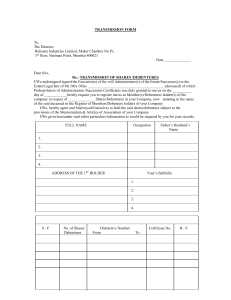

lOMoARcPSD|17277542 2021 Learning guide - Cost of Capital MM Financial Management 200 (University of Johannesburg) Studocu is not sponsored or endorsed by any college or university Downloaded by Charlotte (niikondoci@gmail.com) lOMoARcPSD|17277542 College of Business and Economics School of Accountancy Department of Accountancy Learning Guide: Cost of Capital Financial Management 200 FMA200 Ms Mariska McKenzie Mr Thabiso Madiba 2021 Copyright © University of Johannesburg, South Africa Printed and published by the University of Johannesburg © All rights reserved. Apart from any fair dealing for the purpose of research, criticism or review as permitted under the Copyright Act 98 of 1978 (and as amended), no part of this material may be reproduced, stored in a retrieval system, transmitted or used in any form or be published, redistributed or screened by any means electronic, photocopying, recording or otherwise without the prior written permission of the University of Johannesburg. Downloaded by Charlotte (niikondoci@gmail.com) lOMoARcPSD|17277542 Section A: Learning Outcomes After working through this chapter, you should be able to: Understand the concept of the weighted average cost of capital (WACC) Determine the cost of debt Determine the cost of preference share capital Calculate the cost of equity using the dividend growth model and the CAPM approach Understand the practical issues of estimating the CAPM parameters Understand how a firm’s capital structure affects a firm’s WACC Calculate firm’s weighted average cost of capital (WACC) Section B: FREQUENCY OF TESTING & EXAM POSSIBILITIES Cost of capital is a basis for many other topics such capital budgeting to be done in 3 rd year, Free cash flow valuations done in CTA. The understanding of this topic is crucial and it is tested very often either on its own or as part of other topics. Section C: LITERATURE Correia C et al, Financial Management 9th Edition Chapter 7 You may be required to know important formulas that are used in these chapters. No formula sheets will be distributed Section D: OBJECTIVE TEST Explain in your own words what the point of calculating the cost of capital is (3) Downloaded by Charlotte (niikondoci@gmail.com) lOMoARcPSD|17277542 Section E: TUTORIAL QUESTIONS Tutorial Question (34 Marks) Sapitec Bank is South Africa’s fastest growing bank. They are focused on the middle to lower income groups. They strive to simplify banking and have developed an all-inclusive banking solution. What has made them prosper is that they ensure that they do whatever they can to make banking accessible to everyone. They have also reduced unnecessary paperwork which has resulted in a reduction of admin fees which allows them to pass on the cost-saving to the customer. th Sapitec recently unveiled their 500 branch in Morning Glen. They then unveiled their plans to double the number of branches they have by 2025. This project will require significant capital over the period. After a capital budget was performed, the Financial Director wanted to make sure that the internal rate of return (IRR) of the project was indeed greater than the cost of capital. He has asked you to calculate the cost of capital. The following Statement of Financial Position and notes were made available to you: . Downloaded by Charlotte (niikondoci@gmail.com) lOMoARcPSD|17277542 SAPIT EC BANK Statement of Financial Position As at 28 February 2019 Notes 2019 R'000 458,445 2,841,918 9,963,966 1,067,688 Fixed Assets Cash and Cash Equivalents Loans and Advances to clients Other Current Assets Total Assets 14,332,017 Equity and Liabilities Ordinary Share Capital and Premium Preference shares and Premium Retained Earnings Liabilities Bonds Debentures Customer Deposits Other Current Liabilities Total Equity and Liabilities 1 2 1,918,677 258,969 1,272,867 3,450,513 3 4 1,455,600 2,042,500 6,844,283 539,121 10,881,504 14,332,017 Page 2 Downloaded by Charlotte (niikondoci@gmail.com) lOMoARcPSD|17277542 Note 1 • The share premium equated to R1,900,677,000. The shares have a par value of R1 per share. • Sapitec shares were trading at R168 at the close of business on 28 Feb 2019. Note 2 • 11% preference shares were issued at a par value of R10. The preference shares are cumulative, non-redeemable preference shares. Sapitec has 500,000,000 authorised preference shares and 200,000,000 issued preference shares. Preference shares were trading at R9 per share at the close of business on 28 Feb 2019. Note 3 • The bonds were issued with the following terms: o 9.6% bonds were issued at par with a semi-annual; coupon payment o The bonds will be redeemed in 5 years’ time at a premium of 5% of the nominal value. • Management could not determine the market related yield of the bonds, so they decided to benchmark the rate to the risk-free rate to be used. The Financial Director was happy to use a before tax premium of 2.5% on the risk-free rate to represent the market related interest on the bonds. Note 4 • 8% Debentures were issued to selected lenders on 28 February 2019. This was because special repayment terms were negotiated with the particular lenders as not everyone was happy with the repayment terms proposed. The repayment terms have been agreed on as follows: o The debenture will be settled in 5 years’ time o The par value of R2,150,000 will be paid back at a premium of 40% at the end of the 5 year term. • The debentures were issued at a discount of 5% of the par value. Page 3 Downloaded by Charlotte (niikondoci@gmail.com) lOMoARcPSD|17277542 Additional information • The company tax rate is 28% • The Financial Director searched the Reserve Bank website and found the following information for retail government bonds: Name Coupon Market Yield Maturity R158 5.93% 6.71% 15 September 2022 R203 7.65% 8.42% 15 September 2025 When the head of the Monetary Policy Committee (MPC) and Governor of the Reserve • Bank announced that interest rates were going to remain stable at the last MPC meeting, the returns of the market increased by 2% and the returns of Sapitec Bank increased by only 1.7%. The market risk premium as per a recent study was 6.2%. • REQUIRED (a) (b) MARKS In your own words, give three alternative explanations of what the cost of capital is. 3 Calculate the cost of capital of Sapitec Bank as at 1 March 2019. Show all calculations. 31 TOTAL MARKS 34 Section F: ASSIGNMENTS Assignment (25 MARKS) Kuvaka Ltd (“Kuvaka”) is a South African company that owns and manages property. Kuvaka is highly successful and is listed on the Johannesburg Stock Exchange. The directors of Kuvaka are considering whether or not to embark on a development of residential apartments in Midrand. The apartments will be rented out to tenants once the Downloaded by Charlotte (niikondoci@gmail.com) lOMoARcPSD|17277542 development project is completed. The development will cost R80 million and yield an annual pre-tax return of 16%. The directors have asked for your advice on whether they should embark on this project. They have provided you with the following information: Statement of Financial Position of Kuvaka Ltd as at 31 December 2016 Note R Million ASSETS Property, plant and equipment 400 Trade and other receivables 20 Cash and cash equivalents 60 480 EQUITY AND LIABILITIES Ordinary share capital 11% Cumulative non-redeemable preference shares 8% Loan: ABSA Bank 9% Bonds (par value) 1 2 3 4,5 70 100 80 230 480 Notes 1. The company has an authorised share capital of 5 000 000 no par value shares. On the 31st of December 2016 Kuvaka, had 800 000 ordinary shares in issue. The Kuvaka shares traded at R125 per share on the JSE on the 31st of December 2016. 2. All preference shares were issued at the incorporation of the company at a par value of R20 each. On the 31st of December 2016 the preference shares traded at R18 per share. The company has sufficient authorised share capital available to issue additional preference shares. All preference dividends due to shareholders were paid as at 31 December 2016. 3. Kuvaka’s property serves as security for the ABSA loan. ABSA have indicated that they would be willing to increase the loan facility to Kuvaka, the interest rate on the loan would however increase to 8,25%. 4. The 9% bonds were issued at par value on 1 January 2016. The coupon payments are made semi-annually. The bonds will be redeemed on the 31 st of December 2019 at a discount of 10% on the par value. 5. On 31 December 2016 the current market related interest rate available on bonds similar to the bonds issued by Kuvaka amounts to 10,5% per year compounded once per year. Additional information - The company tax rate is 28%. Round all figures to 2 decimal places. Downloaded by Charlotte (niikondoci@gmail.com) lOMoARcPSD|17277542 - The market risk premium on investments in property companies listed on the JSE is 7%. The beta of Kuvaka was determined to be 0,8. The yield on the R208 is determined through bond auctions and can be found at the SARB (South African Reserve Bank) The Statement of Financial Position has been prepared on the amortised cost basis. REQUIRED MARKS (a) Calculate the weighted average cost of capital of Kuvaka Ltd as at 31 December 2016. Show all calculations 20 (b) Advise the directors of Kuvaka Ltd on whether they should embark on the project in Midrand or not. Support your answer with calculations. 3 (c) Explain why the interest rate on the ABSA loan is lower than the interest paid on the bonds. 2 TOTAL MARKS 25 Section G: PRE-CLASS PREPARATION Weighted Average Cost of Capital (WACC) 11 Shar e What it is: Weighted average cost of capital (WACC) is the average rate of return a company expects to compensate all its different investors. The weights are the fraction of each financing source in the company's target capital structure. How it works (Example): Here is the basic formula for weighted average cost of capital: WACC = ((E/V) * Re) + [((D/V) * Rd)*(1-T)] E = Market value of the company's equity D = Market value of the company's debt V = Total Market Value of the company (E + D) Re = Cost of Equity Downloaded by Charlotte (niikondoci@gmail.com) lOMoARcPSD|17277542 Rd = Cost of Debt T= Tax Rate A company is typically financed using a combination of debt (bonds) and equity (stocks). Because a company may receive more funding from one source than another, we calculate a weighted average to find out how expensive it is for a company to raise the funds needed to buy buildings, equipment, and inventory. Let's look at an example: Assume newly formed Corporation ABC needs to raise $1 million in capital so it can buy office buildings and the equipment needed to conduct its business. The company issues and sells 6,000 shares of stock at $100 each to raise the first $600,000. Because shareholders expect a return of 6% on their investment, the cost of equity is 6%. Corporation ABC then sells 400 bonds for $1,000 each to raise the other $400,000 in capital. The people who bought those bonds expect a 5% return, so ABC's cost of debt is 5%. Corporation ABC's total market value is now ($600,000 equity + $400,000 debt) = $1 million and its corporate tax rate is 35%. Now we have all the ingredients to calculate Corporation ABC's weighted average cost of capital (WACC). WACC = (($600,000/$1,000,000) x .06) + [(($400,000/$1,000,000) x .05) * (10.35))] = 0.049 = 4.9% Corporation ABC's weighted average cost of capital is 4.9%. This means for every $1 Corporation ABC raises from investors, it must pay its investors almost $0.05 in return. Why it Matters: It's important for a company to know its weighted average cost of capital as a way to gauge the expense of funding future projects. The lower a company's WACC, the cheaper it is for a company to fund new projects. A company looking to lower its WACC may decide to increase its use of cheaper financing sources. For instance, Corporation ABC may issue more bonds instead of stock because it can get the financing more cheaply. Because this would increase the proportion of debt to equity, and Downloaded by Charlotte (niikondoci@gmail.com) lOMoARcPSD|17277542 because the debt is cheaper than the equity, the company's weighted average cost of capital would decrease. Source: https://investinganswers.com/financial-dictionary/financial-statement-analysis/weightedaverage-cost-capital-wacc-2905 Section H: SELF-ASSESSMENT QUESTIONS The question bank contains a pool of previous test and exam questions. After you have studied this topic in detail, attempt the questions in the attached question bank. You should do these questions before looking at the solution. Only after you have done the questions properly, should you refer to the solution and mark your answer. QUESTION 1: Klimbo Ltd has a target capital structure of 60% equity and 40% debt. The after-tax cost of future debt is 11% and the cost of new equity is 21%. The financial manager is currently considering a project with an expected return of 20% which will be financed from the issue of ordinary shares as all retained income is already budgeted for in more profitable projects. The company recently issued debentures and, as a result, the present capital structure is more heavily weighted towards debt. YOU ARE REQUIRED TO: (a) Calculate the weighted average cost of capital. (b) State, with reasons, whether the project under consideration should be accepted. QUESTION 1: (Suggested Solution) a) COMPONENT WEIGHT COST AVERAGE Downloaded by Charlotte (niikondoci@gmail.com) lOMoARcPSD|17277542 Equity 60% 21% 12.60% Debt 40% 11% 4.40% 100% 17.00% The weighted average marginal cost of capital is 17% b) Yes the project should be accepted. Any project which offers a return greater than 17% should be accepted, provided that it is in a risk class similar to that of the business as a whole. The fact that new shares with a component cost of 21% are to be issued by Kimbo Ltd at this time in order to finance that particular project, is irrelevant. For all investment decisions the weighted average marginal cost is appropriate as funding should be seen to emanate from a pool of funds. Linking particular investment projects of a business to the source of finance being used at the time will lead to suboptimal decisions. QUESTION 3: It is commonly accepted that a crucial factor in the financial decisions of a company, including the evaluation of capital investment proposals, is the cost of capital. The following information is available for Otago Ltd: Current price per share on Securities Exchange R1.20 Current year’s dividend per share R0.10 Expected average annual growth rate of dividends 7% Beta coefficient for Otago Ltd 0.5 In addition, the following information has been established: Expected rate of return on risk-free securities 8% Expected return on the market portfolio 12% YOU ARE REQUIRED TO: (a) Explain what is meant by the ‘cost of equity capital’ for a particular company. Downloaded by Charlotte (niikondoci@gmail.com) lOMoARcPSD|17277542 (b) Calculate the cost of equity capital for Otago Ltd from the data given above, using the following two alternative methods: (i) a dividend growth model; and (ii) the capital asset pricing model. (c) State, for each model separately, the main simplifying assumptions made and express your opinion about whether, in view of these assumptions, the models yield results that can be used safely in practice. QUESTION 2: a) (Suggested Solution) The cost of equity capital for a particular company is the rate of return on investment that is required by the company's ordinary shareholders. The return consists of both dividend and capital gains (ie. increases in the share price). The returns are expected future returns, not historical returns, and so the returns on equity can be expressed as the anticipated dividends on the shares every year in perpetuity. The cost of equity is then the cost of capital which will equate the current market price of the share with the discounted value of all future dividends in perpetuity. The cost of equity reflects the opportunity cost of investment for individual shareholders. It will vary from company to company because of the differences in the business risk and financial or gearing risk of different companies. b) i) Dividend growth model: r = D1/Po + g r = 0.10 (1.07)/1.20 + 0.07 ii) = 0.159, = say, 0.16 or 16% Capital Asset Pricing Model: r = Rf + B(Rm-Rf) r = 8% + 0.5 (12% - 8%) = 8% + 2% Downloaded by Charlotte (niikondoci@gmail.com) = 10%c) lOMoARcPSD|17277542 Dividend growth model Assumptions in this model are that: - a dividend growth rate can be forecast, and expectations are the same for all shareholders; - dividends will grow at a constant rate; - "r" is greater than "g"; - there is a readily-available current market value for the share, which is also a 'free-market' price; None of these assumptions is necessarily correct, and the weakness of assumption (i) might be particularly damaging to the credibility of the model. However, it might provide a reasonable approximation of the cost of equity, and a better estimate perhaps than other cost of equity models. Capital Asset Pricing Model The main assumptions in this model are that: Investors are risk-averse and attempt to minimise the risk for any expected utility of their end-of-period wealth. All investors can borrow or lend an unlimited amount at a given risk-free rate of interest. Investors have homogeneous expectations about asset returns. All assets are perfectly divisible and perfectly liquid and there are no transaction costs. There are no taxes and market imperfections. All investors are price takers. Information in asset markets is costless and simultaneously available to all shareholders. None of the assumptions in the model are unacceptable, in spite of their simplification of reality, but the potential weaknesses are that: a statistically-reliable beta factor might not exist for some companies; the beta factor is calculated from historical data about dividends and capital growth. Historical data might not provide a representative guide to investors' expectations about a company's future, which ought to be the main basis for the investment decisions. Downloaded by Charlotte (niikondoci@gmail.com) lOMoARcPSD|17277542 Downloaded by Charlotte (niikondoci@gmail.com) lOMoARcPSD|17277542 QUESTION 3: Sincro Ltd’s capital structure is as follows: Debt 35% Preference shares 15% Ordinary share equity 50% The after-tax cost of debt is 6.5%; the cost of preference shares is 10%;and the cost of ordinary share equity is 13.5%. As an alternative to the existing capital structure for Sincro, an outside consultant has suggested the following modifications: Debt 60% Preference shares 5% Ordinary share equity 35% Under this new and more debt-oriented arrangement, the after-tax cost of debt is 8.8%; the cost of preference shares is 11%; and the cost of equity is 15.6%. YOU ARE REQUIRED TO: (a) Calculate Sincro’s existing weighted average cost of capital. (b) Recalculate Sincro’s weighted cost of capital, using the capital structure suggested by the consultant. (c) Discuss the issues which are pertinent to the choice between the two alternative capital structures. Downloaded by Charlotte (niikondoci@gmail.com) lOMoARcPSD|17277542 QUESTION 3: a) (Suggested Solution) Existing weighted cost of capital: COMPONENT COMPONENT WEIGHT WEIGHTED Debt (Rd) Preference shares (Rp) Ordinary shares (RE) COST 6.5% 10.0% 35.0% 15.0% COST 2.28% 1.50% 13.5% 50.0% 6.75% 10.53% b) Weighted cost of capital under consultant's plan: COMPONENT COMPONENT WEIGHT WEIGHTED Debt (Rd) Preference shares (Rp) Ordinary shares (RE) COST 8.8% 11.0% 60.0% 5.0% COST 5.28% 0.55% 15.6% 35.0% 5.46% 11.29% c) The existing capital structure is better than the plan presented. Even though the plan has more relatively cheap debt, the increased costs of other forms of financing, noticeably the equity capital more than offset this factor. This results from ordinary shareholders perceiving the additional risk to which they will be exposed by the higher proportion of debt in the capital structure. QUESTION 4 (40 MARKS) Downloaded by Charlotte (niikondoci@gmail.com) lOMoARcPSD|17277542 You are the partner in charge of the financial advisory services appointment of a listed company, Valpree Limited, a manufacturer and supplier of bottled water. The company started its operations 10 years ago and has shown stable growth ever since. The company grew especially well in certain Africa countries due to the increase in mining activities polluting the water in Africa. In an attempt to diversify, the company decided to introduce a new product line, flavored water. This new product line was expected to first be tested in the market for a period of six months before the final decision would be taken to implement this new product line permanently. Mr.Aquabon, the financial director of Valpree was unsure whether to implement this new project line in the first place, stating that: "Flavoured water won't work in Africa, that is for sure! People in Africa don't have money for luxuries like flavoured water. It is ridiculous!" In another statement Mr.Aquabon said that Valpree always uses the current market value as optimal capital structure in calculating WACC. An extract of the statement of financial position as on 30 November 20x7 was as follows: R '000 Equity Share capital Share premium Retained earnings Shareholders loan 12 500 1 200 25 690 2 000 Liabilities Non-current liabilities Preference shares (13%) Debentures (16, 5%) (non redeemable) Long-term loan (18%) 7 500 18 700 15 300 Current liabilities Trade creditors Bank overdraft 3 651 1 765 Additional information Downloaded by Charlotte (niikondoci@gmail.com) lOMoARcPSD|17277542 1. Ordinary shares are presently trading at R 13,50 per share. The par value of the shares is R10 each. 2. Preference shares have a par value of R5 per share. The preference shares are redeemable within two months at a premium of 11%. 3. R200 nominal debentures interest is payable on 31/05 and 30/11 every year. The market value of debentures at reporting date is R252. 4. The interest on the long-term loan is payable at the end of each year for the next 8 years. The creditors gave Valpree the option to settle the loan on 01/12/2007 for R14 563 000. Valpree did not accept the option. 5. Trade creditors fluctuate from month to month and are not considered as part of the permanent financing 6. Bank overdraft is the result from recent cash flow problems incurred by the company. The problems are expected to be temporary and Valpree is obligated to settle the overdraft within the next 2 months. 8. Other information RSA 153: 11,61% Beta = 1,6 Tax rate: 28% Rm = 14,17% REQUIRED a) Explain what is the cost of capital of a company? (3) b) What is meant by the "pooling of funds" principle? c) Calculate the WACC of Valpree Limited. Give reasons for your calculations and inclusions/exclusions in the WACC calculation. (25) d) Advise Valpree Limited on additional factors they need to take into account before they accept the new project line. (6) e) Explain what impact risks will have on the cost of capital NOTE: Round all calculations off to four decimal places Downloaded by Charlotte (niikondoci@gmail.com) (2) (4) lOMoARcPSD|17277542 QUESTION 4 a) SUGGESTED SOLUTION What is the cost of capital of a company? The minimum return that a project must offer before it can be accepted. It is the return rate that is required by capital suppliers. The opportunity cost of investing in that project. = Cost of equity + Cost of debt + Cost of preference shares. It shows the risk of the company. It is the weighted average cost of required returns of providers of long-term or permanent capital b) Pooling of funds The pooling of funds means that the projects are not financed from one specific source. When evaluating projects, we comparing the IRR to WACC based on the funds pooled. All projects expected are financed from a joined pool of funds that includes all the sources in the capital structure. [in their current ratio to prevent suboptimal decision making] c) Calculation of WACC Share Capital Market value: R12 500 000/R10 = 1 250 000 shares 1 250 000 x R13, 50 = R16 875 000 Cost: CAPM/SML Approach (Re) = Rf + B(Rm - Rf) = 11,61 + 1,6 x (14,7 - 11,61) = 15,706% = 15,71% Preference Shares Not part of the capital structure of Valpree because redeemable within two months thus not included in WACC Assumption: Preference shares will be proportionately replaced with other sources of permanent financing Debentures Debentures are non-redeemable thus = perpetuity Market value: R18 700 000/R200 = 93 500 debentures x R252 = R23 562 000 Cost: Downloaded by Charlotte (niikondoci@gmail.com) lOMoARcPSD|17277542 Interest after tax/Market value per share 200 x 16,5% x 72%/252 = 9,4285% = 9,43% Long Term Loan Market value: R14 563 000 Cost: P/Yr=1 C/Yr=1 PV = 14 563 000 N=8 FV = 15 300 000 PMT=1 982 880 IRR = 14% OR PMT = 2 754 000 IRR = 19.23% 19.23% x 72% = 13.84% Trade Creditors Not part of capital structure of Valpree because not considered part of permanent financing thus not included in WACC Trade credit don't have any explicit cost Bank Overdraft Not part of the capital structure of Valpree because temporary sources of finance(settle in 2 months) thus not permanent source of finance thus not included in WACC To calculate WACC use the market value as the optimal capital structure according to Valpree's policy. Component Equity Debentures Long Term Loan Market Value 16 875 000 23 562 000 14 563 000 Weight 30,68% 42,84% 26,48% Conclusion: The WACC of Valpree is 12, 57% (p) OR Downloaded by Charlotte (niikondoci@gmail.com) Cost 15,71% 9,43% 14,0% Total 4,82% 4,04% 3,71% 12,57% lOMoARcPSD|17277542 Component Equity Debentures Long Term Loan Market Value 16 875 000 23 562 000 14 563 000 Weight 30,68% 42,84% 26,48% Cost 15,71% 9,43% 13,84% Total 4,82% 4,04% 3,66% 12,52% Conclusion: The WACC of Valpree is 12, 52% (p) (MAX:25) d) Additional factors(qualitative factors) The market and demand for the new product Competitors Exposure to foreign exchange fluctuations The risk of the project Additional cost of the project (e.g. flavorings /colorants) Licenses for the product Knowledge and experience in manufacturing flavoured water Impact of the new product line on the present product Will they be able to sell the product to their current customers or do they have to gain new clients Any other valid reason (max:6) e) Impact of risk on cost of capital In general investors are risk adverse thus the higher the risk the higher the required rate of return wanted by investors That leads to an increase in the cost of equity thus leading to an increase in the cost of capital (max:4) (TOTAL:40) Downloaded by Charlotte (niikondoci@gmail.com) lOMoARcPSD|17277542 QUESTION 5 (40 MARKS) You are the recently appointed financial advisor of Boating Adventures Ltd. Boating Adventures Ltd (BA) is a listed company who manufactures boats, Jet Ski’s and various other boating equipment. The company was incorporated 10 years ago, and has shown significant growth since then. The company is currently considered the market leader in the boating industry. Boating Adventures Ltd is planning to open various BA Ltd franchises in Africa as they recently discovered that clients from African countries travel to South Africa for their boating needs. The financial director, Mr. Y.A. Maha informed you that they will need a significant amount of capital for the planned expansion. He also informed you that the acceptance of the project will depend on the outcome of evaluations performed using the historic cost of capital of the company. Mr. Y.A. Maha provided you with the following information: An extract of the balance sheet as at 31 March 2018: Balance Sheet Referenc e R Equity Share Capital (R2 shares) Share Premium 1 1 200 000 12 650 000 Liabilities Non-current liabilities Preference Shares (12%) Debentures (redeemable) Long-term Loan (17%) 2 3 4 500 000 2 250 000 3 500 000 Current liabilities Bank Overdraft Sundry Creditors 5 6 2 000 000 950 000 Downloaded by Charlotte (niikondoci@gmail.com) lOMoARcPSD|17277542 Additional information: 1. Shares are trading on the JSE for R128,50 per share. 2. The preference shares consist of 25 000 non-redeemable preference shares. Similar preference shares currently trade in the market for R17.14 per share. 3. The debentures are redeemable in 6 years. 20 000 Debentures were issued at R112.50 each (a discount of 10%) on 31 March 2016. The debentures will carry interest at 11% of par value per annum, and the par value of the debentures will be paid in 2 equal installments in 2023 and 2024. 4. The long-term loan relates to a loan that carries interest at 17% per annum and will be redeemed in full in 10 years. Similar loans currently trade in the market at prime + 2%. 5. Mr. Y.A. Maha informed you that the bank overdraft will be redeemed in the following month and will not be used as a source of financing again, due to the high cost of the overdraft facility. 6. The sundry creditors relate to a loan from one of Boating Adventures well-known clients which will be settled in 2 months. The loan will however be replaced by a loan of the same value by the client, which will be settled in the following year and carries interest at a rate of 12%. Other information: The current market value represents the optimal capital structure. The prime interest rate is currently 15%. Downloaded by Charlotte (niikondoci@gmail.com) lOMoARcPSD|17277542 An announcement this morning by the Reserve Bank is that the prime interest rate will increase with 0,5% by the end of business today and will therefore be applicable for all future borrowings. The project is expected to be fully implemented within 5 years. Assume a tax rate of 30%. Debentures currently trade at an effective cost of 12% p.a. The required rate of return that shareholders require when investing in a company such as Boating Adventures Ltd is 22,5% p.a. REQUIRED: 6.1 Define the weighted average cost of capital (WACC), and briefly explain why a company would calculate the WACC? 6.2 State with reasons whether or not you agree with the statement made by Mr. Y.A. Maha concerning the historic cost of capital. 6.3 (3) (5) Indicate whether payments on the following instruments are deductible for taxation purposes: 1) Debentures; 2) Preference shares; 3) Long-term loans; 4) Bank overdraft; 6.4 Calculate the market value of the redeemable debentures. 6.5 Calculate the WACC for Boating Adventures Ltd. Give reasons for ALL your inclusions/exclusions from the WACC for each balance sheet item. Downloaded by Charlotte (niikondoci@gmail.com) (4) (8) (20) lOMoARcPSD|17277542 MEMO: QUESTION 5 (40 MARKS) 1. WACC is defined as the weighted average cost of capital (1). The WACC is actually a required rate of return or the minimum required return to the shareholders and other permanent providers of capital (1) to ensure that they are compensated for the risk that they take on by providing finance (1). An entity needs to calculate the WACC to determine whether the benefits arising from a project exceeds the cost of investing in the project (1) (i.e. used to evaluate capital investment projects). 2. No, I disagree with the statement made by Mr Y.A. Maha (1). The cost of capital that should be used to evaluate the new project should not be the same as the cost of capital used to evaluate previous investments. The reasons are: The new project has a different risk profile than the previous investment/project (1). When evaluating a new project we assume that we would need new financing (1) and therefore the cost of obtaining financing should be the new market rates and not historic rates (1). A possible new capital structure could lead the company to a new cost of capital (1). 3. The following is deductible for taxation purposes: Interest on debentures; (1) Interest on long-term loans; (1) Interest on bank overdraft; (1) The following is not deductible for taxation purposes: Preference share dividends. (1) 4. The effective cost of debentures: Downloaded by Charlotte (niikondoci@gmail.com) lOMoARcPSD|17277542 3. Debentures (8) Downloaded by Charlotte (niikondoci@gmail.com) lOMoARcPSD|17277542 Ref Interest After tax cost of interest 1 2 Payment of instalments 3 31-Mar 2016 -192 500 TOTAL Cash flow Present Value 31-Mar 2017 -275 000 -192 500 31-Mar 2018 -275 000 -192 500 -192 500 31-Mar 2019 -275 000 -192 500 -192 500 1 31-Mar 2020 -275 000 -192 500 -192 500 2 31-Mar 2021 -275 000 -192 500 -192 500 3 4 1P for doing a Present Value calculation Calculation 1 Redeemable Debentures @ book value Number of debentures Par value of debentures (bookvalue/0.9%) Interest @ 11% of par value 2 250 000 20 000 2 500 000 (1) -275 000 (1) -192 500 (1) 2 500 000 -1 250 000 (1) Calculation 2 After tax interest: Par value interest of debenture *0.7 Calculation 3 Par value 2 Equal instalments Calculation 4 Cfj 1 Cfj 2 Cfj 3 Cfj 4 Cfj 5 Cfj 6 I/Yr NPV -192 500 -192 500 -192 500 -192 500 -1 442 500 -1 442 500 8.4% 2 484 788.29 (1P) Including the cash flow (1P) Including the cash flow (1) (1P) (12% x 0.7) Calculating NPV Max (8) Downloaded by Charlotte (niikondoci@gmail.com) 31-Mar 2022 -275 000 -192 500 -192 500 4 31-Mar 2023 -275 000 -192 500 31-Mar 2024 -275 000 -192 500 -1 250 000 -1 250 000 -1 442 500 -1 442 500 5 6 (1) lOMoARcPSD|17277542 5. Cost of Capital: 1. Equity (2) Market value of Share Capital =100 000 shares * R 128.50 12 850 000 (1) Should be included as it forms part on long-term financing and thus the cost of capital. (1) 2. Preference Shares (6) Non-redeemable, therefore a perpetuity = 500 000/25 000 20 2.40 Value of pref share Pref share dividend (20*.12) = Market Value 17.14 = X = Market Value of Pref share Cash flow Required rate of return 2.40 X 14.00% (1) (1) (1P) Use perp formula (1P) For not making after tax (1) 428 500 Should be included as it forms part on long-term financing and thus the cost of capital. (1) 4. Long-term Loan (10) The prime interest rate in the current year cannot be used, as we focus on financing that will be obtained in the future, and therefore in effect the future cost of financing. (1) The effective cost of the loan in the market is therefore 15.5% + 2% = 17.5%. (1) Should be included as it forms part on long-term financing and thus the cost of capital. (1) Interest 10 years (1) After tax cost (*.70) =3 500 000*.17 595 000 416 500 (1) Downloaded by Charlotte (niikondoci@gmail.com) lOMoARcPSD|17277542 NPV Cfj 1-9 Cfj 10 416 500 =3 500 000 + 416 500 3 916 500 12.25 I/Yr (1) (1) (1) (1) % (17.5% x 0.7) 3 431 487.38 NPV (1) 5. Bank overdraft (2) The bank overdraft does not form part of the permanent source of financing and therefore does not form part of the cost of capital. (1) (1) 6. Client Loan (4) The current loan cannot be used as it does not form part of the permanent source of financing and therefore does not form part of the cost of capital. (1) (1) The new loan will also not form part of the permanent source of financing and therefore does not form part of the cost of capital. (1) (1) Cost of Capital (8) Item Market Value Equity Preference Shares Debentures 1 12 850 000 2 3 428 500 2 484 788 Long-term Loan Bank Overdraft Client Loan 4 5 6 3 431 487 - Cost 22.50 % 14.00 % 8.40% 12.25 % 0.00% 0.00% 19 194 775 Therefore the cost of capital is 18.65 % Weight WACC 66.95% 15.06% (1P) 2.23% 12.95% 0.31% 1.09% (1P) (1P) 17.88% 0.00% 0.00% 100.00 % 2.19% 0.00% - (1P) (1P) (1P) 18.65% (1P) (1P) Not incl Not incl Conclusio n Downloaded by Charlotte (niikondoci@gmail.com) lOMoARcPSD|17277542 Question 6 (13 Marks) Risky (Pty) Ltd (Risky), a bungy-jumping service provider located in the Drakensberg mountains, recently got sued for their bungy rope snapping while an individual was doing their inaugural jump. After Risky settled the lawsuit, they decided to upgrade their jumping systems. The upgrade was scheduled to be done in phases over 10 years. Risky wanted to calculate the cost of equity. They were uncertain what information to use in order to calculate it. They came to the University of Johannesburg to find a second year student who was proficient in Finance and could help them with this calculation. Fortunately, the directors had already done their research and had information that could be provided by BUNGY Bank Ltd. This is the information that they gave you for their year ended 31 October 2018: 11,00% Average over three months ended October 2018 11,50% 10,00% 9,80% 31 October 2018 31 July 2018 31 October 2017 14,0% 16,1% 17,0% 31 October 2018 Interest rates SA Reserve Bank 91 day treasury bills Yield on the most liquid and traded SA government bond in issue, redeemable in 2029 Equity markets 20 year average annual return of all shares listed on the JSE Securities Exchange Average of beta coefficients of JSE listed companies, similar in size and nature of business to Risky REQUIRED: 1.20 1.18 1. Explain the Capital Asset Pricing Model (CAPM) formular in your own words?(4) 2. Estimate the cost of equity of Risky Ltd at 31 October 2018 based on the information provided by BUNGY Bank Ltd. Show all workings and provide reasons for using specific information provided by BUNGY Bank Ltd. (7) 3. Why is a government bond considered Risk Free? Question 7 Suggested Solution Downloaded by Charlotte (niikondoci@gmail.com) (2) lOMoARcPSD|17277542 1. The Capital Asset Pricing Model is a measure of a companies required rate of return or cost of equity. The inputs that are used to derive it are the risk free rate , the asset beta (or systematic risk) and return on the market . The risk free rate is added to the product of the beta and the market premium. The market premium is calculated by subtracting the risk free rate from the market return. Cost of equity Re = Rf + b (Rm Rf) (Max 4) 2. 10% Risk free rate • Current yield on government bond redeemable in 2029 provides best proxy - maturity profile acceptable (10 years = long term/matches new project timeline) Beta coefficient Average beta of similar companies 1.2 acceptable Adjust the beta for specific risk of company Return on market • 20 year average return on JSE at 31 October 2018 Cost of equity derived Increase cost of equity derived due to higher risks associated with private 14.00% 14.80% company/↑ beta (max 7) 3. A government bond is considered risk free because it has zero or limited default risk. If the government requires additional funds to settle their debts, they can simply raise taxes in order to raise the required funds. (2) Total: 13 Marks Downloaded by Charlotte (niikondoci@gmail.com) lOMoARcPSD|17277542 Question 7 (47 marks) Cold Fields Limited is one of the world’s largest unhedged producers of gold with attributable production of 3,64 million oz per annum from eight operating mines in South Africa, Ghana and Australia. A ninth mine, Cerro Corona Gold/Copper mine in Peru, commenced production in August 2008 at an initial rate of approximately 375,000 gold equivalent oz per annum. The company has total attributable ore reserves of 83 million oz and mineral resources of 251 million oz. This mining group’s main strategy for the 2009 financial year is to have an aggressive pursuit of generating strong cash flow as part of their strategy to realize value. However, as part of Cold Fields’ expansion strategy, they have to complete the following projects: A detailed analysis of the financing options available to fund the the above-mentioned capital projects was performed. The following will be used by Cold Fileds as sources of finance: Ordinary shares: Downloaded by Charlotte (niikondoci@gmail.com) lOMoARcPSD|17277542 26,714,158 Ordinary shares were issued by Cold Fields Limited. The dividend is expected to be R4 per share at the end of the next financial year. Dividend growth is expected to grow consistently by 10% per year. Shares are currently trading at R112.31 per share on the Johannesburg stock exchange. Preference shares: Cold Fields limited issued R1200m three year non-convertible redeemable preference shares. The dividend rate payable is a floating rate linked to the prime interest rate (Hint: use dividend rate of 14%). The entire preference share issue was taken up by Rand Merchant Bank (RMB) and their opportunity cost associated with this preferance share issue is 12%. Project finance facility: Cold Fields entered into a loan agreement with the Industrial Development Corporation (IDC) in terms of which the IDC agreed to provide a loan facility of R2660m. Currently the outstanding debts on this facility is R2300m. Interest will be charged at a fixed rate of 14% on this facility. Commercial Bonds: Cold Fields raised capital in the capital markets by issuing bonds with a principal value of R1,000m. These bonds have a coupon rate of 15% per annum and coupons will be paid semi-annually. These bonds will mature in five years. Interest rate outlook is expected to be stable with Interest rates remaining at 16% per annum. General: The effective corporate tax rate is 28%. REQUIRED: Part A 1) Explain in your own words what the Weighted Average Cost of Capital is?(3) 2) Calculate the Weighted Average Cost of Capital for Cold fields (Round all amounts to R’millions) Downloaded by Charlotte (niikondoci@gmail.com) (28) lOMoARcPSD|17277542 3) 4) What are the potential problems with the using Cost of Capital as a basis of calculation (4) Explain the pooling of funds principle on your own words (4) Part B Cold Field have a big strategic focus on generating cash flow at the moment. Required: 1) Given the current economic circumstances, please explain why access to cash is such a major priority for capital intensive corporates at the moment based on the JP Morgan Cash survey (as discussed in the additional reading material) (5) 2) What is your opinion on the current crises in the financial markets QUESTION 7 (3) SUGGESTED SOLUTION Downloaded by Charlotte (niikondoci@gmail.com) lOMoARcPSD|17277542 Part A 1) WACC: The Weighted Average Cost of Capital is the required rate of return given the risk that they take. . It reflects the expected average future cost of funds over the long run. Found by weighting the cost of each specific type of capital by its proportion in the form’s target / optimal capital structure Max: 3 2) Calculation of the weighted Average Cost of Capital: Ordinary Shares: Gordon Growth Model to determine required return: Re = (D1÷P0) + g = (R4 ÷ R112.30) +10% = 13.56% or 14% rounded Value of ordinary shares: 26,714,158 Ordinary Shares x R112.30 = R3,000m Preference Shares: Required rate of return: = 12% Value of Preference Shares: PMT = -168 (14% x R1200m) FV = -1200 I/Y = 12% P/Y = 1 N =3 PV = 1257.64 Project Finance facility: Funding rate = 14% x (1-0.28) = 10.08% Value of loan: =R2300m Commercial Bonds: Funding rate = 16% x (1-0.28) = 11.52% Value of Bonds P/Y = 2 FV =-1000 PMT =-75 N =10 OR P/Y FV PMT N =2 = -1000 =(-75x(1-0.28)) -54 = 10 Downloaded by Charlotte (niikondoci@gmail.com) lOMoARcPSD|17277542 I/Y PV =16% =996.45 Total Capital: Ordinary Shares: Preference Shares: Project Finance facility: Commercial Bonds: Total: I/Y PV =(16%x(1-0.28)) 11.52% = 973.2 R3,000m R1,257.64m R2,300m R996.45m R7,554.09m P WACC =(3,000 ÷ 7,554.09 x 14%)+ (1,257.64 ÷ 7,554.09 x 12%)+ (2,300 ÷ 7,554.09 x 10.08%)+ (996.45 ÷ 7,554.09 x 11.52%) =12.15%P Presentation marks if amounts were reflected in Rand millions if percentages were not reflected in decimals 3) Reliance on accounting rather than market information Properly accounting for inflation (Is it the real interest rate or nominal) Fitting real world data into theoretical models Difficulties in how your discount rate is used Choosing which measure to use Properly applying the principals of marginality (Available 6, Max 4) 4) Pooling of Funds Principle The pooling of funds means that the projects are not financed from one specific source. When evaluating projects, we comparing the IRR to WACC based on the funds pooled. All projects expected are financed from a joined pool of funds that includes all the sources in the capital structure. [in their current ratio to prevent suboptimal decision making] An average of the pool of the sources of finance needs to be determined in order to get the most accurate cost of capital Part B 1) Downloaded by Charlotte (niikondoci@gmail.com) lOMoARcPSD|17277542 Risk adversion is the order of the day, due the fact that this has been a tumuluous year in the money markets There is currently a hightened concern over the availability of liquidity in the money markets High profile banks are collapsing or dependant on rescue government packages, causing Corporates to enter into multiple bank relationships. Worldwide corporates are therefore focussed on building their own bank deposits. 46% of Companies across the globe are expecting to increase their short term borrowing in the coming year and hence the fear that there may not be money available in the money markets to fund these debt requirements. 2) Principal marks Downloaded by Charlotte (niikondoci@gmail.com) lOMoARcPSD|17277542 Question 8 (13 marks) Indicated below is the yield curve for government bonds as at 31 December 2008. Top line = Oct 08 Middle line = Nov 08 Bottom line = Dec 08 Required: 1) Describe in your own word what a bond is? (3) 2) Describe what yield to maturity is? (2) 3) Describe what the yield curve is? (2) 4) What does the domestic yield curve tell us and interpret the above Domestic yield curve as compiled by the Bond Exchange of SA? QUESTION 8 (6) SUGGESTED SOLUTION 1) A bond is a long-term debt instrument that pays the bondholder a specified amount of periodic interest rateover a specified period of time Downloaded by Charlotte (niikondoci@gmail.com) lOMoARcPSD|17277542 2) The bond’s yield-to-maturity is the yield (expressed as a compound rate of return) earned on a bond from the time it is acquired until the maturity date of the bond. 3) A yield curve graphically shows the relationship between the time to maturity and yields for debt in a given risk class 4) a. The Domestic Yield Curve on Government Bonds is compiled from actual market prices of government bonds as traded on Bond Exchange of South Africa b. It reflects the current prices of all the various classes of bonds as issued by the Government of South Africa based on the maturity of each series of government bonds issued. c. It provides us with a good indication of forecasted market expectations on interest rate changes as well as the inflationary expectations in the economy d. It is therefore expected that interest rates will decline in the South African economy over the long term e. The interest rate outlook also changed from October 2008 to December 2008 reflecting a much sharper drop in expected interest rates in the future. Downloaded by Charlotte (niikondoci@gmail.com) lOMoARcPSD|17277542 Question 9 Cost of Capital Adcock Ingram to consume Cipla Medpro 50 Marks Reuters: – “South Africa's No. 2 drugs producer Adcock Ingram plans to offer R2.1 billion for rival Cipla Medpro South Africa (CMSA) to boost its share of the generic medicine market. The cash offer, which values CMSA at about R4.75 per share which is 36% higher than its closing share price on April 7, pushed the company's stock up to/by about 20%. Adcock, which was listed on the JSE last August and is the country's second biggest pharmaceutical firm after Aspen, said it had secured support from four leading CMSA shareholders holding a combined 30 percent of the company's shares. No one at CMSA was immediately available to comment. CMSA, formerly known as Enaleni Pharmaceuticals, is one of South Africa's largest generic pharmaceutical firms. It has a long-term arrangement to sell products developed by India's Cipla Limited in South Africa. The deal would give Adcock, which was spun off from consumer goods firm Tiger Brands last year, more muscle to compete with Aspen in the fast-growing generic drug market. It would also be the latest in a series of similar transactions as traditional pharmaceutical companies worldwide seek new revenue streams to offset the impact of patent expiries. In order to measure the risk profile of the consolidated entity, created by the potential merger of Cipla & Adcock Ingram, we need to determine the proposed cost of capital for the new entity. Below is an extract of the consolidated Statement of Financial Position: Statement of Financial Position as at 30 June 2019 Downloaded by Charlotte (niikondoci@gmail.com) lOMoARcPSD|17277542 Referenc e Equity Share Capital (R1 shares) Share Premium 1 1 R300 000 R12 650 000 Liabilities Non-current liabilities Preference Shares (12%) Debentures (16.5%) Long term loan (18% variable) 2 3 4 R1 500 000 R18 700 000 R15 300 000 Current liabilities Bank Overdraft Sundry Creditors 5 6 R2 000 000 R950 000 Additional Information 1. Shares are currently trading on the JSE for R37.90 per share. 2. The preference shares consist of 25 000 non-redeemable preference shares. Similar preference shares currently trade in the market for R55.38 per share. 3. Debentures: The debentures were issued in denominations of R200. The market value of these debentures at balance sheet date is R252 inclusive of interest for 6 months. Interest is payable on 30/06 and 31/12 every year. The debentures are redeemable in 8 years time Flotation costs of 5% are payable on all new debentures issued. 4. Long term loan The bank has given Adcock the option of redeeming the loan on the 01/07/2019 at R14 790 000. The company will however not exercise the option. 5. The bank overdraft will be redeemed in the following month and will not be used as a source of financing again, due to the high cost of the overdraft facility. Downloaded by Charlotte (niikondoci@gmail.com) lOMoARcPSD|17277542 6. The sundry creditors relate to various short term exposures. Other information: The current market value represents the optimal capital structure. The prime interest rate is currently 14%. The take-over of Cipla is expected to be fully repaid within 10 years. Assume a tax rate of 28%. Adcock Ingram Number of shares in issue Current share price Beta Effective normal income tax rate Dividend per share declared on 31 January 2019 15 000 000 R37.90 0.90 28% 75c Other information Current yield of the R204 RSA government bond, maturity date 21 December 2028 Current yield of the R153 RSA government bond, 9,0% maturity date 31 August 2020 Adcock Ingram premium for market risk 9,4% 8,0% REQUIRED: a) Briefly explain what the importance of cost of capital is, as well as the relevance thereof for companies in general. (5) b) Calculate the weighted average cost of capital. Give reasons for ALL your inclusions/exclusions from the WACC for each balance sheet items. Downloaded by Charlotte (niikondoci@gmail.com) (40) lOMoARcPSD|17277542 c) Identify the key procedures that Adcock Ingram should follow in assessing the creditworthiness of new customers. (5) SUGGESTED SOLUTION a) The minimum return that a project must offer before it can be accepted. It is the return rate that is required by capital suppliers. The opportunity cost of investing in that project. = Cost of equity + Cost of debt + Cost of preference shares. It shows the risk of the company. It is the weighted average cost of required returns of providers of long-term or permanent capital Projects with a return of more than WACC should be accepted. Pooling of funds b) Ordinary shares (Re) = Rf + B(Rm - Rf) Cost of equity Risk free rate = R204 bond (long term yield) Beta co-efficient of Cloth Group given Insufficient information given in the question to determine whether the quoted beta is levered or unlevered beta Market risk premium given Cost of equity therefore 9.00% 0.90 8.00% 16.20% P Market value R37.90 x 300,000 ordinary shares = R11,370,000 Ordinary shares should be included as part of long term financing and thus cost of capital (i.e. permanent) Preference shares Non-redeemable, therefore a perpetuity Value of pref share =1 500 000/25 000 =60 Downloaded by Charlotte (niikondoci@gmail.com) lOMoARcPSD|17277542 7.20 Pref share dividend (60*.12) Market Value = R55.38 X Cash flow __________________ Required rate of return = = 7.20 X 13.00% Market Value of Pref shares: R55.38x 25,000 pref shares = R1,384,500 Preference shares should be included as part of long term financing and thus cost of capital (i.e. permanent) Debentures Effective Cost of debentures Debentures should be included as part of long term financing and thus cost of capital (i.e. permanent) Market value: Need Ex-interest market value Interest = 200 x 16,5% x 6/12 = 16,5 MV ex-interest = 252 – 16,5 = 235,5 P Total MV = 235,5 x 93 500 P (if interest was deducted) = 22 019 250 P Cost of Debentures: R’000 P/Y =2 PMT = -18,700 x 6/12 x 16.5% x 72% Alternatively: -R18,700 x 6/12 x 16.5% = R1,542.75 =-1,110.78 FV = -18,700 N = 16 PV = 22,019 x 0.95 =20,918.05 I = ? 9.71% Alternatively: PMT = 16.5 Downloaded by Charlotte (niikondoci@gmail.com) lOMoARcPSD|17277542 FV: = 200 PV: = 235.5 x 95% Long term loan Long term loans should be included as part of long term financing and thus cost of capital (i.e. permanent) Market value: 14 790 000 Cost of long term debt: 18% x 72%= 12.96% Bank Overdraft Bank Overdraft does not form part of the long term financing structure of Adcock Ingram (i.e. not permanent) Therefore it should not form part of cost of capital Sundry Creditors Sundry creditors does not form part of the long term financing structure of Adcock Ingram (i.e. not permanent) Therefore it should not form part of cost of capital Weighted Average Cost of Capital Total: 46 Max: 40 (c) Key procedures should include checking the following: The financial position of new customer (proof of salary, personal balance sheet, ownership of fixed property etc) (capital) Downloaded by Charlotte (niikondoci@gmail.com) 1 lOMoARcPSD|17277542 Credit history which can be established by independent credit checks with bureaus Requirements of the National Credit Act & FICA (proof of residency & ID documents) The amount of credit applied for versus surplus monthly cash flow (Capacity) Assess the attitude of debtors towards the commitment of honouring debt (character) Security provided by the debtor (collateral) Economic Conditions that the customer is trading in Other valid procedures Available Maximum Downloaded by Charlotte (niikondoci@gmail.com) 1 1 1 1 1 1 1 8 5 lOMoARcPSD|17277542 Question 10 40 Marks Woolworths (Proprietary) Limited is a respected retail chain of stores offering a selected range of clothing, home ware, food and financial services under its own brand name. During the 2009 financial year, Woolworths completed share buy backs to the value of R1.1 billion. This was conducted to lower the cost of capital at Woolworths. The following is an extract of the Statement of Financial position as at 30 June 2009 NOTES R'm EQUITY & LIABILITIES Share capital Share premium Treasury shares held Non-distributable reserve Distributable reserve Ordinary Shareholders' equity 1 1.10 141.60 (316.50) 207.20 2,991.40 3,024.80 Preference shares 2 1,376.80 Total Shareholders' interest 4,401.60 Non-current liabilitie s Interest-bearing borrowings Operating lease accrual Deferred tax 3 4 5 2,053.70 1,531.60 456.80 65.30 6 2,372.80 2,372.80 Current liabilitie s Trade & other payables Total equity and liabilitie s 8,828.10 Notes: 1) Ordinary Share Capital Woolworths is listed on the Johannesburg Stock Exchange under share code WHL. As at 30 June 2009, Woolworths had 775 million ordinary shares in issue. As at 3 February 2010 ordinary shares were trading at a price of R18.00 per share. Because of the Downloaded by Charlotte (niikondoci@gmail.com) lOMoARcPSD|17277542 nature of their products, the share price of Woolworths is typically less volatile than that of a fully diversified market portfolio, and expects a R0.73 increase in return when the value of a similar diversified portfolio increases by R1.00. The expected return on a fully diversified portfolio is currently 15%. 2) Preference Shares Woolworths issued 1 million non-redeemable preference shares in June 2005. The dividend rate applicable is a variable rate of prime. Dividends will be declared annually. These preferences shares are actively traded and the current market value is R1,400 per share. The par value (nominal value) of the preference shares is R1,376.80 per share. 3) Interest bearing borrowings consist of: Non-current unsecured loan: R500 million fixed rate loan. Woolworths entered into this long term loan with ABSA Capital on 30 June 2009. Woolworths agreed with Absa Capital to structure the repayment of the loan in the following manner: Woolworths will obtain a payment holiday until June 2012 Woolworths will then start paying annual installments of R50 million until June 2014 The above-mentioned installments will increase to R100 million until June 2019 The balance will be settled as a final balloon payment of R550 million in June 2020 Dates Number of installments annual Value of annum July 2009 to June 2012 3 R0 July 2012 to June 2014 2 R50 million July 2014 to June 2019 5 R100 million June 2020 1 R550 million Secured fixed rate bonds in issue: Downloaded by Charlotte (niikondoci@gmail.com) Installment per lOMoARcPSD|17277542 R1 000 million, 8-year notes maturing on 30 June 2017 with a coupon rate of 12% compounded semi-annually. These bonds have a par value of R1,000 each and they are currently trading at a premium of 20%. Finance Lease The outstanding liability of the lease is R31.6 million. The group has entered into finance leases for various items of vehicles and computer equipments. These leases have terms of renewal between three and five years. Floating rate interest of prime plus 1% will be charged on the leases. 4) Operating leases The group has entered into various operating lease agreements on premises. The amount reflected on the statement of financial position, represent lease rentals in arrears which will be repaid shortly. 5) Deferred Tax Woolworths has a deferred tax asset of R162 million. It is expected that the deferred tax liability will be realised through utilizing the current deferred tax asset. 6) Sundry creditors This amount relates to various short term exposures, which will be settled shortly. The current sundry creditors are not deemed to be source of permanent financing by management. 7) Other information: The current market value represents the optimal capital structure. The prime interest rate is currently 10.5%. Assume a tax rate of 28%. The R186 government long bond is currently trading at a yield of 9.13% The Statement of Financial Position reflects nominal values. Downloaded by Charlotte (niikondoci@gmail.com) lOMoARcPSD|17277542 Required: Calculate the weighted average cost of capital. Give reasons for ALL your inclusions/exclusions from the WACC for each statement of financial position item (40) Question 10 Suggested Solution Ordinary Share Capital Ordinary shares should be included as part of long term financing and thus cost of capital (i.e. permanent) Cost of Equity Ke = Rf + B(Rm - Rf) Risk free rate = R186 bond (long term yield) 9.13% Beta = 0.73 Market rate on a fully diversified portfolio = 15% Cost of equity = 13.42% Principle Market value R18 x 775 million ordinary shares = R13 950 million Share premium, treasury shares and reserves form part of the valuation for equity. Preference shares Preference shares should be included as part of long term financing and thus cost of capital (i.e. permanent) Cost of preference shares Nominal value of a preference share = R1,376.80 Dividend received in a year = 1,376.80 x 10.5% = R144.56 per share Market value of preference shares = R1,400 per share Thus, the required rate of return = 144.56/1400 = 10.33% Market value R1,400 x 1 million preference shares = R1,400 million Downloaded by Charlotte (niikondoci@gmail.com) lOMoARcPSD|17277542 Interest bearing borrowings Interest bearing borrowings should be included as part of long term financing and thus cost of capital (i.e. permanent) Cost of unsecured loan Cf0 = R500 million C01 = 0 F01 = 3 C02 = -R50 million F02 = 2 C03 = -R100 million F03 = 5 C04 = -R550 million F03 = 1 IRR = 9.83% x 72% = 7.08 Market value = R500 million Fixed Rate bonds Included in Cost of Capital as it is a long term source of finance. Cost of Fixed Rate bonds N= 16 P/Y = 2 FV = -R1,000 million PMT = -R60 million x 72% (After tax rate) PV = R1200 million I/Y = ? = 5.51% Market value = R1,200 million Note to marker: If the student worked with cash flows before tax, and converted the I/Y to an after tax- rate allocate 1 mark Downloaded by Charlotte (niikondoci@gmail.com) lOMoARcPSD|17277542 Finance lease Included in Cost of Capital as it is a long term source of finance. Market value = R31.6 million Cost of the finance lease = (10.5% +1%) x 72% = 8.28% Operating lease Arrears operating lease exposures do not form part of the long term financing structure of Woolworths (i.e. not permanent) there is also no interest charge associated with operating leases. Therefore it should not form part of cost of capital Deferred Tax Deferred tax will be set-off against deferred tax assets and therefore does not form part of the long term financing structure of Woolworths Therefore it should not form part of cost of capital Sundry creditors Sundry creditors does not form part of the long term financing structure of Woolworths (i.e. not permanent) Therefore it should not form part of cost of capital WACC calculation Instrument Ordinary shares Preference shares Unsecured Loan Bonds Finance lease R'm Market value 13 950.0 1 400.0 500.0 1 200.0 31.6 17 082 Percentage 81.67% 8.20% 2.93% 7.03% 0.18% 100.00% Cost 13.42% 10.33% 7.08% 5.51% 8.28% Total = 46 Marks Max = 40 Marks Downloaded by Charlotte (niikondoci@gmail.com) WACC 10.96% 0.85% 0.21% 0.39% 0.02% 12.42% Principle Principle Principle Principle Principle Principle lOMoARcPSD|17277542 Question 11 35 Marks The Sasol Group comprises diversified fuel, chemical and related manufacturing and marketing operations, complemented by interests in technology development and oil and gas exploration and production. Sasol Limited is currently listed on two stock exchanges (JSE and NYSE), and is subject to the disclosure rules and obligations imposed by these exchanges and their regulators (eg the SEC in the USA). As a listed company, Sasol communicates on an ongoing basis with stakeholders (eg. banks, institutional and retail investors, analysts, equities sales people, fund managers, ratings agencies etc), to ensure that the stakeholders understand Sasol's strategy, operations, performance and future prospects. Sasol's capital providers consist of both equity investors and lenders/debt providers (banks and Institutional investors lending to Sasol or investing in its issues of debt instruments such as local bonds, offshore bonds, commercial paper issues, project finance, loans and other credit facilities and convertible instruments). Sasol's financial year runs from 1 July to 30 June. The group reports on financial performance twice annually for interim and annual results. On 1 December 2009 Sasol approved an investment of R 8,4 billion which will double the Sasol Wax production of hard wax in South Africa. Sasol Wax would be a new division that would be started. "This large investment shows Sasol's commitment to the wax business and enables us to grow with our customers in this market," says Johan du Preez, managing director of Sasol Wax. To finance the new wax production for an amount of R8,4 billion, Sasol Wax planned to issue the following instruments on 1 July 2010: Shares The share price of each Sasol Wax was valued at R280. Sasol Wax planned to issue 15 million shares. In the previous financial year, Sasol declared a dividend of R11.50 per share. Sasol expects a stable average growth rate for the company of 7%. Marita McKrenzo, a professor in the department of finance was researching market behaviour and discovered that when the average market return declined by 15% in the recession, Sasol shares only declined by 8%. Downloaded by Charlotte (niikondoci@gmail.com) lOMoARcPSD|17277542 Her research also showed that the average market risk premium that investors were looking for was 7%. Debentures Sasol planned to issue 90 million debentures with a R24 par value. Each debenture was going to be issued at R25.20 per debenture. The terms of the debenture were as follows: Redemption date: 30 June 2018 Redemption value: Premium of 8% to nominal value. Coupon: 9% Payment period: Semi-annually on 31 December and 30 June until redemption date Non-participating Preference Shares Sasol Wax management were also planning to issue 50 million non-participating preference shares with a par value of R32 per share as “they said that a preference share allowed for additional financing without giving away any more ownership or decision-making powers, however will incentivize shareholders to invest as they will receive any unpaid accumulated dividend plus capital in case of liquidation,” said Johan Du Preez. The expected dividend for the preference share was 12% of nominal value. Each preference share is going to be issued at a price of R36.96. These shares are not redeemable. Bank Overdraft Sasol has a bank overdraft facility of R250 million. The current balance of the overdraft is R84 million. This balance has been maintained at this level for over ten years now and management said that they expect it will be maintained for the next ten years. Due to the size of Sasol, the Financial Director managed to negotiate an interest rate of prime plus 2 on the overdraft from the bank. The overdraft has been used in the financing of their assets. Current Liabilities The current liabilities balance was R20 million from normal trading. This is expected to be settled before the year is over. Additional information The tax rate is 28% The prime rate is 10.5% The R187 is currently trading with a return of 8.7% and is the basis for all Sasol trading. Sasol regards market values as their optimal capital structure. Downloaded by Charlotte (niikondoci@gmail.com) lOMoARcPSD|17277542 REQUIRED a) Explain in your own words what weighted average cost of capital is. b) Calculate the Weighted Average Cost of Capital for Sasol Wax division. (5) (30) __________________________________________________________________________ Question 11 Cost of Capital Suggested solution a) - The minimum return that a project must offer before it can be accepted. - It is the return rate that is required by capital suppliers. - The opportunity cost of investing in that project. - = Cost of equity + Cost of debt + Cost of preference shares. - It shows the risk of the company. - It is the weighted average cost of required returns of providers of long-term or permanent capital Available (6) Max (5) b) Weighted Average Cost of Capital Shares - Cost of Equity Re = Rf + b(Market premium) = 8.7% + 8%/15% (7%) = 12.43% Re = (D1 MV) + g = [(11.50 x 1.07)/ 280] + 0.07 = 11.40% Therefore Average Re = (12.43% + 11.40%) / 2 = 11.91%P MV = Number of shares x Price = 280 x 15 million shares = 4,2 billion Debentures P/yr = 2 PV = -25.20 FV = (24 x 1.08) = 25.92 PMT = (9% x 24)/2 x 72% = 0.778 N = 8 x 2 = 16 Therefore I/Yr = 6.45% MV = Number of shares x Price = 25.20 x 90 million = 2.268 billion Non – Participating Prefs Rp = Div / MV = (0.12 x 32) / 36.96 Downloaded by Charlotte (niikondoci@gmail.com) lOMoARcPSD|17277542 = 10.39% MV = Number of shares x Price = 36.96 x 50 million = 1,848 Bank Overdraft Rd = Prime + 2 = 10.5% + 2 = 12.5% x 72% = 9% MV = R84 million Shares Debentures Non-Participating Prefs Bank Overdraft Total MV 4,20 0 2,26 8 1,84 8 8 4 8,40 0 Ratio Cost WACC 50% 11.91% 5.96% P 27% 6.45% 1.74% P 22% 10% 2.29% P 1% 9% 0.09% P 10.08% P 100% Attention to marker: give the principle mark for each line if the logic of it makes sense Available (34) Max (30) Downloaded by Charlotte (niikondoci@gmail.com)