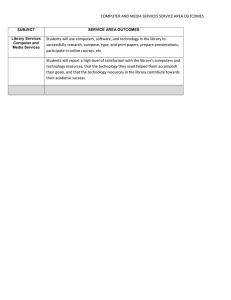

See discussions, stats, and author profiles for this publication at: https://www.researchgate.net/publication/313967372 The Service‐Profit Chain Chapter · January 2015 DOI: 10.1002/9781118785317.weom090241 CITATIONS READS 2 21,960 1 author: Christine Ennew The University of Warwick 165 PUBLICATIONS 8,682 CITATIONS SEE PROFILE Some of the authors of this publication are also working on these related projects: Trust and Fairness in Financial Services: Antecedents and Consequences View project Conceptualizing and validating resource recombination in context of higher educational institution competitiveness View project All content following this page was uploaded by Christine Ennew on 04 January 2018. The user has requested enhancement of the downloaded file. Wiley Encyclopedia of Management Volume 9 (1-4) - Marketing The Service Profit Chain Christine T Ennew, University of Nottingham Malaysia Campus Published online – Jan 2015 Abstract The Service-Profit Chain explains in detail how one of the most basic principles of marketing works in a service context; specifically, it outlines a sequence of causal links which demonstrate how employee satisfaction contributes to service quality and customer satisfaction and how they in turn can influence revenue and profit. In essence, the service profit chain highlights the important links between how an organisation manages itself internally, the impact of this on the experience of customers and the benefits in terms of organisational performance. Keywords Service-profit chain, employee satisfaction, customer satisfaction Main text In very simple terms, the foundational premise of marketing is that organisational performance can be enhanced by a focus on satisfying customer needs and wants. The Service-Profit Chain explains in detail how this premise works in a service context; specifically, it outlines a sequence of causal links which demonstrate how the management of employees internally impacts on the service delivered to customers, on customer satisfaction and ultimately on financial performance. The concept was originally introduced in a paper by James Heskett and colleagues, published in Harvard Business Review in 1994. This paper subsequently gave rise to a book in 1997 and was then republished in 2008 under the title “Best of HBR”. The logic that underlies the service-profit chain is intuitive and compelling – look after your employees, they will look after your customers and those satisfied customers will deliver better revenue. It is a concept that has secured widespread adoption among educators, researchers, managers and consultants. Google records in excess of 1.2million references to the service profit chain and publications databases such as ABI/Inform and Business Source Premier report in excess of 1400 and 600 articles respectively on the subject. The original conceptualisation of the service profit chain (SPC) as developed by Heskett et al (1994, 2008) is outlined in Figure 1. This model starts with internal service quality which refers to the extent to which an organisation is able to deliver to its employees the kind of quality support that will enable them to service customers effectively. Included in the general concept of internal service quality would be factors such as job design, working environment, reward systems, training and support systems. A high level of internal service quality will result in higher levels of employee satisfaction, productivity and retention. Employees who are satisfied in their job and well motivated will deliver a high quality service to customers. This high quality is the foundation for delivering enhanced service value. In turn, value leads to increased levels of customer satisfaction and retention. Given the economics of customer retention, improved revenues and profit are the expected consequences. In essence, the service profit chain highlights the important links between how an organisation manages itself internally, the impact of this on the experience of customers and the benefits in terms of organisational performance. Figure 1 A particular feature of this model is that there are very clear managerial interventions internally that can be used to address problems with customer experiences and ultimately with organisational profitability. Arguably this is one of the reasons why the SPC has proved to be so popular with consultants and managers. Indeed, when Heskett et al (1994) first introduced the concept of the SPC, they described the effective use of its key principles by organisations as diverse as South West Airlines, Xerox and Taco Bell. One widely cited example of the SPC in action comes from the experience of Sears in the mid 1990s. Rucci, Kirn and Quinn (1998) describe how senior managers at the company employed an “employee-customer profit model” to engineer a dramatic turnaround in the fortunes of one of the US’s most iconic retailers. And while the simplicity of the underlying SPC model as used by Sears is clear, the authors highlight the very real challenges associated with: understanding the drivers of employee and customer satisfaction, being able to measure and manage those drivers and securing managerial engagement with the process. Systematic research to test the SPC model has proved difficult because of the complexities of measurement and data collection. One of the first and most comprehensive studies was undertaken in relation to retail banking in the US. Loveman, (1998) used secondary, branch level data and found that internally, reward systems, the organisation’s customer focus and the quality of management had a positive impact on employee satisfaction. There was limited evidence for a link between employee satisfaction and loyalty and the relationship between employee satisfaction and customer satisfaction was weak. Customer satisfaction had a positive impact on loyalty which in turn was found to have an impact on financial performance. Kamakura et al (2002) also used bank data – this time from Brazil – to evaluate the whole SPC. They combined information from individual customers with branch level data to estimate the entire chain for the bank as a whole and to provide efficiency benchmarking at individual branch level. The model for the bank as a whole suggested that all estimated links in the SPC were significant. In a particularly comprehensive test of SPC, Larivière, (2008) used data from a financial services provider to demonstrate links between customer metrics (satisfaction, quality, share of wallet) and performance metrics (retention and profitability). Longitudinal testing highlighted the potential complexity of some of the relationships including non-linearity over time and variations in strength across segments and over time. Evidence from other contexts has been less supportive. In the case of a leading UK grocery retailer, Silvestro and Cross (2000) noted that store profitability tended to be negatively rather than positively correlated with employee satisfaction, although they did find evidence to support the customer dimensions of the SPC. Similarly using data from a major UK home improvement store, Pritchard and Silvestro (2005) also noted the absence of any substantial link between employee and customer satisfaction. In the case of UK and Irish Banks, Gelade and Young (2005) find only weak evidence to suggest that customer satisfaction mediates the relationship between employee attitudes and revenues. More recently, Homburg et al (2009) have argued that the conventional SPC needs further development, not least because the potential for customer satisfaction to impact significantly on loyalty is becoming increasingly limited as customer expectations increase on the back of past positive experiences. Organisations need to look for other mechanisms to improve loyalty and Homburg et al (2009) propose the use of social identity theory. They estimate an SPC model for German travel agencies and include as additional constructs employee-company and customer-company identification. The results suggest only weak support for the traditional SPC paths but much stronger support for the identity based paths. Milliaman and Ferguson (2008) also propose an augmentation to the traditional SPC model but their focus is on the employee component. Reporting on a case study of a nonprofit organization, they highlight the importance of expanding the focus on internal service quality to encompass a broader range of supportive services and programs to help employees deal with personal issues which might impact on work performance. The evidence to support individual links within the SPC is more compelling (see Johnson and Chiagouris,(2006) for a brief review). During the late 1980s and the 1990s, a range of studies provided evidence for the links between quality, satisfaction, loyalty, and word-of-mouth. Cronin and Taylor (1992) provided some of the earliest evidence concerning the relationship between quality and satisfaction; other studies have demonstrated that the link between customer satisfaction and customer loyalty is positive (eg, Anderson and Sullivan, 1992) as is the link between service quality and customer loyalty (Zeithaml, et al, 1996, Ennew and Binks, 1996). And there are a growing number of studies which demonstrate the link between the employee experience and customer satisfaction (see for example Malhotra and Mukherjee, 2004) Links between loyalty and profitability have been much more difficult to demonstrate because of the difficulties associated with relating constructs measured at the individual level (satisfaction/loyalty) with constructs measured at the organisational level (profit). However the development of customer satisfaction indices such as the American Consumer Satisfaction index (ACSI) has resulted in a number of empirical studies that have been able to demonstrate the link between an aggregate measure of satisfaction and organisational profitability (see for example Itter and Larckner, 1998). Notwithstanding the array of evidence to support the SPC and the relationships it encompasses, there are dissenting voices. There is a generic concern that the model itself does not explicitly address issues relating to the cost of quality and that it focuses more on revenue than profit. A further issue is that retention may be behavioural rather than attitudinal and thus a reflection of inertia rather than positive attachment (see for example Colgate and Lang (2001). It has also been argued that satisfaction alone is not sufficient and that what really creates loyalty is customer ‘delight’, an issue which has subsequently been addressed by Homburg et al (2009). Others have questioned the financial value of loyalty in a service profit chain context, and it has been argued that many loyal customers may not be profitable and many profitable customers may not be loyal (Reinartz and Kumar, 2002). SPC is a model which tries to represent in a parsimonious fashion the complex chain of causality that runs from managerial decisions, via employee responses and consumer experiences through to financial performance. There is some evidence to support the operation of the entire chain in certain contexts; there is more evidence to support the existence of key individual links. Inevitably the process of simplifying a complex set of relationships means that researchers will identify gaps and failings with the model and that very process has seen the SPC model being developed and refined while remaining fundamentally a way of trying to explain, in the context of service industries, how the management of employees can deliver a positive customer experience and thereby improve organizational performance. Figure 1: The Links in in the Service Profit Chain Source: Heskett et al (1994, 2008) References Anderson, E.W and M.W. Sullivan (1993), "The Antecedents and Consequences of Customer Satisfaction for Firms", Marketing Science, (Vol. 12 Spring), 125-143 Colgate, M and Lang, B (2001) Switching barriers in consumer markets: an investigation of the financial services industry Journal of Consumer Marketing; Volume 18 No. 4; 2001 Cronin, J J & Taylor, S A (1992) "Measuring Service Quality: A Re-Examination And Extension", Journal of Marketing, 56, July, p.55-68 Ennew, C T and Binks, M (1996b) 'The Impact of Service Quality and Service Characteristics on Customer Retention: Small Businesses and their Banks in the UK', British Journal of Management vol 7 (3) pp 219-230 Gelade, G. A., & Young, S. (2005). Test of a service profit chain model in the retail banking sector. Journal of Occupational and Organizational Psychology, 78(09631798), 1-22. Heskett, J. L., Jones, T. O., Loveman, G. W., Sasser, J., & Schlesinger, L. A. (1994). Putting the Service-Profit Chain to Work. Harvard Business Review, 72(2), 164-170. Heskett, J. L., Jones, T. O., Loveman, G. W., Sasser, J., & Schlesinger, L. A. (2008). Putting the Service-Profit Chain to Work. Harvard Business Review, 86(7/8), 118-129. (Best of HBR) Homburg, C., J. Wieseke, et al. (2009). "Social Identity and the Service–Profit Chain." Journal of Marketing 73(2): 38-54. Ittner, C and Larcker, D F (1998)”Are non-financial measures leading indicators of financial performance? An analysis of customer satisfaction”, Journal of Accounting Research, vol 36 pp 1-35 Johnson, W. C. and L. G. Chiagouris (2006). "So Happy Together." Marketing Management, vol15(2): 47-49. Kamakura, W. A., Mittal, V., & de Rosa, F. (2002). Assessing the service-profit chain. Marketing Science, 21(3), 294-317. Lariviere, B. (2008). "Linking Perceptual and Behavioral Customer Metrics to Multiperiod Customer Profitability: A Comprehensive Service-Profit Chain Application." Journal of Service Research vol 11(1): 3. Loveman, G. W. (1998) ‘Employee satisfaction, customer loyalty and financial performance’, Journal of Service Research, Vol. 1, No. 1, pp. 18–31. Malhotra, N., & Mukherjee, A. (2004). The relative influence of organisational commitment and job satisfaction and job satisfaction on service quality of customer-contact employees in banking call centres. The Journal of Services Marketing, 18(2), 162-174. Milliman, J. F., J. M. Ferguson, et al. (2008). "Breaking the Cycle." Marketing Management, vol 17(2): 14-17 Pritchard, M., & Silvestro, R. (2005). Applying the service profit chain to analyse retail performance: The case of the managerial strait-jacket? Journal of Service Management, 16(3), 337-356. Reinartz, W and Kumar, V (2002) The Mismanagement of Customer Loyalty,.Harvard Business Review, Vol. 80 Issue 7, p86, 9p Rucci, A. J., Kirn, S. P. and Quinn, R. T. (1998) ‘The employee-customer profit chain at Sears’, Harvard Business Review, Vol. 76, No. 1, pp. 83–97. Silvestro, R., & Cross, S. (2000). Applying the service profit chain in a retail environment challenging the "satisfaction mirror". Journal of Service Management, 11(3), 244-268. Zeithaml, V. A., Berry, L. L. and Parasuraman, A. (1996) ‘The behavioural consequences of service quality’, Journal of Marketing, Vol. 60, (April) pp. 31–46. View publication stats