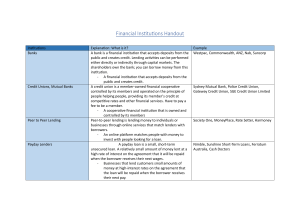

THEME 42. CREDIT RISK Plan: 1. The concept of credit risk. 2. Methods for assessing the risks of lending to legal entities. 3. Risk assessment of lending to individuals based on credit scoring. 4. Credit rating. 1. The concept of credit risk Traditionally, credit risk is defined as the risk that a debtor will not repay money in accordance with the terms and conditions of a loan agreement. There are different approaches to determining the essence of credit risk. So, for example, the concept of "credit risk" includes the danger of non-payment by the borrower of the principal and interest due to the creditor. Others associate the concept of credit risk with the profits received by banks: credit risk is a possible drop in a bank's profits and even the loss of part of the equity capital as a result of the inability of the borrower to repay and service the debt. This approach reflects only one side of the impact of credit risk on the bank's profit - negative, associated with the negative consequences of lending. At the same time, the outcome of a loan transaction can be positive, without excluding the presence of a certain level of risk throughout the term of the loan agreement. Credit risk is the probability that the value of the bank's assets, primarily loans, will decrease due to the inability or unwillingness of customers (borrower) to repay the debt or part of the debt, including interest due under the agreement. In its most general form, credit risk can be defined as the risk of losing assets as a result of a borrower's default on contractual obligations. Another definition of credit risk is based on the lender's uncertainty that the debtor will be able to meet its obligations in accordance with the terms and conditions of the loan agreement. It could also be proposed to understand credit risk as “the probability of complete or partial non-fulfillment by the borrower of the main conditions of the loan agreement”. The inability of the debtor to fulfill its obligations in accordance with the terms and conditions of the loan agreement may be caused by: the inability of the debtor to generate adequate future cash flow due to unforeseen adverse changes in the business, economic or political environment in which the borrower operates; uncertainty about the future value and quality (liquidity and the possibility of selling on the market) of collateral for an issued loan; crises in the business reputation of the borrower. Factors affecting the risk of each individual loan: appointment of a loan (to increase capital, to temporarily replenish funds, to form current assets, capital construction); 1 type of credit (consumer, mortgage, investment, payment, leasing); loan size (large, medium, small); loan term (short-term, medium-term, long-term); repayment procedure (as proceeds are received, one-time); sectoral affiliation (agro-industrial complex, industry, commerce); form of ownership (private, joint-stock);the size of the borrower (by the size of the authorized capital, by the amount of own funds); creditworthiness (in accordance with the rating score); the degree of relationship between the bank and the client (the presence of a current account in the bank, one-time relations); degree of awareness of the bank about the client; methods of security (collateral, guarantees, guarantees). Table 1 shows the classification of credit risks. Table 1 Classification of credit risks 1 1 No. Criteria classification Types of credit risks 1. Level of risk risks at the macro level of relations (external); risks at the micro level of relations (internal). 2. The degree of risk independent of the activities of the credit institution; dependence on the dependent on the activities of a credit institution. bank 3. Sectoral focus of industrial; trade; agricultural, etc. lending 4. Scale of lending complex risk; private risk 5. Loan types risks by subjects, objects, terms, security 6. Loan structure risks at the provision stage; use of the loan by the borrower; release of resources needed to pay off the debt; loan repayment 7. Acceptance stage solutions risks at the preliminary stage of lending, the subsequent stage of lending Prepared on the basis of materials of Internet-sites 2 8. Degree acceptance of 9. Sphere occurrence of 10. Type of borrower minimal, elevated, critical, invalid. borrower risk, loan product risk, risk of changes in the external environment of the bank and the borrower country risk, corporate lending risk, retail lending risk The nature of the 11. manifestation of moral, business, financial risks, collateral risk risk risks arising from loan, leasing, factoring transactions, as well as the provision of bank 12. Type of operation guarantees and guarantees, the conclusion of transactions using promissory notes Nature of actions of the risk of the borrower's refusal to pay interest and 13. the (or) principal; misuse of the loan; obstruction of borrower bank control Basic principles of credit risk management in commercial banks: compliance with the credit policy developed by the bank; accounting for external and internal factors when the bank conducts credit operations; continuity of the nature of managerial decision-making; risk control; availability of a clear methodology for managing credit risks. 2. Methods for assessing the risks of lending to legal entities. The work on assessing credit risk in a bank is carried out in the following three main stages At the first stage, the quality indicators of the borrower's activity are assessed. To this end, the bank examines the reputation of the borrower; determines the purpose of the loan and the sources of repayment of the principal debt and interest due; assesses the borrower's risks assumed by the bank indirectly. At the second stage, quantitative indicators are evaluated, i.e. calculation of financial ratios, analysis of the borrower's cash flows, and assessment of business risk. At the final stage, a summary assessment-forecast and the formation of the final analytical conclusion are made. What is Altman’s Z-Score Model? 3 Altman’s Z-Score model is a numerical measurement that is used to predict the chances of a business going bankrupt in the next two years. The model was developed by American finance professor Edward Altman in 1968 as a measure of the financial stability of companies. Altman’s Z-score model is considered an effective method of predicting the state of financial distress of any organization by using multiple balance sheet values and corporate income. Altman’s idea of developing a formula for predicting bankruptcy started at the time of the Great Depression, when businesses experienced a sharp rise in incidences of default. Altman’s Z-Score Model Explained The Z-score model was introduced as a way of predicting the probability that a company would collapse in the next two years. The model proved to be an accurate method for predicting bankruptcy on several occasions. According to studies, the model showed an accuracy of 72% in predicting bankruptcy two years before it occurred, and it returned a false positive of 6%. The false-positive level was lower compared to the 15% to 20% false-positive returned when the model was used to predict bankruptcy one year before it occurred. When creating the Z-score model, Altman used a weighting system alongside other ratios that predicted the chances of a company going bankrupt. In total, Altman created three different Z-scores for different types of businesses. The original model was released in 1968, and it was specifically designed for public manufacturing companies with assets in excess of $1 million. The original model excluded private companies and non-manufacturing companies with assets less than $1 million. Later in 1983, Altman developed two other models for use with smaller private manufacturing companies. Model A Z-score was developed specifically for private manufacturing companies, while Model B was created for non-publicly traded companies. The 1983 Z-score models comprised varied weighting, predictability scoring systems, and variables. Altman’s Z-Score Model Formula The Z-score model is based on five key financial ratios, and it relies on the information contained in the financial statements. It increases the model’s accuracy when measuring the financial health of a company and its probability of going bankrupt. The Altman’s Z-score formula is written as follows: ζ = 1.2A + 1.4B + 3.3C + 0.6D + 1.0E Where: Zeta (ζ) is the Altman’s Z-score A is the Working Capital/Total Assets ratio B is the Retained Earnings/Total Assets ratio C is the Earnings Before Interest and Tax/Total Assets ratio D is the Market Value of Equity/Total Liabilities ratio 4 E is the Total Sales/Total Assets ratio What Z-Scores Mean Usually, the lower the Z-score, the higher the odds that a company is heading for bankruptcy. A Z-score that is lower than 1.8 means that the company is in financial distress and with a high probability of going bankrupt. On the other hand, a score of 3 and above means that the company is in a safe zone and is unlikely to file for bankruptcy. A score of between 1.8 and 3 means that the company is in a grey area and with a moderate chance of filing for bankruptcy. Investors use Altman’s Z-score to make a decision on whether to buy or sell a company’s stock, depending on the assessed financial strength. If a company shows a Z-score closer to 3, investors may consider purchasing the company’s stock since there is minimal risk of the business going bankrupt in the next two years. However, if a company shows a Z-score closer to 1.8, the investors may consider selling the company’s stock to avoid losing their investments since the score implies a high probability of going bankrupt. The Five Financial Ratios in Z-Score Explained The following are the key financial ratios that make up the Z-score model: 1. Working Capital/Total Assets Working capital is the difference between the current assets of a company and its current liabilities. The value of a company’s working capital determines its short-term financial health. A positive working capital means that a company can meet its short-term financial obligations and still make funds available to invest and grow. In contrast, negative working capital means that a company will struggle to meet its short-term financial obligations because there are inadequate current assets. 2. Retained Earnings/Total Assets The retained earnings/total assets ratio shows the amount of retained earnings or losses in a company. If a company reports a low retained earnings to total assets ratio, it means that it is financing its expenditure using borrowed funds rather than funds from its retained earnings. It increases the probability of a company going bankrupt. On the other hand, a high retained earnings to total assets ratio shows that a company uses its retained earnings to fund capital expenditure. It shows that the company achieved profitability over the years, and it does not need to rely on borrowings. 3. Earnings Before Interest and Tax/Total Assets EBIT, a measure of a company’s profitability, refers to the ability of a company to generate profits solely from its operations. The EBIT/Total Assets ratio demonstrates a company’s ability to generate enough revenues to stay profitable and fund ongoing operations and make debt payments. 4. Market Value of Equity/Total Liabilities The market value, also known as market capitalization, is the value of a 5 company’s equity. It is obtained by multiplying the number of outstanding shares by the current price of stocks. The market value of the equity/total liabilities ratio shows the degree to which a company’s market value would decline when it declares bankruptcy before the value of liabilities exceeds the value of assets on the balance sheet. A high market value of equity to total liabilities ratio can be interpreted to mean high investor confidence in the company’s financial strength. 5. Sales/Total Assets The sales to total assets ratio shows how efficiently the management uses assets to generate revenues vis-à-vis the competition. A high sales to total assets ratio is translated to mean that the management requires a small investment to generate sales, which increases the overall profitability of the company. In contrast, a low or falling sales to total assets ratio means that the management will need to use more resources to generate enough sales, which will reduce the company’s profitability. Parser method. As a borrower carefully consider the following: The Lending Manager’s task is the MANAGEMENT OF RISK and to be successful at this he needs to be conversant with certain principles which can best be remembered by the mnemonic PARSER. There are very few ideal propositions and as a result it is a matter of judgement whether funds can be safely and profitably lent. The Lending Manager’s function in this respect is To identify in what ways any proposition falls short of ideal To establish what the risks are and whether they are acceptable to the Bank If acceptable, to structure the borrowing in such a way as to minimise that risk and negotiate an acceptable reward in return. Whether the funds are to be advanced by short, medium or long term financer or through equity capital or export finance the general principles stay the same. P = PERSONALITY CHARACTER – Who is the borrower? How long has he been a customer? What is his background? Is he a man of integrity and reliability? COMPETENCE – What is his record? Has he the management, accounting and technical skills? What is his experience in the particular field for which the finance is required? What is the strength of the management team? CAPACITY – Has he the energy for hard work to use the advance and make sufficient profit to ensure repayment? What is the condition of existing resources? Are they adequate? Are there any constraints of an economic, legal or local nature? What are market conditions? Has he put together a business plan? Has he taken advice or had training? A = AMOUNT & PURPOSE AMOUNT – How much is required? Is it sufficient or too much? Is the proposition supported by a cash flow forecast and accurate costings? Has 6 allowance been made for increased working capital requirements? Is the proprietor’s stake acceptable? PURPOSE- What is the reason for the advance? Is it suitable as a banking proposal? How should the borrowing be structured? Is a ‘Group’ package worth considering? Is it a new venture? R = REPAYMENT SOURCE – Where is repayment to come from? income? sale of assets? profits? Is it reliable and reasonably certain? Do we have a profit and/or cash forecast? Is there a secondary source of repayment as a ‘back-up’? WHEN – Have repayments been fully appraised and related to existing and future commitments? Are repayment proposals realistic or optimistic? IF THE P, A AND R ARE NOT ACCEPTABLE – GO NO FURTHER S = SECURITY SECURITY – Unsecured advances are the exception rather than the rule. No amount of security will make a bad proposition good. Balance risk with reward. APPROPRIATE– Is the security appropriate to the advance and to the structure of the business? Is it easily valued, readily realisable and of stable or increasing value? Is it properly valued? COMPLETION – It is essential that security is completed or perfection can be finalised without further recourse to borrower before advance is made. Suitable Insurance cover should be completed when appropriate. E = EXPEDIENCY PERSPECTIVE – There are occasions when the principles of good lending are breached in favour of expediency, but this should be kept in the right perspective. To be fully – OBJECTIVE, consideration of this factor should be ignored and in any event expediency should not lead us to lend unwisely and unsafely. R = REMUNERATION TERMS – need to be negotiated from the outset with provision for periodic review if considered necessary. MAY VARY – in the light of economic conditions and the market place in which we operate. RISK – The REWARD should relate to the RISK entailed and the customer AFFORD to borrow without impediment to his repayment programme. CAMPARI METHOD Bank loans are an important source of funding for any business, helping to fulfil orders, employ staff or finance patent protection applications. This guide uses a handy acronym to help you fully prepare for a loan application and maximise your chances of receiving capital. THE CAMPARI METHOD STANDS FOR Character Ability Means 7 Purpose Amount Repayment Insurance The principles it outlines are used by banks and investors worldwide. It’s an easy way of making sure that you are fully prepared when you apply for any business finance – maximising your chance of securing the funds you need. We will take you through each part of this process and explain what each letter means. CHARACTER Banks take a gamble when providing loans. The more confidence they have in your ability to deliver, the more likely you are to receive the capital you require. Naturally, presentation is very important. Dress and act like a professional and don’t be late. Interact well with your bank manager and show you are a capable business leader. Be willing to show evidence of a good trading history and the ability to provide quality services to customers while making a profit. ABILITY You must be unequivocal when telling the bank what you need the capital for and how you’ll be able to afford the repayments. There is no room for ambiguity. Many applications fail because the entrepreneur does not directly and clearly show how a profit will be made on the initial capital; bank managers cannot clearly see how they will get the money back and therefore consider the application to be too risky. When presenting your case, it must be obvious how you’ll repay the loan; use illustrations or bring in an accountant if necessary. MEANS Your business plan must be logical, display knowledge of your industry and target markets and be professionally presented. Business plans are important variables in whether a firm succeeds or fails; bank managers will be very keen to see your business plan is viable and can produce a return. Make sure yours is watertight; ask a professional to help you if required. Additionally, ensure your business model is solid. If your business model is poorly monetised, irrational or hard to make sense of, this is going to dent your chances of getting a loan. PURPOSE You must clearly show why you need the money and how you’re going to use it. There needs to be a good business case for the capital rather than simply because your business will benefit from increased revenue. Some examples are: You have an order that needs fulfilling but there’s not enough liquidity in the business to do so You need a specific piece of machinery in order to expand your range of products and services Whatever the reason for the loan, you need to show that it’s a good reason, and one that will generate a return. AMOUNT Bank managers want to know why you need the amount you’re asking for. In 8 specific detail, you need to show precisely what the money will be spent on. This is more than about telling the bank manager the purpose of the loan. You need to explain how you’ve arrived at the figure you’re requesting and how it’s going to be spent. REPAYMENT Bank managers must be confident you’ll meet repayment terms, or your application will get rejected. Be prepared to show substantial documentation relating to profit margins, cashflow forecasts and other key financial information. Bring your accountant or consult them in advance of the appointment if you’re unsure. Don’t exaggerate forecasts or profit margins. If your loan is secured, you may lose your property or business assets if repayment terms are not adhered to. INSURANCE Ensure you’ve taken steps to protect yourself should things go worse than expected. You’ll need a backup plan to ensure you can still pay off the loan should you receive a less than satisfactory return. Take out adequate insurance where need be and take steps to diversify revenue streams to ensure you’ll still be making a profit should the loan capital fail to make a return. INFORMED FUNDING Workspace are proud to partner with informed Funding (iF) who frequently offer free conferences, seminars and one-to-one financial consultations for our customers. They work both on and offline to help businesses identify financing issues and raise the funds they need. 3. Risk assessment of lending to individuals based on credit scoring Credit scoring is a method of separating groups of potential borrower clients in the context of the availability of information not about the parameters separating these groups, but only about some secondary variables. The idea of separating groups according to secondary characteristics was first proposed in 1936 by R.A. Fisher, who introduced a method for determining varieties of iris by measuring the size of plant parts, and a few years later the idea to use a similar approach to identify borrowers with a high and low probability of default was put forward by D. Duran. Durand's scoring model D. Duran singled out a group of factors that, in his opinion, make it possible to determine with sufficient certainty the degree of credit risk when providing a consumer loan to a particular borrower. He used the following coefficients in scoring: age: 0.1 points for each year over 20 years old (maximum 0.30); sex: women - 0.40, men - 0; length of residence: 0.042 for each year of residence in the area (maximum 0.42); occupation: 0.55 for a low-risk occupation, 0 for a high-risk occupation, and 9 0.16 for other occupations; work in the industry: 0.21 - public utilities, government agencies, banks and brokerage firms; employment: 0.059 - for each year of work at this enterprise (maximum 0.59 points); financial indicators: 0.45 for having a bank account, 0.35 for owning real estate, 0.19 for having a life insurance policy. Applying these coefficients, D. Duran determined the boundary separating "good" and "bad" customers - 1.25 points. A client who scored more than 1.25 points was considered creditworthy, and a client who scored less than 1.25 was considered undesirable for the bank. Thus, the scoring method allows for an express analysis of a loan application. What Is a Credit Score? A credit score is a number from 300 to 850 that rates a consumer’s creditworthiness. The higher the score, the better a borrower looks to potential lenders. A credit score is based on credit history: number of open accounts, total levels of debt, repayment history, and other factors. Lenders use credit scores to evaluate the probability that an individual will repay loans in a timely manner. There are several different credit bureaus in the United States, but only three that are of major national significance: Equifax, Experian, and TransUnion. This trio dominates the market for collecting, analyzing, and disbursing information about consumers in the credit markets. The credit score model was created by the Fair Isaac Corp., now known as FICO, and is used by financial institutions. While other credit scoring systems exist, the FICO Score is by far the most commonly used. There are a number of ways to improve an individual’s score, including repaying loans on time and keeping debt low. How Credit Scores Work A credit score can significantly affect your financial life. It plays a key role in a lender’s decision to offer you credit. For example, people with credit scores below 640 are generally considered to be subprime borrowers. Lending institutions often charge interest on subprime mortgages at a rate higher than a conventional mortgage to compensate themselves for carrying more risk. They may also require a shorter repayment term or a co-signer for borrowers with a low credit score. Conversely, a credit score of 700 or higher is generally considered good and may result in a borrower receiving a lower interest rate, which results in their paying less money in interest over the life of the loan. Scores greater than 800 are considered excellent. While every creditor defines its own ranges for credit scores, the average FICO Score range is often used. Excellent: 800–850 Very Good: 740–799 Good: 670–739 Fair: 580–669 10 Poor: 300–579 A person’s credit score also may determine the size of an initial deposit required to obtain a smartphone, cable service, or utilities, or to rent an apartment. And lenders frequently review borrowers’ scores, especially when deciding whether to change an interest rate or credit limit on a credit card. Credit Score Factors: How Your Score Is Calculated The three major credit reporting agencies in the U.S. (Equifax, Experian, and TransUnion) report, update, and store consumers’ credit histories. While there can be differences in the information collected by the three credit bureaus, five main factors are evaluated when calculating a credit score: Payment history Total amount owed Length of credit history Types of credit New credit 4. Credit rating A credit rating is an integral assessment of the financial stability and solvency of a country, a borrower or a particular loan product. Credit ratings are usually issued and published by specialized rating agencies, the most famous of which are Standard & Poor's, Moody's, FitchRatings. The rating expresses the agency's opinion on the future ability and intention of the borrower to make payments to creditors in repayment of principal and interest on it in a timely manner and in full. Each agency applies its own methodology for assessing creditworthiness and expresses the result of this measurement using a special rating scale. Typically, an alphabetic scale is used, which allows you to show ratings that reflect the agency's opinion on the relative level of credit risk in the range, for example, from AAA to D. The credit rating scale is usually divided into two ranges: investment quality (rating not lower than BBB on the S&P scale) and speculative quality (rating is lower than investment quality). What Is a Sovereign Credit Rating? A sovereign credit rating is an independent assessment of the creditworthiness of a country or sovereign entity. Sovereign credit ratings can give investors insights into the level of risk associated with investing in the debt of a particular country, including any political risk. At the request of the country, a credit rating agency will evaluate its economic and political environment to assign it a rating. Obtaining a good sovereign credit rating is usually essential for developing countries that want access to funding in international bond markets. Understanding Sovereign Credit Ratings In addition to issuing bonds in external debt markets, another common 11 motivation for countries to obtain a sovereign credit rating is to attract foreign direct investment (FDI). Many countries seek ratings from the largest and most prominent credit rating agencies to encourage investor confidence. Standard & Poor's, Moody's, and Fitch Ratings are the three most influential agencies. Other well-known credit rating agencies include China Chengxin International Credit Rating Company, Dagong Global Credit Rating, DBRS, and Japan Credit Rating Agency (JCR). Subdivisions of countries sometimes issue their own sovereign bonds, which also require ratings. However, many agencies exclude smaller areas, such as a country's regions, provinces, or municipalities. Investors use sovereign credit ratings as a way to assess the riskiness of a particular country's bonds. Sovereign credit risk, which is reflected in sovereign credit ratings, represents the likelihood that a government might be unable—or unwilling—to meet its debt obligations in the future. Several key factors come into play in deciding how risky it might be to invest in a particular country or region. They include its debt service ratio, growth in its domestic money supply, its import ratio, and the variance of its export revenue. Many countries faced growing sovereign credit risk after the 2008 financial crisis, stirring global discussions about having to bail out entire nations. At the same time, some countries accused the credit rating agencies of being too quick to downgrade their debt. The agencies were also criticized for following an "issuer pays" model, in which nations pay the agencies to rate them. These potential conflicts of interest would not occur if investors paid for the ratings. Examples of Sovereign Credit Ratings Standard & Poor's gives a BBB- or higher rating to countries it considers investment grade, and grades of BB+ or lower are deemed to be speculative or "junk" grade. S&P gave Argentina a CCC- grade in 2019, while Chile maintained an A+ rating. Fitch has a similar system. Moody’s considers a Baa3 or higher rating to be of investment grade, and a rating of Ba1 and below is speculative. Greece received a B1 rating from Moody's in 2019, while Italy had a rating of Baa3. In addition to their letter-grade ratings, all three of these agencies also provide a one-word assessment of each country's current economic outlook: positive, negative, or stable. 12