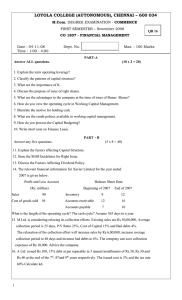

Department of Accounting, Economics and Finance Learning Guide Cost of Capital 2019 Section A: Learning Outcomes After working through this chapter, you should be able to: Understand the concept of the weighted average cost of capital (WACC) Determine the cost of debt Determine the cost of preference share capital Calculate the cost of equity using the dividend growth model and the CAPM approach Understand the practical issues of estimating the CAPM parameters Understand how a firm’s capital structure affects a firm’s WACC Calculate firm’s weighted average cost of capital (WACC) Section B: FREQUENCY OF TESTING & EXAM POSSIBILITIES Cost of capital is a basis for many other topics such capital budgeting to be done in 3rd year, Free cash flow valuations done in CTA. The understanding of this topic is crucial and it is tested very often either on its own or as part of other topics. Section C: LITERATURE Correia C et al, Financial Management 8th Edition Chapter 7 You may be required to know important formulas that are used in these chapters. No formula sheets will be distributed Section D: OBJECTIVE TEST Explain in your own words what the point of calculating the cost of capital is (3) Section E: TUTORIAL QUESTIONS The tutorial question that needs to be done for the tutorial is named TUTORIAL QUESTION MARCH 2018 Section F: ASSIGNMENTS The Cost of capital assignment is to be discussed with the lecture Section F: PRE-CLASS PREPARATION Please read the QFinance article: Section G: SELF-ASSESSMENT QUESTIONS The question bank contains a pool of previous test and exam questions. After you have studied this topic in detail, attempt the questions in the attached question bank. You should do these questions before looking at the solution. Only after you have done the questions properly, should you refer to the solution and mark your answer. ESSAY QUESTIONS QUESTION 1: PART A: Lucky Jackson is trying to choose between the following investment alternatives recommended to him by his broker: 15% R1 000 bonds of Star Mining Company, selling in the market at R1 146,58. Interest is payable semi-annually, and the bonds are redeemable in sixteen years’ time; or 11,75% non-redeemable R100 preference shares of Supernova Minerals Company, selling in the market at R98. YOU ARE REQUIRED TO: advise Lucky as to which investment alternative to choose, by calculating the specific returns he will earn on the two investments. QUESTION 2 Assessment 2 2006 [15 marks] This question consists of TWO independent parts. PART A Cresta Investment Ltd is a prospering investment company. They currently (thus year 0) pay a dividend of R3,50 per annum. They expect their dividends to increase by 8% over the next 4 years after which it will remain constant. REQUIRED 2.1 Determine the value of a Cresta-share if an investor requires a return of 16% and the shares are currently trading cum-dividend. (9) PART B A bond is a form of a fixed interest debt security. REQUIRED 2.2 Explain the following concepts: a) Bond stripping b) Floating-rate bonds c) Securitised bonds (3 x 2 = 6) QUESTION 3 Assessment 2 2007 [30 marks] This question consists of TWO independent parts PART A (12 marks) The following is an extract from the Balance Sheet of Leeds Limited for the year ended 31 December 2006: LEEDS LIMITED EXTRACT FROM THE BALANCE SHEET AS AT 31 DECEMBER 2006 EQUITY AND LIABILITIES Non-current liabilities 12% Cumulative redeemable preference shares 8.4% R1 000 bonds Convertible debentures R [Note 1] [Note 2] [Note 3] 200 000 100 000 500 000 Additional information: 1. Leeds Ltd issued R1 000 cumulative redeemable 12% pref. shares. Although preference dividends are outstanding for the last 3 years, normal dividend payments continued from this year. The shares will be redeemed in 4 years time at a premium of 10%. All outstanding dividends will be paid at that stage. The shares have a current value of R1 300 each. 2. The bonds issued are 12-year bonds and were issued two years ago at a discount of 5%. The bonds make semi-annual payments. The bonds currently sell for R975. 3. The debentures are convertible to 16 000 ordinary shares in two years time. The expected value of the ordinary shares in two years time according to Gordon’s growth model is R30 per share. If the debenture holders do not convert their debentures it will be redeemed at a discount of 10%. Similar debentures are trading at 18%. REQUIRED: 3.1 Calculate the cost of preference shares. (4) 3.2 Calculate the bond yield-to-maturity (4) 3.3 Determine whether the convertible debentures will be converted in two year time. (4) PART B (18 marks) Freeway Limited has two different bonds currently outstanding. Bond A has a nominal value of R20 000 and matures in 20 years. The bond makes no payments for the first six years, then pays R1 000 semi-annually over the subsequent eight years, and finally pays R1 750 semi-annually over the last six years. Bond B also has a nominal value of R20 000 and a maturity of 20 years; it makes no coupon payments over the life of the bond. The required return on both these bonds is 12 percent compounded semiannually. REQUIRED: 3.4 Calculate the current price of Bond A. (14) 3.5 Calculate the current price of Bond B. (4) QUESTION 4: Klimbo Ltd has a target capital structure of 60% equity and 40% debt. The after-tax cost of future debt is 11% and the cost of new equity is 21%. The financial manager is currently considering a project with an expected return of 20% which will be financed from the issue of ordinary shares as all retained income is already budgeted for in more profitable projects. The company recently issued debentures and, as a result, the present capital structure is more heavily weighted towards debt. YOU ARE REQUIRED TO: (a) Calculate the weighted average cost of capital. (b) State, with reasons, whether the project under consideration should be accepted. QUESTION 5: It is commonly accepted that a crucial factor in the financial decisions of a company, including the evaluation of capital investment proposals, is the cost of capital. The following information is available for Otago Ltd: Current price per share on Securities Exchange R1.20 Current year’s dividend per share R0.10 Expected average annual growth rate of dividends 7% Beta coefficient for Otago Ltd 0.5 In addition, the following information has been established: Expected rate of return on risk-free securities 8% Expected return on the market portfolio 12% YOU ARE REQUIRED TO: (a) Explain what is meant by the ‘cost of equity capital’ for a particular company. (b) Calculate the cost of equity capital for Otago Ltd from the data given above, using the following two alternative methods: (i) a dividend growth model; and (ii) the capital asset pricing model. (c) State, for each model separately, the main simplifying assumptions made and express your opinion about whether, in view of these assumptions, the models yield results that can be used safely in practice. QUESTION 6: Sincro Ltd’s capital structure is as follows: Debt 35% Preference shares 15% Ordinary share equity 50% The after-tax cost of debt is 6.5%; the cost of preference shares is 10%;and the cost of ordinary share equity is 13.5%. As an alternative to the existing capital structure for Sincro, an outside consultant has suggested the following modifications: Debt 60% Preference shares 5% Ordinary share equity 35% Under this new and more debt-oriented arrangement, the after-tax cost of debt is 8.8%; the cost of preference shares is 11%; and the cost of equity is 15.6%. YOU ARE REQUIRED TO: (a) Calculate Sincro’s existing weighted average cost of capital. (b) Recalculate Sincro’s weighted cost of capital, using the capital structure suggested by the consultant. (c) Discuss the issues which are pertinent to the choice between the two alternative capital structures. QUESTION 7 (Second Assessment 2008) (40 MARKS) You are the partner in charge of the financial advisory services appointment of a listed company, Valpree Limited, a manufacturer and supplier of bottled water. The company started its operations 10 years ago and has shown stable growth ever since. The company grew especially well in certain Africa countries due to the increase in mining activities polluting the water in Africa. In an attempt to diversify, the company decided to introduce a new product line, flavored water. This new product line was expected to first be tested in the market for a period of six months before the final decision would be taken to implement this new product line permanently. Mr.Aquabon, the financial director of Valpree was unsure whether to implement this new project line in the first place, stating that: "Flavoured water won't work in Africa, that is for sure! People in Africa don't have money for luxuries like flavoured water. It is ridiculous!" In another statement Mr.Aquabon said that Valpree always uses the current market value as optimal capital structure in calculating WACC. An extract of the statement of financial position as on 30 November 20x7 was as follows: R '000 Equity Share capital Share premium Retained earnings Shareholders loan 12 500 1 200 25 690 2 000 Liabilities Non-current liabilities Preference shares (13%) Debentures (16, 5%) (non redeemable) Long-term loan (18%) 7 500 18 700 15 300 Current liabilities Trade creditors Bank overdraft 3 651 1 765 Additional information 1. Ordinary shares are presently trading at R 13,50 per share. The par value of the shares is R10 each. 2. Preference shares have a par value of R5 per share. The preference shares are redeemable within two months at a premium of 11%. 3. R200 nominal debentures interest is payable on 31/05 and 30/11 every year. The market value of debentures at reporting date is R252. 4. The interest on the long-term loan is payable at the end of each year for the next 8 years. The creditors gave Valpree the option to settle the loan on 01/12/2007 for R14 563 000. Valpree did not accept the option. 5. Trade creditors fluctuate from month to month and are not considered as part of the permanent financing 6. Bank overdraft is the result from recent cash flow problems incurred by the company. The problems are expected to be temporary and Valpree is obligated to settle the overdraft within the next 2 months. 8. Other information RSA 153: 11,61% Beta = 1,6 Tax rate: 28% Rm = 14,17% REQUIRED a) Explain what is the cost of capital of a company? (3) b) What is meant by the "pooling of funds" principle? c) Calculate the WACC of Valpree Limited. Give reasons for your calculations and inclusions/exclusions in the WACC calculation. (25) d) Advise Valpree Limited on additional factors they need to take into account before they accept the new project line. (6) e) Explain what impact risks will have on the cost of capital NOTE: Round all calculations off to four decimal places (2) (4) QUESTION 8 – June 2008 Assessment (40 MARKS) You are the recently appointed financial advisor of Boating Adventures Ltd. Boating Adventures Ltd (BA) is a listed company who manufactures boats, Jet Ski’s and various other boating equipment. The company was incorporated 10 years ago, and has shown significant growth since then. The company is currently considered the market leader in the boating industry. Boating Adventures Ltd is planning to open various BA Ltd franchises in Africa as they recently discovered that clients from African countries travel to South Africa for their boating needs. The financial director, Mr. Y.A. Maha informed you that they will need a significant amount of capital for the planned expansion. He also informed you that the acceptance of the project will depend on the outcome of evaluations performed using the historic cost of capital of the company. Mr. Y.A. Maha provided you with the following information: An extract of the balance sheet as at 31 March 2008: Balance Sheet Reference R Equity Share Capital (R2 shares) Share Premium 1 1 200 000 12 650 000 Liabilities Non-current liabilities Preference Shares (12%) Debentures (redeemable) Long-term Loan (17%) 2 3 4 500 000 2 250 000 3 500 000 Current liabilities Bank Overdraft Sundry Creditors 5 6 2 000 000 950 000 Additional information: 1. Shares are trading on the JSE for R128,50 per share. 2. The preference shares consist of 25 000 non-redeemable preference shares. Similar preference shares currently trade in the market for R17.14 per share. 3. The debentures are redeemable in 6 years. 20 000 Debentures were issued at R112.50 each (a discount of 10%) on 31 March 2006. The debentures will carry interest at 11% of par value per annum, and the par value of the debentures will be paid in 2 equal installments in 2013 and 2014. 4. The long-term loan relates to a loan that carries interest at 17% per annum and will be redeemed in full in 10 years. Similar loans currently trade in the market at prime + 2%. 5. Mr. Y.A. Maha informed you that the bank overdraft will be redeemed in the following month and will not be used as a source of financing again, due to the high cost of the overdraft facility. 6. The sundry creditors relate to a loan from one of Boating Adventures well-known clients which will be settled in 2 months. The loan will however be replaced by a loan of the same value by the client, which will be settled in the following year and carries interest at a rate of 12%. Other information: The current market value represents the optimal capital structure. The prime interest rate is currently 15%. An announcement this morning by the Reserve Bank is that the prime interest rate will increase with 0,5% by the end of business today and will therefore be applicable for all future borrowings. The project is expected to be fully implemented within 5 years. Assume a tax rate of 30%. Debentures currently trade at an effective cost of 12% p.a. The required rate of return that shareholders require when investing in a company such as Boating Adventures Ltd is 22,5% p.a. REQUIRED: 2.1 Define the weighted average cost of capital (WACC), and briefly explain why a company would calculate the WACC? 2.2 State with reasons whether or not you agree with the statement made by Mr. Y.A. Maha concerning the historic cost of capital. 2.3 (3) (5) Indicate whether payments on the following instruments are deductible for taxation purposes: 1) Debentures; 2) Preference shares; 3) Long-term loans; 4) Bank overdraft; 2.4 Calculate the market value of the redeemable debentures. 2.5 Calculate the WACC for Boating Adventures Ltd. Give reasons for ALL your inclusions/exclusions from the WACC for each balance sheet item. (4) (8) (20) Question 9 (Assessment 1 – 2009) (13 Marks) Risky (Pty) Ltd (Risky), a bungy-jumping service provider located in the Drakensberg mountains, recently got sued for their bungy rope snapping while an individual was doing their inaugural jump. After Risky settled the lawsuit, they decided to upgrade their jumping systems. The upgrade was scheduled to be done in phases over 10 years. Risky wanted to calculate the cost of equity. They were uncertain what information to use in order to calculate it. They came to the University of Johannesburg to find a second year student who was proficient in Finance and could help them with this calculation. Fortunately, the directors had already done their research and had information that could be provided by BUNGY Bank Ltd. This is the information that they gave you for their year ended 31 October 2008: Interest rates SA Reserve Bank 91 day treasury bills Yield on the most liquid and traded SA government bond in issue, redeemable in 2019 Equity markets 20 year average annual return of all shares listed on the JSE Securities Exchange Average of beta coefficients of JSE listed companies, similar in size and nature of business to Risky 11,00% Average over three months ended October 2008 11,50% 10,00% 9,80% 31 October 2008 31 July 2008 31 October 2007 14,0% 16,1% 17,0% 31 October 2008 1.20 1.18 REQUIRED: 1. Explain the Capital Asset Pricing Model (CAPM) formular in your own words?(4) 2. Estimate the cost of equity of Risky Ltd at 31 October 2008 based on the information provided by BUNGY Bank Ltd. Show all workings and provide reasons for using specific information provided by BUNGY Bank Ltd. (7) 3. Why is a government bond considered Risk Free? (2) Question 10 (Assessment 2 – 2009) (47 marks) Cold Fields Limited is one of the world’s largest unhedged producers of gold with attributable production of 3,64 million oz per annum from eight operating mines in South Africa, Ghana and Australia. A ninth mine, Cerro Corona Gold/Copper mine in Peru, commenced production in August 2008 at an initial rate of approximately 375,000 gold equivalent oz per annum. The company has total attributable ore reserves of 83 million oz and mineral resources of 251 million oz. This mining group’s main strategy for the 2009 financial year is to have an aggressive pursuit of generating strong cash flow as part of their strategy to realize value. However, as part of Cold Fields’ expansion strategy, they have to complete the following projects: A detailed analysis of the financing options available to fund the the above-mentioned capital projects was performed. The following will be used by Cold Fileds as sources of finance: Ordinary shares: 26,714,158 Ordinary shares were issued by Cold Fields Limited. The dividend is expected to be R4 per share at the end of the next financial year. Dividend growth is expected to grow consistently by 10% per year. Shares are currently trading at R112.31 per share on the Johannesburg stock exchange. Preference shares: Cold Fields limited issued R1200m three year non-convertible redeemable preference shares. The dividend rate payable is a floating rate linked to the prime interest rate (Hint: use dividend rate of 14%). The entire preference share issue was taken up by Rand Merchant Bank (RMB) and their opportunity cost associated with this preferance share issue is 12%. Project finance facility: Cold Fields entered into a loan agreement with the Industrial Development Corporation (IDC) in terms of which the IDC agreed to provide a loan facility of R2660m. Currently the outstanding debts on this facility is R2300m. Interest will be charged at a fixed rate of 14% on this facility. Commercial Bonds: Cold Fields raised capital in the capital markets by issuing bonds with a principal value of R1,000m. These bonds have a coupon rate of 15% per annum and coupons will be paid semi-annually. These bonds will mature in five years. Interest rate outlook is expected to be stable with Interest rates remaining at 16% per annum. General: The effective corporate tax rate is 28%. REQUIRED: Part A 1) Explain in your own words what the Weighted Average Cost of Capital is?(3) 2) Calculate the Weighted Average Cost of Capital for Cold fields (Round all amounts to R’millions) 3) 4) (28) What are the potential problems with the using Cost of Capital as a basis of calculation (4) Explain the pooling of funds principle on your own words (4) Part B Cold Field have a big strategic focus on generating cash flow at the moment. Required: 1) Given the current economic circumstances, please explain why access to cash is such a major priority for capital intensive corporates at the moment based on the JP Morgan Cash survey (as discussed in the additional reading material) (5) 2) What is your opinion on the current crises in the financial markets (3) Question 11 (Assessment 2 – 2009) (13 marks) Indicated below is the yield curve for government bonds as at 31 December 2008. Top line = Oct 08 Middle line = Nov 08 Bottom line = Dec 08 Required: 1) Describe in your own word what a bond is? (3) 2) Describe what yield to maturity is? (2) 3) Describe what the yield curve is? (2) 4) What does the domestic yield curve tell us and interpret the above Domestic yield curve as compiled by the Bond Exchange of SA? (6) Question 12: June 2009 assessment Cost of Capital Adcock Ingram to consume Cipla Medpro 50 Marks Reuters: – “South Africa's No. 2 drugs producer Adcock Ingram plans to offer R2.1 billion for rival Cipla Medpro South Africa (CMSA) to boost its share of the generic medicine market. The cash offer, which values CMSA at about R4.75 per share which is 36% higher than its closing share price on April 7, pushed the company's stock up to/by about 20%. Adcock, which was listed on the JSE last August and is the country's second biggest pharmaceutical firm after Aspen, said it had secured support from four leading CMSA shareholders holding a combined 30 percent of the company's shares. No one at CMSA was immediately available to comment. CMSA, formerly known as Enaleni Pharmaceuticals, is one of South Africa's largest generic pharmaceutical firms. It has a long-term arrangement to sell products developed by India's Cipla Limited in South Africa. The deal would give Adcock, which was spun off from consumer goods firm Tiger Brands last year, more muscle to compete with Aspen in the fast-growing generic drug market. It would also be the latest in a series of similar transactions as traditional pharmaceutical companies worldwide seek new revenue streams to offset the impact of patent expiries. In order to measure the risk profile of the consolidated entity, created by the potential merger of Cipla & Adcock Ingram, we need to determine the proposed cost of capital for the new entity. Below is an extract of the consolidated Statement of Financial Position: Statement of Financial Position as at 30 June 2009 Reference Equity Share Capital (R1 shares) 1 R300 000 Share Premium 1 R12 650 000 Preference Shares (12%) 2 R1 500 000 Debentures (16.5%) 3 R18 700 000 Long term loan (18% variable) 4 R15 300 000 Bank Overdraft 5 R2 000 000 Sundry Creditors 6 R950 000 Liabilities Non-current liabilities Current liabilities Additional Information 1. Shares are currently trading on the JSE for R37.90 per share. 2. The preference shares consist of 25 000 non-redeemable preference shares. Similar preference shares currently trade in the market for R55.38 per share. 3. Debentures: The debentures were issued in denominations of R200. The market value of these debentures at balance sheet date is R252 inclusive of interest for 6 months. Interest is payable on 30/06 and 31/12 every year. The debentures are redeemable in 8 years time Flotation costs of 5% are payable on all new debentures issued. 4. Long term loan The bank has given Adcock the option of redeeming the loan on the 01/07/2009 at R14 790 000. The company will however not exercise the option. 5. The bank overdraft will be redeemed in the following month and will not be used as a source of financing again, due to the high cost of the overdraft facility. 6. The sundry creditors relate to various short term exposures. Other information: The current market value represents the optimal capital structure. The prime interest rate is currently 14%. The take-over of Cipla is expected to be fully repaid within 10 years. Assume a tax rate of 28%. Adcock Ingram Number of shares in issue Current share price 15 000 000 R37.90 Beta 0.90 Effective normal income tax rate 28% Dividend per share declared on 31 January 2009 75c Other information Current yield of the R204 RSA government bond, maturity date 21 December 2018 9,0% Current yield of the R153 RSA government bond, maturity date 31 August 2010 Adcock Ingram premium for market risk 9,4% 8,0% REQUIRED: a) Briefly explain what the importance of cost of capital is, as well as the relevance thereof for companies in general. (5) b) Calculate the weighted average cost of capital. Give reasons for ALL your inclusions/exclusions from the WACC for each balance sheet items. (40) c) Identify the key procedures that Adcock Ingram should follow in assessing the creditworthiness of new customers. Question 13 (Assessment 2 2010) (5) 40 Marks Woolworths (Proprietary) Limited is a respected retail chain of stores offering a selected range of clothing, home ware, food and financial services under its own brand name. During the 2009 financial year, Woolworths completed share buy backs to the value of R1.1 billion. This was conducted to lower the cost of capital at Woolworths. The following is an extract of the Statement of Financial position as at 30 June 2009 NOTES R'm EQUITY & LIABILITIES Share capital Share premium Treasury shares held Non-distributable reserve Distributable reserve Ordinary Shareholders' equity 1 1.10 141.60 (316.50) 207.20 2,991.40 3,024.80 Preference shares 2 1,376.80 Total Shareholders' interest Non-current liabilities Interest-bearing borrowings Operating lease accrual Deferred tax Current liabilities Trade & other payables Total equity and liabilities 4,401.60 3 4 5 2,053.70 1,531.60 456.80 65.30 6 2,372.80 2,372.80 8,828.10 Notes: 1) Ordinary Share Capital Woolworths is listed on the Johannesburg Stock Exchange under share code WHL. As at 30 June 2009, Woolworths had 775 million ordinary shares in issue. As at 3 February 2010 ordinary shares were trading at a price of R18.00 per share. Because of the nature of their products, the share price of Woolworths is typically less volatile than that of a fully diversified market portfolio, and expects a R0.73 increase in return when the value of a similar diversified portfolio increases by R1.00. The expected return on a fully diversified portfolio is currently 15%. 2) Preference Shares Woolworths issued 1 million non-redeemable preference shares in June 2005. The dividend rate applicable is a variable rate of prime. Dividends will be declared annually. These preferences shares are actively traded and the current market value is R1,400 per share. The par value (nominal value) of the preference shares is R1,376.80 per share. 3) Interest bearing borrowings consist of: Non-current unsecured loan: R500 million fixed rate loan. Woolworths entered into this long term loan with ABSA Capital on 30 June 2009. Woolworths agreed with Absa Capital to structure the repayment of the loan in the following manner: Woolworths will obtain a payment holiday until June 2012 Woolworths will then start paying annual installments of R50 million until June 2014 The above-mentioned installments will increase to R100 million until June 2019 The balance will be settled as a final balloon payment of R550 million in June 2020 Dates Number of annual Value installments of Installment per annum July 2009 to June 2012 3 R0 July 2012 to June 2014 2 R50 million July 2014 to June 2019 5 R100 million June 2020 1 R550 million Secured fixed rate bonds in issue: R1 000 million, 8-year notes maturing on 30 June 2017 with a coupon rate of 12% compounded semi-annually. These bonds have a par value of R1,000 each and they are currently trading at a premium of 20%. Finance Lease The outstanding liability of the lease is R31.6 million. The group has entered into finance leases for various items of vehicles and computer equipments. These leases have terms of renewal between three and five years. Floating rate interest of prime plus 1% will be charged on the leases. 4) Operating leases The group has entered into various operating lease agreements on premises. The amount reflected on the statement of financial position, represent lease rentals in arrears which will be repaid shortly. 5) Deferred Tax Woolworths has a deferred tax asset of R162 million. It is expected that the deferred tax liability will be realised through utilizing the current deferred tax asset. 6) Sundry creditors This amount relates to various short term exposures, which will be settled shortly. The current sundry creditors are not deemed to be source of permanent financing by management. 7) Other information: The current market value represents the optimal capital structure. The prime interest rate is currently 10.5%. Assume a tax rate of 28%. The R186 government long bond is currently trading at a yield of 9.13% The Statement of Financial Position reflects nominal values. Required: Calculate the weighted average cost of capital. Give reasons for ALL your inclusions/exclusions from the WACC for each statement of financial position item (40) Question 14 (June Assessment 2010) 35 Marks The Sasol Group comprises diversified fuel, chemical and related manufacturing and marketing operations, complemented by interests in technology development and oil and gas exploration and production. Sasol Limited is currently listed on two stock exchanges (JSE and NYSE), and is subject to the disclosure rules and obligations imposed by these exchanges and their regulators (eg the SEC in the USA). As a listed company, Sasol communicates on an ongoing basis with stakeholders (eg. banks, institutional and retail investors, analysts, equities sales people, fund managers, ratings agencies etc), to ensure that the stakeholders understand Sasol's strategy, operations, performance and future prospects. Sasol's capital providers consist of both equity investors and lenders/debt providers (banks and Institutional investors lending to Sasol or investing in its issues of debt instruments such as local bonds, offshore bonds, commercial paper issues, project finance, loans and other credit facilities and convertible instruments). Sasol's financial year runs from 1 July to 30 June. The group reports on financial performance twice annually for interim and annual results. On 1 December 2009 Sasol approved an investment of R 8,4 billion which will double the Sasol Wax production of hard wax in South Africa. Sasol Wax would be a new division that would be started. "This large investment shows Sasol's commitment to the wax business and enables us to grow with our customers in this market," says Johan du Preez, managing director of Sasol Wax. To finance the new wax production for an amount of R8,4 billion, Sasol Wax planned to issue the following instruments on 1 July 2010: Shares The share price of each Sasol Wax was valued at R280. Sasol Wax planned to issue 15 million shares. In the previous financial year, Sasol declared a dividend of R11.50 per share. Sasol expects a stable average growth rate for the company of 7%. Marita McKrenzo, a professor in the department of finance was researching market behaviour and discovered that when the average market return declined by 15% in the recession, Sasol shares only declined by 8%. Her research also showed that the average market risk premium that investors were looking for was 7%. Debentures Sasol planned to issue 90 million debentures with a R24 par value. Each debenture was going to be issued at R25.20 per debenture. The terms of the debenture were as follows: Redemption date: 30 June 2018 Redemption value: Premium of 8% to nominal value. Coupon: 9% Payment period: Semi-annually on 31 December and 30 June until redemption date Non-participating Preference Shares Sasol Wax management were also planning to issue 50 million non-participating preference shares with a par value of R32 per share as “they said that a preference share allowed for additional financing without giving away any more ownership or decision-making powers, however will incentivize shareholders to invest as they will receive any unpaid accumulated dividend plus capital in case of liquidation,” said Johan Du Preez. The expected dividend for the preference share was 12% of nominal value. Each preference share is going to be issued at a price of R36.96. These shares are not redeemable. Bank Overdraft Sasol has a bank overdraft facility of R250 million. The current balance of the overdraft is R84 million. This balance has been maintained at this level for over ten years now and management said that they expect it will be maintained for the next ten years. Due to the size of Sasol, the Financial Director managed to negotiate an interest rate of prime plus 2 on the overdraft from the bank. The overdraft has been used in the financing of their assets. Current Liabilities The current liabilities balance was R20 million from normal trading. This is expected to be settled before the year is over. Additional information The tax rate is 28% The prime rate is 10.5% The R187 is currently trading with a return of 8.7% and is the basis for all Sasol trading. Sasol regards market values as their optimal capital structure. REQUIRED a) Explain in your own words what weighted average cost of capital is. b) Calculate the Weighted Average Cost of Capital for Sasol Wax division. (5) (30) __________________________________________________________________________

![THE COMPANIES ORDINANCE, 1984 [Section 82]](http://s2.studylib.net/store/data/015174202_1-c77c36ae791dae9b4c11c6213c9c75e5-300x300.png)