the candlestick criteria. It is not neceassay that all the big candlesticks represent an impulsive wave. So, that’s why you should follow strict guidelines. First, the body-to-wick ratio of a big candlestick must be greater than 70%. Second, base candlestick must have a body-to-wick ratio of less than 25%. By following the above two rules, you will identify a right drop base rally pattern. 4 FINANSYA TRADING ACADEMY Website: finansya.com What does this pattern tell forex traders? In trading, the investor is always looking for zones on the price chart that is being considered by large traders or market makers similar to Bump and Run Pattern. This is because you want to trade with either institutions or trending levels created by market makers. Since the drop base rally pattern is similar to zone patterns. It helps us to find those zones. DBR pattern creates a zone on the chart that shows the demand for retail traders. We consider a demand zone when more buyers want to buy from that zone. Because in technical analysis the market is always moving from one zone to another zone. Rally base rally Pattern Strategy Rally base rally (RBR) is a price chart pattern that represents generally the formation of a demand area. It creates special areas on the chart that increases the demand or the number of buyers at that zone. Supply level or demand level are the basics of technical analysis trading. Without understanding this strategy of demand and supply, you might not be good at technical analysis. The chart below is an example of a rally base rally pattern. 5 FINANSYA TRADING ACADEMY Website: finansya.com In the RBR, a base zone is comprised between two bullish trends of price. The base zone is the demand zone. The simplistic form of this RBR pattern has three candlesticks. 1. Two big bullish candlesticks. 2. One Base Candlestick. There is a clear formula to identify RBR patterns in trading. RBR= impulsive bullish candlestick + base of the candlestick + impilsive bullish candlestick. As we mentioned with the drop base rally pattern, the RBR pattern has also some criteria that every trader needs to follow before starting to identify a good RBR pattern. These criteria are : 6 FINANSYA TRADING ACADEMY Website: finansya.com The body-to-wick ratio of the two big candlesticks should be greater than 70% of the total candlestick size. In the case of the base candlestick, the body-to-wick ratio should be less than 25%. The RBR Pattern helps traders to figure out demand zones that big traders care about. As the rule suggests, prices will only go up when the demand is rising. The base zone in the RBR pattern is the footprint that institutions have left. You must use those footprints left and follow the path. Drop base drop Pattern Strategy Drop base drop is a price action strategy that represents the creation of a supply zone on the chart. The supply zone means that more sellers are willing to sell from the supply area that is created by the drop base drop pattern. It is the most simplistic type of supply in technical analysis. If you are trading, you need to learn the basics of price action to become a good supply or demand trader. In brief, we can also say DBD pattern. DBD consists of two bearish big waves and one retracement wave (base). The retracement wave is comprised between these two bearish impulsive waves. 7 FINANSYA TRADING ACADEMY Website: finansya.com But, as we can see in the chart below and after going deeper into technical analysis, a bearish impulsive wave can be marked in a single big bearish candlestick. A bullish candlestick represents the sideways movement of price or price retracement. So, to see if there is a DBD pattern on the candlestick chart, you probably must look for two big candlesticks with a bullish candlestick sandwiched between two big bearish candlesticks. In general, to identify a DBD pattern, a trader follows the following simple formula for DBD. DBD = Big bearish candlestick + bullish candlestick + big bearish candlestick. 8 FINANSYA TRADING ACADEMY Website: finansya.com As with drop base rally pattern, the DBD pattern, to identify that trend, the trader needs to follow some criteria to identify it. The body-to-wick ratio of the two big bearish candlesticks must be greater than 70% per candlestick. This criterion is necessary since the big body of the candlestick shows the huge momentum of sellers. The candlestick between the two big bearish candlesticks must-have body to wick ratio below 25%. It indicates the sideways movement of price on the chart. Also, it represents indecision in the market. Conclusion Supply or demand levels form and come in different forms. This is why you have to know the different types of levels to be able to spot them easily. Drop base rally pattern, rally base rally, and drop base drop patterns can be a valuable part of your toolbox. By reading the strategy above, you can begin practicing them right away. 9