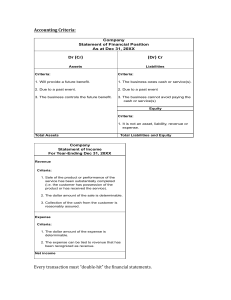

Accounting Criteria: Company Statement of Financial Position As at Dec 31, 20XX Dr#(Cr) (Dr)#Cr Assets Liabilities Criteria: Criteria: 1. Will provide a future benefit. 1. The business owes cash or service(s). 2. Due to a past event. 2. Due to a past event 3. The business controls the future benefit. 3. The business cannot avoid paying the cash or service(s) Equity Criteria: 1. It is not an asset, liability, revenue or expense. Total Assets Total Liabilities and Equity Company Statement of Income For Year-Ending Dec 31, 20XX Revenue Criteria: 1. Sale of the product or performance of the service has been substantially completed (i.e. the customer has possession of the product or has received the service). 2. The dollar amount of the sale is determinable. 3. Collection of the cash from the customer is reasonably assured. Expense Criteria: 1. The dollar amount of the expense is determinable. 2. The expense can be tied to revenue that has been recognized as revenue. Net income Every transaction must “double-hit” the financial statements. Accounting Rules: Expenses)3)Salaries,)Rent,)Utilities,)Advertising,)Property)Tax) ) • If#the#benefit#is#realized#by#the#business#within#the#month#of#the#expense# being#paid#for,#then#the#amount#paid#is#recorded#as#an#expense#on#the#income# statement.# • As#noted#below,#a#business#will#not#know#for#sure#when#inventory#will#be# sold,#therefore#inventory#is#always#recorded#as#an#asset#first,#even#if#the# business#plans#to#sell#it#within#the#month.### ) PP&E)333!)Depreciation:) ) • Each#time#a#business#purchases#a#piece#of#property,#plant#or#equipment# (PP&E)#it#will#be#put#on#the#balance#sheet#as#an#asset#at#a#value#equal#to#the# cost#of#acquiring#it.# # • At#yearDend#a#portion#of#the#PP&E#will#be#expensed#each#year#as#depreciation# on#the#income#statement#to#match#the#revenue#it#generated.# # • Trigger#point#for#becoming#an#expense#–#YearDend# # Inventory)333!)COGS) ) • Each#time#a#piece#of#inventory#is#purchased#it#will#be#put#on#the#balance#sheet# as#an#asset#at#a#value#equal#to#the#cost#of#acquiring#it.# # • When#the#inventory#is#sold#(i.e.#each#time#a#unit#is#sold),#the#portion#of# inventory#sold#will#be#expensed#as#COGS#on#the#income#statement#to#match# the#revenue#it#generated.## # • Trigger#point#for#becoming#an#expense#–#When#inventory#is#sold# # Prepaids)333!)Expenses) ) • Each#time#a#business#pays#in#advance#for#an#expense#that#they#will#not#realize# the#benefit#for#till#a#timeframe#greater#than#30#days#(i.e.#the#next#month),#the# prepaid#purchased#will#be#put#on#the#balance#sheet#as#an#asset#at#a#value# equal#to#the#cost#of#what#was#paid.### # • Once#the#period#lapses#in#which#the#business#will#benefit#from#the#prepaid,# the#portion#of#the#prepaid#that#lapses#will#be#expensed#as#an#“expense”# (depending#on#what#was#prepaid#for)#on#the#income#statement#to#match#the# revenue#it#generated.# # • Trigger#Point#–#Usually#month#or#yearDend.# )