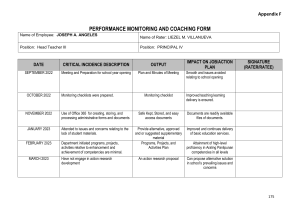

FINC 3306 INVESTMENTS SECTION 2 SEMESTER 1, 2022/2023 STOCK SIMULATION STUDENT’S NAME: SHARIFAH NUR HUSNA ALEZA BINTI SYED ALWI MATRIC NO.: 2010708 INSTRUCTOR’S NAME: DR. AZNIZA HARTINI BT AZRAI AZAIMI AMBROSE DATE OF SUBMISSION: 9 JANUARY 2023 1 1. PORTFOLIO 2. WATCHLIST 2 I. II. I analyzed these stocks because they had positive 1-Day Change and % Change. I chose to put Gamuda Bhd on my watchlist because based on Kenanga Research, Gamuda guided for a profit before tax margin of mid-to-high single-digit which is consistent with their assumption of 9%. The research firm believes Gamuda's third Australian job has further boosted its stature as an international contractor. It also mentioned, Kenanga Research has maintained its 'outperform' call on the company with a target price of RM5.15. III. I felt more comfortable adding APB Resources to my watchlist after reading an analysis on Simply Wall ST. The impressive earnings report from APB Resources Berhad (KLSE:APB) was rewarded with an increase in the stock price, claims Simply Wall ST. They conducted some research and discovered a lot of characteristics that are advantageous outside the profit figures. The analysis shows that APB can be undervalued. IV. All of the stocks in my watchlist are shariah compliance. I analyzed it to practice receiving a shariah compliance passive income 3 3. I. TRADING ACTIVITY I decided to buy Mega First Corporation based on my analysis on the screener with analyst recommendation of “buy”, it recommended buying Mega First Corp’s stock at RM3.33 as of 3rd January 2023. 4 II. On 4th January I sold 100 shares from AAX for RM0.61 per share because I have already made a decent return on it. Equally, I decided to sell out completely when I’m happy with my returns so far and believe that another firm would reap an even bigger profit. III. I purchased shares of Maxis since it is a technology company that recently asked its shareholders for approval to enter into a 5G access deal with Digital Nasional Bhd (DNB). The firm is focused on launching 5G as a part of its suite of offerings in the near future, subject to shareholder approval, and looks forward to presenting the best 5G services and convergent solutions to all of its clients. Because the selling price was RM 0.04 more than the buying price, I also sold the stocks. As a result, I earned profits. IV. Axiata Group Berhad's ratio of 75.47x, which is greater than its peer average of 20.03x, implies that the company is selling at a premium compared to the Wireless Telecom industry, per a study by Simply Wall ST. Additionally, it appears as though the share price of Axiata Group Berhad is fairly stable, which could indicate two things: first, it might take some time for the share price to return to an appealing buying range, and second, there might be fewer opportunities to buy low in the future once it reaches that value. Due to the stock's low beta, it is less volatile than the overall market. I trust that Axiata's stock price will keep increasing and will bring me profit in future so I bought it now. 5 REFERENCES Bernama/BernamaDecember 23, 2022 12:38 pm +08. (2022, December 23). Gamuda shares up after construction contract win in Australia. The Edge Markets. Retrieved January 8, 2023, from https://www.theedgemarkets.com/node/649393 Lam Jian Wyn & Shazni Ong/theedgemarkets.comNovember 02, 2022 21:25 pm +08. (2022, November 2). Maxis to seek shareholders' nod to enter 5G access agreement with DNB. The Edge Markets. Retrieved January 8, 2023, from https://www.theedgemarkets.com/article/maxis-seek-shareholders-nod-enter-5g-acc ess-agreement-dnb Simply Wall St. (2022, December 7). We think APB resources berhad's (KLSE:APB) robust earnings are conservative. Simply Wall St News. Retrieved January 8, 2023, from https://simplywall.st/stocks/my/capital-goods/klse-apb/apb-resources-berhad-shares /news/we-think-apb-resources-berhads-klseapb-robust-earnings-are-c 6